FAQs

Why was Temasek established?

Temasek was incorporated under the Singapore Companies Act in 1974 to own and commercially manage investments and assets previously held by the Singapore Government. This allowed the Ministry of Finance to focus on its core role of policymaking and regulations, while Temasek would own and manage these investments on a commercial basis.

Where did Temasek’s original portfolio come from?

The initial portfolio of S$354 million comprised shares in companies, start-ups and joint ventures previously held by the Singapore Government. They included a bird park, a hotel, a shoemaker, a detergent producer, naval yards converted into a ship repair business, a start-up airline, and an iron and steel mill.

For further information on the list of companies in Temasek’s initial portfolio, please refer here.

Is Temasek a statutory board or a government agency?

Temasek is a Singapore incorporated company, and operates under the provisions of the Singapore Companies Act. Temasek is neither a statutory board nor a government agency.

Like any other commercial companies, Temasek has its own Board of Directors and a professional management team. It pays taxes to tax authorities, and distributes dividends to its shareholder.

As a global investment company, Temasek has Board members from across the world, each with diverse skills, experiences, and knowledge. Temasek’s Board of Directors comprises mainly non-executive independent private sector business leaders. Our Board operates on a commercial basis and there are no nominees of the Singapore government or any other government on Temasek’s Board. Details of all our Board members can be found here.

In addition, as a key institution in Singapore, Temasek is also designated a Fifth Schedule entity1 under the Singapore Constitution, with certain safeguards to protect its past reserves. For instance, any transaction which is likely to result in a draw on Temasek’s past reserves2 is also subject to the approval of the President. The right to appoint, reappoint, or remove our Board members is subject to the concurrence of the President of Singapore.

Other than specific safeguards to protect the integrity of Temasek Board appointments and its past reserves, Temasek continues to operate independently on a commercial basis.

Footnotes:

1 Under the Singapore Constitution, the concurrence of the elected President of Singapore is required over certain governance matters concerning Fifth Schedule entities. These include the appointment and removal of board members and the CEO, and the drawdown of past reserves built up by the entity before the term of the current Government. Other Fifth Schedule entities include the Central Provident Fund Board, GIC Private Limited, and the Monetary Authority of Singapore.

2 Temasek’s past reserves are those accumulated by the Company before the current term of Government. Temasek’s current reserves are those Temasek accumulates during the current term of Government.

Is Temasek required to pay tax?

As a commercial investment holding company, Temasek pays the required taxes to the relevant tax authorities.

Does Temasek disclose its financial results? How can I find out more about Temasek?

As an exempt private company, Temasek is not required to disclose financial information.

However, since 2004, Temasek has published its annual Temasek Review, which serves as a public scoreboard of its business and performance.

The Temasek Review forms part of Temasek’s annual disclosure exercise, which also includes an online version of the Temasek Review, international media engagement, and advertising.

Temasek has also established a presence on digital platforms X, Facebook, Instagram, LinkedIn, and YouTube to reach out and further engage the public.

Through these channels, Temasek provides updates on its performance, activities, and topics of interest. We hope to build communities with whom we engage more directly, as we share Temasek’s story over time.

Temasek’s annual report exceeds the standards of disclosure under the Santiago Principles, a set of best practices adopted by sovereign investors in collaboration with the IMF and various governments, including Australia, Canada, Norway and the USA.

Please refer to www.temasekreview.com.sg for the latest Temasek Review and to https://www.ifswf.org/santiago-principles to read more about the Santiago Principles.

Is Temasek credit rated?

Temasek and its bond programmes are rated Aaa/AAA by Moody’s Investors Service (Moody’s) and S&P Global Ratings (S&P) respectively. Our ECP programme has been assigned top short-term ratings of P-1/A-1+ by Moody’s and S&P respectively. All Temasek Bonds issued to date have been rated Aaa by Moody’s and/or AAA by S&P.

Temasek’s MTN Offering Circulars and Reports by international credit ratings agencies are published on the bond section on Temasek’s website.

Does Temasek manage Central Provident Fund (CPF) savings or Singapore’s foreign reserves?

Temasek does not manage CPF savings (which are managed by the Central Provident Fund Board), Government surpluses, or Singapore’s Official Foreign Reserves (which are managed by the Monetary Authority of Singapore).

Are Temasek and GIC the same organisation?

There are 3 key financial institutions in Singapore, which are linked to the Singapore Government.

The Monetary Authority of Singapore (MAS) was formed in 1971, and acts as the central bank of Singapore. It manages the foreign reserves of Singapore. It is a statutory board.

Temasek is an investment holding company incorporated in 1974 in the early years of Singapore‘s independence to own and manage its assets and investments on a commercial basis. Temasek is wholly owned by the Singapore Minister for Finance1.

GIC is also wholly owned by the Singapore Minister for Finance1. GIC manages the Government reserves, including surpluses accumulated and built up since independence.

They are separate entities with distinct roles and mandates, and distinct management teams.

Temasek is an investment company with a global portfolio, and manages its investments based on commercial principles. Temasek owns the assets it manages, is credit rated and issues international bonds.

Temasek aims to deliver sustainable returns over the long term. As an engaged shareholder, Temasek promotes sound corporate governance in its portfolio companies.

You can obtain more information about GIC at www.gic.com.sg, and more information about the MAS at www.mas.gov.sg.

Footnotes:

1 Under the Singapore Minister for Finance (Incorporation) Act 1959, the Minister for Finance is a body corporate.

Is the Singapore Government or the President involved in Temasek’s business decisions?

Neither the Singapore Government nor the President of Singapore is involved in or directs Temasek’s investment strategies, investment decisions, or other business decisions, except in relation to the protection of Temasek’s past reserves.

The Singapore Government’s role as shareholder in respect of Board appointments is subject to the concurrence of the President in order to protect the integrity of the Board of Temasek as a Fifth Schedule entity.

How is the President involved in the protection of Temasek’s past reserves?

The President of the Republic of Singapore has an independent custodial role to safeguard Singapore’s past reserves.

As a key institution under the Singapore Constitution, Temasek is required by the Singapore Constitution to seek the President’s approval before a draw occurs on Temasek’s past reserves.

Temasek’s Chairman and CEO also certify the Statement of Reserves and Statement of Past Reserves to the President at prescribed intervals.

Is an investment loss considered a draw on past reserves?

A draw on past reserves occurs when total reserves are less than past reserves.

So if total reserves equal or exceed past reserves, there is no draw.

We then have to look at what is meant by investment loss.

When we invest in a portfolio of shares, there are constant changes in market values. Such changes happen for instance to the value of our shares during the global financial crisis, where we saw our portfolio value fall 30%, only to rebound 43% one year later. Such falls in the market value of shares are not a draw.

When investing, we may have realised gains or losses on disposal of shares. We may realise losses in our investments, either because the investment has gone bad, or we decided to exit in order to redeploy our funds to more attractive opportunities.

We may exit at a high or a low, depending on our views of the potential returns compared to putting the same dollar to work elsewhere.

Our Board has a responsibility to ensure that every disposal of investment is transacted at fair market value.

A realised loss would not constitute a draw on past reserves, so long as the disposal is done at fair market value (i.e., based on a price agreed between a willing buyer and a willing seller on an arm’s length basis).

How is the President involved with the Board of Temasek?

To safeguard the integrity of those involved in managing Temasek’s reserves, the President’s concurrence is required for the appointment, renewal or removal of Board members and the appointment or removal of the CEO by the Board.

Further to its normal fiduciary duties to the Company, the Board and CEO are accountable to the President to ensure that every disposal of investment is transacted at fair market value.

As a global investment company, Temasek has Board members from across the world, each with diverse skills, experiences, and knowledge. Temasek’s Board of Directors comprises mainly non-executive independent private sector business leaders. Our Board operates on a commercial basis and there are no nominees of the Singapore government or any other government on Temasek’s Board. Details of all our Board members can be found here.

What are the companies in Temasek’s portfolio? How many are listed and what is the market capitalisation of these companies?

A list of some of Temasek’s portfolio companies is provided in the Temasek Review.

For further information on Temasek’s portfolio companies, please see Temasek Major Investments in the Temasek Review.

How does Temasek work with its portfolio companies?

