Transcript: Temasek Review 2025 Media Briefing

The following is the speaker notes that accompanied the presentation deck for Temasek Review 2025. The text should be read in conjunction with the slides shown in this document.

For selected questions & answers from the Temasek Review Media Briefings 2025, click here.

To see all of the key financial metrics and diagrams in the Temasek Review 2025, please click here.

Please note that:

All data presented are for our financial year ended 31 March 2025

All currencies quoted are in Singapore dollars unless otherwise stated

The theme for this year’s Temasek Review is

“Sense, Adapt, Thrive”.

This is a reminder that in the highly dynamic world today,

we need to take a pragmatic approach in

Sensing the changes taking place around us,

and Adapt nimbly to chart our course;

so that we can Thrive amidst uncertainty and deliver sustainable returns over the long term.

Let’s take a look at our results for the year.

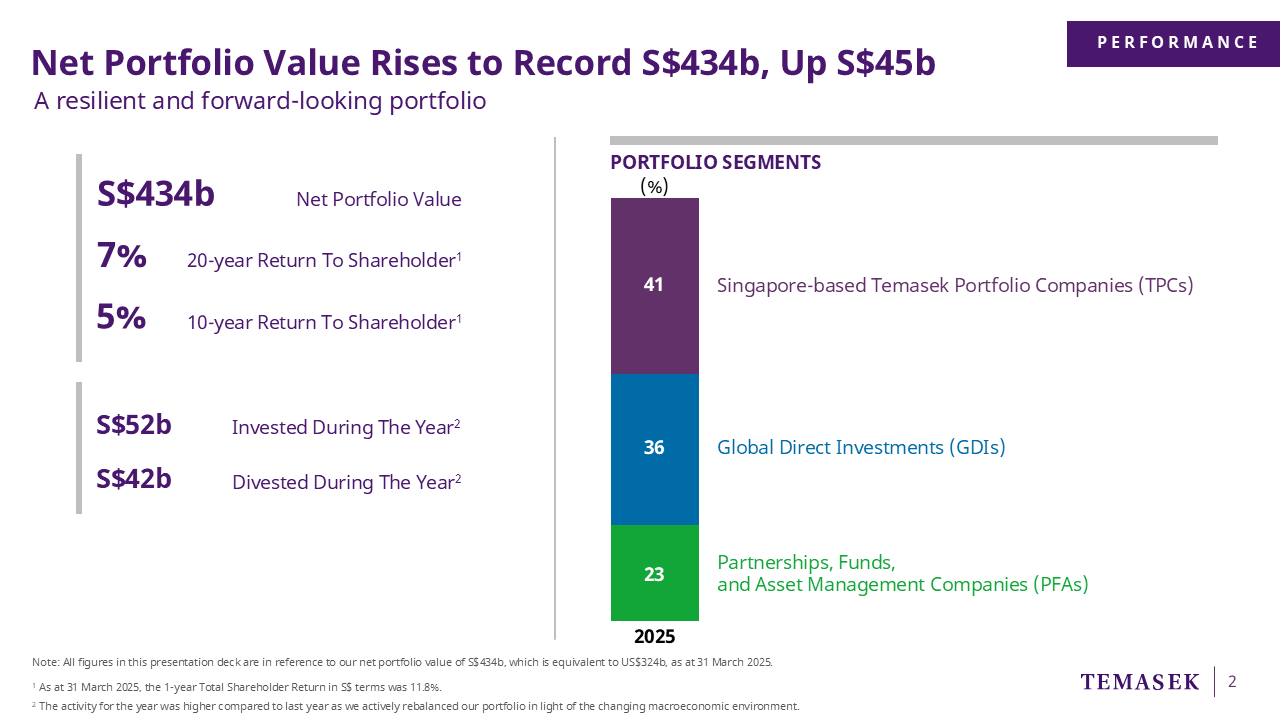

We ended the financial year with a record Net Portfolio Value of 434 billion dollars,

an increase of 45 billion dollars from the previous year.

This was largely due to the strong performance of our

listed Singapore-based Temasek Portfolio Companies,

as well as our Direct Investments in China, the US, and India.

Our 20- and 10-year total shareholder returns, or TSR, are 7% and 5% respectively.

These longer term TSRs are more representative of our performance and the resilience of our portfolio.

Our 10-year TSR this year is 5%, compared to 6% last year.

This is because our March 2015 performance, a strong one due to the favourable market performance that year, has been dropped from the measurement period.

Over the past financial year, we made a net investment of 10 billion dollars,

reversing the net divestment of 7 billion dollars last year.

You can see we’ve had an active year – rebalancing our portfolio amidst the changing market environment.

The bar chart on the right of this slide shows our three portfolio segments –

starting from the top, our Singapore-based Temasek Portfolio Companies, or TPCs for short;

Global Direct Investments, or GDIs; and

Partnerships, Funds, and Asset Management Companies, or PFAs.

I will share more about our performance and each of these portfolio segments

in the next few slides.

