Temasek Review Media Conference 2021: FAQs

Selected Questions & Answers from the Temasek Review Media Conference 2021

On Zoom; 13 July 2021, Singapore

The following is an edited transcript of questions and answers at the Temasek Review 2021 Media Conference.

Grammatical edits have been made to aid readability. For the same reason, questions are not necessarily listed in the order in which they were asked, but grouped thematically.

Slides and charts have been added from the Temasek Review 2021 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to view all of the key financial metrics and diagrams in Temasek Review 2021.

Question on Net Portfolio Value

QUESTION: The $75 billion increase in NPV is a big bounce forward during this pandemic. How does this increase compare to past crises and is this shaping out to be a V or an L‑shaped recovery?

MUKUL CHAWLA: We don't manage our portfolio from one year to the next, rather, we position the portfolio for the long term. The returns are an outcome of that, of the individual investment decisions that we've made. It’s hard to compare one year with others. I point you to look at our long term returns and what those have trended to as the real marker of our performance.

We manage to TSR and NPV and continue to look at that from a long term perspective with each individual investment standing on its own merits. So, again, it's a little hard to take a call on the portfolio going forward.

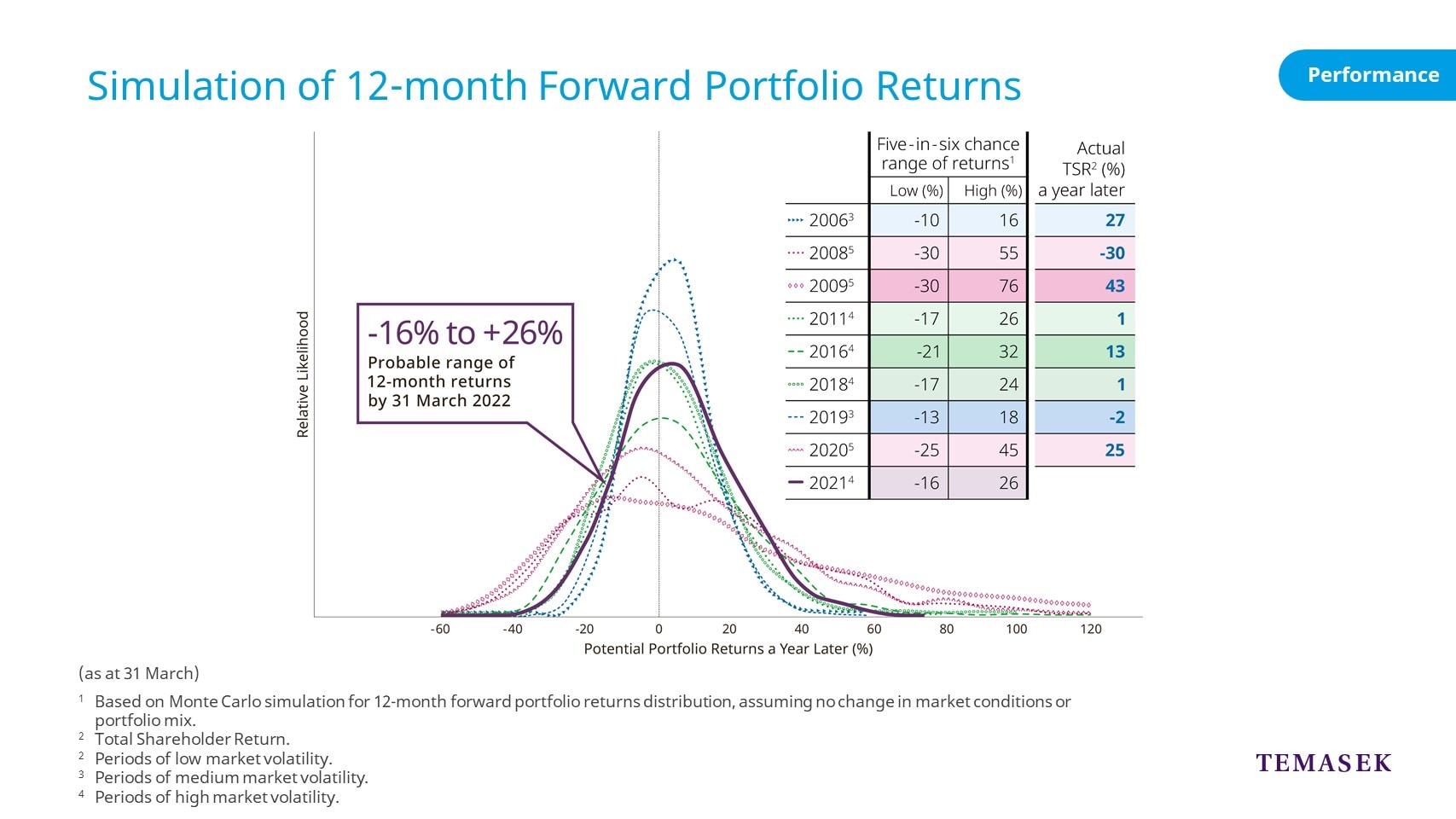

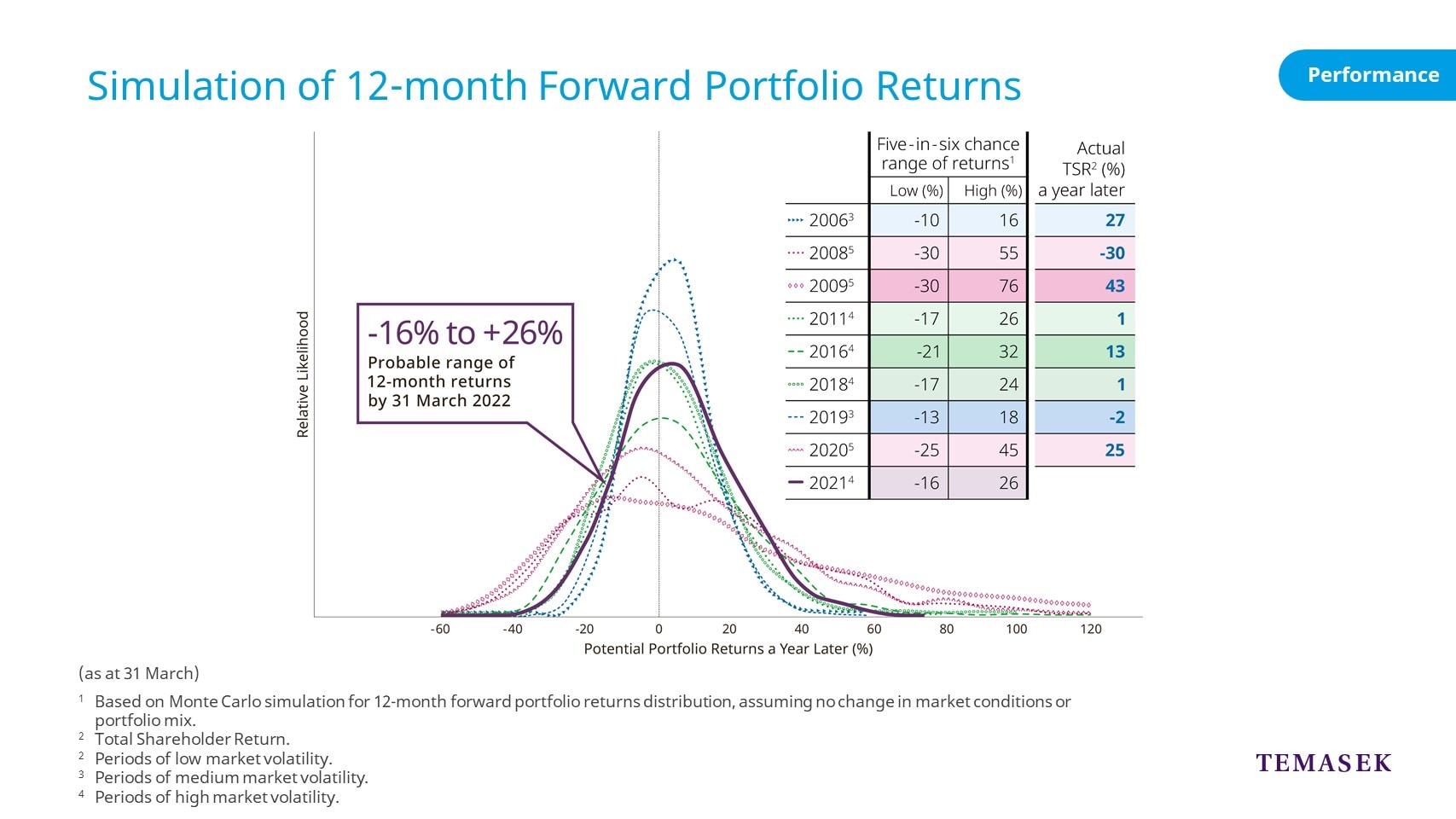

All that being said, we do have some simulations on a going forward basis, and the simulations show that over the next 12 months, we could have a range of outcomes from +26% to -16%, with very high probability. That's a wide range and that speaks to the fact that numerous inputs go into any analysis like that.

STEPHEN

FORSHAW: This is the one that Mukul was just

illustrating, that potential range of returns using our Monte Carlo simulation

method is somewhere between -16% and +26% that Mukul just mentioned.

Question on Investments and Divestments

QUESTION: Could you tell us a little about some of the divestments you've made and the reasons for that?

It has been very interesting around the world for cross‑border M&A. It has been a very difficult year where no one can fly or meet. In that environment, Temasek has made S$49 billion of new investments, a similar amount of divestments [$39 billion], and was probably the most active dealmaker in the world. What have you learnt about the ability to complete cross‑border deals with satisfactory due diligence in an environment with limited travel, and how will it affect the way you do deals in the future?