As stewards of our assets, we engage our portfolio companies to enhance shareholder value and advocate good governance, and sustainability and corporate practices.

Governance

The day-to-day management and business decisions of companies in our portfolio are the responsibility of their respective boards and management, we do not direct their business decisions or operations. We support the formation of high-calibre and effective boards and advocate that the Chairman and CEO roles be held by separate persons, independent of each other, to ensure a healthy balance for independent decision making, and a greater capacity for management supervision by the board.

When we exercise our vote, we seek to promote sound governance, protect our interest as an investor, and support long-term financial value creation.

Engagement

We add value as a shareholder by exchanging ideas, sharing best practices, and organising roundtables and networking events in areas such as corporate governance, cybersecurity, finance, industry and technology trends, legal and regulatory, reputational risk management, and sustainability.

We (and our Board) do not have access to any non-public technical information nor personal data held by our portfolio companies.

Expectation

As part of our constructive engagement, we share our shareholder expectations with the boards of our portfolio companies, which contribute to Temasek delivering sustainable returns over the long term.

We expect companies to comply with applicable laws, and to abide by sound corporate governance and appropriate codes of conduct and ethics. We do not condone any form of misconduct and malfeasance and hold the boards accountable for the activities of their companies.

Does Temasek request representation on the boards of companies in which it invests?

In general, Temasek is not represented on the boards of its portfolio companies.

Temasek’s decision to nominate a director to the board of a company we invest in depends on the size of our investment amount and the stake that we hold in the portfolio company.

We support the formation of high-calibre, effective and predominantly independent boards. An effective board is one that displays independent judgement, a good mix of competencies and expertise, as well as diversity and accountability. Boards should comprise individuals with the requisite skills, experience, and attributes to significantly contribute to the success of the company.

Where we do nominate a board director, we can leverage our wide network to suggest qualified individuals for election to the board. While these persons need not be Temasek employees, we may also nominate employees to act as directors.

These key principles hold in all situations:

- Temasek does not direct the operations and management of our portfolio companies;

- Directors have a fiduciary duty to that company and shareholders as a whole;

- In certain cases or where required by law or exchange rules, directors nominated by us will be recused from any decisions involving Temasek.

We rely on the boards to set the company’s strategy, supervise management’s performance, exercise effective oversight, and be accountable to stakeholders for their decisions and outcomes of their actions.

How does Temasek fund its investments?

Temasek investments are financed using dividends and other cash distributions it receives from its portfolio companies and other investments, and borrowings and debt financing sources such as the Temasek Bonds and Euro-commercial Paper Programme.

Further information on Temasek’s Ins & Outs is available here.

What is Temasek's divestment schedule?

Temasek does not have a divestment schedule.

Temasek is an investment company that rebalances its portfolio from time to time. Decisions to invest, divest or hold its investment positions are based on Temasek’s intrinsic value test.

How does Temasek engage the community?

Since 2003, we have been setting aside a portion of our net positive returns above our risk-adjusted cost of capital for community gifts.

These are approved by the Temasek Board before being gifted, mainly to Temasek Trust (TT), which then disburses the gifts via grants and endowments to our non-profit ecosystem including Temasek Foundation (TF), Temasek Life Sciences Laboratory, Stewardship Asia Centre, and Mandai Nature.

To date, Temasek’s gifts to TT have enabled programmes which have impacted about 4.4 million lives across Singapore and beyond, delivering on Temasek’s community objectives to connect people, uplift communities, protect our planet, and advance capabilities.

TT’s role has evolved since its inception in 2007 when it was set up primarily to manage philanthropic financial assets. Today, TT also strives to be a leading advocate of sustainability and governance in philanthropy, a catalyst in creating shared value, and an investor for impact.

Globally, we also support communities in the markets we operate in. Our offices donate to local charities and work with partners to deliver sustainable impact, underscoring our commitment as a responsible corporate citizen.

You can read more about Temasek’s community approach here.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns result in any impact on Temasek?

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long-term real rate of returns of the investment entities in the framework.

The inclusion of Temasek under the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long-term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

The NIR framework does not determine the amount of dividends that Temasek distributes to our shareholder.

The Government has a variety of sources of liquidity and cash flows that enable the Government to manage its liquidity needs independent of the strategies of Temasek, MAS and GIC.

Temasek will continue to declare dividends annually based on the profit we earn, in accordance with our Board-approved dividend policy. The dividend policy balances the sustainable distribution of profits as dividends to our shareholder, with the retention of profits for re-investment and future returns. The policy also takes into account the constitutional requirement to independently protect Temasek’s past reserves.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns require Temasek to pay more cash to the Singapore Government?

The NIR framework does not require Temasek to pay more dividends or cash to the Singapore Government.

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long-term real rate of returns of the investment entities in the framework.

The inclusion of Temasek under the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long-term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

The NIR framework does not determine the amount of dividends that Temasek distributes to our shareholder.

The Government has a variety of sources of liquidity and cash flows that enable the Government to manage its liquidity needs independent of the strategies of Temasek, MAS and GIC.

Temasek will continue to declare dividends annually based on the profit we earn, in accordance with our Board-approved dividend policy. The dividend policy balances the sustainable distribution of profits as dividends to our shareholder, with the retention of profits for re-investment and future returns. The policy also takes into account the constitutional requirement to independently protect Temasek’s past reserves.

Will the application of the Net Investment Returns (NIR) framework to Temasek’s expected returns result in any changes in Temasek’s investment strategy?

Including Temasek’s expected returns in the NIR framework does not change Temasek’s investment strategy as a long-term investor, and has no impact on Temasek’s ability to buy, sell or hold assets.

The NIR framework provides rules for determining how much the Government can spend on its Budget, based on the expected long-term real rate of returns of the investment entities in the framework.

The inclusion of Temasek under the NIR framework does not affect, change or impact:

- Temasek’s dividend policy;

- Temasek’s strategies and operations as a long-term investor; and

- Temasek’s special responsibility under the Singapore Constitution to protect Temasek’s past reserves.

Any changes to Temasek’s strategies or portfolio composition will affect our expected long-term returns.

Temasek’s investment strategy is the responsibility of Temasek’s Board and management. Investment and divestment decisions will continue to be based on our intrinsic value tests.

Temasek will continue to focus on delivering sustainable returns over the long term.

The Singapore Government is not involved in the investment, divestment or other business decisions of Temasek.

Do the financials in the Temasek Review and Offering Circular reflect Temasek’s performance as an investment company?

The Credit Profile section of our Temasek Review and Business of Temasek section of our Medium Term Note programme Offering Circulars include key credit parameters based on the financials of Temasek as an investment company1. Our Credit Profile provides a quantitative snapshot of our credit quality and the strength of Temasek’s financial position. Temasek’s overall performance as an investment company is also highlighted in our Temasek Review and Offering Circulars, through measures such as total shareholder returns over various time periods.

Footnotes:

1 Based on the financial information of Temasek as an investment company, namely Temasek Holdings (Private) Limited (THPL) and its Investment Holding Companies (IHCs). IHCs are defined as THPL’s direct and indirect wholly-owned subsidiaries, whose boards of directors or equivalent governing bodies comprise employees or nominees of THPL, wholly-owned Temasek Pte. Ltd. (TPL), and/or TPL’s wholly-owned subsidiaries. The principal activities of THPL and its IHCs are that of investment holding, financing, and/or the provision of investment advisory and consultancy services.

Does Temasek guarantee its portfolio companies’ debts?

As a policy, Temasek does not issue any financial guarantees for the obligations of our portfolio companies.

How do I apply for a position at Temasek?

Please submit your details via the career portal under the respective application links. For further queries, please contact us at career@temasek.com.sg.

What happens after I submit my resume and how will I know if I am selected to participate in the interview process?

We will notify you if your qualifications and experience are relevant to the requirements of a currently available position. If you are selected to proceed in the process, you will be contacted directly by the Human Resources team.

What are your selection criteria when reviewing a candidate’s suitability?

We will broadly consider a candidate based on the following:

- Competency

- Relevant experience

- Values

- Leadership qualities (for experienced hires)

Selected Questions & Answers from the Temasek Review And Sustainability Report Media Briefings 2025

9 July 2025, Singapore

The following is an edited transcript of questions and answers from various media briefings on the Temasek Review and Sustainability Report 2025.

