FAQs

Why was Temasek established?

Temasek was incorporated under the Singapore Companies Act in 1974 to own and commercially manage investments and assets previously held by the Singapore Government. This allowed the Ministry of Finance to focus on its core role of policymaking and regulations, while Temasek would own and manage these investments on a commercial basis.

Where did Temasek’s original portfolio come from?

The initial portfolio of S$354 million comprised shares in companies, start-ups and joint ventures previously held by the Singapore Government. They included a bird park, a hotel, a shoe maker, a detergent producer, naval yards converted into a ship repair business, a start-up airline, and an iron and steel mill.

For further information on the list of companies in Temasek’s initial portfolio, please see Temasek Portfolio since Inception in the Temasek Review.

Is Temasek a statutory board or a government agency?

Temasek is a Singapore incorporated company, and operates under the provisions of the Singapore Companies Act. Temasek is neither a statutory board nor a government agency.

Like any other commercial companies, Temasek has its own Board of Directors and a professional management team. It pays taxes to tax authorities, and distributes dividends to its shareholder.

In addition, as a key institution in Singapore, Temasek is also designated a Fifth Schedule entity1 under the Singapore Constitution, with certain safeguards to protect its past reserves. For instance, any transaction which is likely to result in a draw on Temasek’s past reserves2 is also subject to the approval of the President. The right to appoint, terminate or renew board members is subject to the concurrence of the President of Singapore.

Other than specific safeguards to protect the integrity of Temasek board appointments and its past reserves, Temasek continues to operate independently on a commercial basis.

Footnotes:

1 Under the Singapore Constitution, the concurrence of the elected President of Singapore is required over certain governance matters concerning Fifth Schedule entities. These include the appointment and removal of board members and the CEO, and the drawdown of past reserves built up by the entity before the term of the current Government. Other Fifth Schedule entities include the Central Provident Fund Board, Government of Singapore Investment Corporation Pte Ltd, and the Monetary Authority of Singapore.

2 Reserves accumulated by Temasek before the term of the current Government form Temasek’s past reserves. Current reserves are primarily profits accumulated after a newly elected government is sworn into power. The swearing-in of the new Cabinet on 1 October 2015 after the Singapore Parliamentary General Election marked the start of a new term of government.

Is Temasek required to pay tax?

Temasek pays the required taxes to the tax authorities, and separately declares dividends to its shareholder, as a commercial investment holding company.

Does Temasek disclose its financial results? How can I find out more about Temasek?

As an exempt private company, Temasek is not required to disclose financial information.

However, since 2004, Temasek has published its annual Temasek Review, which serves as a public scoreboard of its business and performance.

The Temasek Review forms part of Temasek’s annual disclosure exercise, which also include an online version of the Temasek Review, international media engagement, and advertising.

Temasek has also established a presence on digital platforms Twitter, Facebook, Instagram, LinkedIn, and Youtube to reach out and further engage the public.

Through these channels, Temasek provides updates on its performance, activities, and topics of interest. We hope to build communities with whom we engage more directly, as we share Temasek’s story over time.

Temasek’s annual report exceeds the standards of disclosure under the Santiago Principles, a set of best practices adopted by sovereign investors in collaboration with the IMF and various governments, including Australia, Canada, Norway and the USA.

Please refer to www.temasekreview.com.sg for the latest Temasek Review and to https://www.ifswf.org/santiago-principles to read more about the Santiago Principles.

Is Temasek credit rated?

Temasek is rated Aaa/AAA by Moody’s Investors Service and S&P Global Ratings respectively.

Temasek’s Global Medium Term Note (MTN) and Euro-commercial Paper programmes are rated, as well as each Temasek Bond.

Temasek’s MTN Offering Circulars and Reports by international credit ratings agencies are published on the bond section on Temasek’s website.

Does Temasek manage Central Provident Fund (CPF) savings or Singapore’s foreign reserves?

Temasek does not manage CPF savings (which are managed by the Board of the Central Provident Fund), Government surpluses, or Singapore’s Official Foreign Reserves (which are managed by the Monetary Authority of Singapore).

More information on the management of Singapore’s reserves is available by visiting the Singapore Ministry of Finance website, https://askmof.mof.gov.sg/MOF/apps/fcd_faqmain.aspx, which has an 'Ask MOF' section on the management of reserves.

Are Temasek and the Government of Singapore Investment Corp (GIC) the same organisation?

There are 3 key financial institutions in Singapore, which are linked to the Singapore Government.

The Monetary Authority of Singapore (MAS) was formed in 1971, and acts as the central bank of Singapore. It manages the foreign reserves of Singapore. It is a statutory board.

Temasek is an investment holding company incorporated in 1974 in the early years of Singapore‘s independence to own and manage its assets and investments on a commercial basis.

GIC or the Government of Singapore Investment Corporation is wholly owned by the Singapore Minister for Finance1 and manages Government reserves, including surpluses accumulated and built up since independence.

They are separate entities with distinct roles and mandates, and distinct management teams.

Temasek is an investment company with a global portfolio, and manages its investments in accordance with its Charter. Temasek owns the assets it manages, is credit rated and issues international bonds.

As an active investor, Temasek aims to deliver sustainable returns over the long term. As an engaged shareholder, Temasek promotes sound corporate governance in its portfolio companies.

You can obtain more information about GIC at www.gic.com.sg, and more information about the MAS at www.mas.gov.sg.

Footnotes:

1 Under the Singapore Minister for Finance (Incorporation) Act 1959, the Minister for Finance is a body corporate.

Is the Singapore Government or the President involved in Temasek’s business decisions?

The Singapore Government is not involved in Temasek’s investment, divestment, or any other business or operational decisions. Its role as shareholder in respect of Board appointments is subject to the concurrence of the President in order to protect the integrity of the Board of Temasek as a Fifth Schedule Company.

The President of Singapore is not involved in or direct Temasek’s investment, divestment or any other business or corporate decisions, except in relation to his custodial role1 in the protection of Temasek’s past reserves.

Further information on the President’s involvement is covered comprehensively in the Singapore Ministry of Finance FAQ on their website, http://app.mof.gov.sg.

Footnotes:

1 Under the Singapore Constitution, the concurrence of the elected President of Singapore is required over certain governance matters concerning Fifth Schedule entities. These include the appointment and removal of board members and the CEO, and the drawdown of past reserves built up by the entity before the term of the current Government. Other Fifth Schedule entities include the Central Provident Fund Board, Government of Singapore Investment Corporation Pte Ltd, and the Monetary Authority of Singapore.

How is the President involved in the protection of Temasek’s past reserves?

The President of the Republic of Singapore has an independent custodial role to safeguard Singapore’s critical assets and past reserves.

As a key institution under the Singapore Constitution, Temasek is required by the Singapore Constitution to seek the President’s approval before a draw occurs on Temasek’s past reserves.

Temasek’s Chairman and CEO also certify the Statement of Reserves and Statement of Past Reserves to the President at prescribed intervals.

Further information on the President’s involvement is covered comprehensively in the Singapore Ministry of Finance FAQ on their website, http://app.mof.gov.sg.

Is an investment loss considered a draw on past reserves?

A draw on past reserves occurs when total reserves are less than past reserves.

So if total reserves equal or exceed past reserves, there is no draw.

We then have to look at what is meant by investment loss.

When we invest in a portfolio of shares, there are constant changes in market values. Such changes happen for instance to the value of our shares during the global financial crisis, where we saw our portfolio value fall 30%, only to rebound 43% one year later. Such falls in the market value of shares are not a draw.

When investing to maximise long term returns, we may have realised gains or losses on disposal of shares. We may realise losses in our investments, either because the investment has gone bad, or we decided to exit in order to redeploy our funds to more attractive opportunities.

We may exit at a high or a low, depending on our views of the potential returns compared to putting the same dollar to work elsewhere.

Our Board has a responsibility to ensure that every disposal of investment is transacted at fair market value.

A realised loss would not constitute a draw on past reserves, so long as the disposal is done at fair market value (i.e., based on a price agreed between a willing buyer and a willing seller on an arm’s length basis).