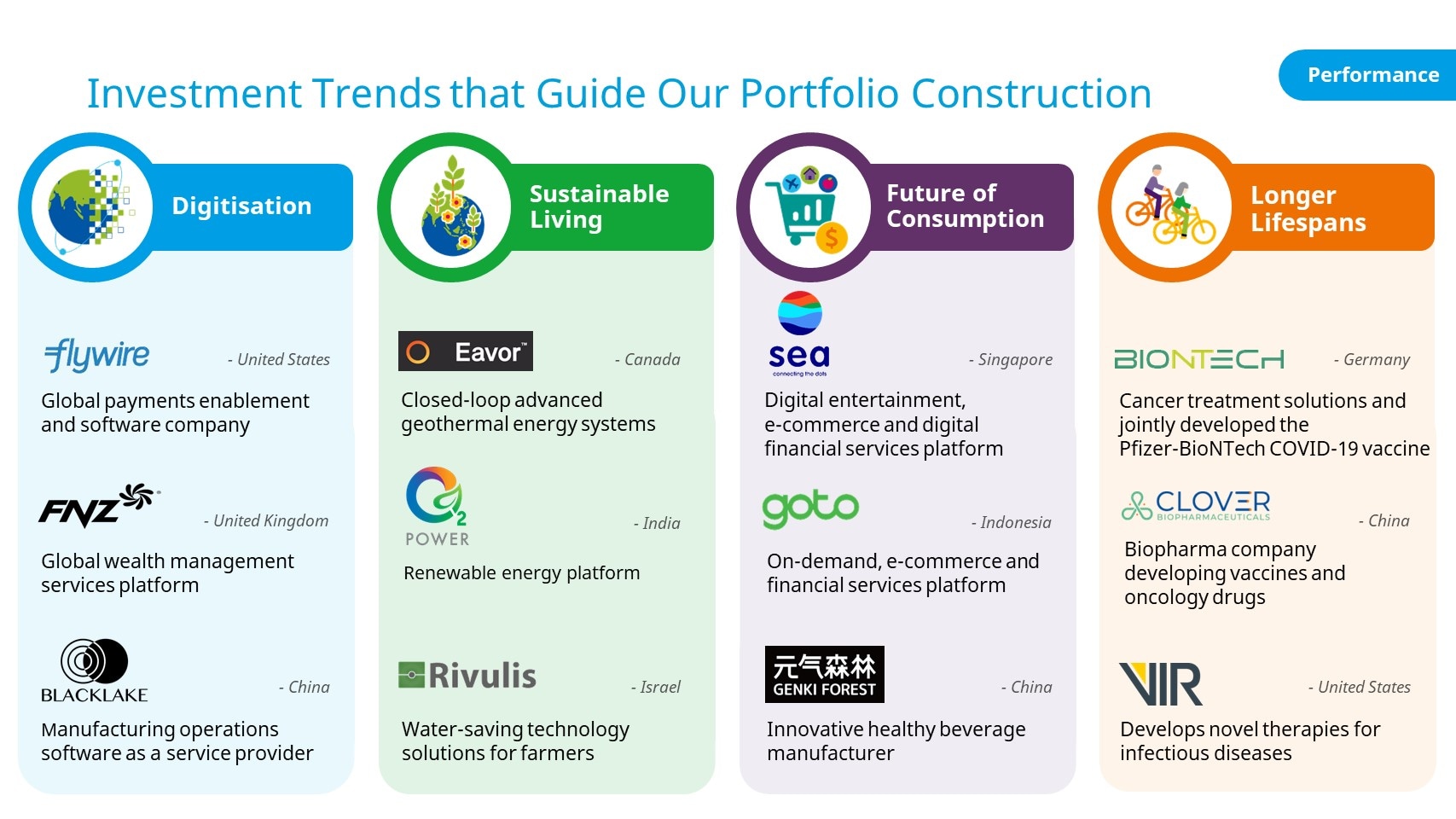

NAGI HAMIYEH: In terms of us having a very active year, you're right, we invested S$49 billion and divested S$39 billion, both records for us. I believe what we have learnt is that if you start on a journey much earlier on and you nurture a relationship with key companies that you would like to invest in, we can very well, in a scenario like the one we had this year, be able to conduct proper due diligence and close on deals. This is very possible as long as you have built relationships with these companies. We have embarked on rebalancing the portfolio into the four key areas that Wai Hoong talked about, and have also been emphasising quite a bit of our resources into these areas. In each area, the teams had a good idea on where and which companies they wanted to invest in, so this is not something new.

In terms of the divestments, we are a dynamic investor. We divest and invest accordingly. There are no specific reasons why we divest. We apply the value test on both our investments and divestments. We see if we have gotten to the underwritten valuation, and if there’s an opportunity cost. Then we look at the portfolio construction overall, where we would favour areas over others. So there is no one specific reason why we divest.

MUKUL CHAWLA: In some cases, the divestments are subject to the intrinsic test that Nagi talked about. But in some cases, as you may have seen, a lot of our companies had the opportunity to tap into the public markets this year, and that has allowed us to rebalance our portfolio. I will give you a real example, a company called BluJay Solutions where we are selling out of a small amount but not all of it, and it's natural that we continue to rebalance our portfolio in line with our stated trends and themes.

Question on Investments and Divestments (2)

QUESTION: The Americas accounted for their largest share of new investments made during the year, followed by Singapore and China. What has driven this flow into the Americas? Does it have to do with concerns or potential insurgency over regulatory actions in China which do have potentially longer term effects as, again, a longer term investor, or are there other reasons why essentially the Americas were the key region receiving most of your investment flows?

MUKUL CHAWLA: If you look at Americas as a recipient of incremental capital, what's been true this year has been true for the last seven years where the largest portion of our incremental capital has gone to the Americas and that, in turn, ties with ‑‑ going back to the T2020 objectives that we talked about, of building a more resilient portfolio, a portion of which was anchored in developed markets. So it's very consistent with our strategy, it's not a knee‑jerk reaction to any changes in markets on a relative basis, and it's been the same for a number of years, it hasn't changed in any recent moment in time.

I want to just underscore at the same time, while the Americas have gone up in gross dollars by almost six times, Europe, Middle East & Africa is up almost by five times and China has doubled even as the underlying composition has changed. So again, there's no relative asset allocation between geographies — it's where bottom‑up opportunities have shown themselves and have made sense for us.

Question on Investment – Listing of Unlisted Assets

QUESTION: Temasek seems to have just benefitted from the public listings of some of its holding companies. Can you talk a bit about that, and also the path forward for further companies being listed from its portfolio?