Grammatical edits have been made to aid readability. For the same reason, questions are grouped thematically.

Slides and charts have been added from the Temasek Review 2025 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to view all of the key financial metrics and diagrams in Temasek Review 2025.

Question on Performance

QUESTION: Congrats on hitting a record NPV and a sharply increased one-year TSR. Are you confident that Temasek can maintain its current growth trajectory going forward in this current financial year ending March next year?

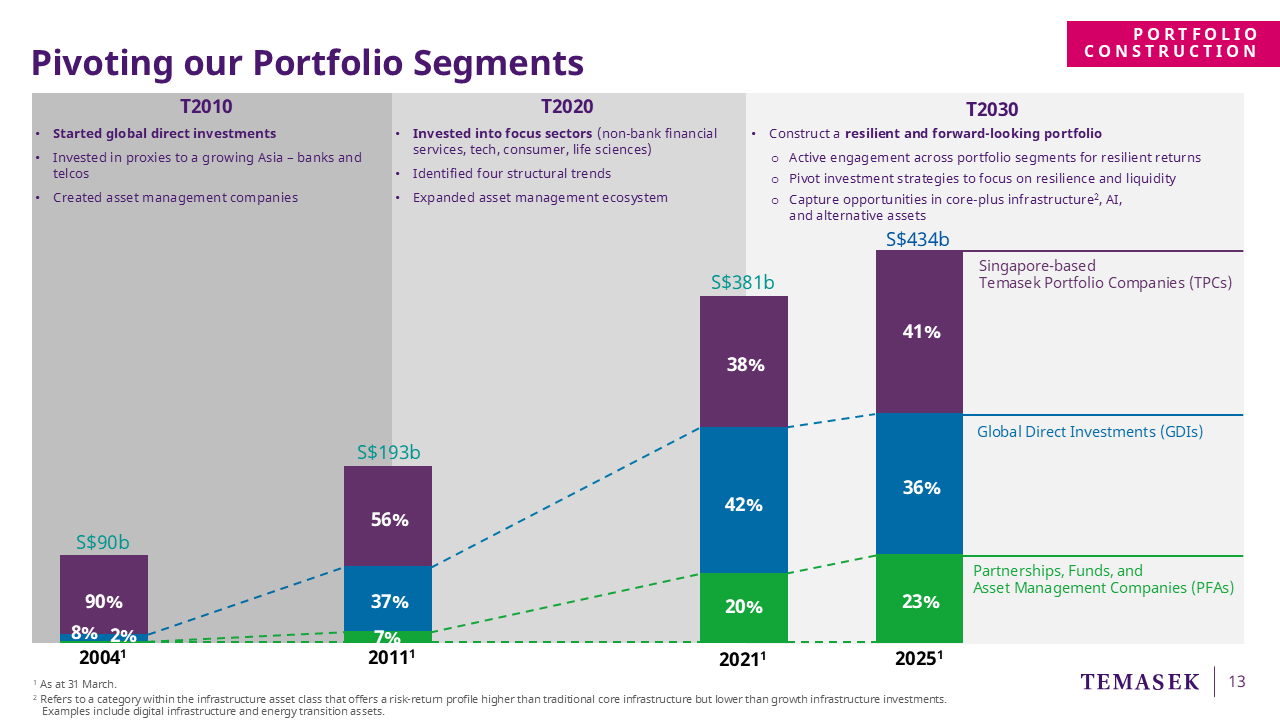

PNG CHIN YEE: We do not look at year-on-year performance, or our one-year TSR. We look at our performance over the long term. We look at the 10-year and 20-year performance, and over time that has been quite resilient. Our 10-year TSR was 5% and 20-year TSR was 7%. It is hard to say where we will end up exactly next year, but it is important to ensure that our portfolio remains resilient despite the external environment. That is what we have been really focusing on — to build a portfolio that can withstand exogenous shocks and deliver returns over the long term.

Ming Pey has talked about our three segments: our Temasek Portfolio Companies (TPCs) based in Singapore, our Global Direct Investments (GDIs) and our Partnerships, Funds and Asset Management Companies (PFAs). For TPCs, we have engaged them to make sure they have sustainable business models, and that they remain competitive and relevant in this dynamic environment. In the GDI space, we have been much more focused on investing in companies with a strong cash flow, strong pricing power with resilient supply chains, and operating in one geoeconomic sphere of influence. We invest in companies that have access to big domestic markets and can be more insulated to tariffs or whatever else that is going on in the world. We build more resilience in the portfolio for long-term returns, rather than year-on-year returns.

CHIA SONG HWEE: The returns for the year were not driven by new investments made during that year or the year before. We have held those assets for much longer. We want to construct a portfolio that is resilient and forward-looking. Hopefully, the portfolio construction will deliver returns in spite of the market volatility or the stress that we are seeing or may see from time to time. That is what we are doing.

Question on Portfolio – Ideal Split

QUESTION: Between TPCs, GDIs and PFAs, what is the ideal portfolio split going forward?

CHIA SONG HWEE: There is no ideal split. Based on portfolio construction, we think the rough split would be 40/40/20, plus or minus 5%.

We cannot predict the bottom-up investment opportunities. In some years, some segments may have more opportunities, and when it comes to divestments, other sectors may have more. We do not think of it as a rigid percentage but as a range.

Question on Portfolio – Resilient Returns

QUESTION: You said you are looking at investments that have a more stable and narrower range of outcomes, and have more resilient cash flows. Is that a change or is Temasek being more cautious in generating returns?

ROHIT SIPAHIMALANI: We are talking about a much more uncertain environment today than in the past decade. How do you build a portfolio that can navigate that? We need to build a portfolio that does well, regardless of high or low inflation, high or low growth, and whether or not we have trade tensions or bifurcations across all environments. This is something we recognised a few years ago as the world has been changing geopolitically. We need to be conscious of these changes and adapt our portfolio construction accordingly. For example, we have looked at businesses that have access to large domestic markets, like hospitals, banks, or consumer brands in India. Similarly, in China, we look at domestic brands, and in the US, software or fintech companies. Ultimately, these are relatively more resilient industries, and within that, we are looking at companies that can have a narrower range of outcomes.

Question on Portfolio – Geographical Exposure to US and China

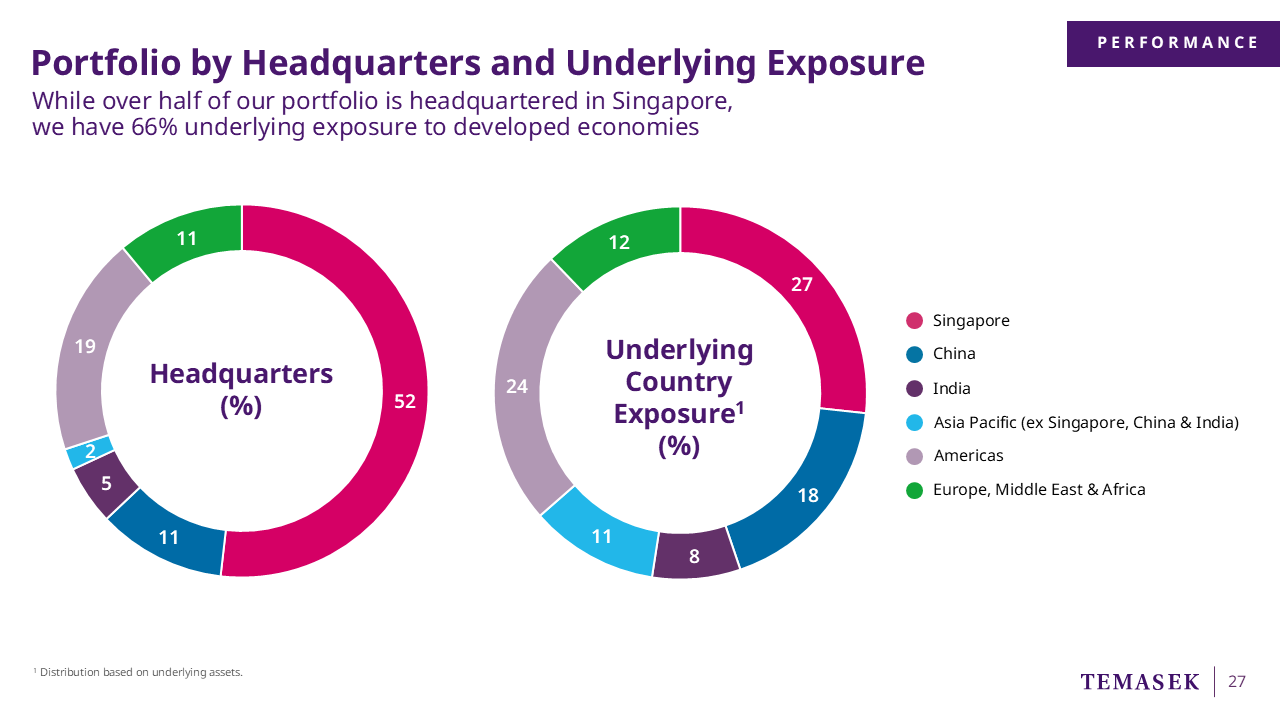

QUESTION: In terms of geographic split, given the uncertainties, are there plans to adjust your exposure in the US and China? The exposure in China has decreased significantly in the last five years.