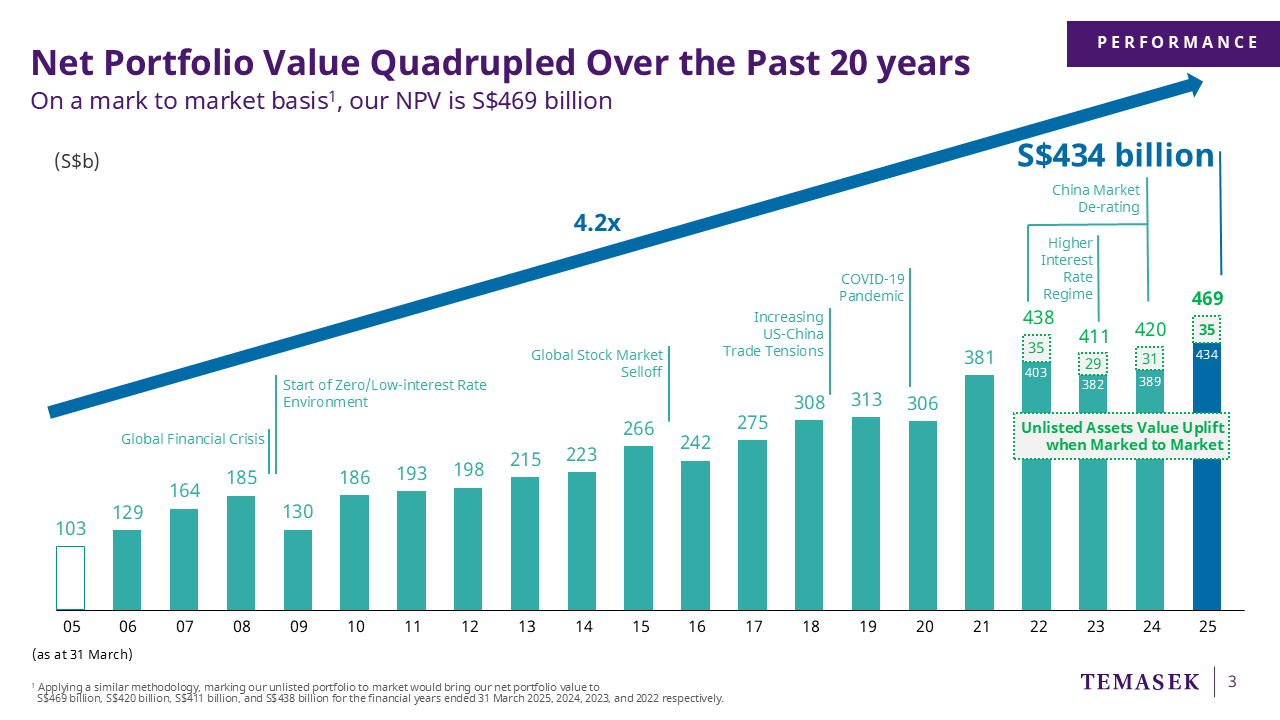

But first, on our overall Portfolio Value.

Our portfolio remained resilient through external shocks and market cycles.

On a mark to market or MTM basis, our NPV is 469 billion dollars.

Compared to the MTM number last year, we are up 49 billion dollars from 420 to 469.

We quadrupled our portfolio in the last 20 years, despite several market dislocations along the way.

This was the outcome of our active portfolio shaping and reshaping over the past 2 decades,

and this is something which we will continue to do,

to enable us to deliver sustainable returns over the long term.

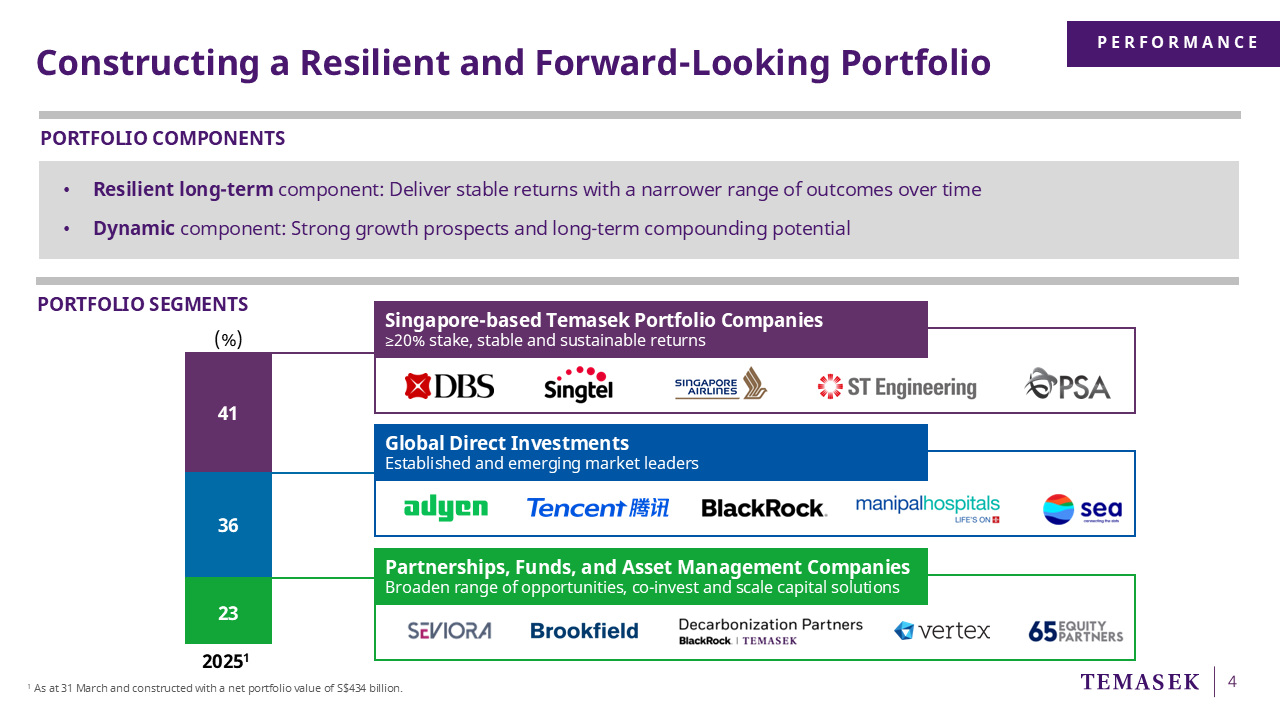

The key to this is the construction of a Resilient and Forward-Looking Portfolio.

(We’ve spoken to you about our Resilient and Forward-Looking Portfolio in the past)

There are two components to our portfolio:

First, a resilient long-term component that delivers stable returns.

These are companies with a steady growth outlook, strong business model, low leverage,

and low earnings and cashflow volatility.

And second, a dynamic component that is forward-looking.

These are companies with strong growth and returns prospects

and long-term compounding potential.

Some of these could eventually become a part of our resilient component.

Another way of looking at our investments – regardless of whether it is resilient or dynamic –

is by our portfolio segments.

Our three portfolio segments are, starting from the top,

the Singapore-based TPCs, which make up 41% of our portfolio.

They are the stalwarts of our portfolio,

delivering stable and sustainable returns to us over the long term.

Second, our GDIs, at 36%.

Here, we focus on investing in established or emerging market leaders that are aligned to

the four structural trends of digitisation, sustainable living, future of consumption,

and longer lifespans.

Lastly, we have our PFAs, making the remaining 23% of our portfolio.

This comprises our investments in funds, partnerships with other investors

and asset management companies,

These help to broaden our range of opportunities,

and scale our capital in both private and public markets.

Each of these segments have different attributes and market dynamics.

We have to manage each segment differently and actively,

in order to achieve our T2030 goal of building a resilient and forward-looking portfolio,

one that can withstand shocks across market cycles.

So, how exactly are we managing each of these segments?