The final test is whether total reserves are less than past reserves, after taking the divestment loss into consideration.

Further information is covered comprehensively in the Singapore Ministry of Finance FAQ on their website, http://app.mof.gov.sg.

Is a fall in the share price of Temasek’s investments considered a draw on past reserves?

When we invest in a portfolio of shares, there are constant changes in market values. Such changes happen for instance to the value of our shares during the global financial crisis, where we saw our portfolio value fall 30%, only to rebound 43% one year later. Such falls in the market value of shares are not a draw.

We will also test if total reserves are less than past reserves, after taking the fall in market value into consideration. A draw on past reserves happens when total reserves are less than past reserves. There is no draw if total reserves equal or exceed past reserves.

Let’s take an example. Assume Temasek owns five shares worth $10 today. But one year later, the same five shares are worth $8. These share price changes (mark to market declines) on existing investments do not constitute a draw on Temasek's past reserves.

Further information is covered comprehensively in the Singapore Ministry of Finance FAQ on their website, http://app.mof.gov.sg.

How is the President involved with the Board of Temasek?

To safeguard the integrity of those involved in managing Temasek’s reserves, the President’s concurrence is required for the appointment, renewal or removal of Board members and the appointment or removal of the CEO by the Board.

Further to its normal fiduciary duties to the Company, the Board and CEO are accountable to the President to ensure that every disposal of investment is transacted at fair market value.

Over time, Temasek has assembled a Board and management team made up of people from broad backgrounds, across various industries, in both public and private sectors, from Singapore and overseas. The majority of Temasek’s Board of Directors are independent.

Further information on the President’s involvement is covered comprehensively in the Ministry of Finance FAQ on their website, http://app.mof.gov.sg.

What are the companies in Temasek’s portfolio? How many are listed and what is the market capitalisation of these companies?

A list of some of Temasek’s portfolio companies as at 31 March 2023 is provided in the Temasek Review.

For further information on Temasek’s portfolio companies, please see Temasek Major Investments in the Temasek Review.

How does Temasek work with its portfolio companies?

Temasek manages its portfolio as an active investor increasing, decreasing, or holding our investments to enhance our risk-adjusted returns for the long term.

Temasek promotes sound corporate governance in its portfolio companies. This includes supporting the formation of high calibre, experienced and diverse boards to guide and complement management leadership.

Companies in Temasek’s portfolio are guided and managed by their respective boards and management. Temasek does not direct their business decisions or operations.

Temasek advocates that boards be independent of management in order to provide effective oversight and supervision of management. This includes having mostly non-executive members on boards with the independence and experience to oversee management. Similarly, Temasek advocates that the Chairman and CEO roles be held by separate persons, independent of each other.

Temasek is prepared to exercise its shareholder rights to protect its commercial interests.

Does Temasek request representation on the boards of companies in which it invests?

In general, Temasek is not represented on the boards of its portfolio companies.

Temasek promotes sound corporate governance in its portfolio companies by supporting high calibre, experienced and diverse boards to complement management leadership. By leveraging its wide network of contacts, Temasek can suggest qualified individuals for consideration by the respective boards.

Temasek employees on boards would be appointed in their personal capacity, and are expected to meet their fiduciary responsibilities as directors of companies.

How does Temasek fund its investments?

Temasek investments are financed using dividends and other cash distributions it receives from its portfolio companies and other investments, divestment proceeds from sale of its investments, and borrowings and debt financing sources such as the Temasek Bonds and Euro-commercial Paper Programme.

Further information on Temasek’s Ins & Outs is available here.

What is Temasek's divestment schedule?

Temasek does not have a divestment schedule.

Temasek is an active investor and rebalances its portfolio from time to time. Decisions to invest, divest or hold its investment positions are based on Temasek’s intrinsic value test.

How does Temasek engage the community?

Since 2003, we have been setting aside a portion of our net positive returns above our risk-adjusted cost of capital for community gifts.

These are approved by the Temasek Board before being gifted, mainly to Temasek Trust (TT), which then disburses the gifts via grants and endowments to our non-profit ecosystem including Temasek Foundation (TF), Temasek Life Sciences Laboratory, Stewardship Asia Centre, and Mandai Nature.

To date, Temasek’s gifts to TT have enabled programmes which have impacted about 2.5 million lives across Singapore and beyond, delivering on Temasek’s community objectives to connect people, uplift communities, protect our planet, and advance capabilities.

We are committed to do our part as a trusted steward, and TT plays a central and pivotal role in our journey to do good.

TT’s role has evolved since its inception in 2007 when it was set up primarily to manage philanthropic financial assets. Today, TT also strives to be a leading advocate of sustainability and governance in philanthropy, a catalyst in creating shared value, and an investor for impact.

Globally, we also support communities in the markets we operate in. Our offices donate to local charities and work with partners to deliver sustainable impact, underscoring our commitment as a responsible corporate citizen.

You can read more about Temasek’s community approach here.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns result in any impact on Temasek?

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long term real rate of returns of the investment entities in the framework.

The inclusion of Temasek’s expected long term returns in the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

The NIR framework does not determine the amount of dividends that Temasek distributes to our shareholder.

The Government has a variety of sources of liquidity and cash flows that enable the Government to manage its liquidity needs independent of the strategies of Temasek, MAS and GIC.

Temasek will continue to declare dividends annually based on the profit we earn, in accordance with our Board-approved dividend policy. The dividend policy balances the sustainable distribution of profits as dividends to our shareholder, with the retention of profits for re-investment and future returns. The policy also takes into account the constitutional requirement to independently protect Temasek’s past reserves.

For further information, please see the 'Ask MOF' section of the Singapore Ministry of Finance website: https://www.ifaq.gov.sg.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns require Temasek to pay more cash to the Singapore Government?

The NIR framework does not require Temasek to pay more dividends or cash to the Singapore Government.

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long term real rate of returns of the investment entities in the framework.

The inclusion of Temasek’s expected long term returns in the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

The NIR framework does not determine the amount of dividends that Temasek distributes to our shareholder.

The Government has a variety of sources of liquidity and cash flows that enable the Government to manage its liquidity needs independent of the strategies of Temasek, MAS and GIC.

Temasek will continue to declare dividends annually based on the profit we earn, in accordance with our Board-approved dividend policy. The dividend policy balances the sustainable distribution of profits as dividends to our shareholder, with the retention of profits for re-investment and future returns. The policy also takes into account the constitutional requirement to independently protect Temasek’s past reserves.

For further information, please see the 'Ask MOF' section of the Singapore Ministry of Finance website: https://www.ifaq.gov.sg.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns result in any changes in Temasek’s investment strategy?

Including Temasek’s expected returns in the NIR framework does not change Temasek’s investment strategy as a long term investor, and has no impact on Temasek’s ability to buy, sell or hold assets.

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long term real rate of returns of the investment entities in the framework.

The inclusion of Temasek’s long term returns in the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

Any changes to Temasek’s strategies or portfolio composition will affect our expected long term returns.

Temasek’s investment strategy is the responsibility of Temasek’s Board and management. Investment and divestment decisions will continue to be based on our intrinsic value tests.

Temasek will continue to focus on delivering sustainable returns over the long term.

The Singapore Government is not involved in the investment, divestment or other business decisions of Temasek.

For further information, please see the 'Ask MOF' section of the Singapore Ministry of Finance website: https://www.ifaq.gov.sg.

Do the financials in the Temasek Review and Offering Circular reflect Temasek’s performance as an investment company?

The Credit Quality section of our Temasek Review and Business of Temasek section of our Medium Term Note programme Offering Circulars include key credit parameters based on the financials of Temasek as an investment company1. Our Credit Profile provides a quantitative snapshot of our credit quality and the strength of Temasek’s financial position. Temasek’s overall performance as an investment company is also highlighted in our Temasek Review and Offering Circulars, through measures such as total shareholder returns over various time periods.