ROHIT SIPAHIMALANI: Across all the markets, we see opportunities and risks. In the last 10 years, we've made major shifts in the portfolio because, back then, we were mainly an Asia-focused investor. We then opened offices in the US and Europe only in 2014, so it was natural then — as we built up exposure in those markets — to see larger shifts in the portfolio. When we were just in Asia, our biggest exposure was in China, so it was natural for exposure in China to decrease as we increased our US and Europe exposure. But now, we are quite happy with the relative positioning we have across markets. Moving forward, the differences will be more marginal. It will depend on bottom-up opportunities and how individual markets are performing year by year, but you will not see the same level of changes or big moves that you saw over the last decade.

CHIA SONG HWEE: If you compare this year’s China exposure to last year’s, by absolute dollar amount, it is up by S$4 billion.

PNG CHIN YEE: As Rohit has mentioned, in the early days, we were mainly Asia-based, so our portfolio’s geographic exposure was mainly focused on Singapore and China. As we opened offices in Europe and the US, we did more in those markets and that's why you see the big shift in geographic exposure over the 10-year horizon.

CHIA SONG HWEE: You may ask, why the US and Europe? It is because that is where we believe there will be opportunities for growth and returns, such as in the areas of technology, life sciences, and non-bank financial services. From a comparative advantage standpoint, the US and Europe markets offered us those opportunities, and that led us to establish offices in these regions to have people on the ground to pursue those investment opportunities.

ROHIT SIPAHIMALANI: In terms of portfolio resilience, having a geographically balanced portfolio gives us more resilience. There will always be some regions that will do better, and some regions not as well. If we see trends emerging, we can shift from one to another. Whereas if you are only established in one or two markets, you are totally exposed to the cycles happening in those markets. So in that sense, we feel more comfortable with the more diversified portfolio that we have today.

Question on Portfolio – Engagements with TPCs

QUESTION: We would like to get more colour on how Temasek would provide more guidance to Singapore-based TPCs like SIA with all the uncertainties and geopolitical uncertainties moving forward? How are you going to engage them and in what areas?

CHIA SONG HWEE: With regard to geopolitics, we have been sharing our thoughts with our portfolio companies on what they need to be aware of, such as geopolitics, tensions between countries, regulations, trade, and supply chain rewiring. All these are pointing to a more fragmented world versus a more globalised one.

Every business needs to adjust to this new norm. We believe these are not going to go away. In fact, you could argue that it is probably going to go more in that direction. So every company, given their business model, needs to make appropriate adjustments or pivot.

Following COVID, our portfolio has become more resilient compared to pre-COVID times because it was a period when our portfolio companies took very concrete steps to strengthen their business fundamentals, including the strength of their balance sheet and capital allocation, so that they could strengthen their core.

If you look at the performance of SIA, clearly they have moved quite successfully out of the COVID situation and enjoyed a few years of good growth. But I'm sure the management is not being complacent — competitors are catching up in terms of aircraft deployment, and will get more competitive as yield is compressed. These are just some of the business dynamics that our portfolio companies need to deal with.

Beyond the usual sharing of our view of the macroeconomic landscape as well as geopolitical situation, we do work with our portfolio companies on various aspects. So we do discuss and engage with them on how they can address threats and take advantage of the opportunities.

This year, our portfolio companies did quite well. One of the things that we can point to, is that many of them have communicated to their broader shareholders on their five-year financial plans and what they are doing to improve their business profile. For companies who have delivered results against those targets, their share prices have performed well. So this is something that we have emphasised to all our portfolio companies — that they must be able to communicate and articulate what they are doing to their investors.

Question on Portfolio – IPO Plans for TPCs

QUESTION: The Singapore-listed TPCs have done very well over the past few years. Does Temasek have any plans to ride on this momentum, especially to list the large TPCs like Mapletree, PSA, or SP Group?

CHIA SONG HWEE: The decision to list or not is for the board and management to decide. We must also ask this fundamental question — is accessing capital markets and being listed necessarily the right thing for the company? That may not be a straightforward answer.

For example, if you take businesses like PSA, which are rather capital intensive, you would have to go through a period of capital investment that will depress the financial performance of the company. A company of this nature may not be well suited for public markets. But there may come a time when capital expenditure is moderated and cashflow generation becomes more acceptable to the public, then the management or the board can consider doing that. So far, the company has been able to manage their growth with their capital, leveraging their self-generating capability so there is no need for them to access funding from the capital market.

We talk about capital structure optimisation. If we believe that the capital market structure is not optimised for their business, then we'll have a discussion with them to see how they can optimise it for better returns, for the growth of the business and its resilience, as well as from a shareholder standpoint. There is no one-size-fits-all approach. Requiring the company to be listed may not necessarily be our objective.

Question on Investments and Divestments

QUESTION: From the latest financial year, I see that Temasek invested more than it divested while previously, it was the other way around. Just wanted to get your view on the reason why. Is it because the environment presented a lot of value for bargain hunting for you during the financial year? Or is it because the exit environment is not doing well? Or it is a combination of both?

ROHIT SIPAHIMALANI: Generally, we've been looking over the last few years to reshape our portfolio to increase its resilience in this highly uncertain geopolitical environment.

Ultimately what we do in a particular year ends up partly being a function of bottom-up opportunities. Also, the investment figure refers to the actual money deployed. So in some cases, it may have been a commitment that we made in the previous year, but the investment actually happened right now.

Year by year, I would not look at that too seriously. If you look at the past two years combined, the net investment is close to a balance, which is what you would expect from us because ultimately, we invest money based on our divestments and dividends. So year by year, those shifts will happen, but I would not read too much into it.

On the divestments again, we may invest into similar themes when that thesis has paid out significantly.

One example would be Eternal, which used to be called Zomato, in India. So we've been invested for well over a decade. It's done really well for us, and our position is quite sizeable, but as we were investing into some other companies in India around the consumer and technology — for example Rebel Foods and increasing our stake in Lenskart — we divested a portion of our exposure to Eternal and redirected it out here. Eternal is still a big position for us, but as we are investing in the same theme, we may reallocate capital from one investment to another.

PNG CHIN YEE: Another example is that we partially divested our stake in Adyen and we invested into Stripe. So we know they are both in the payment space with slightly different exposure, slightly different segments, but very much the same theme around payments across the globe.

I think some of the activities are really around portfolio rebalancing, as Rohit said, within the same thematic looking for different opportunities to actually express our views.

We had SIA return capital to us as well because of the mandatory convertible bonds which has matured.

Question on Investments – Asset Management Companies

QUESTION: We've been told that Temasek is one of those Asian investors that could be very interested in scaling up your Asset Management Companies segment, looking at markets like Europe and the US. Are you on the lookout for this, or acquisitions or investment into the asset management space of fund management?

ROHIT SIPAHIMALANI: Most of our asset management companies right now are in Asia. Over the last 15 years, we seeded many of them from SeaTown to Vertex and 65 Equity Partners. You can see all of them are really anchored more here in Asia.

Now each one of them obviously has their own strategies. Some asset management companies are under our TPCs, so whether it's CapitaLand, Mapletree, or Keppel, they have their own asset management businesses on real estate and they already are operating on a more global level.