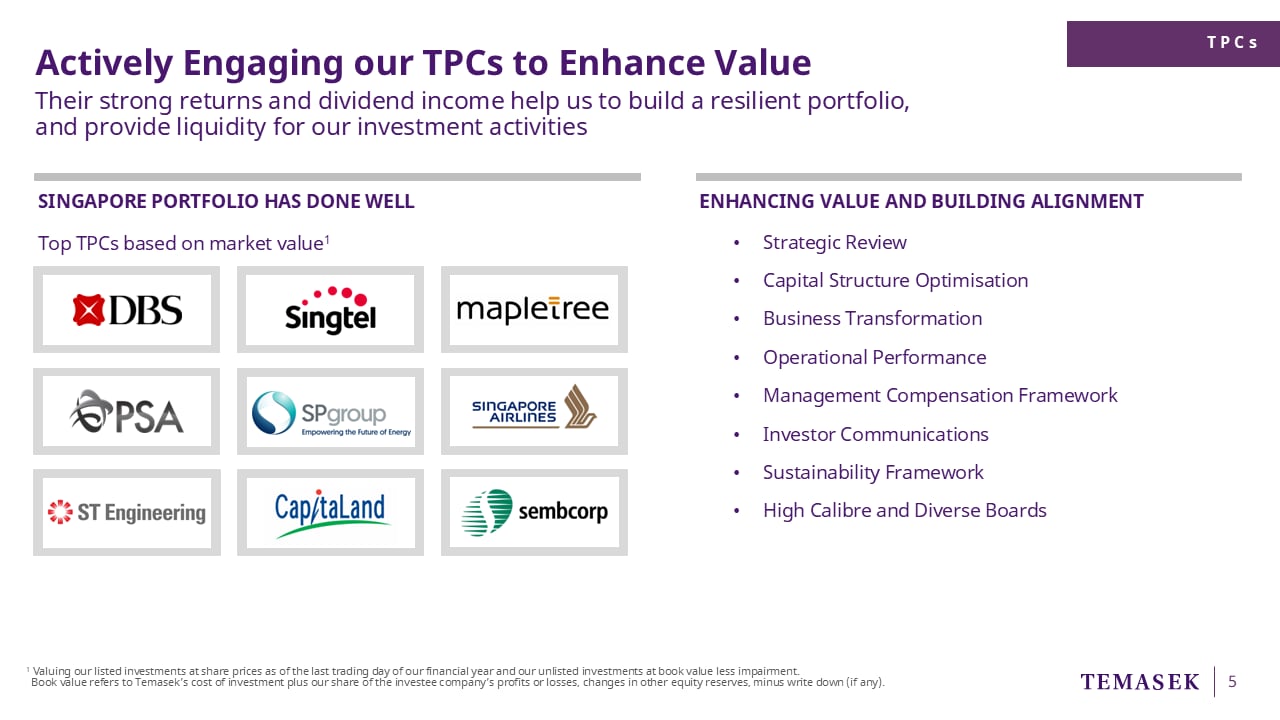

First, our Singapore-based TPCs.

TPCs have historically anchored the stability of our portfolio,

and are key to our portfolio resilience.

Many of them are household names here in Singapore.

This year, the TPCs contributed strongly to our performance.

Their robust returns have uplifted our portfolio value and

provided liquidity for our investment activities.

Over the years, we have actively engaged our TPCs to enhance value and build alignment.

We have an active and constructive engagement with these companies.

We share our expectations as a shareholder with the boards,

and we work with them to promote a close alignment between

strategy and performance, returns and rewards.

We do not direct the day-to-day operations of these companies.

We hold their respective boards and management teams accountable

for overall business performance and results.

(Now) from time to time, we would work with them and engage them

in their strategic reviews and initiatives,

to strengthen their foundations for future growth.

We also engage them on their sustainability framework,

as they continue to deliver stable and sustainable returns.

Now that we have covered the TPCs,

let’s move on to our second portfolio segment, the GDIs.

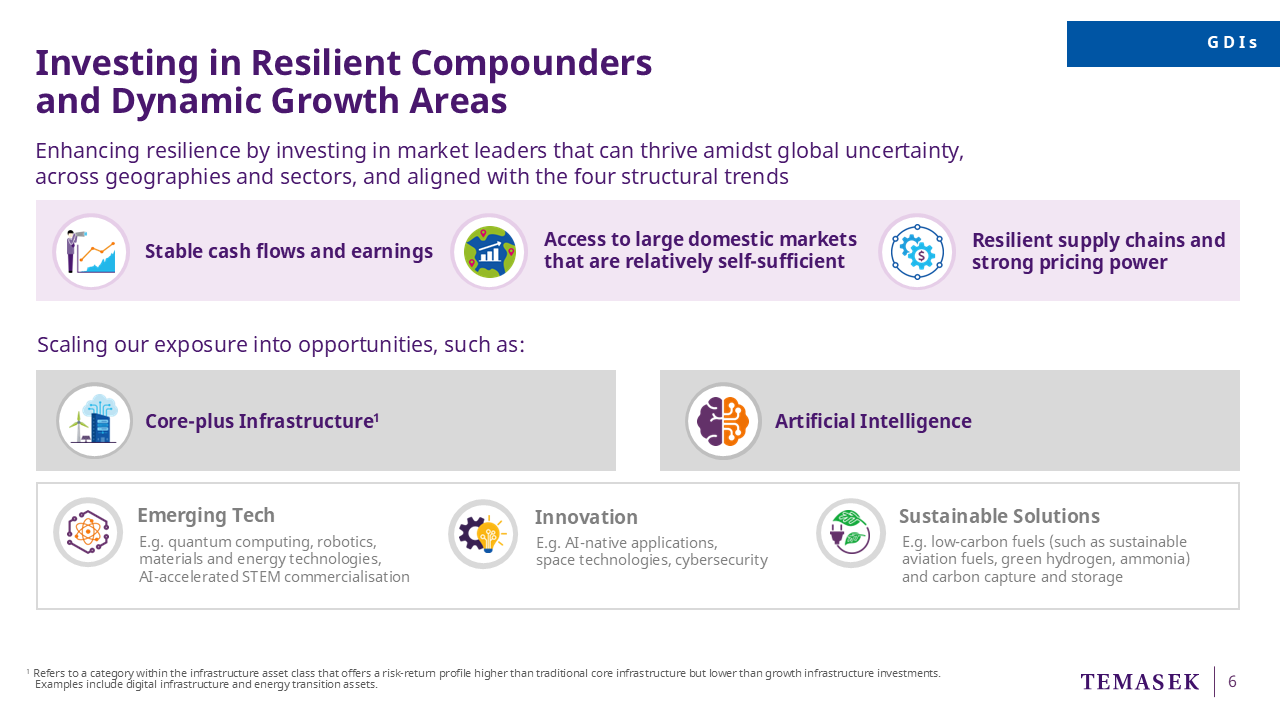

To enhance the resilience of our portfolio,

we make global direct investments, or GDI,

into established and emerging market leaders that can thrive amidst uncertainty.