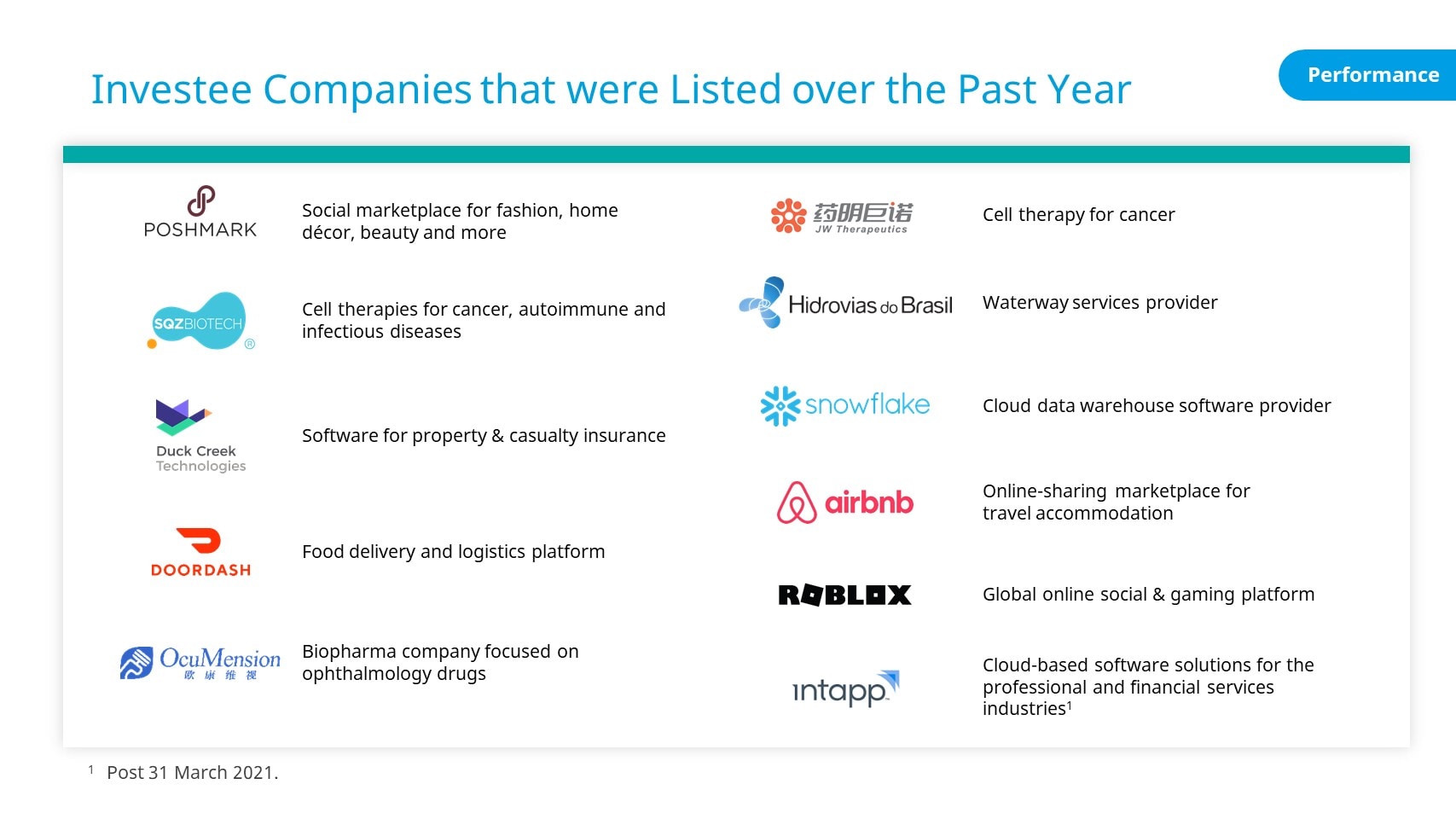

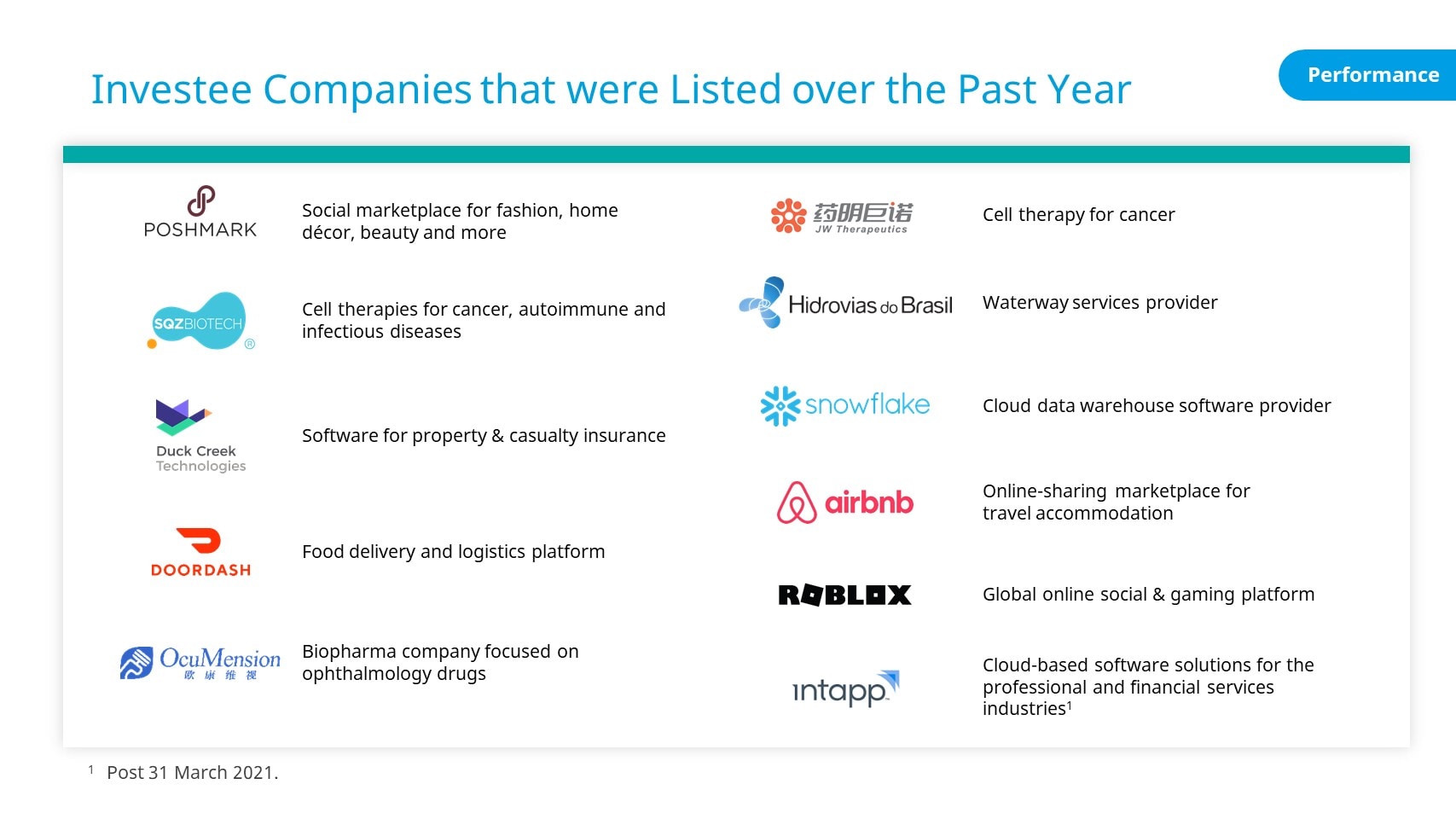

MUKUL CHAWLA: These are some of the investee companies that went public over the last year, and as you see, they're a cross‑section. They are geographically in a number of countries, Brazil, China, the US are represented on this page. They also go across sectors, from Technology to Life Sciences and Translog. So yes, a number of our companies did take advantage of the public markets over the last year and these decisions and calls are being made by their boards and their management teams.

A number of these companies are levered to trends such as digitisation that got accelerated through the pandemic. It was a great opportunity for these companies to further strengthen their balance sheets using public capital in this instance and position themselves for growth going forward.

As it relates to us, we remain supportive. These calls are ultimately made by the boards and management teams of these companies, but as both public and private investors, we have the ability to partner with these companies through their journey, whether private or public. There will be others, but this is an individual decision being taken by these companies as opposed to something that is a blanket perspective.

Question on Investment – Unlisted Assets

QUESTION: What is your view on the competition for private deals since a huge chunk of Temasek's investments are in privately‑held companies?