For us, our focus in the US and Europe is as LPs (Limited Partners) in many of these global funds. In some cases where it makes sense, we may take a small GP (General Partner) stake. But I would say in terms of our asset management companies, at this point we are still mostly anchored in Asia.

Question on Investments – Unlisted Assets

QUESTION: How do you benchmark your private unlisted performance against your peers? How do you measure success? You pointed out last year, Temasek's portion of private unlisted assets was more than half of the portfolio for FY2024. This is higher than usual pension funds. Can you provide some colour behind Temasek's confidence level in the private unlisted segment?

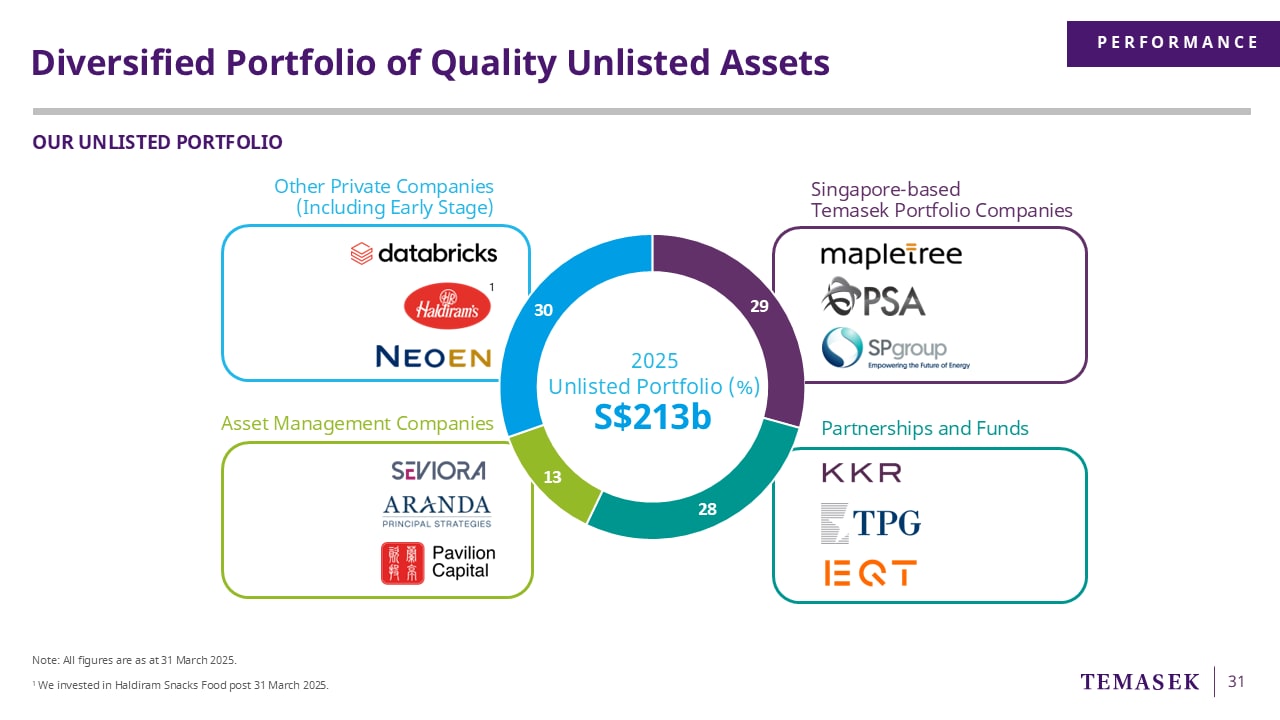

ROHIT SIPAHIMALANI: Our private assets have given us superior returns over the long term. This is because of the illiquidity premium that we can harvest. For us, we should be investing as a long-term investor to get higher long-term returns, so it is natural to have a greater proportion in private assets. We are different from other pension funds as our portfolio composition is different.

So the question is how much are we doing in both the public and private sectors? From a returns perspective, we should do as much (as possible) for private markets as we receive higher returns. However, we need to find a balance as we seek portfolio resilience. This results in balance sheet and liquidity strains. Therefore, if we invest only in private equity, then we may not have the right liquidity to shift our portfolio (in) response (to changing trends). Overall, the high proportion of private equity provides us with higher confidence to receive higher returns.

PNG CHIN YEE: If you look at the composition of private assets, 30% of the portfolio are TPCs. Then, another 30% is diversified across a range of private equity funds, which have historically provided good returns for Temasek over the long term. We also have 10% in Asset Management Companies, and the direct private equity component constitutes another one-third of our overall private asset portfolio. As mentioned earlier, that portfolio has done well relative to listed because we are able to get the illiquidity premium out of those investments. If you look at it together, it looks like a big proportion, but if you break it down, you'll see that many of the segments are diversified and very focused on blue chip companies. They do provide us with liquidity, in the form of distributions and dividends coming out of this portfolio, and have been a resilient portfolio, giving us good return outcomes.

Question on Investments – Core-plus Infrastructure

QUESTION: Infrastructure is not a new asset class. Why is there a sudden different tier that you have assessed to be a focus area this year? What are the pros and cons of core-plus infrastructure? I assume it might not be very liquid and it could take a long time to realise the gains.

ROHIT SIPAHIMALANI: There is a significant need for capital and there are also significant opportunities out there, particularly around AI and relatedly, energy. In some areas, there is just a need to upgrade infrastructure. We are not looking at basic infrastructure, which is already up and running and generating cash flows, because the returns there probably do not meet our thresholds. That is why we are looking at core-plus infrastructure, where there is some development part, but they also have stable, long-term contracts with some inflation protection.

Coming back to the point that because we're looking for more resilience in the portfolio in an uncertain environment, we want a greater proportion of our portfolio to have a narrower range of outcomes. We find that this asset class — because of the huge demand for data centres, and huge demand for energy — is giving us double-digit returns and actually a lot of it also with a stable cash yield. So that combination provides resilience to the portfolio.

You are right that in some cases, the investment period may be long and therefore exit periods may be longer, but you are getting regular cash flows in the process through dividends. So in that sense, it does give you some element of liquidity, while providing a stable growth outlook and a stable outcome of returns over a longer period.

PNG CHIN YEE: You are right to say that this is not necessarily a new asset class for us. Our TPCs have actually been very much involved in the infrastructure space and we are working with them, alongside partners, to assess this asset class. I think the other shift has been that interest rates today, are much higher compared to three or five years ago. So the returns you can get from the infrastructure space have also gone up in line with where interest rates have gone, so it makes it a little bit more attractive for us.

Question on Investments – Alternative Assets

QUESTION: Can you share more of your views on alternative assets? You mentioned that this is one of the growing areas, so can you give more colour to what we can do?

ROHIT SIPAHIMALANI: We want to increase the overall resilience of our portfolio. And as a part of that, this segment helps us gear ourselves towards that. So there are three main areas in this segment — one is private credit and hybrid solutions. We're looking at not-very-high-risk private credit, but credit that can give us low double-digit returns but a very high cash yield. We found that this asset class over long periods — five years, 10 years, 20 years — tends to give a fairly stable range of returns. Given the fact that compared to the last decade when interest rates were close to zero, base rates have gone up, we find it gives us pretty attractive returns with relatively low risk. So that's one piece of it.

For private equity funds, we've been investing in it for a long time and we'll continue to do so. Again, the more diversified multi-country funds tend to give a fairly stable base of returns and add to the portfolio resilience.

And lastly, we've been looking at liquid alternatives in certain strategies which are less correlated to equities. So for example, on the liquid strategies; we look at multi-strategy and macro hedge funds. We believe if we have the right portfolio of these funds, as a group, it gives us fairly stable double-digit returns regardless of the equity market environment. So again, this adds to portfolio resilience, and then we will look at other asset classes like closed block insurance, which again is a very stable asset class we've been investing in the last (few) years, giving us low-teens returns with a high cash yield. As a group of assets, we find it interesting. It adds to the portfolio resilience, and we've been there for over the last few years, investing quite steadily in this area.

Question on Investments – Alternative Assets as an Asset Class

QUESTION: How can an asset class provide equity-like returns without equity-like risks?