We like companies that:

One, have a track record of stable cash flow and earnings,

Two, are self-sufficient and have access to a large domestic market, and

Three, have a relatively resilient supply chain and have strong pricing power

Such companies are better protected against the risks of tariffs or other geopolitical impacts.

On top of that, we are looking to increase our exposure into promising opportunities

such as core-plus infrastructure and artificial intelligence.

I’ll elaborate more on these two areas in my later slides.

At the bottom of the slide, you will see that we continue to look around the corner,

investing in emerging technologies such as robotics and quantum computing;

innovations in critical spaces such as cybersecurity;

and in sustainable solutions such as low-carbon fuel to catalyse climate action.

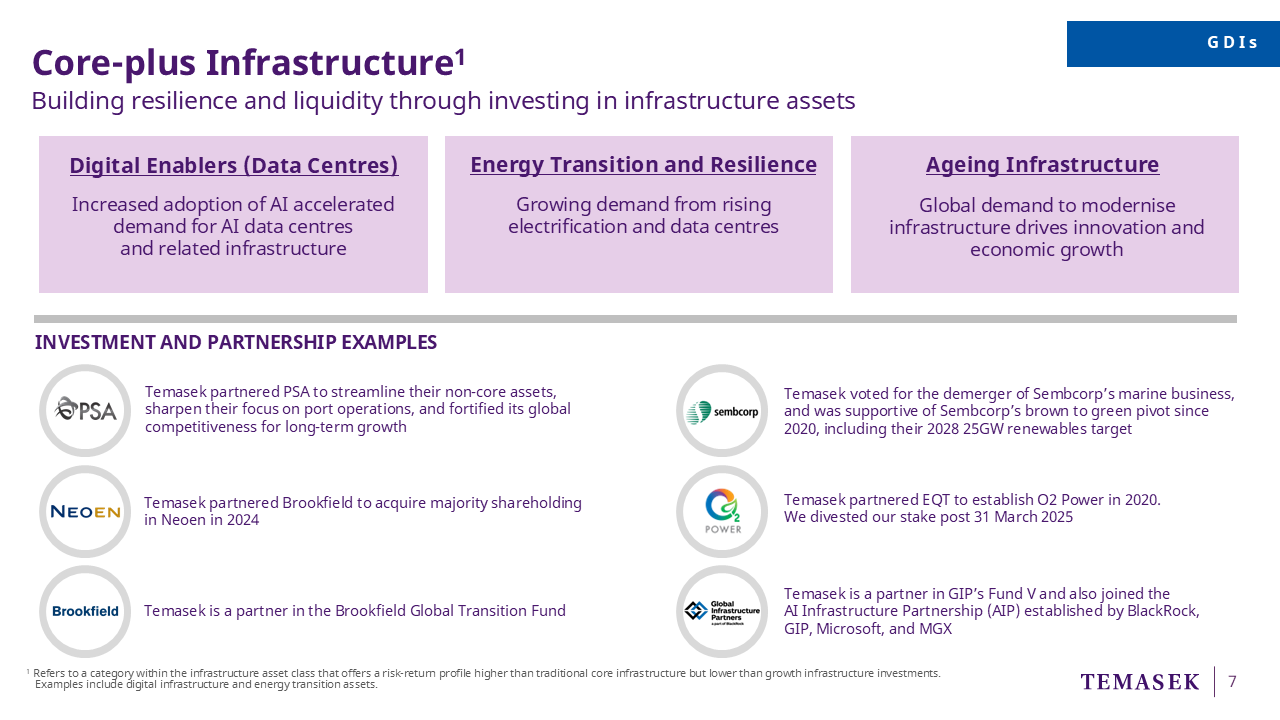

I mentioned earlier about the opportunities in core-plus infrastructure and AI.

First, let’s talk about core-plus infrastructure.

This is an asset class that can provide resilient risk-adjusted returns, and stable cash yields.

Infrastructure, as a category, is not new to Temasek.

In fact, it has been an integral part of our portfolio since our inception.

Our TPCs, such as PSA and Sembcorp, operate critical infrastructure in Singapore.

And there are still ample and attractive opportunities in this space -

driven by the demand for data centres, energy transition and resilience,

and the replacement of ageing infrastructure.

We deploy our capital to core-plus infrastructure in a few ways:

One, directly through our TPCs that have deep infrastructure domain expertise.

Two, through partnerships with key global investors,

such as Brookfield to acquire a majority stake in Neoen,

and with EQT to establish O2 Power in India.

And three, we invest through funds, such as Brookfield and GIP.

We are a partner in Brookfield’s Global Transition Fund.

We are also a partner in GIP’s fund,

and recently joined the AI Infrastructure Partnership established by

BlackRock, GIP, Microsoft, and MGX from the Middle East.