MUKUL CHAWLA: If you look underneath our unlisted investments, about a third of those are mature companies, in many cases, dividend payers like Mapletree and PSA. About 25% each are funds that we’re invested in or mature companies that were outside of Singapore or outside of Southeast Asia. And then less than 10 per cent of our portfolio are early stage companies; the unlisted mix is something worth calling out. To your question about competition and private deals, it's a reality, there's competition out there. But I point you to some of the spaces where we've really developed or differentiated franchise such as agri‑food. We've invested about S$5 billion in Agri‑Food. We have really nurtured the ecosystem across the globe, the investment activity in the west, but also the ecosystem we've nurtured here. It's a good example of how we position ourselves in the private markets.

Where we bring these differentiated capabilities, or what we call a Networked Organisation, the way we bring our knowledge networks together and our portfolio is really how we differentiate ourselves and our capital in the private capital markets.

Question on Investment – Portfolio by Geography

QUESTION: Could you please clarify why investments in China as a percentage of portfolio slightly declined this year?

NAGI HAMIYEH: We grew our portfolio in China by S$14 billion this year, so the only mismatch that you are referring to is the difference in reporting numbers between this year’s end of March and last year’s end of March. China’s market had started the recovery at the end of last March while Western markets, specifically US and European markets, were still close to the trough, and that explains the mismatch on a relative basis to the question that you have.

Question on Investment – Structural Trends

QUESTION: Temasek is planning to ride on trends such as digitisation, so could I get a view about Temasek's view on tech valuations, as well as how it takes tech valuations into consideration when investing in tech? And also, is Temasek seeing better valuations in the public or private sector?

MUKUL CHAWLA: Coming back to the intrinsic value test, the valuation question as it relates to tech, it's got a few dimensions to it. First, there are many aspects of tech that are very, very early in their evolution. You can look at autonomous driving, you can look at robotics, there are many categories, AI and blockchain in particular, where we developed our pods. Those are in very early stages of evolution. So when you look at the path forward for these technologies and the assets that are expressions of them, and you look at valuations on a growth‑adjusted basis, you know, I point out the fact that valuations today are lower than they were before the GFC.

So as a category, yes, it's true, some things are highly valued, others are not, the runway is very long for digitisation‑aligned opportunities and some of which are extremely early and we believe that there will be ample opportunity for us to find interesting things to do. At the end of the day, with the kind of global aperture that we have, we have the privilege of being able to look at investments individually, so we look at them bottom‑up, and valuation is one of the inputs that goes into that exercise, as I mentioned before.

So yes, of course, valuation matters but it is not an aggregate basis. It is against the growth prospects and the opportunity of a particular asset.

Question on Investment – Total Shareholder Return

QUESTION: This question is a follow‑up on your outlook for the future gains. The 25% returns we've seen this year is very impressive; what should we expect going forward?

MUKUL CHAWLA: With regards to the returns, where we showed earlier the 12‑month forward simulation, it's at best a simulation which features a wide range of outcomes subject to a number of factors that could play into the future. We have also talked about our long term returns and our high ambition scenario as it ties to climate change and sustainability. I think I will go back to saying that we're positioning the portfolio for the long term, and the returns that we look at, both TSR and NPV, are really over a long period of time. We're not managing from year to year, even though we have a simulation here that shows at least some range of outcomes.

Question on Investment – Total Shareholder Return (2)

QUESTION: What drove the returns this year? Is it safe to say it was just public equities or was it something else?

MUKUL CHAWLA: It’s a mix of multiple things that drove returns. About half our portfolio is public, so there's also the private component. Obviously we're reporting an aggregate. It's hard to say any one component is singularly responsible. But it is true that last year, because we have a March cycle, markets were down at the time, and they're in a better place now so the public portfolio has done well. But so have a number of our private companies.

A number of those have benefitted from public listings in some cases and others through marks in their private markets. So I think it's a very broad‑based answer although clearly the public markets are a part of what goes into it.

Question on Investment – Singapore-based Portfolio Companies

QUESTION: Regarding your local portfolio companies, Singapore Airlines (SIA), Keppel O&M and Sembcorp Marine (SCM), given the challenges that they face in these sectors, are there any updates that Temasek is able to provide in terms of the commitments moving forward, specifically for Sembcorp Marine and SIA?

NAGI HAMIYEH: SIA, to start with, is an iconic brand, it's one of the best global airlines in the world. It was, like every other airline, hit by the perfect storm last year. So they did the rights issue and an MCB. Obviously we participated in both. you know the numbers we have invested — S$6.3 billion last year, S$5.8 billion this year. What the company has said is that this amount of money raised will be good for them for the next two years.

Now, let me tell you why we've done that, besides that obviously we're a majority shareholder. As we keep on saying, we are a commercial institution and everything we do has to pass the value test. In the case of SIA specifically, we were fairly excited about the transformation plan that the company has embarked on three years ago before they were hit by COVID. And despite COVID and the long period of inactivity of the company, they managed on cost rationalisation. Yet when it came to the fleet renewal, they pushed with it because it will provide them a huge advantage going forward in a post‑COVID world, where the fuel efficiency of their fleet will be 25 to 30% more efficient than the rest, and will provide them with a huge advantage compared to the others. And this is very aligned with our decarbonisation plan, and yet we believe it puts them in a much stronger position.

On Sembcorp Marine, as the company has mentioned, since the demerger, the good thing is that they are starting on their pivot journey to exciting areas like offshore and floating wind, as well as hydrogen and other new energy areas. However, the company was hit by two areas.

One, over the last few years where oil price was weak and exploration budgets were dwindling, so they didn't have enough orders to sustain themselves. Plus, when COVID hit, the big impact on them was on the manpower front as well as procurement, and it hit them acutely as they came out and said, and this is why they came out with the rights issue of $1.5 billion. This is to strengthen their position, give the confidence to their lenders, to their employees as well as the counterparties, that they are well capitalised in order for them to, one, be able to get bigger contracts and, two, most importantly, pivot to sustainable areas where we see a big future for them.

Question on Investment – Singapore-based Portfolio Companies (2)

QUESTION: A couple of Temasek’s local portfolio companies have undergone or are undergoing restructuring, such as Sembcorp Industries, Sembcorp Marine, Keppel and CapitaLand. Going forward, will Temasek restructure its other portfolio companies?