Footnotes:

1 Based on the financial information of Temasek as an investment company, namely, Temasek Holdings (Private) Limited (THPL) and its Investment Holding Companies (IHCs) rather than the consolidated group of THPL and its subsidiaries. IHCs are defined as THPL’s direct and indirect wholly-owned subsidiaries, whose boards of directors or equivalent governing bodies comprise employees or nominees of THPL, THPL’s wholly-owned subsidiary Temasek Pte. Ltd. (TPL) and/or TPL’s wholly-owned subsidiaries. The principal activities of THPL and its IHCs are that of investment holding, financing and/or the provision of investment advisory and consultancy services.

Does Temasek guarantee its portfolio companies’ debts?

As a policy, Temasek does not issue any financial guarantees for the obligations of our portfolio companies.

How do I apply for a position at Temasek?

Please submit your details via the career portal under the respective application links. For further queries, please contact us at career@temasek.com.sg.

What happens after I submit my resume and how will I know if I am selected to participate in the interview process?

We will notify you if your qualifications and experience are relevant to the requirements of a currently available position. If you are selected to proceed in the process, you will be contacted directly by the Human Resources team.

What are your selection criteria when reviewing a candidate’s suitability?

We will broadly consider a candidate based on the following:

- Competency

- Relevant experience

- Values

- Leadership qualities (for experienced hires)

Selected Questions & Answers from the Temasek Review Media Conference 2023

11 July 2023, Singapore

The following is an edited transcript of questions and answers at the Temasek Review 2023 Media Conference.

Grammatical edits have been made to aid readability. For the same reason, questions are not necessarily listed in the order in which they were asked, but grouped thematically.

Slides and charts have been added from the Temasek Review 2023 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to view all of the key financial metrics and diagrams in Temasek Review 2023.

Question on Net Portfolio Value (NPV) and Group Net Profit

QUESTION: Regarding the drop in your Net Portfolio Value, are the valuations all marked to market, or does it include actual losses and write downs? And on Group Net Profit, which is a loss this year, how do you calculate that, what is involved in it? Are these two related, the portfolio and the returns and the group loss? And, overall, combining both of these things, would they affect Temasek’s contribution to Singapore's budget?

PNG CHIN YEE: So, first, the way we look at our performance is really through Net Portfolio Value (NPV) and Total Shareholder Return (TSR). So, what goes into NPV? For all our listed assets, we will take the market value as of 31 March, and for our private assets, we will take the book value less any impairments that is required to be taken. So, everything that is impaired is already taken into consideration when you look at the NPV that we disclose.

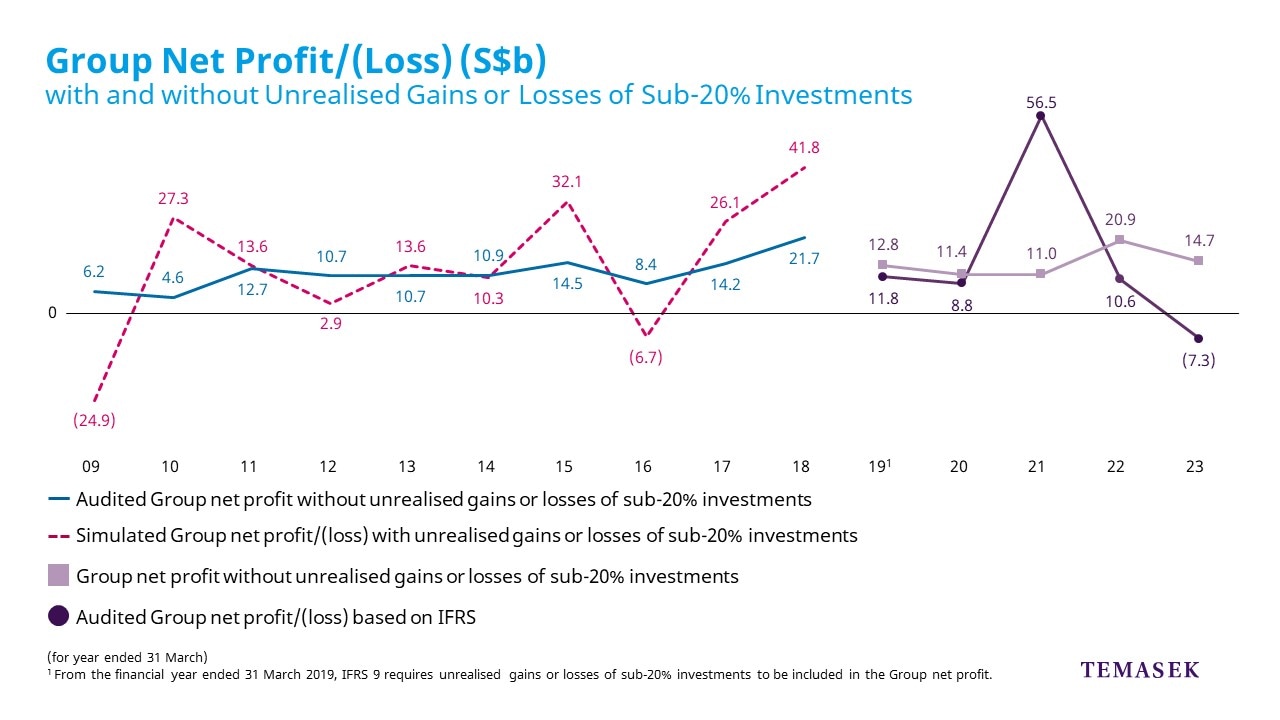

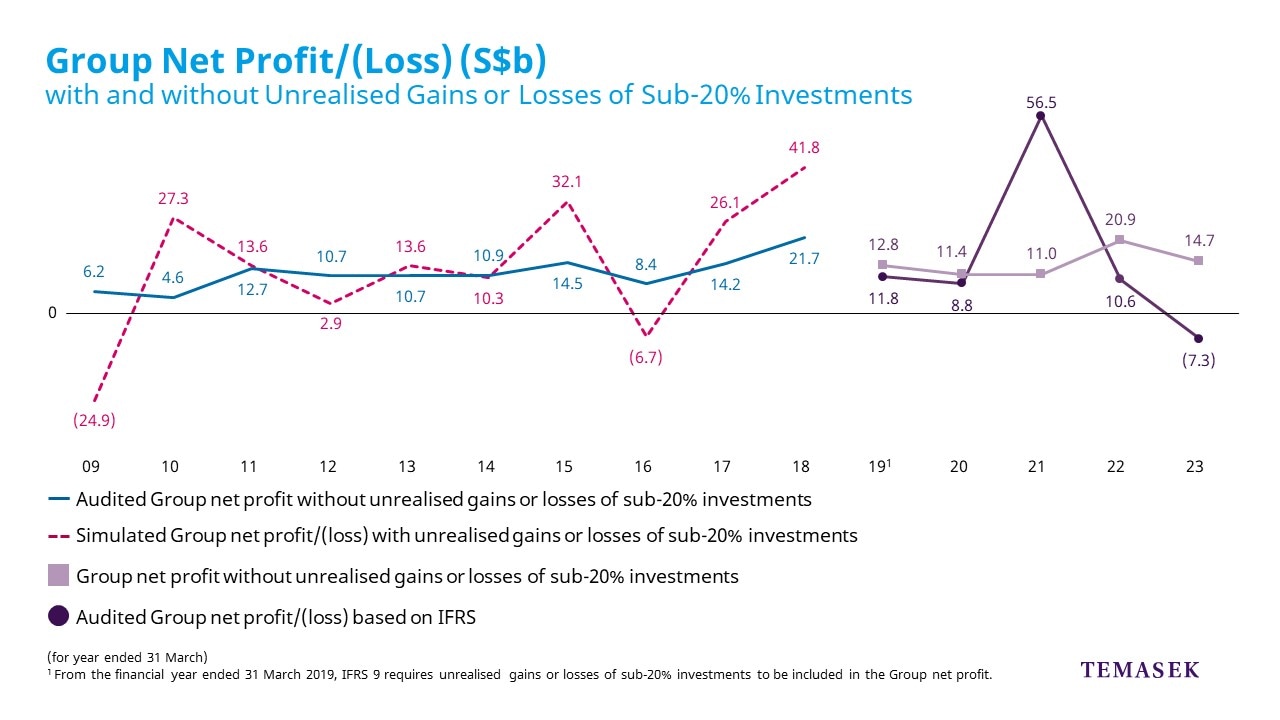

That is distinct from our Temasek Group accounts, which is when you talk about our net loss for the year. Our Temasek Group accounts take into account our performance but also that of our subsidiaries as well as associates. So it does not really reflect our performance as an investment house, which we really look at from a NPV perspective. So from the Temasek Group financials, you will see that this year we actually had a net loss and that is really because of the unrealised mark-to-market losses that we had to take into the profit and loss this year. And if you adjust for that, mark-to-market, unrealised losses of the sub‑20% portfolio, actually, the group profits would have been about S$15 billion. Can I get the team to pull up the chart?