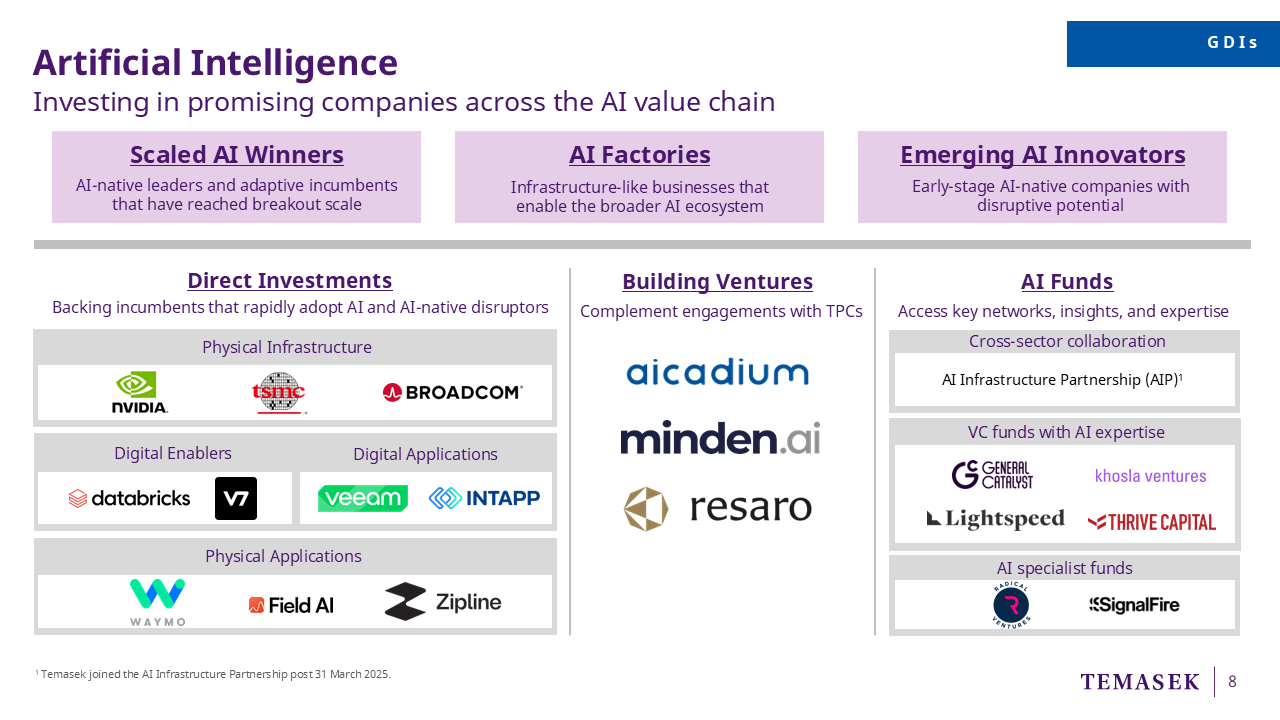

Besides core-plus infrastructure, we are also looking at AI.

We look for opportunities across the AI value chain,

from AI winners which are growing and scaling at an exponential pace,

to AI factories or infrastructure that enable the broader AI ecosystem.

We also look at Emerging AI innovators with the potential to disrupt and redefine the market.

How do we invest in AI?

We invest directly – into companies and categories which you see on the slide.

We have also set up AI-related ventures,

which can work with our TPCs for value uplift,

and also address the broader market.

Lastly, we invest into AI Funds, such as the AI Infrastructure Partnership, which I mentioned earlier.

The last segment of our portfolio is PFAs – which we have been growing over the years.

Within this segment, partnerships and funds constitute more than two-thirds.

We started with a long-standing portfolio of high-quality fund investments,

and have deepened the strategic partnerships with many of our key fund managers.

Our asset management companies in the bottom box make up the remaining one-third

of this PFA segment.

Since the 2000s, we have set up asset management companies

to scale capital solutions for the market.

You may recognise the more familiar names such as Seviora, Vertex and Clifford Capital.

A new addition is Aranda, a private credit platform which was spun out

from Temasek’s in-house Credit Portfolio team.

Together, our asset management companies manage over 90 billion dollars of assets.

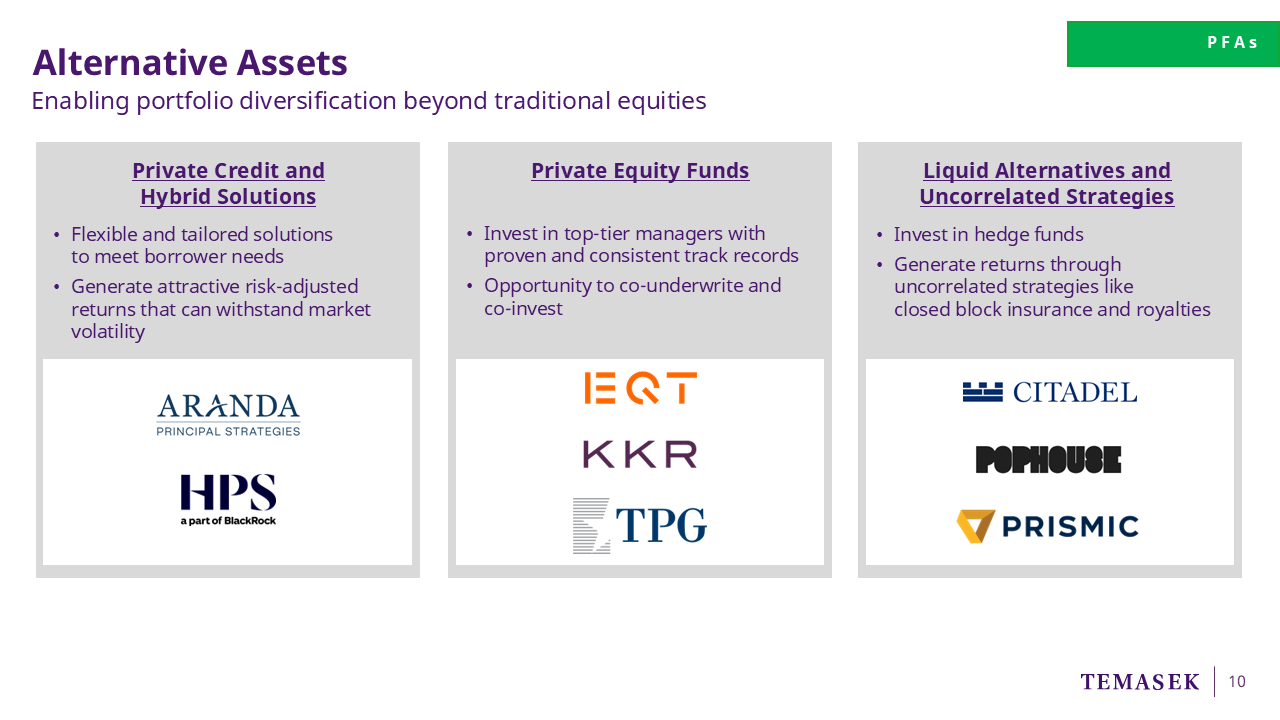

Many of our PFAs fall within the definition of what we call Alternative Investments.

In recent years, investors around the world have been deploying significant amount of capital

into this asset class.

Alternative Assets provide diversification to our portfolio beyond traditional equities,

and is an important return driver for us in the years ahead.

There are three focus areas for us in Alternative Assets:

Firstly, private credit and hybrid solutions.

