So Every Generation Prospers: Catalysing Asia’s Energy Transition

So Every Generation Prospers: Catalysing Asia’s Energy Transition

A reservoir in western Singapore that opens into the Johor Strait, bordering Singapore and Malaysia: this is one of the world's largest inland floating solar photovoltaic systems, spanning an area equivalent to 84 football fields and producing enough electricity to power five water treatment plants in Singapore.

Unveiled in July 2021, the Sembcorp Tengeh Floating Solar Farm is part of efforts by the land-scarce Southeast Asian city-state to meet its goal of quadrupling solar energy production by 2025 to address the climate crisis.

Accelerating a Crucial Transition

All across Asia, solar projects are booming. In China alone, new installations rose 59% to a record 87.4 gigawatts in 2022. Such renewable additions are key to ending global reliance on fossil fuels, which currently provide around 80% of the world’s energy – a sector that single-handedly accounts for more than two-thirds of total greenhouse gas emissions.

In Asia, the stakes of rapid global warming are particularly high. The region is home to 99 of the world’s 100 cities most at risk from environmental issues, yet it lacks access to the green financing required to achieve its decarbonisation and energy transition goals. Meanwhile, Asia’s major banks are seeing a widening gap between environmental, social and governance (ESG) leaders and laggards, with more than half of the 46 regional lenders making “little to no progress.”

Global investment companies like Temasek can play a crucial role in financing Asia's energy transition.

The butterfly effect of Temasek’s capital will not only provide financing that can generate impact at scale alongside investment returns, but also drive innovation of sustainable technologies, build capabilities in people and enable social resilience in communities.

Jeff Johnson, Managing Director, Sustainable Investing, and Managing Director, Investment (North America)

Enabling Emerging Technologies

While the cost of renewable energy has declined rapidly over the past years, there are still challenges of an existing gap between market readiness and abatement-ready opportunities, and available capital needed to deliver carbon reduction.

“It is vital that we direct investments towards sustainable solutions and activities in a comprehensive, yet cohesive way as we transition to a green economy,” says Johnson. “We need to continue seeking and supporting opportunities in this space as and when it becomes feasible."