So this has come about because of accounting policy. In 2018, there was a new accounting policy called IFRS 9 which was introduced. As a result of that, all the mark-to-market gains and losses of your sub‑20% investments have to be taken to the profit and loss. So if you see this year, the purple line on the right‑hand side, negative S$7.3 billion, would include the mark-to-market losses. If you adjusted for that, actually our Temasek Group result is about S$15 billion, which reflects the underlying profitability and resilience of our portfolio.

If you were to look back in time in history and if we had this policy in place prior to 2019, you can actually see from the dotted pink line, that there is actually a lot of volatility in that segment. So if you had applied the same accounting policy then it will also have created the same, both up and down volatility in the profit and loss statements.

QUESTION: What part of it is actual loss that someone has to pay?

PNG CHIN YEE: So the negative part really is mark-to-market losses, so they are paper losses, they are not realised losses. But again, I refer you to the NPV that we announced and the fact that actually the NPV was down negative 5% from last year. So that will be how we should think about our performance as an investment company.

DILHAN PILLAY: Most of the loss is due to the reduction in value from mark-to-market of our listed portfolio. That is the first thing. There will be some impairments that we took during the year that will also be factored in. There will be write downs also, as we do in every year in our portfolio, as part of our performance review.

CHIA SONG HWEE: That is a very small portion relative to the drop of NPV.

QUESTION: Is that reflected anywhere?

CHIA SONG HWEE: Yes, it is already included in the numbers.

PNG CHIN YEE: Then to go to your last question around the contribution to the budget. The way we contribute to the budget is through the NIR framework, which I am sure you are familiar with. So the Singapore Government can spend up to 50% of what is the expected long term real returns that Temasek, GIC, and MAS delivers. So that is actually quite separate from the NPV numbers and the profit and loss numbers that you see. So this really does not impact, in that sense, the Government spending ability that they have.

DILHAN PILLAY: That is why we have these long term plans, like the T2020 strategy and the T2030 strategy and sometime in the future we will have T2040. That helps us to figure out where we are going to allocate our capital for this long term sustainable returns that will then factor into the NIR framework.

Question on Group Net Profit

QUESTION: When was the last time you recorded a loss using the accounting framework that you have used, moving to the International Financial Reporting Standards (IFRS)?

PNG CHIN YEE: Since the new accounting standards, IFRS, was introduced in 2018, this is the first time we have had a loss, but if you were to apply the same accounting standards previously, then I think you would have seen from the chart that in 2016 and 2009, we would have also registered losses.

ROHIT SIPAHIMALANI: Also I just want to clarify that even internally as a management, none of us really look at Group Net Profit as a performance metric because as an investment company, we really measure our performance by the value of our portfolio and that is really what we are looking at in terms of growing and the objective is to meet our cost of capital and exceed it over the decade to 2030.

Question on Investment – Temasek Operating System

QUESTION: I think it was mentioned that AI, Blockchain and Cybersecurity, and a list of other categories could differentiate Temasek and value add basically, but a lot of people are investing in these areas already. So, what are you doing specifically? Can you give examples that are going to set you apart from the other people out there?

CHIA SONG HWEE: When Dilhan spoke about the Temasek Operating System, it is about building capabilities so that the benefits can be harnessed by our portfolio and beyond. Now, this is not just investment. We are actually building companies with engineers who will build products and services. Let me take the example of Cybersecurity. Between ISTARI and Ensign, working with our portfolio companies who have been attacked by cyber-crime, we were able to help these companies reduce their mean time to resolution from over 100 days to a benchmark level. If we have not had these capabilities, the impact on the portfolio will be tremendous, not to mention the reputation impact that we will suffer. So this is just one example of what we mean by building capabilities. The return may be in a less tangible form financially, but clearly has value.

Question on Investment – Portfolio Composition

QUESTION: Because you are looking to beat the 9% cost of capital over the long term, what is the expected returns you will see in the resilient part and the more dynamic, forward looking part of your portfolio?

CHIA SONG HWEE: As Dilhan has articulated, the dynamic part will be very much growth-driven and therefore it should allow us to generate a higher return relative to the resilient component of it. But in order for us to achieve the overall objective, we have to work on both of these engines. We cannot be having a portfolio that is just catering for high growth, high return, but we could suffer a very big drawdown when the market is unfavourable.

DILHAN PILLAY: So, both components have to meet or beat cost of capital. The target is to make sure we exceed cost of capital. So we do have spread targets whenever we invest our capital, especially on the dynamic pathways, which is where most of our capital gets allocated. And for the part on the left, much depends on the performance of our Temasek Portfolio Companies, the asset management businesses, and the like. So that is where the companies have to work on it as well.

CHIA SONG HWEE: And also, I want to stress the point that Dilhan mentioned – some of the companies under the dynamic component could become compounders over time, which we have already seen in our experience.

Question on Investment – Investment Pace

QUESTION: You mentioned that your pace of investments has slowed, but shouldn't a slowing market be a better time to invest? Can you explain your rationale?

ROHIT SIPAHIMALANI: You are completely right, but the challenge is you should be able to invest at the right valuations to reflect the slower market. There are some markets like the US where valuations are still very high in the public markets. In the private markets, a lot of companies raised a lot of money in 2021 and so the good companies have not been coming back to market or are willing to accept lower prices to reflect the changed environment.

And so we have been patient. But we are seeing some signs of some cracks. So in the private markets, you are seeing now some private equity firms need to sell their stakes in companies to return liquidity to their limited partners (LPs) and that is creating opportunities. Similarly, we are looking out for these opportunities. We had an example earlier this year, Stripe, which actually raised money at about 50% of what they have raised earlier – it was some share buy‑back from shareholders – and we participated in that. But we have not seen as many compelling opportunities with that valuation correction so far. We think we are beginning to see the cracks and we will probably see more of that and, once we do, we will be ready to lean in.

CHIA SONG HWEE: A point I want to add is in the private credit side, there seems to be very compelling risk-adjusted risk return profile as liquidity is tight in the credit market and businesses not wanting to be diluted into a shareholding see private credit as a viable funding option and we are seeing increasingly a very compelling proposition there.

Question on Investment – Risk-adjusted Cost of Capital

QUESTION: I think last year we saw an increase in the risk-adjusted cost of capital to about 9%. Is this a concern for Temasek and how does it plan to deal with it? And, also, if you look at the 20-year TSR, it seems to have trended somewhat down from 2004, to 2016, to now. Is that also a concern and how does Temasek plan to change that?

PNG CHIN YEE: Yeah, you are absolutely right that the cost of capital has gone up for all of us and that has had two impacts. One is that it creates a higher bar for us as we think about the investment returns that we need to deliver to get across our cost of capital. But also actually, the cost of capital increase has actually de-rated markets. Valuations have fallen as a result of the higher cost of capital, so in that sense, it has got a double whammy. So, as Dilhan and Rohit had mentioned, we need to look at trying to build the portfolio that can actually deliver the returns and also withstand shocks. So the repositioning that we have talked about during the presentation really strives to deliver that.