This fills the void for underserved borrowers who are, for various reasons,

not covered by traditional credit providers such as banks.

Borrowers also find private credit financing increasingly appealing

as it can offer them a more flexible and tailored solution.

At Temasek, we have been growing our credit capabilities for over a decade.

We established Aranda Principal Strategies to better capture opportunities in this space.

Today, Aranda manages a 10 billion dollar portfolio comprising both direct investments and funds, and we expect to grow this over time.

Secondly, we invest in top-tier private equity funds, such as EQT, KKR, and TPG.

We provide both Limited Partner or LP capital, and Co-Investment capital;

Our Direct Investment sector and markets teams also co-underwrite larger investment opportunities with some of these funds.

Lastly, we invest in other alternative strategies and hedge funds, which generate resilient returns through uncorrelated strategies like closed block insurance and music royalties.

Now you’ve heard about the three segments of our portfolio.

I want to talk about one of the overarching trends across our entire portfolio –

and that is Sustainability.

Across our portfolio, we continue to focus on sustainability.

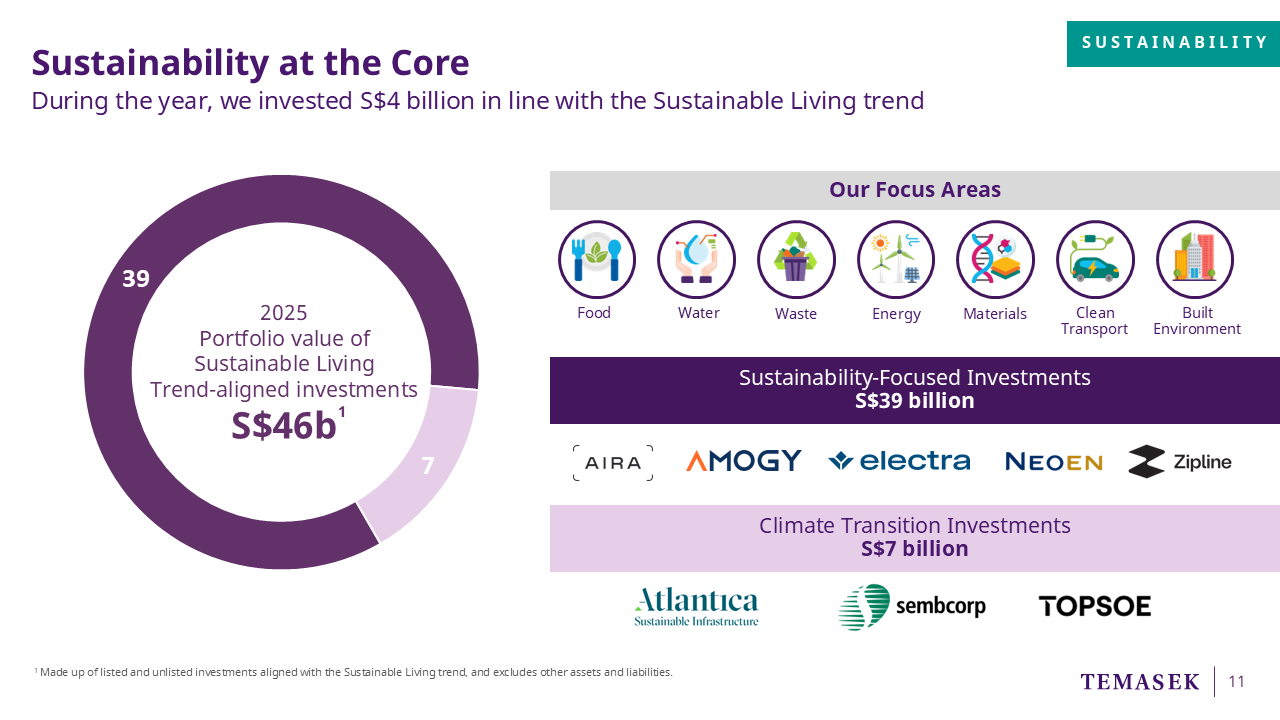

During the year, we invested 4 billion dollars in line with the sustainable living trend.

Today, the total value of our investments aligned with the Sustainable Living trend

stands at 46 billion dollars.

39 billion of this is in sustainability-focused investments and

7 billion in climate transition investments.

For example, this year we partnered Energy Capital Partners to acquire

Atlantica Sustainable Infrastructure.

For Temasek as an organisation, sustainability is at the core of everything that we do –

from delivering sustainable returns, to how we operate as an institution,

and how we engage our portfolio companies.

Importantly, we remain committed to achieve a net zero portfolio by 2050 and

to deliver sustainable returns over the long term.

Now that I have covered our current year performance and portfolio segments.

I want to give some perspectives on how we have been sensing and adapting our portfolio

in line with market opportunities through the decades.

If you look at how our portfolio has evolved over the years,

Both in terms of our portfolio segments and geographical exposure

You will see that it is a reflection of specific strategies which we have adopted over the years.

