Digitalising the Agriculture Supply Chain

Digitalising the Agriculture Supply Chain

Produced in partnership with Bloomberg Media Group

In Brief

- Emerging digital platforms are aggregating data from thousands of farms, providing farmers with data-driven insights and making unprecedented gains in productivity.

- Digital connectivity could also make supply chains more efficient in tackling the food wastage problem that costs the world US$1 trillion every year.

- While global investment into agritech has grown significantly over the past five years, investment into Asia is lagging behind the West.

Ben Riensche’s corn and soybean farm stands on 12,000 acres of windswept plains in Iowa. Having grown two of America’s most valuable crops there for six generations, the Riensche family has accumulated a treasure trove of handwritten notes — from the bushels of corn produced each season to how many eggs his grandfather’s chickens laid1.

Digital agritech is changing all that. Where Ben once relied on field observations and his family’s notes, artificial intelligence (AI) now analyses a wide variety of data points — such as crop rotation and fertiliser usage — to drive results. In the years since he signed up for a farming data analytics service, Ben has reduced seed and fertiliser usage by as much as one-tenth, while reaping his best harvests ever.

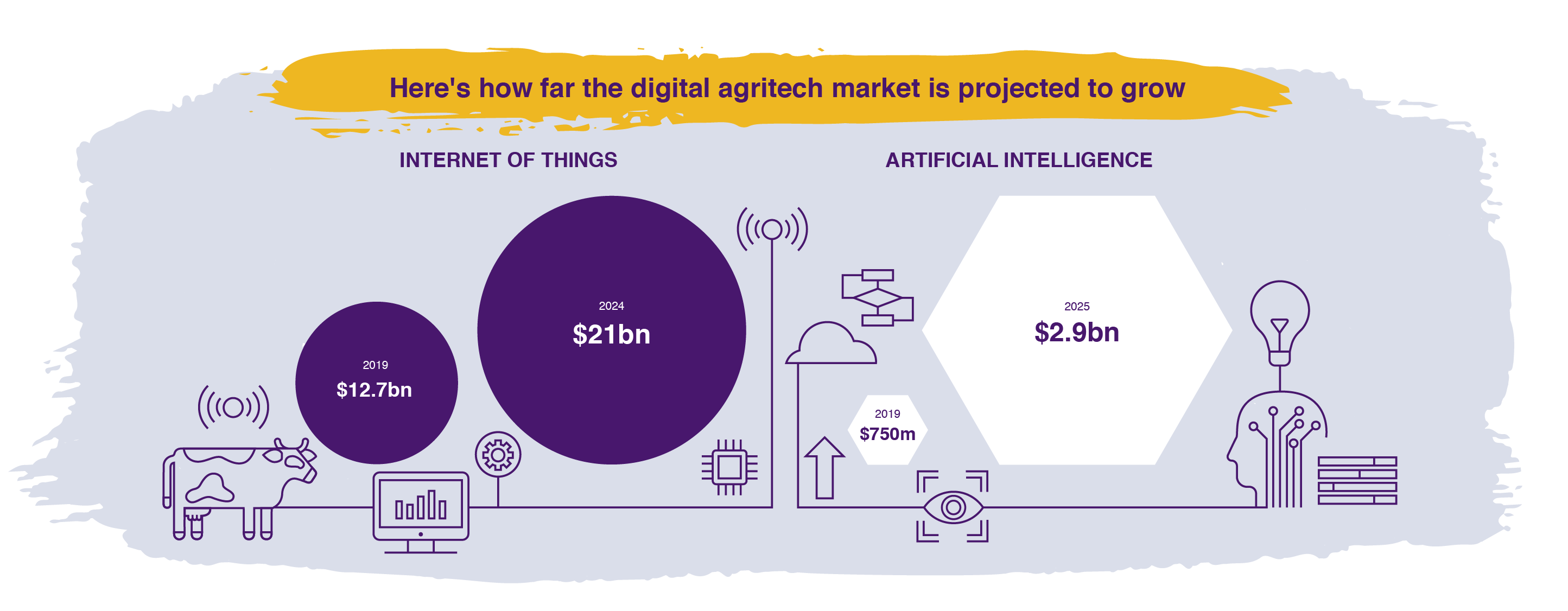

Like Ben, farmers and producers around the world are fast adopting digital agritech to drive greater efficiencies in the food supply chain. The growth opportunity is significant — the agriculture Internet of Things market is forecast to reach US$21 billion by 2024, nearly double 2019 levels2. Meanwhile, the market for agriculture AI solutions is forecast to reach US$3 billion by 2025, more than triple its size in 20193.

“Digital agritech presents a huge opportunity for agriculture,” said Anuj Maheshwari, Managing Director of Agribusiness at Temasek. “It connects participants across otherwise opaque and fragmented supply chains. That new level of visibility allows for the targeted intervention of issues, such as reducing waste and enhancing food safety, while empowering all parties with market benchmarks.”