If you look at longer term returns, I think when you, for example, look at Temasek since inception, when we were actually benefitting from the growth of Singapore as an economy. So I think the high-growth period of Temasek in that period probably is not replicable in the current environment. So I think we also have to think about the context that we are in and where we are heading. We talk about the fact that we are potentially looking at a period of lower real returns in the next decade ahead and so, again, coming back to our point around how do we then build a portfolio that is resilient, that can actually deliver at least a cost of capital that we are looking for.

ROHIT SIPAHIMALANI: I just want to clarify the reason our cost of capital has gone up – as you said is a matter of concern – is because the risk‑free rates have gone up everywhere. So it is just a natural consequence of that. But the risk‑free rate has gone up because inflation has gone up and so, therefore, on a nominal basis you should not be able to get higher returns on that basis. So I do not think that in itself would be a problem for us. The second point, also keep in mind that you said post‑2016, 20‑year returns coming down. Part of it is, in the late 1990s, which forms the base for your 20‑year returns, up to post‑2016 for a few years, you had Singtel that went public and was trading at about 50 times earnings. At that time, that was more than 50% of our portfolio. So that base effect also is there for the second half of between 2016 to 2020 when you look at 20‑year returns. As you see, today, our 20‑year returns are about 9%, which is fully held, even if you look back 20 years from today.

Question on Investment – Portfolio Diversification

QUESTION: Quick question. In terms of diversification of the portfolio that you have talked about, in the current situation where generally the market is risk-averse, so you would find probably most of the assets correlation happens to be coming closer, so the possibility of a diversification benefit is less.

ROHIT SIPAHIMALANI: Just to clarify, the diversification that I mentioned was in the context of our early stage portfolio, because that is a high‑risk portfolio, with a limit of 6%, and therefore, diversification is one way we can manage the risk.

By definition, we do have concentrated positions in the rest of the portfolio and the portfolio construction is such so that the portfolio as a whole can still be resilient across different environments. But diversification per se is not an important objective there, as it is for the early stage portfolio.

Question on Investment – Americas and China Portfolios

QUESTION: I see that your portfolio to Americas has steadily increased, about 11% for over a decade, while China has more or less been the same. Given the fact that in Dilhan's presentation there was a point of doing business in China, China for China, China for Asia, and China for the rest of the world, I would assume, how do you see, as an investor, do you see the barriers of entry being high and difficult to invest in China?

CHIA SONG HWEE: Maybe I will address the US‑China portfolio shift and then China itself. I think I need to bring ourselves back a little bit in history. Temasek started being an active investor in the early 2000s. Prior to that it was pretty much focused on the Singapore assets. So at that time, the focus was to invest in Asia to ride the growth of Asia, and India, China were the two main markets. So as a result we have built a portfolio, especially in China, in a much more significant way.

As we go through our T2020 strategy, the trends that we are seeing involve a lot of Technology, Life Sciences, which led us to look for opportunities in the US and that is the reason why we decided to set up an office there and allocate more capital over the last seven, eight years to grow our portfolio there. So there was not a specific target we set, but it was just bottom‑up, trend‑focused and that is how our portfolio has developed over time. Now, it just so happened that now they are more or less equal in size, in percentage term.

Now, for China, I like to mention that we have gone through portfolio reshaping over the years. Our initial exposure to China was mainly through our Temasek Portfolio Companies when they participated in the early industrialisation of China. When we decided to invest directly in the early 2000s, since then we have gone through three waves.

The first wave was investing when China opened up and had access to the World Trade Organisation, mainly in the banks and the Financial Services sector, including Insurance. The next phase was to ride the wave of consumption growth and during that period we have invested in companies in the Electronic Commerce space, Gaming, as well as Ride-Hailing, just to name a few, so that we move more towards that direction and less of the banks. And now we are in the third wave, focusing on the Green Energy transition, Enterprise Software, Healthcare, and Life Sciences.

So, as you can see our portfolio in China and globally is not static. We will move based on what we see going forward, geopolitics, policy, as well as investment opportunities. So what we try to do is to build a portfolio that is relevant going forward, not only from the whole Temasek standpoint, but also by region.

Question on Investment – Developed Market Exposure

QUESTION: As your portfolio shows, you have been moving towards developed markets more, and I understand that you do not invest thinking in regional terms, it is a bottom‑up approach. But it has taken you to have a higher weightage for developed markets rather than emerging markets. How do you look at that? Why has that happened? And what will change it in the future?

ROHIT SIPAHIMALANI: One of the things as we have mentioned – we identified certain focus areas a decade ago, which we felt were going to be attractive for the next decade and where we should spend time on. As Song Hwee mentioned, a couple of the areas are Technology and Life Sciences, and that told us that for that, naturally, the hotbed of innovation and the most successful companies are in the US and that was what actually led us to open the US office and naturally we focused on those areas and will end up spending more in the US rather than other places.

Similarly, now when we are looking at sustainability as an area, clearly there are significant opportunities in China, but there are also a lot of opportunities particularly with the Inflation Reduction Act (IRA) and the EU Green Deal in the US and Europe. So you will have a mix of that. What you will find is our portfolio is still a mix, roughly 60-40 in developed markets and emerging markets. And it is something we are comfortable with. But really the shape of how it has emerged has been a function of our focus on our trends and where that leads us to.

PNG CHIN YEE: I just wanted to add two points to say that we have also been growing our India portfolio over the last 10 years and, India today being able to benefit from some of the changes in geopolitics, that continues to be a big focus for us in the themes that Rohit talked about. The other market that we are trying to also increase our exposure is Southeast Asia. So as you think about the opportunities in Southeast Asia in the technology space, et cetera, I think those will be two markets that we will put more resources into.

DILHAN PILLAY: Maybe I will just put it a different way, in addition to what has been said. I think you go to where the opportunities are and it goes to a depth of the opportunities and a broad range of sectors that we can get into. So the US obviously is the most developed, deepest market you can get into – it has the deepest capital markets, it also has the one where there is significant capital flows to actually back promising companies to success. And that is very important because if you can identify a good business model, good founders, for example, a good management team, et cetera, you can invest in them and that's fine, but after some time the success very much depends on availability of capital as they grow.

So, when you look at capital flows, say, back 10 years ago, you would definitely put money into US and China as the first two markets because those are the two biggest markets; those are where capital is moving towards. You have other investors, sophisticated investors getting into the market, that would be good for the market, good for the companies who want to invest in especially.

Europe has got very good companies but does not have as deep a market, which is why you can see that in 2011, US was 6% of our portfolio by underlying assets and Europe was 5%. Today, US is 21% and Europe is 12%, simply because of the range of opportunities that we can access and invest in.

So as Chin Yee mentioned, we do not look at it as developed markets versus emerging markets. But exposure to developed markets today, which was a desire to access opportunities in Europe and US that fit within our focus areas first and then our trends, has allowed us to have a very stable portfolio where 64% of it is in the developed markets and 36% in emerging markets.

Now, with the cost of capital being where it is today, unless you can find markets which are going to have the tailwinds arising from something which has happened globally, like Chin Yee mentioned, India, Southeast Asia are possibilities, actually going to developed markets is still a good thing in terms of getting returns over the long term, especially if you can access the right opportunities there.

So, we remain focused on investing in the four markets that we have always put more money towards which is the US, China, Europe, and India. Southeast Asia has got promise. It still needs a bit of time to get to where it could get to. A lot of it is very dependent upon capital formation in this region.

Question on Investment – Unrealised Losses

QUESTION: The impairments for this year, were they significantly more than previous years? Not just impairments for your unlisted assets but also your realised losses for your listed assets.

PNG CHIN YEE: I would say that it probably is in line with historical experiences, it is not out of the ordinary.

QUESTION: That is including the FTX impairments?

PNG CHIN YEE: Yes.

Question on Investment – Investments with Valuation Drops

QUESTION: Can you share which specific investments have you seen a fall in the value or a total write down?