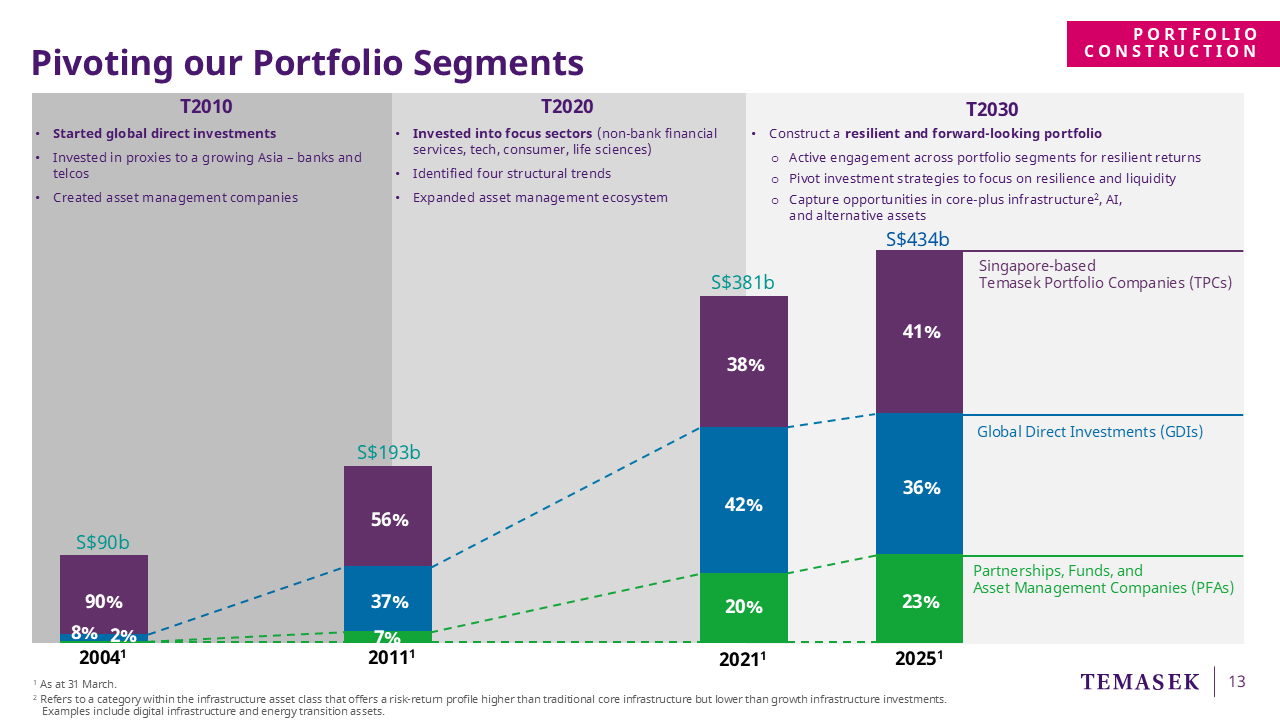

The chart shows the evolution of our portfolio segments across

TPCs;

GDIs; and

PFAs.

T2010

In the early 2000s, as part of our T2010 strategy,

we expanded beyond our TPC holdings – which made up 90% of our overall portfolio,

and started investing in emerging markets, particularly in a growing Asia.

We made Direct Investments in proxies of growth and consumption,

such as banks and telcos,

across China, India, and Southeast Asia.

We also set up Asset Management Companies,

such as Fullerton Fund Management and Seatown, to scale our capital.

This is where you see the blue and green segments of our portfolio

growing substantially by the end of the decade,

and our purple TPC segment, is decreasing in proportion

simply because the other two segments are growing.

T2020

Then we moved to T2020, our roadmap for the next decade.

We continued to grow our GDI segment –

investing in focus sectors such as non-bank financial services, tech, life sciences, and consumer, and also growth equity.

To further guide our investing, we identified four structural trends.

These cut across sectors and business models: digitisation, sustainable living, future of consumption, and longer lifespans.

We expanded our Asset Management ecosystem with new platforms

such as InnoVen, in venture debt, and Azalea, in private equity funds.

Again, you can see the blue and green portions of our portfolio growing through the decade.

T2030

We developed our T2030 strategy in 2019.

Our goal is to construct a resilient and forward-looking portfolio for 2030,

one that can withstand exogenous shocks and

still deliver sustainable returns for us over the long term.

How do we achieve this?

As shared previously,

We actively manage and engage across our three portfolio segments;

We pivot our investment strategies to focus more on resilience and liquidity, and

We also look around the corner to capture opportunities in emerging asset classes

such as core-plus infrastructure, AI, and alternative assets

2025

Fast forward to today in 2025.

The shape of our portfolio, the approximate 40-40-20 split you see across the three segments,

is a reflection of the forward-looking strategies which we have deployed over the years,

and will continue to adopt in the years ahead.

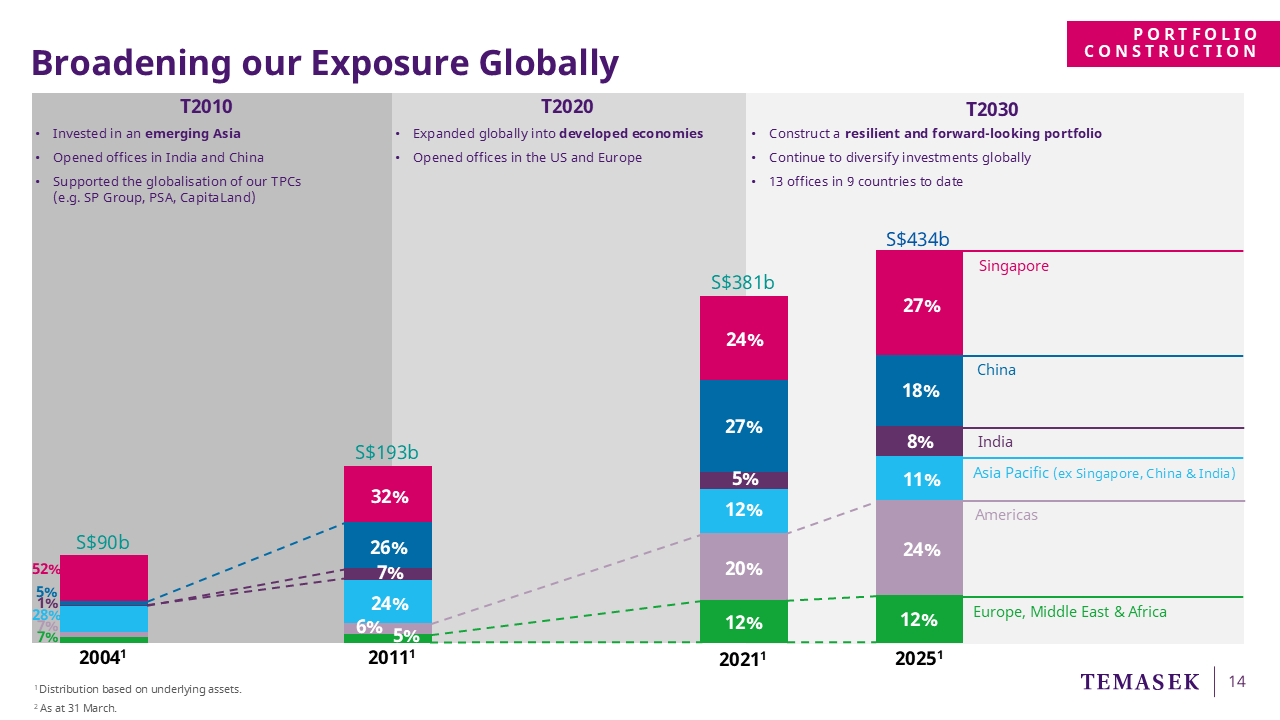

I can also give you another version of how our portfolio has evolved,

this time from a geographical perspective.