ROHIT SIPAHIMALANI: When looking at equities, we are talking about returns in the last few years with private equity being lower than the rest. Today, interest rates are higher than what they were in the last decade. If we look at the last 5, 10 and 20 years, the difference between private equity and private credit returns is around five percentage points. If we look at Preqin, they are forecasting that in the next five years, the gap is probably going to be two percentage points.

From a risk-adjusted basis, private credit looks like an attractive asset class. Just like core-plus infrastructure, that's not going to give us the returns we are getting on, for example, a leveraged buyout . We want our portfolio as a whole to have a narrower range of outcomes. We want some which produce more stable, low double-digit returns but with a narrower range of outcomes, and also some which will potentially have higher returns. Private credit has a role in the portfolio in that context.

Ultimately, it comes back to resilience — to build a resilient portfolio with a narrower range of outcomes. So, we decide where we want to play in the capital structure, decide which types of companies we want to look at — all with that objective.

Question on Investments – USD Foreign Exchange Risk

QUESTION: Do you expect the US dollar to weaken further, against the major trading partners, like the Euro and Yen? What are some opportunities that are presented to Temasek?

ROHIT SIPAHIMALANI: It is difficult to predict where things will go, but we have the benefit of owning a global portfolio. The US dollar has depreciated about 6% to 7% against the Singapore dollar (this year), but the Singapore dollar has depreciated 6% against the Euro which helps to create a balanced portfolio. We also manage our exposure to some extent by hedging, in terms of having (US dollar) liabilities against in our assets. None of us can predict where the US dollar value will be 12 months from now. Hence, we will need to think about it at the portfolio level and manage the risks accordingly. The positives of a weak US dollar is when you look at US companies that have 40% of revenue internationally, they provide earnings boost to the US dollar. So if you can manage to mitigate the currency risk, it helps to boost the earnings growth.

Question on Investments – Defence Industry

QUESTION: Is Temasek exploring the defence industry?

ROHIT SIPAHIMALANI: Historically, we always had exposure to defence through ST Engineering. In today's geopolitical context, defence is becoming one key pillar of national sovereignty. Hence, expenditure is going to ramp up. Therefore, we clearly see that as a space where there should be opportunities, and have since started investing in counters in the public markets.

CHIA SONG HWEE: Whatever we do, we are mindful that we must comply with rules and regulatory laws; we will definitely be 100% on top of it. Similar to food and cybersecurity, defence is growing to become part and parcel of what a nation needs to do and invest in.

Question on Investments – AI in China

QUESTION: Talking about AI, I'm curious about Rohit's views on the AI trends emerging in China. Is Temasek also looking to grab any opportunities from this trend in China?

ROHIT SIPAHIMALANI: We are already benefitting or at least investing in companies that we see will be huge beneficiaries of this trend, the most obvious companies are Tencent and Alibaba. For example, Alibaba is building up some infrastructure around AI, and it also sees the benefits of AI in its use of its own business, such as in terms of targeting consumers. Given the talent that China has, the ability of companies to absorb AI in their businesses and use it for their benefit may be faster than many other regions. That is really where we hope to be able to capitalise on.

PNG CHIN YEE: If we were to think about it, AI is an extension of the Digitisation trend that we have been investing in for such a long time.

CHIA SONG HWEE: AI is very pervasive. It is a global opportunity, and not just restricted to China. But I agree with Rohit that China’s adoption, such as in some of the consumer applications, can probably be a lot faster given how they are set up. We look at investment in AI in multiple layers, it's not just in Large Language Models or in applications. We look at anything from the physical infrastructure to the digital enablers, applications, as well as the physical aspect of AI, for example, embedding AI in physical products. It is not only these layers of opportunities, but also what we can do with our fund investments. They have a much deeper and wider reach than us, so we are leveraging those relationships for investment opportunities as well. These are 20-year opportunities, and we are still at a very early phase of this journey.

Question on Investments – Electric Vehicles (EVs) in China

QUESTION: Electric Vehicles (EVs) are a very active sector right now but with China facing some problems in overcapacity, do you see risk in this area? How are you going to manage this risk?

ROHIT SIPAHIMALANI: Every business has risk. We do know that in the long run, EV as an industry will grow and get share from the traditional combustion vehicles. Within that, BYD is clearly the global leader out there, having the lowest cost position, the largest market share, and one of the best technologies. Companies like that should be better positioned to be able to navigate those environments.

CHIA SONG HWEE: EV is only part of the value chain of the electrification of transportation, right? So we have battery technologies, we have infrastructure-related investment opportunities as well. So we look at it as a whole rather than just the OEM for the vehicles.

Question on Investments – eFishery

QUESTION: Could you tell us what is your takeaway from the eFishery investment case?

ROHIT SIPAHIMALANI: I will start by saying we are very disappointed with what has happened there. Clearly, we did not anticipate this. When you have an early-stage portfolio, when you have dozens of companies, you cannot completely eliminate the risk of fraud. So what we try to do is learn from experiences like this. We just try and apply it in future situations to make sure we minimise the likelihood of repeating what happened out there.

For example, we are trying to ensure the right quality of auditors, and that the independent directors of the board can challenge the CEO and the management to further strengthen due diligence. Ultimately, it is about the person, his or her integrity that matters. We always check that by doing reference checks. From our perspective, we learn from experience and we hope that there will not be such situations. But we also realistically recognise that we cannot completely eliminate this risk unless we do not do early-stage investments, which we think would be a mistake on our part.

We invest in these companies partly to look around the corner, and see what the new trends are, and what disruptive technologies there are, so that we can guide our portfolio companies, including our TPCs.

Secondly, for every failure, there are many successes. For companies like Adyen and Alibaba, because we entered early with small cheque sizes, we had the opportunity to progressively put in larger amounts and make good returns in those.

So we manage our risk by limiting the early-stage exposure, and right now it is about 5% of our portfolio. Our risk management guideline is not more than 6%. Within that 5%, half of it is in diversified venture capital funds — diversified across hundreds of companies. The other half, the really early-stage stuff are done by our Emerging Technologies team, which looks at truly disruptive technologies like in quantum computing and nuclear fusion, et cetera.

On our end, we also reduce early-stage risk by deploying capital into slightly later stages like Series C/D. Because by that time, the companies will be a little more mature, and it is easier to get a Big Four auditor for those companies to try and reduce our risk out there. So those are the approaches we have taken. As I said, we are very disappointed with this particular outcome, as we should be.

Question on Singapore – Equity Market Review

QUESTION: The ongoing equity market review is gathering a nice momentum. Prior to this, many market players have asked whether Temasek can be more active in doing something to help the market improve, such as tapping on MAS’ S$5b programme.

PNG CHIN YEE: It is a great thing that the government is looking to catalyse the Singapore market as it is important for Singapore as a financial centre. It is also useful for any Singapore corporate looking to raise capital in the state market.

You are right to say that it has been very welcomed by the industry. There have been measures which have been introduced to reduce friction for issuers to list — so the move to a disclosure regime is very helpful for issuers wanting to be listed here in Singapore versus other markets. That’s a good thing.

Then, as you pointed out, there is the seed money which is being offered to catalyse demand. Hopefully that will attract fund managers to come to Singapore and participate in the Singapore market. With both supply side and demand side measures, hopefully this will create a mature cycle to make the Singapore market more vibrant.

And when the market is more vibrant, obviously it can attract more people to list here, and it will also be a much more interesting venue for our portfolio companies, should they choose to list and to consider Singapore as a venue for listing. At end of the day, this is a commercial decision, and some of these companies may be better in private hands for the time being, rather than being in the public space. It also means that you want to only access the capital markets if you have use for the funding you will receive. Those are broader considerations when companies decide whether or not they want to go public.

Question on Outlook – Geopolitical Environment (Tariffs)

QUESTION: Given the geopolitical environment, with the tariffs and the trade war, could you elaborate more on the kind of derisking decisions Temasek is taking to protect itself from global volatility.

ROHIT SIPAHIMALANI: I would say derisking has been more in the direction of improving portfolio resilience. For example, if there are businesses that we feel are more likely to be caught in the crosshairs of US-China tensions or this polarising world, that is something that we have been very conscious of over the last few years. Therefore, we have been shifting our portfolio more towards businesses which have access to large domestic markets that are relatively self-contained within those markets. That is why when Liberation Day happened, stock prices were impacted, but when we did an assessment of our portfolio, the first order impact of the tariffs on our portfolio was very low because of these businesses.