PNG CHIN YEE: The significant fall in valuations, as I mentioned, was really due to our portfolio in Technology, Life Sciences, as well as Payments. These are the three sectors that have been quite badly hit by the focus on more profitable growth and because of the interest rates movement. But despite the fact that they suffered from valuation deratings – so, for example, our Payments portfolio was down – but if you look at the lifetime returns on our Payments portfolio, it is actually in the 20% Internal Rate of Return (IRR) range. So they still remain a very well‑performing asset but it is just that the valuations in the last two years, which went very high post‑COVID, was unsupportable and so they retraced some of those gains.

We have taken impairments including FTX, as you know, and so anything that we need to write down, we would have put that into our NPV.

Question on Investment – Artificial Intelligence (AI)

QUESTION: I think just now there was a question on tech investments. But I want to focus more on Generative AI. As it was mentioned that Temasek is very keen on investments in this area. So can Temasek share more on that, perhaps give examples of what kind of AI technologies are you particularly excited about? Do they include AI that can help your existing portfolio companies do their work better, for example?

CHIA SONG HWEE: AI has been an emerging technology for a while now, right? The big question is when is the real inflection point? ChatGPT has created a lot of excitement. But frankly speaking, it is still very nascent, especially when you talk about business-to-business. That is where we are spending more time to try to understand that, rather than the business-to-consumer space, which today it has been dominated by the big tech companies which may not offer compelling investment opportunities for us.

So our investment in the AI technology side is still a very small portion and our exposure mainly came from our investments through specialised funds that invest in these opportunities. They are mainly in the start‑up areas.

Our own activities focus on building capabilities, as we have said earlier on, as part of Dilhan's presentation on our Operating System, is to help ourselves and our portfolio companies apply the technology so that value can be created. So we really believe that the value creation of such technology would be with the incumbent and that is where we are spending our time on – building capabilities to co‑innovate products and services with our portfolio companies.

ROHIT SIPAHIMALANI: I will also say from an investment perspective, the revenue‑generating opportunities from these start‑ups are still very unclear, the business models are very unclear. Plus there is a lot of hype and the valuations are through the roof. So, we are being very cautious and not really directly investing in those opportunities.

What is very clear, is that the infrastructure around AI, there will be a lot of investment. So whether that is in chip companies like NVIDIA or Taiwan Semiconductor Manufacturing Company, technologies that are looking at cooling data centres and so on and so forth. And those companies, we continue to invest in because they are more established companies, it is clear that they will be winners. But we are less excited, at this point of directly investing in some of the start‑ups where the revenue model is unclear and valuations are very high.

Question on Investment – Ant Group

QUESTION: What is your view on Ant Group?

PNG CHIN YEE: We view it quite positively. Obviously there was an overhang in the tech sector – hopefully this draws a line in the sand and will allow Ant to focus on growth in a new regulatory framework and a new regulatory environment. Ant still has got strong advantages – it has got great technology, it has got a great track record of innovation. So once this is behind them, they can really focus on stabilising and growing the business.

I think it does have a very important role to play in financial inclusion in providing inclusive finance, accessible finance, in line with policy direction actually. So I think this is actually a good development for the sector. You can see the stock prices have reflected that as well.

Question on Investment – FTX and Zilingo

QUESTION: Last year, your investment losses in companies including FTX and Zilingo were reported on. You had mentioned that due diligence was conducted, and compensation was reduced and so on, but no one has lost their jobs or received demerits. You talk a lot about cultural change – is that really possible without firing anyone or carrying out more radical disciplinary actions?

DILHAN PILLAY: We are in the business of investing, and we assess our early stage portfolio based on a portfolio basis, not by individual investments. So when we look at returns, we look at it portfolio-wide to see how well we have done. And actually we have done well, as you saw from the results.

Now, when you do early stage, you accept the binary outcome of an investment. The question you have to ask yourself is what did you see when you went into it, versus what has transpired in between the journey and comes out at the end. Thankfully for us, most of our investments have turned out well. Very few of our investments have turned out very badly, like FTX, and some have been in the middle where a company has started off well and has progressively gotten worse, either because of external market conditions or because of something internal.

Now, bear in mind when you are an early stage investor, your percentage holding in the company is actually not very large, and you rely also on other investors who are in there to join you in trying to shape the journey of the company, mentor the founders and other key people, making sure new talent comes in and so on to move forward.

Now very much depends then on the values of the individuals that you are backing. It is not your values because your values are pretty clear. It is the values of the people you are backing. Now, if those values have changed over time, or were not what they were meant to be, then you have a problem. Most of the issues where there is a blow up that we have encountered, have to do with what is perceived to be individual actions according to what comes out in the media, for example. For that, you can never prevent against. That is something that is very difficult to make a clear‑cut determination from day one, how that is going to turn out at the end of the journey. It is not possible.

So in the case of FTX, the reason why we decided to take the penalty, or why we decided to take action, was simply because of the way in which that company imploded, and so soon after we made the investment. And we felt, at the end of the day, that the reputational effect of that was something very significant. Now if we were to start to punish people beyond what we have done, who would want to be an investor? Because when you do invest, you take risks – you take calculated, calibrated risks – and as long as you have done the work required to make the investment, the committee approves it, it goes forward. Now when it does not turn out well, the whole portfolio gets impacted by it. We get impacted in terms of our compensation because we do not get paid what we think we are going to get paid, but when you have something which affects the reputation, that is when you take action which might be a little bit more punitive because you want to remind yourself that every time you do something, the issue is not just the financial risk associated with the investment, it is the reputational risk associated with the investment and we take that very seriously. We take our reputation very seriously. I would say that if we took more action, I do not think it would have been warranted in the cases that you mentioned.

CHIA SONG HWEE: And one thing that was communicated in our Chairman's statement is that there was no misconduct found by the investment team involved. So there is no basis of going down that path.

Question on Investment – FTX

QUESTION: With FTX lessons in mind, how will you do things differently?

ROHIT SIPAHIMALANI: FTX clearly was a situation we were all disappointed with, but I will just step back and say it is part of our early stage investing. As you said, early stage investing is risky by definition – it is binary and that is why we manage that risk by keeping it to less than 6% of our portfolio. Within that, half of that is in funds, so it is in dozens of funds, each of which are in dozens of companies, and the other half is directly invested by us, spread over 200 companies. So it is very diversified.

The other objective in that early stage investing, apart from getting good returns, is to really identify new trends in technology and to see where the world is going, because that has value that we can bring back to our portfolio companies, to our Singapore companies, and to the Singapore ecosystem, but beyond that, it also allows us to identify early winners and then double down on them and make them part of our core portfolio.

So companies like, Adyen, which has been mentioned by us earlier, our first cheque was €35 million in a series B round, and a €1 billion valuation, and we have subsequently invested much more before IPO and today it is a US$50 billion company. There are many such examples.

So that is why we do that. We invested in FTX because at that time it seemed like a company having good technology, it was rapidly gaining market share, and all the checks from regulators suggested that they were very regulatory‑compliant and wanted to get licensed everywhere. So all that led us to invest in that company, but, clearly, there has been a situation of fraud there, which we are very disappointed about and, ultimately, we had to write off that investment.

But there are some lessons, clearly, that we have taken away in our entire early stage investing. For example, we have enhanced some of our due diligence processes. We have enhanced the nature of integrity due diligence we are doing on founders. Again, in very hypergrowth companies, some of the operational areas that we are looking at, we have enhanced that. So there are clearly learnings from that and we hope that we will be able to avoid such a situation in the future, recognising that fraud is something that is difficult to protect against completely, and we do recognise that early stage investing will have binary risks and we need to manage the risks through what I just talked about.

QUESTION: Yes, granted it is fraud but what exactly went wrong in the due diligence process? Previously my colleague wrote that there was a pay cut. So what exactly went wrong? There were no details, basically.

ROHIT SIPAHIMALANI: As I said, you have fraud in companies like Enron or Wirecard which had Big Four auditors – if there is a management that is committed to doing fraud, no matter how much diligence you do, it is very difficult to uncover that. For us, the reason that you have mentioned, the pay cut was taken was because beyond the financial risk which we have for all early stage investments, we recognised that there was a reputational hit to us as part of that and, for that, senior management took accountability and a pay cut associated with that.