Using the same T2010, 2020, 2030 periods…

T2010

In the first decade, we invested in an emerging Asia

as it recovered from the Asian Financial Crisis.

We set up offices in emerging markets such as India and China,

to capture opportunities from the growth of the middle-income population and

local industrial champions.

So you can see our exposure to China and India (in dark blue and purple)

growing to 26% and 7% respectively,

and we were beneficiaries from the spike in China’s growth.

During that period, we also supported our TPCs in their globalisation plans,

which also added to the geographical diversification of our portfolio by underlying assets.

An example is PSA. Since corporatising in 1997, it has expanded to become a global cargo partner across more than 180 locations in 45 countries today.

We have shared a factsheet with you separately with more examples.

T2020

Under T2020, we extended beyond Asia, with the aim to become a global investment house by 2020.

After the Global Financial Crisis,

we saw an opportunity to invest in developed markets such as the US and Europe,

as they restructured to recover from the GFC.

So we began to deploy more capital to these regions.

We opened our first offices there in 2014.

Today, we have six offices across both continents.

You can see that our combined exposure to both continents (at the bottom in light purple and green)

has tripled from 11% in 2011, to 36% today.

In dollar terms, the exposure to these regions were approximately 21 billion dollars in 2011.

It has grown by about seven times to approximately 156 billion dollars today.

So, you can see that the geographical exposure of our portfolio today

is the result of our portfolio strategies and regional focus over the years.

T2030

Today, we have 13 offices in 9 countries.

And for T2030 and beyond, we will continue to sense the market,

and adjust our portfolio allocation towards regions with attractive investment opportunities.

I hope these two slides have given you a useful perspective

on our investment strategies over the years,

and how they have shaped our portfolio composition which you see today

– both by segment and by geography.

Now let me move on to share with you our outlook on each of the markets.

First up, what is our outlook for Singapore?

We expect the Singapore economy to be under some pressure this year

due to global policy uncertainties, especially on the tariffs front.

Nonetheless, Singapore has ample fiscal and monetary policy levers

that can be pulled in the event of a more challenging growth backdrop.

For Temasek, we will focus on building a resilient portfolio in Singapore on two fronts.

First, we will continue to actively engage our TPCs to

enhance value and future-proof their businesses.

Second, we will work with like-minded partners and innovators,

and create synergistic networks with them to further grow our capital and gain access to innovation.

Moving on to the US.

While the risks around immigration, tariffs, and fiscal tightening have likely peaked,

we still have to be watchful of the tariff developments over the next few weeks and months.

Regulators like the Fed are more likely to react to macro conditions

as they remain focused on managing inflation risks.

Investors, on the other hand, will be mindful of potential volatility in the currency markets

and capital flows, and the impact on earnings and returns.

However, we do see bright spots

Such as the US’ world-class capabilities in AI, which will have transformative impact across all sectors.

Against this backdrop, we remain confident in the US market.

It continues to be the largest destination for our capital,

given the strong business fundamentals, deep capital markets

and a culture of accelerative innovation.

Onto China…

China is our second largest market outside of Singapore, in terms of underlying exposure.

China is aiming for a steady growth target of 5%,

which could be challenging due to persistent global tensions and trade uncertainties.

We are also mindful that softer consumption has kept inflation subdued.

But there are positive signs - stronger government spending and support for consumption.

And we look forward to seeing the effective implementation of these plans.

We continue to believe in the longer-term prospects of China.

We see opportunities in the green economy and life sciences innovations,

and also in leading domestic brands which continue to scale and grow in a resilient manner.

Next, on to Europe.

There is a sense of elevated trade uncertainty,

which could impact the growth trajectory of the region.

Tighter credit conditions for domestic market may also form headwinds,

but the moderated inflationary pressures can enable the European Central Bank to keep rates low.

The Draghi report, which addresses the competitiveness and future of the European Union,

gives focus to streamlining regulations, which could have a significant impact

on investment opportunities in the region.

More recently, Europe has also responded with ReArm Europe and Germany’s new fiscal package,

and these would be things to look out for.

For Temasek, our portfolio in Europe remains resilient.

There are many Europe-based or family-run businesses

which have strong franchises, deep engineering or technical leadership,

which are or have the potential to be global market leaders in their industries.

We are focused on these companies…

as well as in sectors such as industrials and new energy, financial services, and consumer.

Looking ahead at India.

Notwithstanding the uncertain global backdrop,

India’s growth is likely to remain resilient driven by capex growth.

It will also be accelerated by the recovery in domestic consumption,

and the accelerated pace of production from supply chain reorientation.

A US-India trade deal looks promising along with other free trade agreements.

India remains a key geopolitical player both in the region and globally,

the current government is eager to advance and strengthen relations with strategic partners.

We maintain a positive outlook given India’s strong domestic market,

especially in the areas of consumer, financial services, and healthcare.

Lastly, and closer to home, Southeast Asia.

The near-term economic outlook for Southeast Asia is clouded by some uncertainties…

around trade negotiations with the US,

and complex domestic and international issues faced by the respective governments.

This is especially so for export-oriented markets like Vietnam, Malaysia, and Thailand.

A weakening dollar, however, could offer some reprieve,

and allow the region’s central banks to ease policy and support domestic growth.

Over the medium term, we believe that there is still structural upside in the region.

It has some of the fastest growing economies in the world,

driven by urbanisation, a growing middle-income population, and rapid digitalisation.

Temasek remains committed to Southeast Asia.

Our TPCs also see opportunities to invest in Southeast Asia, such as in Vietnam and Malaysia.

For this region, we continue to invest in opportunities aligned with the four structural trends

by ourselves and also through partnerships with our TPCs or other investors.

This leads me back to our theme for this year – Sense, Adapt, Thrive.

We need to make SENSE of the environment around us,

Spot opportunities where we want to deploy our capital,

And be disciplined in how we manage risks amidst structural headwinds.

We will continue to manage our portfolio segments for resilient returns,

ADAPT and pivot our strategies as needed,

such as to the areas of core-plus infrastructure, AI, and alternative assets.

This is so that we may THRIVE amidst the uncertainties around us.

We ended the financial year with a record net portfolio value of 434 billion dollars,

and our 20-year returns remained resilient at 7%.

We remain steadfastly anchored by our Purpose, and are committed to construct a resilient and forward-looking portfolio that can deliver sustainable returns over the long term,

So Every Generation Prospers.