NAGI HAMIYEH: On corporate restructuring, as you mentioned, CapitaLand, Sembcorp and Sembcorp Marine, I believe your question was if there are further restructuring coming. These are issues for the respective boards of the companies to take into consideration. As you know, our stated governance is very, very clear: we do not interfere with our companies, day‑to‑day management, it's something we leave to the boards. We advocate for having strong boards that work hand‑in‑hand with management. However, as a very active shareholder, we do provide our opinions, we do like to think that from time to time we add value by providing different perspectives in terms of what we see in the world or what we see other best‑in‑class companies are doing, and we work with our companies as partners to try to create value for every shareholder.

Now, in terms of new restructuring, you will have to ask the companies in question.

NEO GIM HUAY: To add to that, the two key trends that we've identified as part of our investment themes, digitisation and sustainability, are also impacting our companies, providing good opportunities for them to think about how they can position themselves for the future and this is a direction that you will likely see coming out of the ecosystem. Because as I mentioned earlier, the issue around climate change and sustainability, is no longer a "why" but a "how", and we are working closely with our companies to look at developing capabilities that will better position them for the future.

Question on Investment – Singapore-based Portfolio Companies (3)

QUESTION: Going back to the domestic companies, since the pandemic started to date, how much has Temasek spent to support the companies that have been in need of capital? Do you think that that sort of financial support, due to COVID, will end soon or continue? If it will continue, do you have an upper limit for the money you will spend to support them? And eventually, will you be bringing down the exposure, the shareholding, that has been raised due to this run of support for companies like Singapore Airlines (SIA), Sembcorp Marine?

NAGI HAMIYEH: Yes, there have been several capital raisers at some of our portfolio companies where we have participated as an investor. As an active investor, we look at each opportunity on a standalone basis, and we look at the outlook for the company, the business plan, and decide accordingly in terms of how we participate. So we don’t have a fixed plan on how much we're going to deploy to support our companies, because unfortunately things don't come out this way. It's on a situation‑by‑situation perspective.

As I mentioned, for SIA, over the last year and a half, we deployed S$13 billion, among other investors, of course. On the demerger of Sembcorp Industries and Sembcorp Marine, we got the shares as part of the dividend in specie from Sembcorp Industries to all shareholders, and then we ended up investing S$200 million in it. Out of the rights issue that was announced, we decided that we would take our pro rata shares, and in case there is any excess shares that the minorities don't want — and bear in mind we're the last in the stacking order — we would take up to 67% while DBS is taking the residual 33%.

The reason why we have done that is not to increase our shareholding, but we wanted to ensure that the company has certainty and access to these funds to be able to move into their new objective of looking at the new areas, which happened to be very aligned with us.

As for the future, what other companies of ours do, again, it's up to their boards and management. We will ascertain every situation and then decide how we act.

NEO GIM HUAY: If I may add, just on the outlook of the situation, we are cautiously optimistic about the progressive recovery of business as the vaccines continue to get rolled out. The recovery may be a bit uneven across different countries and different sectors, but we are cautiously optimistic that we could resume business, and regain confidence with the various measures that are being rolled out by the Government.

FOCK WAI HOONG: When it comes to Singapore specifically, once again ‑‑ I think we're well positioned to emerge from, I guess, the post‑pandemic world. The manufacturing sector should benefit from global cyclical recovery. Our financial services and technology sectors remain resilient and have shown strength through the pandemic. And certainly the domestic economy has taken the brunt of a lot of the lockdown measures and the circuit breakers, but is also well positioned to improve and benefit at this stage as we move forward through, as Gim Huay has mentioned, improving vaccination and all the work that has been done around a safe reopening of the economy.

Question on Investment – Ant Group and Didi

QUESTION: You're obviously an early investor in Ant. We've seen many other funds come up with new valuations for that company, given the stalled IPO. Fidelio, for example, recently cut it by half. What is your valuation on Ant and what is your opinion of that company now, given the stalled IPO?

Secondly, around Didi, you're an investor in Didi as well as the trucking business; did you have any inkling that the regulator was cautioning them about going public? When did you find out? How did you react? And what are your thoughts on that company now as it tumbles post‑debut in New York?

MUKUL CHAWLA: So I think first up, it's worth mentioning we mark our private companies at book value less impairment, so we aren't really looking at mark‑to‑market markers for our own results and, you know, that stays sort of in line with what we do for all of our other portfolio companies that are unlisted. So that's true of Ant and that's true of the other names that you may have called out.

As it relates to our perspectives, again I'll go back to what was said about regulations earlier on. The changing regulations specifically as they applied to Didi or otherwise, I don't think are different or new in the sense that regulation or regulation change is part of our risk assessment for any investment. We look at that, and I know I'm going to sound like a broken record speaking about the intrinsic value test, we use the same test for every investment, and I think in that regard we remain bullish on the opportunities in China and for these companies going forward.

Question on Investment – Singapore Airlines (SIA)

QUESTION: Will Singapore Airlines be a player in any potential M&As, and will you financially support Singapore Airlines, should it aim to be consolidated with M&As in the airline industry?

NAGI HAMIYEH: We believe that through the transformation program that SIA has gone through, their renewal of the fleet which will give them a comparative advantage, and the fact that Singapore Airlines is well capitalised for the next two years, we do believe that they will come out stronger as a result of this. Now, if their strategy stipulates that they need to consolidate, of course, as a supportive shareholder we're going to look at their strategy. I cannot opine on something that one, didn't happen, and two, is up to the board and management to come up with the right strategy and we, using our shareholder role, decide if we're supportive or not.

Question on Investment – Pavillion Capital [PAVCAP] Japan Fund

QUESTION: I'd love to know more about the PAVCAP Japan Fund which you mentioned in your release. I’m interested to know why there’s a dedicated fund for that, and what its approach and scale will be.

FOCK WAI HOONG: As we think about Japan, we're certainly optimistic about future prospects. We believe that Japan is very well positioned to benefit from a global cyclical recovery. In the near term, we expect a turn in economic activity really driven by two things — pace of vaccinations improving, as well as continued support by the Bank of Japan. Over the medium term to longer term, we're also very encouraged by the Government's efforts to accelerate digitisation, improve corporate governance, as well as to achieve its climate change goals. We think all those things will really help them bolster productivity and mitigate any future risks.