An example in India — the last few years we have invested in financial services, healthcare services, domestic consumer businesses, and none of them had any first order impact from tariffs. The same is true across most regions. The second order impact, based on global growth, would impact everyone, but the first order impact has actually been minimal and that has been partly a result of our conscious portfolio construction over the last few years.

CHIA SONG HWEE: That also applies to China. We do not have any investments that rely on exports to the rest of the world. So the tariffs are less of a concern for us as a first order impact.

Question on Outlook – Macroeconomic Environment

QUESTION: It has been a record year for Temasek. However, can we say that the outlook this year will be a bit more cloudy?

ROHIT SIPAHIMALANI: We faced a period of high uncertainty in the first half of the year. Initially, there were concerns about whether AI capital expenditure will collapse, and the issues of tariffs.

There was also a question whether there will be fiscal tightening in the US. However, this is no longer an issue. In fact, most governments globally are spending more, such as announced in Europe in Germany.

On the issue of AI, the momentum is back. In fact, estimates of AI expenditure have increased from the beginning of the year. On tariffs, we will know more in time to come. The fact is the level of the Liberation Day tariffs will not go back to its peak level.

The US Federal Reserve may cut interest rates — that may be a tailwind. There may also be more deregulation in the US and in Europe, the European Central Bank has been cutting interest rates. Now, there is talk about boosting fiscal expenditure in Germany. As for China, it should achieve its 5% growth rate for the year, based on where they seem to be tracking in the first half. Since Liberation Day, all markets are up (although) it is very difficult to predict where we will be in the next one year. Therefore, I would not be too negative about our outlook.

CHIA SONG HWEE: We cannot control some of these elements, and how the stock market will react. The only thing we can do is to work on our portfolio to ensure it is resilient and can generate sustainable returns over the long term. With our key portfolio companies, we are also stressing a lot on the importance of stronger balance sheets to withstand exogenous shocks — this applies to ourselves too.

Question on Outlook – Top Risk

QUESTION: What is the top risk projection in the year ahead?

CHIA SONG HWEE: I think the biggest risk is still geopolitics — those are very hard to call. You could say that some geopolitical events have no direct impact on us, but if geopolitical events cause growth to slow because of widespread uncertainty, then it will affect everybody and there is nowhere to hide. So those are the more concerning ones. But we cannot control it, so instead of worrying, we spend our time building a portfolio that is resilient and adaptive, and being agile wherever we can.

One of the factors to be resilient is to have a sound and strong balance sheet, which can withstand many market shocks. With that, not only can we ride through problematic phases, but we can also invest when no one is willing to, which will result in us making good returns.

Question on Outlook – Banks

QUESTION: Do you think that the record performance of your portfolio can be sustained in the future given the backdrop that banks are not performing as well in the coming year or so?

PNG CHIN YEE: It is hard to say where the portfolio value is going to be one day or the other. Hence, we try to build a portfolio that can be resilient across cycles over the long term, focusing on a 10-year or 20-year horizon rather than year-on-year.

We are working with all our portfolio companies to ensure that they have the resilience in terms of balance sheet strength and business models, to be able to withstand the volatility and shocks coming through in this very dynamic environment. Even in the banking space, we talk about the fact that there could be headwinds facing banks if rates were to come down over time. But if you look at the banks that we own, they have been doing a lot to ensure they are able to continue to perform even in a lower interest rate environment.

For example, DBS has been building their non-interest income revenues. They have built up the cash management business and wealth management business, which will hopefully be more insulated from changes in interest rates. They have also been doing a lot in digital, so they can lower the cost to serve customers, improve customer engagement, and have better underwriting outcomes, amongst other things.

Our portfolio companies are not just sitting around and not preparing themselves for the headwinds that they see coming. We cannot say where it will go next year or the following year, but over the long-term, these efforts should play out.

Questions on Outlook – US and China

QUESTION: Moving to a topic we cannot escape, what are your view towards the attractiveness of the US and China right now?

ROHIT SIPAHIMALANI: Both have attractive opportunities and risks. Both markets are very important to us, and we continue to invest in them.

In the US, AI is a big theme and we are seeing large-scale innovation happening out there, so there are significant opportunities which we are looking to invest in, across infrastructure, AI (applications) and tools. Some of the risks that we were concerned about earlier this year, for example fiscal tightening, could have slowed growth. Now that the ‘Big Beautiful Bill’ is out, it is not an issue. There were some concerns about AI capital expenditure slowing down, but that has now been largely put to rest.

Tariffs are still an issue and we still have to see where they settle. But clearly, they are not going to go back to the (peak) levels we had (after) Liberation Day. Going forward in the year, you will see more deregulation happening, and potentially the US Federal Reserve cutting rates. Regarding the slowdown in growth that we are seeing right now because of tariff uncertainties, we should see a recovery in growth towards the end of the year, particularly as the US Federal Reserve cuts rates, with more deregulation, and more clarity around the tariffs.

The challenge in the US is on valuations, which are currently high. At 22 times earnings, they are probably at the top decile of the last 70-80 years. We have to be disciplined and conscious when we make investments. In the medium term, there is always going to be the debt issue but we do not think that is an immediate issue. But we have to think about that with a long-term perspective, and what it means for the US dollar. But the attractive opportunities remain.

For China, in the first half of this year, the economy has been running at over 5% growth, helped by government support in certain areas like purchasing durable goods. Also, export growth has been strong, partly because of a pull-forward ahead of the tariffs. Some of these benefits may go away in the second half of the year, but the Chinese government has made it clear that if there is a major growth shock, they will step in to support.

So, the downside risks have been reduced. However, consumption is still slow and the real estate market remains a challenge. We do not see a rapid recovery, but we see now that this is a more mature market with more stable, steady growth. But we continue to see significant opportunities — it is a big market, a US$18 trillion economy — in businesses that are not connected with the tariffs like domestic business, whether it is domestic brands like Pop Mart with its Labubu dolls, or in F&B.

Large domestic brands present attractive opportunities. In the renewables space, there are significant opportunities like in EVs and batteries. Also, we recently invested, for example, in companies operating commercially distributed solar generation, like rooftop panels. So those are areas which could be attractive. Innovation is still very strong in China. The Life Sciences sector is a big area, especially around new drug discoveries that have been out-licensed to the rest of the world. So there continue to be attractive opportunities. Valuations in China are also quite reasonable. Those are the positives. We just have to be conscious that this growth we have seen in China in the last decade, we are not going to be seeing the same level of growth rates given it is now a more mature economy. We need to shift our priorities to align with views of China as a more mature economy.

QUESTION: On the US, you said that ''unless something happens”, the US is going to “remain the recipient of our investments", what is that "something" you are thinking about? Who are the other recipients?

ROHIT SIPAHIMALANI: There is nothing we can foresee. Things happen that none of us can predict. We see it to be an attractive market and there are segments that we have identified that we think are going to be attractive. AI is a clear example. Nothing we can foresee will cause us to change that. We had mentioned last year about our plans to invest US$30 billion over five years in the US and we are well ahead of that pace. So at this point, we feel pretty comfortable investing in the US. In the other key three markets that we have a strong presence in Europe, India, China, I think those four markets are going to be the biggest recipients of our capital. And like I said, we are looking to incrementally doing a little more in Japan. In Southeast Asia, we always want to do more, but the scale of opportunities is not as big as elsewhere.

Question on Outlook – Japan

QUESTION: Last year, you mentioned that 1% your portfolio was invested in Japan. Now, what is your current view on the country? And are you looking at direct investment opportunities in companies? I have seen Temasek investing through venture capital funds.

ROHIT SIPAHIMALANI: Temasek has always had Pavilion Capital investing in funds and co-investments. We have also started investing directly too, but mostly in public markets as we still do not have a presence on the ground.

Hence, the private deals we are doing are either through Pavilion Capital and their funds or co-investing with our own private equity funds. For example, we co-invested with KKR in the Fuji Soft deal this year.

Then, we also invested in some engagement funds and public market funds in Japan. I am pleased to say we have continued to increase our exposure to Japan. Today, our portfolio in Japan stands at more than S$5 billion, and while it is still a small part of our portfolio, it is something we are looking to build on over the years.