“The challenge is whether companies that are developing these digital solutions can establish sustainable business models and secure capital to scale up.”

Democratizing Farmers’ Access to Big Data

Digital platforms that aggregate data from thousands of farms offer farmers a comprehensive overview of their operations vis-à-vis their peers. However, these technologies often remain prohibitively expensive for many smallholder farms.

In the United States, Farmers Business Network (FBN) is changing that with their affordable digital platform. The farmer-to-farmer network analyses data such as seed performance and satellite imagery from over 37 million acres of farmland, mostly in the Midwest4. It then provides a platform for farmers to glean aggregated insights derived from this data, empowering them to make more informed decisions.

“The data that comes into FBN is very in-depth because of all the sensors that are embedded in the machinery that farmers use,” said Amol Deshpande, CEO and Co-Founder of Farmers Business Network. “With all that data, we can establish benchmarks, develop analytical tools, and tell each farmer where they’re overplanting or overfertilising, or what kind of return they might be looking at if they were to use an alternative practice.”

Such platforms have tremendous potential in countries like India, China and Indonesia, where smallholder farms tend to be the least connected with other participants across the supply chain. Yet, it is these same smallholders that often lack access to such game-changing technologies.

“Smallholder farms in Asia face a series of different struggles,” Amol said. “These include accessing credit and insurance. Establishing credit is important for farmers to operate and grow their businesses.”

New solutions are emerging in Asia to tackle these problems, such as Mumbai-based Agribazaar. The agritech company currently provides farmers across India a one-stop platform connecting them to a network of banks and financial institutions, as well as buyers and crop advisors.

Farmers in India going through Agribazaar’s Agri-Entrepreneur Programme, which trains them on how to use the digital platform to market their harvests. Photo: Agribazaar

“Traditionally, banks are hesitant to provide rural farmers loans because of the lack of verifiable data, such as crop yield and revenue,” said Amith Agarwal, CEO of Agribazaar. “To address this, we developed a payment gateway for farmers to conduct transactions with buyers and suppliers on our platform. That data is then verified with satellite imagery and provided to banks to assess the creditworthiness of farmers requesting credit through our platform.”

Founded in 2017, Agribazaars’ platform today facilitates the financing of around US$15 million of crop sales every month for its 133,000 farmers. And with plans to bring 10 million more farmers onboard its platform within the next four years, the access to credit for smallholders in India looks set to increase.

Tackling Food Waste Through Technology

Beyond improving crop yields and access to credit, digital agritech may hold the key to addressing the global food wastage problem. The issue is acute in Asia — the region is projected to generate around 500 million tons of food waste annually by 2030 as a result of its fragmented supply chains, inefficient distribution methods and lack of investment5.

“If you look at innovation and investment, Asia starts from a really low base,” said Ping Chew, Asia Head of RaboResearch Food & Agribusiness at Rabobank. “Innovations that tackle supply chain inefficiencies, while increasing access to markets, will provide a lot of opportunities to reduce food wastage.”

One such innovation is the digital agrifood marketplace, which Agribazaar and FBN have both developed. Agribazaar allows farmers to auction crops directly to buyers, while FBN’s Crop Marketing system helps specialty grain farmers receive bids from buyers far beyond their physical location.

Both systems help bypass intermediaries where crop wastage often occurs, and facilitates direct feedback between buyer and seller, thus empowering farmers to respond to market conditions in a much more agile manner.

“Already, we are beginning to see platforms emerge at the upstream level where you're connecting farmers with inputs and downstream consumers and distributors. The impact can be tremendous,” added Ping.

Driving investment into agritech solutions

This promising new wave of agritech companies has not gone unnoticed by investors. In 2018, investment in agritech startups grew to US$16.9 billion globally, eight times more than in 20136.

“We’re seeing diverse pools of capital coming in. Venture capitalists, family offices and non-food conglomerates have gotten interested in this broader agrifood opportunity,” said Anuj. “It reflects a shift in the mindset of investors towards this sector, which has traditionally been seen as old school with low growth rates.”

The next critical step, he opines, is to drive investment towards Asia, where it is needed most. The region requires an estimated US$800 billion of cumulative investment over the next decade to meet the food demands of its rapidly growing population, as well as to mitigate the impact of climate change7.

“Asia presents unique investment challenges, ranging from varying dietary preferences to complex regulatory systems,” said Anuj. “Partnering with the right companies and financial institutions, especially those with established networks and a deep understanding of the region, will play a key role in helping new capital navigate this landscape.”

As a long term investor rooted in Asia, Temasek is committed to working alongside its portfolio companies and partners across the agri-food ecosystem - to build a better, smarter and more sustainable world.

Temasek is an investor in Farmers Business Network and StarAgri, the parent company of AgriBazaar.

_____________________________

1 Bloomberg: Big Data Becomes Cash Crop for Big Agriculture

2 Markets and Markets: Agriculture IoT Market Worth $20.9 Billion by 2024

3 Grand View Research: AI in Agriculture Market Worth $2.9 Billion by 2025