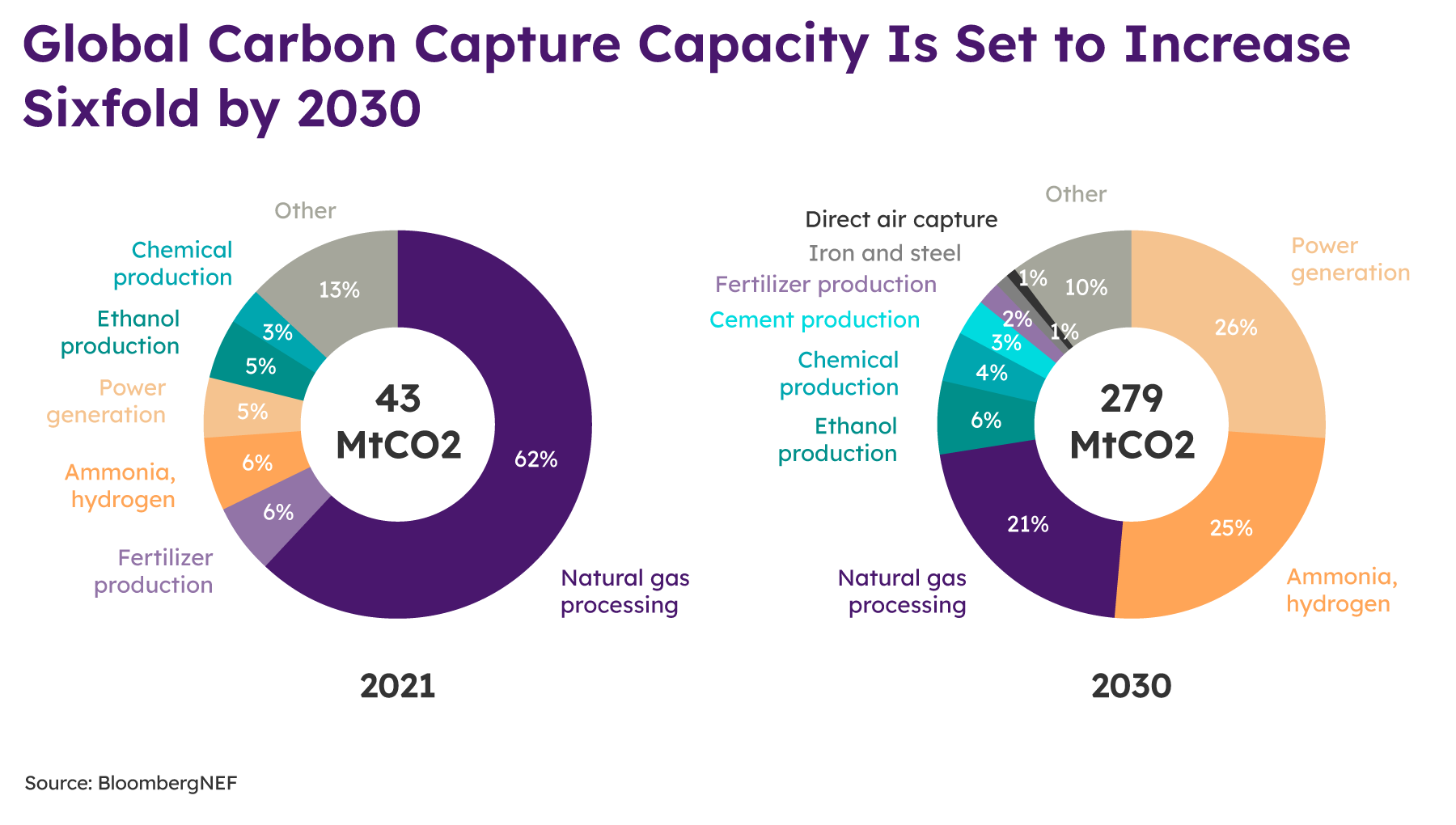

Over the years, Temasek has stepped up its investment in climate-aligned opportunities. These span carbon avoidance opportunities which reduce carbon emissions, as well as carbon negative solutions which remove carbon from the atmosphere. Temasek has also increasingly backed novel technology companies with promising disruptive decarbonisation solutions and the potential for scalability.

Beyond investments, Temasek also works with partners that share its goal of reaching net zero, combining their strengths and capabilities to identify and accelerate decarbonisation solutions of the future. In the energy space, for example, green hydrogen is one of the emerging technologies Temasek is actively exploring as part of its comprehensive approach to the energy transition, beyond mature renewable technologies like wind and solar.