As it pertains specifically to the PAVCAP question, Pavilion Capital is a wholly owned subsidiary. Having said that, they are managed independently, they have their own management team, and they have their own board. I think this was a very nice way for us to complement our Japan exposure.

Question on Global Trade Issues

QUESTION: Given the US and China tensions that are still ongoing and the possibility that their bilateral relations might worsen in the future, how are Temasek's investments in the Chinese market affected and is there anything that Temasek is doing to ameliorate any potential impact?

NAGI HAMIYEH: Thank you for the question. Our investments in China look at, specifically, the proxy in terms of domestic growth. When we look at our four investment trends, we mentioned future of consumption, longer lifespans, or digitisation, are very, very prevalent in the case of China, and hence all the investments we make in China are domestic in nature. They do not rely on import or export. While we keep monitoring the situation around the tension between the US and China, both US and China are very important investment destinations for us, and we will continue investing. And, as I said, we are not looking at import or export‑related companies. So the order of magnitude of impact on our portfolio is very, very minimal.

Question on Global Outlook – Interest Rate Environment

QUESTION: You said before that you are confident over the short to medium term. I'm wondering how long the medium term is. And a follow‑on, at some point central banks will pull back on their quantitative easing. Is that something you believe you're already positioned for, and if not, to position yourself for it, will that be an incremental adjustment or something more substantial?

NAGI HAMIYEH: I think that the day will come where the accommodative policies obviously would have to slow down. We, again, it's our guess, and it's up to the central bankers to decide how to take it forward, but we don't believe there would be any abrupt movement in the other direction. Clearly, everybody is concerned about inflation; we believe inflation is transitory – at least what we see as of now, and might be with us for the next year – but it will boil down to really what happens in inflation and then the decision on what to do with the fiscal spending.

However, again, let me say that from a portfolio perspective, we are solving for the long term. So we don't recalibrate the portfolio on a month‑by‑month or even year‑by‑year basis, except following the plans we have in terms of portfolio construction going forward. We believe that the portfolio is well balanced between value, cyclical and yield stocks, and that should be a good portfolio that we will calibrate over time to sustain the reversal in policies when it happens.

Question on Global Outlook – COVID-19

QUESTION: Temasek takes a long term view of investments, can you identify some key changes to the market environment you're seeing now versus pre‑COVID, and specifically how you're changing your portfolio to adapt to that?

NAGI HAMIYEH: We mentioned to you that we're emphasising and we even refreshed the trends that we look at, and when you look at what happened during COVID last year, all of us working from home, what does it mean? It means that digitisation has been a very prevalent area. Payments has been a very, very prevalent area, e‑commerce has been a very important area. Even when you look at Cybersecurity, all of us working on unsecured networks, you look at the ransomware attacks and everything. So all the areas we mentioned in our presentation, we believe have been accelerated because of COVID, and that gave a very good idea to companies that if they are not disrupted yet, some of them would have to disrupt themselves to survive.

And this trend, we think, is irreversible. It will get accelerated and we feel fortunate that we have started emphasising quite a bit of our efforts and capital towards these trends over the last several years.

Question on China Outlook

QUESTION: Many of your Chinese investments are either listed in the US or have considered plans to list there. Will this pathway be slightly less common in light of the Chinese Government's actions on Didi and the recently issued draft rules? Will it have an impact on valuations there?

MUKUL CHAWLA: I think I will just underscore the optimism around China that we have. We continue to look at the growth opportunities in China and the ensuing investment opportunities that it brings for us. Back to the intrinsic value test that we keep talking about, we have a model where we invest against a risk‑adjusted cost of capital. One of many risks is regulation and regulatory change. So I think regulation and regulatory change, first, it's not unique to China; to the extent that there are changes, we must remain compliant and we encourage our portfolio companies to remain compliant. It doesn't change our optimism around the opportunity set in China going forward.

Question on China Outlook (2)

QUESTION: On Temasek's Chinese investments. As Chinese authorities are tightening regulation on Didi and other IT companies, do you see the tightening regulations on Chinese companies by the Chinese Government as a main risk factor, and would Temasek become more cautious about investing in Chinese companies in the future?

MUKUL CHAWLA: It's one of many risks in any country that we invest in, not just in China, that we are mindful of regulation and changing regulation, so I don't believe that it changes our stance on China anyway. We will continue to invest, we will consider regulation as it comes forward and at the end of the day, I want to underscore that we will comply and we will encourage our portfolio companies to comply with regulation, and our stance on China remains unchanged in our optimism.

NAGI HAMIYEH: It boils down to the view that we have of the specific country, specific company, and the specific sector. Regardless of what happens in the interim, as long as this view is unchanged, as what Mukul said, we take a risk‑adjusted approach, and looking at the regulatory environment is the same way we look at every intrinsic risk to the opportunity.

MUKUL CHAWLA: We don't manage our portfolio from one year to the next. We're managing portfolio construction for the long term, and the long term management, which is underpinned by the mechanics that we've talked about, allows us to ride through changes and, again, they apply to all geographies, all sectors uniformly.

Question on US Outlook

QUESTION: My question is on inflation. It's suspected to pick up faster going forward, especially in the US, so how will Temasek position its portfolio going ahead?

MUKUL CHAWLA: We are managing our portfolio and positioning our portfolio for a number of scenarios, and balancing out such that we can be resilient in a multitude of outcomes as a portfolio. We believe that the inflation is transitory, although it will or could be around for a year or more, and that's our current position. We continue to tune the portfolio, for that eventuality of various kinds. There's a bunch of scenario planning that goes into that.

It's important to mention that we don't manage our portfolio for a single year. We are constantly constructing and tuning the portfolio over the long term, and therefore we have to consider all of these eventualities in there.

Question on Sustainability

QUESTION: Will you disclose the amount of investment the Group has made in sustainability in the past year, or so far? And how will the increased investment in this area affect the Group's returns? Does Temasek set carbon reduction targets for portfolio companies?

NAGI HAMIYEH: Sustainability has been a theme for us since we came up with T2020, our 2020 vision, and that's back in 2011, before sustainability became a mainstream trend. In the last few years, we have invested tremendously in sustainability. I cannot give you a specific number because sustainability is very pervasive to many sectors we invest in. Most of the investments we've done in the Agri‑Food space, and this is roughly over US$5 billion over 5 years, it's predominantly targeted towards sustainability. How we invest it in new energy and solutions is mainly renewables, hydrogen, carbon capture, anything to do with sustainability. When we look at smart buildings or urban development as well, from an exposure perspective, sustainability is always at the core. So everything will go through the sustainability but it's very hard to quantify.