But it is something which the team spent time doing diligence on. Clearly, there were lessons which we are applying to other situations, but I would also like to point out that it is impossible to always discover fraud, no matter how much diligence you do.

Question on Investment – FTX (2)

QUESTION: I think Temasek was the only fund which actually cut compensation for staff because of this failed investment, which is a transparent process. Is this going to be the case for all failed investments?

DILHAN PILLAY: No. As I said earlier on, we are in the business of taking risks and we accept binary outcomes when we do the underwriting to an investment. We consider all the risks, the mitigation factors as against the investment thesis that we underwrite towards, and we make a judgment call – a lot of them are judgment calls. The question on whether the portfolio does well is also ultimately the combination of different efforts in making those different judgment calls to come to that outcome. As long as that is the end goal and objective and we can hit it, then it is alright. FTX was an aberration, if I can put it that way.

Question on Investment – FTX (3)

QUESTION: Apart from your capital injection into FTX when you invested in the company, what were some of the mentorship or support you provided the company? Were you also exploring some work with some of your blockchain companies that you have founded with other companies too?

CHIA SONG HWEE: Our stake in FTX is actually relatively small. It is one plus percent. So we are really not in a position to influence. But leading up to the investment, we have made suggestions on what they can do to improve certain aspects of their business – we have recommended that they should bring in a professional that will help them in regulatory compliance because we thought that regulation is one of the higher risks for that business. So those are the things that we have made suggestions for and they have done and, like what Rohit said, they are quite amenable to be in compliance with the regulations. But as a 1% shareholder, we did not really have much of an influence over the company.

Question on Macro Outlook

QUESTION: I note your portfolio value fell because 2022 was the most challenging year over the last decade. I know we are only in July, but do you see your portfolio recovering this year? And I have a second question because you mentioned that your pace of investments has slowed, but shouldn't a slowing market be a better time to invest? Maybe can you explain your rationale?

ROHIT SIPAHIMALANI: So I would say on the first question, as I said, we have a predominantly equity portfolio, so it is very difficult for us to predict where the markets will be. What we can try and do is have a resilient portfolio and do better than the markets. Even in the last year, yes, our portfolio is down 5%, but MSCI ACWI is down 9%, MSCI Asia Pacific ex Japan is down 11%. We do believe that if markets remain poor, we would expect to do better than that. Obviously, we would hope for a market recovery, and we are investing in companies that we think in a market recovery would do well and we recover as a part of the portfolio.

On your second question, you are completely right. But the challenge is, you should be able to invest at the right valuations to reflect the slower market. There are some markets like the US where valuations are still very high in the public markets. On the private markets, a lot of companies raise a lot of money in 2021. And so the good companies have not been coming back to market or are willing to accept lower prices to reflect the change in environment. And so we have been patient, but we are seeing some signs of some cracks. So in the private markets, you are seeing now that some private equity firms need to sell their stakes, and companies return liquidity to their LPs. And that presents trading opportunities. So we are looking out for those opportunities. We had an example earlier this year, Stripe, which actually raised money at about 50% of what they raised earlier, it was some share buyback from shareholders. And we participated in that. But we have not seen as many compelling opportunities with that valuation collection so far and we think we are beginning to see the cracks and we will probably see more of that. And once we do, we will be ready to lean in.

CHIA SONG HWEE: A point I want to add is in the private credit side, there seems to be very compelling risk-adjusted return profile as liquidity is tight in the credit market and businesses, not wanting to be diluted into a shareholding, see private credit as a viable funding option and we are seeing increasingly a very compelling proposition there.

Question on Macro Outlook (2)

QUESTION: What have been some of the biggest changes in the external environment in the past year that are steering Temasek's investment approach differently? And, also, you seem to be a bit gloomy about global growth, yet you are ready to pick up bargains. So, how do you balance that?

ROHIT SIPAHIMALANI: So global growth is a cyclical thing. Cyclically we feel that to contain inflation, particularly in developed markets, central banks will have to keep raising rates until the economy weakens, until you have some slack in employment, so that inflation gets under control. But once that happens, then from a structural basis there are growth drivers that we are seeing today. We talked about AI as a driver. We talked about the green transition as a huge driver. There are other things happening in different sectors. So I talked about that from a cyclical perspective, not a structural perspective.

So if the valuations reflect that cyclical downturn in earnings that we sort of expect, then we will be ready to jump in. If the valuations are assuming that things are going in a straight line, we do not want to pay up for that, given our view that we will see a cyclical downturn before the structural return out there, so that was the context of my comments.

QUESTION: Can you highlight some of the major changes that, in the last one year, are steering your investment approach?

ROHIT SIPAHIMALANI: So I mentioned a couple of things in my slide, right? For example, we have to be very conscious of the fact that we are going to be in an era of higher inflation, higher rates. So we will still invest in growth, but on balance the bias is a little more towards companies with stronger cash flows, on a relative basis compared to the past. That is one example.

Secondly, the green transition, we think, is real, and we are basically looking at all our portfolio companies from that lens, not just in the past one year, it is something we have been looking at for the last few years.

And then, when we look at bifurcation, when we look at diversification of supply chains, we recognise that both India and Southeast Asia are going to be key beneficiaries of that. And so, particularly more recently, we have been looking to see how we can step up our activity there. We have significantly stepped it up in India. We are looking to do more so in Southeast Asia as Dilhan pointed out.

Question on Global Outlook

QUESTION: When do you see a return to growth in terms of both profitability as well as in your investment returns, given the geopolitical and other headwinds that you have mentioned in your talks?

CHIA SONG HWEE: In the presentation, we said that we want to construct a portfolio that is resilient and forward looking and all that meant that we want to deliver a sustainable return over the long term, and our aim is to deliver a return that is at or exceeding our cost of capital.

ROHIT SIPAHIMALANI: I would also add that as a predominantly equity portfolio, we will not be immune to market cycles. But over the medium term, we do expect to generate the absolute returns that we have talked about, and we have seen this in the past. We have had years where we had negative returns, but that is why typically we focus very little on one‑year returns and really for us, it is the 10- and 20‑year returns that are more relevant.

Question on Global Outlook (2)

QUESTION: Do you see a difference between decoupling and de‑risking and how does that guide your portfolio adjusting and rebalancing over the next 12 months?

DILHAN PILLAY: It depends on what you mean by de‑risking. De‑risking could, in some circumstances, be a decoupling, for example. I think the most important thing is people are talking about resilience and security today much more than before, so in the context of that, everyone is looking to see how they can effectively protect themselves from shocks and from other things that would impact the economies or their comparative stance. So whether you use the word "decoupling" or "de‑risking", it depends on what you are doing and that is what we have to pay attention to – what are people doing and how will that impact our investment thesis, the companies we are already invested in. Take, for example, US companies, to what extent is China a relevant market for them, as it was maybe 10 years ago? Maybe it is not, then you have to think where else would they be looking for growth, as an example. If you look at supply chains, well, if you are thinking about de‑risking your supply chains or even moving to China plus one, the cost associated with that may also affect your margins, et cetera, so how does that impact? Will it be effective or not?

So there are various factors we have to take into account when we look at what is happening geopolitically in that context. So whether it is de‑risking or decoupling, it really depends.

Question on China Outlook – Decoupling

QUESTION: To develop a bit more on the decoupling theme, which specific sectors and opportunities in China have you gotten more bearish on and shying away from in terms of your investments for the coming quarters and for the coming year?

CHIA SONG HWEE: In terms of direct exposure, we really do not have any companies that would be affected by the decoupling in a direct sense. However, with decoupling, with the higher cost and inflationary pressure, it will affect the economy. It will slow down economic development and that effect will be felt by businesses, so it is more of second- or third-order effects.

Question on China Outlook – Tech Sector

QUESTION: What is Temasek’s view on the tech sector in China in general, following the fine issued to Ant Group by regulators?