Question on Outlook – Southeast Asia

QUESTION: Singapore and Malaysia signed an agreement for the Johor-Singapore Special Economic Zone this year. What is your outlook for the space and Southeast Asia as a whole?

ROHIT SIPAHIMALANI: Southeast Asia, as a whole, is a high growth area and we would like to see where we can increase our exposure there.

The practical reality is that right now the scale of opportunities is not the same as in some of the other geographies we are in. We are a bottom-up investor, and we continue to look at opportunities that would make sense for us.

We like the structural reforms and supply chain diversification, but it's something we are tracking closely to see where opportunities scale for us. Where there are opportunities, we will definitely lean in.

Question on Outlook – EMEA

QUESTION: Just looking at your performance, I see that your allocation to the US went up and to Europe went down. Is that just the market? Is that just general market performance?

And the second thing I'd asked before about private equity as well, can you talk us through a little bit about your thinking towards current private equity market in which exits are proving quite difficult and we're seeing a lot of investors, for example: GP is going to continuation funds etc. Is that a concern for you? (Note: the answer to the second question can be found in the Question on Investments — Unlisted Assets)

ROHIT SIPAHIMALANI: Firstly, on your first point, as you said, the minor movements year by year, I won't read too much into it. Actually Europe was a pretty active market for us last year. We made some fairly significant investments that I can talk about that later if you want. But as you would expect, a lot of these European investments actually are global companies and this is the underlying exposure. So to give you an example, we partnered Brookfield to acquire Neoen, which is a renewables company, headquartered in France. It's got some European assets. There's also a large portfolio in Australia for example, so it wouldn't show up in the underlying exposure in Europe, only a small portion you know. Similarly, we invest in a utilities company headquartered in the UK, that has some assets in Spain, but a lot of assets in the US. So not all of it will show up under Europe as such. So like I said, I wouldn't read too much into the movements, they're not material.

LENA GOH: So Arjun, actually on the Europe point, if you show the Europe slide — actually the absolute amount is up, even though it’s a slight 1 percent dip.

ROHIT SIPAHIMALANI: We don't have the previous year's numbers, but by headquarters, if I remember correctly, Europe has gone up from 10% last year to 11% this year. The underlying exposure can shift depending on the types of assets we sort of buy.

In fact, in Europe also like in other locations, we've been again focused on businesses that are gonna be less impacted by what's going on geopolitically. So as you can see, the investments we made last year, they've been either on core plus infrastructure, or they have been more service oriented. So we have been invested in Keyword Studios for example, which basically does technology services for mobile gaming companies globally, but they're based in Europe.

Similarly, we did SRG, which was an insurance broker in Europe. So again, businesses that are going to be more resilient to the geopolitical shocks that are the sort we are seeing today.

Question on Outlook – Major Markets

QUESTION: On the US, you said that ''unless something happens”, the US is going to “remain the recipient of our investments", what is that "something" you are thinking about? Who are the other recipients?

ROHIT SIPAHIMALANI: There is nothing we can foresee. Things happen that none of us can predict. We see it to be an attractive market and there are segments that we have identified that we think are going to be attractive. AI is a clear example. Nothing we can foresee will cause us to change that. We had mentioned last year about our plans to invest US$30 billion over five years in the US and we are well ahead of that pace. So at this point, we feel pretty comfortable investing in the US. In the other key three markets that we have a strong presence in Europe, India, China, I think those four markets are going to be the biggest recipients of our capital. And like I said, we are looking to incrementally doing a little more in Japan. In Southeast Asia, we always want to do more, but the scale of opportunities is not as big as elsewhere.

Question on Sustainability – Sustainable Living Portfolio

This question and the response are from the Sustainability Report 2025 Media Briefing which took place on 3 July 2025.

QUESTION: There has been a general pullback from sustainability in some countries, (including the US). Do you see this affecting the Sustainable Living trend portfolio going forward in terms of short-term and long-term investments?

ROHIT SIPAHIMALANI: You would have seen that we stepped up our investments in Sustainable Living during the last year compared to the previous year. One of the things that we've always been very conscious of is that we shouldn’t make investments that are dependent on subsidies or where the business case requires subsidies to be there. As these are long-term investments, you can't count on that. In that sense, this should not change our approach towards investing in the space.

Secondly, regardless of what's happening on the regulatory front or policy front, you can see even in the US, large multinationals, such as the hyperscalers, require (renewable) energy for their data centres — that’s just one example, but they are still very committed towards their net zero goals.

So, we're not seeing a change from the end demand perspective — for moving towards a lower carbon world, moving away from fossil fuel into renewables. And therefore, we see significant opportunities to participate in the transition, in ways that would be financially attractive, regardless of government subsidies.

KYUNG-AH PARK: The one other thing I would add is economics. So, many of the renewable energy technologies, particularly solar, are the most competitive form of energy in most cases around the world now. Energy storage is also on a similar trajectory. (Costs have) been coming down some 90% over the last 10 or so years, so it's very exponential. And when you think about speed to deployment, solar combined with battery storage in most cases have the fastest pace of deployment than doing traditional forms of energy. , And so, if you look at the total picture, the opportunity sets are actually quite compelling, despite some short-term volatility.

Question on Sustainability – 2030 Target

This question and the response are from the Sustainability Report 2025 Media Briefing which took place on 3 July 2025.

QUESTION: There has been a general pullback from sustainability in some countries. On a longer timeline, how do you feel about hitting your 2030 target (of reducing the net carbon emissions attributable to Temasek’s portfolio to half of its 2010 levels, with the ambition to achieve net zero by 2050)?

KYUNG-AH PARK: It is ambitious, but we are not taking our foot off the pedal. We are staying the course and the reason for that is, the more you delay action, the higher the costs are going to be, and the more mature the risks will be. Despite some of the headwinds, we do see a fair number of opportunities to be able to lean in and capture returns as well as sustainable outcomes. Some other market dislocations that have been mentioned are examples* of where we committed because we have the capital, and we have the partnerships to bring them into the private market, and be able to really turbocharge the expansion.

So, Neoen for example is going from 8.6, they’re aiming for 10 gigawatts this year alone. We are seeing that as some of these platforms scale, they are showing characteristics similar to infrastructure investments, which is much more resilient than some of the early-stage investments. And so, when you think in terms of portfolio construction, it is a resilient and cash flow-generating set of opportunities. We also see in some of the innovative technologies that we have to scale, that to be able to help the hard-to-abate sectors, companies continue to execute a conceived line of sight into their built-in competitive technologies that are addressing key pain points. Form Energy is an example, where even with renewable energy — because it’s intermittent — you need long duration storage that is multi-day. So, Form Energy is a good example of addressing that pain point. And we see that many of those types of technologies around the world are also geopolitically resilient, hence why we’ve very much stayed the course.

* Neoen, a France-based leading independent producer, and Atlantica, a UK-based sustainable infrastructure provider.

Question on Sustainability – Investments in Sustainability

This question and the response are from the Sustainability Report 2025 Media Briefing which took place on 3 July 2025.

QUESTION: What do you plan to invest in over the next 12 months in the sustainability space?

ROHIT SIPAHIMALANI: At the very early stage, we are looking at disruptive technologies which will make a difference towards the greening of the world.

We've invested in the past in green steel and software businesses which can help manage energy efficiency. We still do some of that, but we really try to look forward through our Emerging Technologies team on what are truly disruptive technologies.

A lot of early-stage investments though are made through partners of ours, for example, Breakthrough Energy, and through Decarbonization Partners during early growth. The bulk of our dollars are going to go more in, I would say, more scaled opportunities. So, we talked about renewables* that we've invested in the last year. These two examples that I shared earlier are public-to-private transactions. I think we will look at those sorts of opportunities.

Generally, we will look at infrastructure which will help us transition to a green world. So, things like transmission and energy storage continue to be a big area for us.

In summary, I would say our focus, our dollars, are going to be in the more scaled opportunities. And some of the earlier stuff, if it's truly disruptive, we will do a certain amount through our Emerging Technologies team. But a lot of the early-stage stuff will be done more through partners who are more focused in the area.

* Neoen, a France-based leading independent producer, and Atlantica, a UK-based sustainable infrastructure provider.