Catalysing Sustainable Solutions

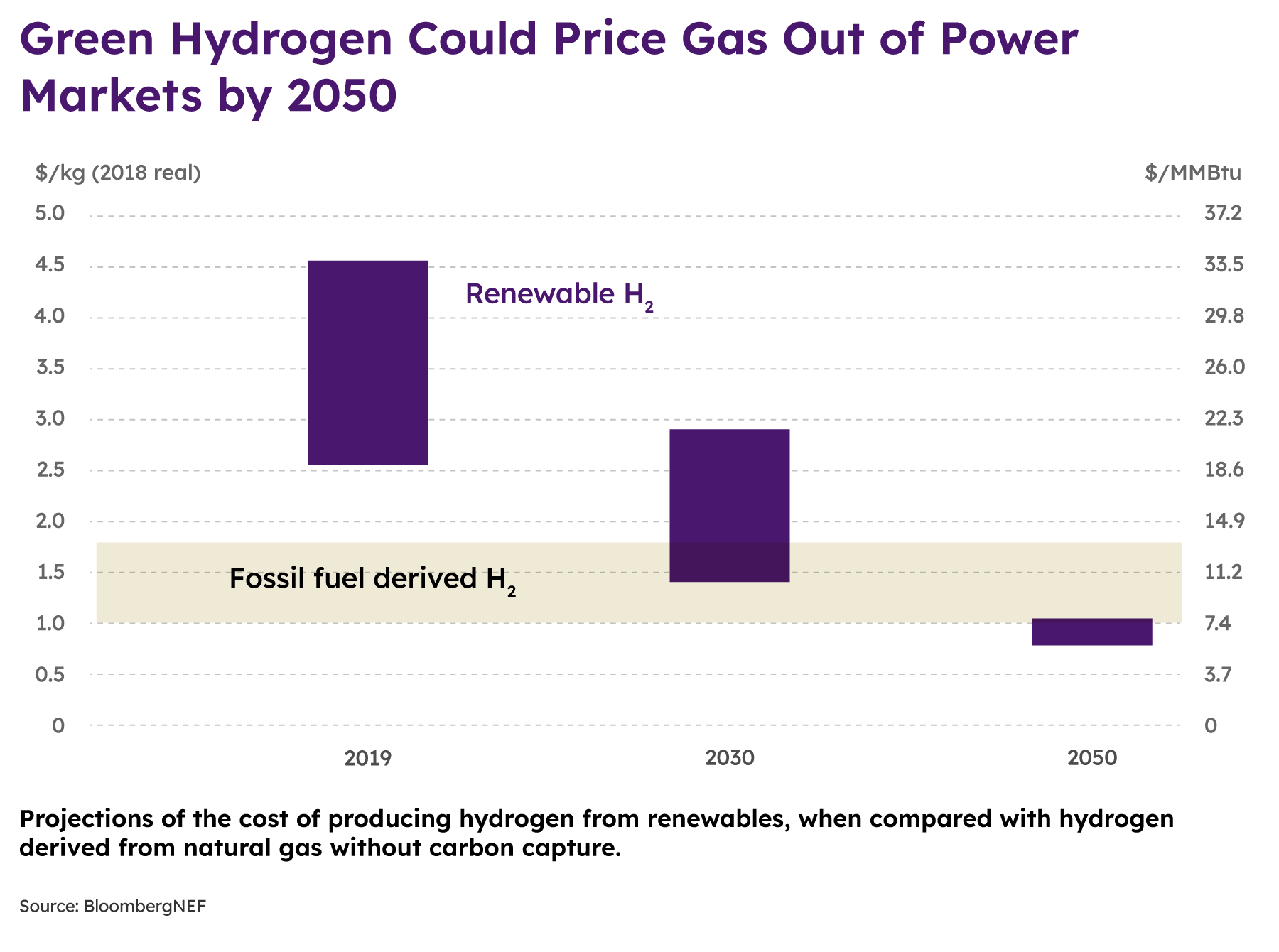

With the potential to decarbonise typically heavy industries like steel and transportation, and even mainstream consumer activities like cooking, green hydrogen is particularly promising as a completely renewable, carbon-free primary fuel source.

But challenges remain. Besides being difficult to safely store and transport, green hydrogen is expensive: one kilogram currently costs $2.50 to $4.50 to produce. To become cost-competitive, it needs to come in at under $1 per kilogram.

To this end, Temasek is actively partnering public institutions and private businesses that are addressing the hydrogen challenge. In July 2022, for example, Temasek partnered the National University of Singapore to launch the Centre for Hydrogen Innovations, which will conduct cutting-edge research to power a hydrogen economy. The first of its kind in Southeast Asia, it aims to create breakthrough technologies that make hydrogen commercially viable as a green energy source.

“By investing in sustainable clean energy and supporting its transition, we hope to accelerate technological innovation and development of renewable sources of energy, so that commercialisation can, in turn, be accelerated. This will allow communities and businesses to transition to cleaner forms of energy without compromising on their energy needs and uses, allowing us to create climate impact at scale,” says Johnson.

Providing Access to Climate Finance

To further accelerate the energy transition, Temasek established Pentagreen Capital together with HSBC to remove upfront capital barriers.

When capital meets purpose to solve challenging market inefficiencies, it becomes a catalyst for solutions in funding a greener world,

says Johnson.

Pentagreen Capital is a debt financing platform committed to accelerating the development of sustainable infrastructure by removing barriers that prevent marginally bankable projects from accessing much-needed capital through blended finance solutions and technical assistance. With an initial focus on Southeast Asia, they target the renewable energy and storage, water and waste treatment and sustainable transport sectors, to offset the impact of climate change and contribute to the global transition to net zero.

Temasek also partnered BlackRock to establish Decarbonization Partners, which will focus on investments that advance decarbonisation solutions. With initial capital from Temasek and BlackRock, Decarbonization Partners will invest across multiple funds focusing on late-stage venture capital and early growth private equity investing into proven, next-generation renewable and mobility technology and solutions.

Partnerships like these demonstrate Temasek’s commitment to a spectrum of sustainable solutions, and highlight the imperative of inclusive climate finance in the path to decarbonisation. “We need strong collaboration in our transition to cleaner energy sources for the benefit of generations to come,” says Johnson.

An Evolving, Hands-On Approach

A pragmatic, transformation-focused determination underlines Temasek’s long-term approach to net zero. It recognises that the energy transition is not binary in nature, with certain industries and geographies requiring both traditional and renewable energy sources in the near-term due to business and infrastructural limitations.

“Temasek is focused on delivering real-world impact. While decarbonising our portfolio by divesting from high carbon-emitting businesses could easily allow us to show a lower carbon portfolio in a shorter period of time, this does nothing to reduce emissions,” notes Johnson.

Where it makes financial sense to do so, Temasek works directly alongside its portfolio companies, supporting their efforts to transform their business models and take abatement action.

And it continues to lead by example, adjusting its climate yardsticks to reflect new realities. In 2021, for example, Temasek began implementing an internal carbon price of US$42/tCO2e. The following year in 2022, it raised this to US$50/tCO2e to internalize the economic and social costs of carbon emissions across its portfolio, and further guide its investment decisions.

By the end of the decade, it expects to increase the internal carbon price to US$100/tCO2e, in line with broader climate targets. For Temasek, the science is clear. “The need for urgent and deep emissions reductions is critical. We need in place mechanisms to incentivise technological innovations that drive the adoption of cost-effective emissions reduction solutions,” says Johnson.

So Every Generation Prospers

Demand for energy has never been higher, and the consequences of climate change have never been so multi-dimensional or far-reaching. But instead of being overwhelmed, Temasek is reframing the challenge of the traditionally hard-to-abate energy sector as an opportunity to generate greater impact.

“There are no returns on a dead planet,” cautions Johnson. “Specific to clean energy, Temasek is continuously building a diversified portfolio of companies to increase the global portfolio of clean energy options, while building resilience for energy networks.

By being more sustainable, we will see a world that thrives indefinitely with reduced impact to the environment. This can create healthier economies, communities and businesses that are more vibrant, inclusive and sustainable, and it is inextricably linked to a multi-generational mindset."

This content was produced in partnership with Bloomberg Media Studio and was republished with permission.