CHIA SONG HWEE: In general, the tech sector is still important. What we need to take into consideration is the policy direction, so that we invest with that view clearly in mind. There are promising technologies coming up from China. The Electric Vehicle (EV) supply chain – battery and so on – is a very compelling investment opportunity space for us and does not seem to be in conflict with the policy direction. We have also seen very strong growth on the enterprise software side, very much catering to the domestic market. Again, we do not see external factors or conflicting policy directions that will derail that.

Question on US Outlook – Committee on Foreign Investment in the United States (CFIUS)

QUESTION: There has been a lot of talk about beefed‑up CFIUS rules in the US. Given your exposure there, and most recently reverse CFIUS, have you taken any steps to review the portfolio as a result of that?

DILHAN PILLAY: First of all, we have seen a proliferation of foreign investment regimes over the world. There has been a number that have come about. In the EU, you have one for almost every country in the EU and you have an EU foreign investment regime as well. Some of them have been around for longer so they are much more well developed in terms of practices, for example, in Australia and in the US. In the US, clearly there are certain sectors where it is going to become more difficult for foreign investors to invest. So far, we have been able to get all our CFIUS rulings. Sometimes the timeframes take longer than before, so that itself is a cause for concern because the issue is whether we will become uncompetitive if we are in a competitive position for an asset.

But these are things that we have been observing in the last five years. I mean, CFIUS first went to a change with the Foreign Investment Risk Review Modernization Act (FIRRMA) law during the Trump administration. But as long as you continue to engage regulators, whether it is the US, Europe, Australia, parts of Asia, as to what we are doing, how we are investing, the fact that we do not get involved in day‑to‑day running of companies gives them a better understanding of us as an investor and whether they see us as a responsible investor. As long as we continue to be seen as a responsible investor, we will still be able to deploy capital where we want it to be put to, although it is much more challenging.

CHIA SONG HWEE: I would like to add a couple of points. One is that the shift of supply chains itself could present investment opportunities for us. The national industrial policies of EU and the US are promoting investment – they are promoting manufacturing, nearshoring or onshoring. Those could bring opportunities to us, so may not be all that negative.

The second part I would like to add is that all these shifts are mainly having second‑order effects on our portfolio because our direct exposure to countries like China and the US are very much driven by the domestic market demand. For example, we do not invest in any companies in China that rely on export to the US or Europe or that rely on imports of supplies. This is the same for the US. So from the direct exposure standpoint, we are okay but I think what we have to deal with is second- or third-order effects.

Question on Sustainability

QUESTION: On sustainability and climate change, Temasek has always talked about its engagement with portfolio companies. You have taken an approach to work with companies in their decarbonisation journey instead of choosing to divest or exclude carbon‑intensive industries. As part of this engagement, is there some sort of escalation process when you are talking to the companies? I understand that divestment is the last resort, but what is the process, for example when it comes to voting at the AGMs of these portfolio companies? Do you have a voting policy, and how is it being communicated?

DILHAN PILLAY: So we do have active engagement with all our companies, and we have done that for years. When it comes to sustainability, there are multiple touchpoints with Temasek, including our Sustainability Group, the Portfolio Development Group, as well as some of us in senior management. And we share with them what we think they should be moving towards.

So, I give you one example. If you look at Seatrium, which is the combination of Keppel Offshore Marine and Sembcorp Marine, its real focus was in building some of the best platforms for offshore oil and gas drilling, especially when you look at jackup rigs, semi-submersibles and fuel ships. But what we have been engaging them on is how we can find a carbon capture solution for their drilling rigs, especially if it is for oil and gas. Secondly, how can we pivot even more to offshore renewable energy platforms? They do substations now, they do high-voltage direct current systems (HVDCs) and so on. What more can be done, such as for wind turbine installation vessels (WTIV) and what have you? So we engaged them on that. And that is with a view towards the fact that over time, that will be the future, as opposed to now where because of energy security, oil and gas drilling is still rather significant.

And when we talk about SIA, it is about sustainable aviation fuels.

So the engagement is always there about understanding industry trends, and we are learning as well from them. I want to be clear that it is a two-way process. We also learn from them as to how they see the industry dealing with these challenges. And then we have the Temasek Portfolio Companies Sustainability Council where we get everybody to come together to share their own experiences. Some companies are actually significantly ahead in terms of thinking through the issues. Like, for example, how do you really measure your carbon emissions and your intensity? What is the right measurement for it and the like? And we bring in third parties who are consultants and advisors to share their perspectives with the companies as well.

There is a multifaceted approach to this issue because our Singapore Portfolio Companies make up 40% of our portfolio, so they are very important to us. The fact that they can be ahead of the game, or keep ahead of the game, or keep up with the game, is critical for their success and therefore our success.

CHIA SONG HWEE: It is also not fair to say that we do not need to resort to exercising our shareholder rights at AGMs. The fact of the matter is the world is heading towards sustainability, so everybody better get on the train, otherwise you will seriously impact your business going forward.

Question on Sustainability (2)

QUESTION: I want to clarify the elevation of sustainability and climate change into a core pillar for Temasek’s T2030 strategy. What is the practical difference on a day‑to‑day basis, given that Temasek has always talked about sustainability being at its core. Would there be a change in the way Temasek engages with its portfolio companies with sustainability being elevated to one of the core pillars?

Secondly, Temasek’s Total Portfolio Emissions increased from 26 million tCO2e for the financial year ended 31 March 2022 to 27 million tCO2e for the financial year ended 31 March 2023. What is the reason for the increase? I assume it has to do with the economy reopening, but do you have other insights you could share? And with regards to your 2030 target to reduce your emissions to 11 million tCO2e, is Temasek on track for that?

DILHAN PILLAY: The first question has to do with what has changed. Actually, everything is a journey for us. We started thinking about sustainability in 2011, to keep a watchful eye. In 2016, we stepped up and set up a group called the Sustainability and Stewardship Group. And in 2019, we put together all that we were doing and the new initiatives into the T2030 strategy.

That has really got three main components to it. The first is that we should invest more in climate‑aligned sectors. I mentioned our seven focus areas – food, water, waste, energy, materials, clean transportation, and built environment. More capital should be going into these areas, where we can see the opportunity for growth over a multi‑year basis. Some of this will involve early stage investments, while others will be a little bit more mature.

For example, last year, we took a majority ownership in the number two drip irrigation company in the world called Rivulis, which will be very significant for water resource management because 70% of freshwater goes into the agricultural sector – so that is an area that needs to have solutions to lower the use of water, which is important for the sustainability of the planet, including the production of food, for example.

The second prong is that we want to invest in carbon negative areas or solutions that contribute to a significant reduction in carbon. Nature‑based solutions are a clear example of the former. The second refers to our investments in companies like Electra, which can hopefully contribute towards reducing emissions in the production of steel. And the same thing, for example, for cement.

And the third prong is that we work with our portfolio companies on their journey to reduce their own carbon emissions. The good thing is that all the key companies within our Singapore portfolio are on the journey – some are more advanced than others, while some are in really challenged sectors. Take for example aviation, which bring us to your second question, why did our portfolio emissions increase from 26 million tCO2e to 27 million tCO2e? Well, a lot of it is attributed to air travel. We are not quite at pre‑pandemic levels yet, because Singapore Airlines (SIA) is only at 79% of fleet capacity utilisation, but a significant amount of travel has come about in the last two years. To calculate our Total Portfolio Emissions, we take the pro rata part of SIA’s emissions, which accounts for significant part of the increase.

But what is SIA doing? Well, part of the S$15 billion that we committed to them went towards fleet renewal. They have done a fleet renewal programme over three years that has brought about a newer fleet which is 25% to 30% more fuel‑efficient than the pre‑existing fleet.

The other thing that we are working with them on is sustainable aviation fuel – already, that is being mandated in Europe, for example. It will be mandated in stages around the world and so the question there is for airlines, for engine makers, for airports, et cetera, to come together and figure out how we can make sustainable aviation fuel more of a reality, in terms of blended fuel for aviation.

On the third question, it comes back to the second question, which is that much depends on SIA. But let me tell you why.