Going forward, I can tell you with certainty that we are going to double down on this investment because when we look forward in terms of our journey, we see that sustainability is going to be at the very core of everything that we do. I cannot give you a number, but I can assure you that it's going to be trending towards a much heavier investment in this area.

NEO GIM HUAY: We've been engaging our portfolio companies on climate as well as sustainability issues. The good news is that it's no longer about a ‘why’, but about a ‘how’. The specific transition pathway is a decision that each company's management and Board will have to make. You've heard announcements recently by SIA as well as SembCorp Marine to double down on their climate ambitions. I think they've both committed to achieve net zero by 2050.

Having said that, one of the things we've also done is provide platforms for regular exchange of ideas and experience. Some of our companies are ahead of others in terms of thinking about climate risks, carbon climate footprinting, and disclosures related issues. We've actually created a Temasek Portfolio Companies Sustainability Council. It comprises the CEOs of our portfolio companies, where they come together to exchange ideas and knowledge to see how they can move towards a more climate‑aligned economy.

Question on Sustainability (2)

QUESTION: How is Temasek going to decide on divestments in line with its carbon targets? Are there any hard metrics, like in Norway?

NAGI HAMIYEH: We don't use hard metrics, per se. We go back to the value test that Mukul mentioned, but it's extremely important. We look at two factors: one, this is generally for the portfolio. We look at opportunity by opportunity, bottom-up, have we reached the type of returns that we have underwritten? What is the upside left from here onwards? What's the opportunity cost versus other opportunities? And how does everything fit together as part of the portfolio construction that we are trying to develop going forward?

Now with regards to the example of Norway, they have divested from industries which are high emitters generally. We don't have such hard targets because for us, sustainability is especially critical. Besides what we mentioned in terms of investing in climate-aligned opportunities and investing in technologies, the third part is working with companies on their decarbonisation journeys. Gim Huay mentioned the Temasek Portfolio Companies Sustainability Council – this is one example; but we have many other examples where we do work with our investee companies on their journeys to decarbonise. So if our investee companies are fully aware and are trying to decarbonise and we can be helpful, we'd rather do that, because being serious about sustainability is not pushing the problem to somebody else, and we'd rather deal with it ourselves.

NEO GIM HUAY: If I could underscore the point, we much prefer to work with our investee companies. By asking questions such as, “Can you reduce your emissions? Can you replace your emissions with a different technology solution? And if you're in a hard‑to‑abate sector, can you explore offsets and invest into potential carbon negative emission solutions like reforestation to help with the climate transition?”

It is a global problem. We prefer not to pass the problem to someone else. If we can deal with it and engage companies, we’d much prefer to take this approach.

MUKUL CHAWLA: We're even open to investing, if appropriate, in emitters as long as we have a clear line of sight to its decarbonisation journey. So for us, the journey is in fact what we'd like to partner with companies on and we'd like to support them.

Question on Special Purpose Acquisition Companies (SPACs)

QUESTION: What is the panel's take on portfolio companies potentially pursuing a SPAC merger for a listing, especially as these instruments are starting to lose lustre not only with investors, but also regulators in large markets like the US, where we have seen some of those potential SPAC deals be put on hold?

MUKUL CHAWLA: To your SPAC question, I think it's a solution for some companies. We have some companies who are going to take advantage of it, others for whom it’s not the right solution. We don't take a stand necessarily on the class itself, and there are interesting opportunities to invest in SPACs as well. We remain open to our companies exploring these SPACs as ways to tap into the public markets.

I want to just highlight, it's been a very active year for a number of our companies accessing the public markets, and I think we have a slide on this that we can show. But it speaks to the fact that it's been an attractive opportunity for a number of our companies as the trends that we leaned into have accelerated in many cases through the pandemic. That represented an interesting opportunity for these companies to strengthen their balance sheets as such. So SPACs or otherwise, we encourage our companies to look at all sources of capital, and it may be the right thing for some of our companies to do.

FOCK WAI HOONG: I will acknowledge the fact that in Southeast Asia we've also seen a fairly heightened interest in terms of exploring SPACs as one of the many capital market opportunities that they have at their disposal. Once again, I think when it comes to portfolio companies, whether they go down the SPAC route or other capital raising methodologies, it's really a function of the state of their business, how the management team thinks about it, and certainly the decision is left with the Board. We're happy to share our views with all of them when it comes to decision‑making, but it's something that's left to the companies.

Question on Temasek’s Leadership Transition

QUESTION: My question is on Temasek's strategic direction ahead. Mr Dilhan Pillay is expected to be the CEO of Temasek Holdings on 1 October. Under his leadership, how do you think Temasek will move forward in terms of the investment strategy and focus?

FOCK WAI HOONG: Dilhan has been a part of our senior leadership team for well over a decade. And if you think about where we are in our journey and where we're going, together with the senior management team, it has to be critically involved with all those efforts. And, two, we're an evolutionary organisation, not a revolutionary organisation. So I think changes that we make are progressive, and I think well-positioned for the future.

NAGI HAMIYEH: Dilhan was an integral part to our 2020 vision and our journey going forward. He's been the CEO of Temasek International for a couple of years, and, you know, what we have endeavoured to do over the last few years is to come up with a strong bench of senior management. So there is no one person that makes any one decision. We all work collectively together through committees, through participation, and we're all part and parcel of this journey going forward. So I don't believe there will be much change.

The last point I will make is that succession planning is something that we take very seriously. The Board goes through the effort and identifies contenders internally and externally every year, and this is always ongoing. Even though Dilhan is taking over on 1 October, we are already planning for the next generation.

Question on Retail Bonds

QUESTION: I noticed that Temasek had issued retail bonds in 2019. In this current quite low interest environment, does Temasek have any plans to issue another retail bond offering for investors?

FOCK WAI HOONG: As we think about bond financing, we remain flexible and open. Our decision making will be driven by three factors: Number one, the investment opportunities that lie ahead of us. Number two, the market conditions, as you pointed out, include interest rates, which is quite attractive at this time. Number three, thinking through our liquidity levels and gearing levels which, at this point, our gearing levels remain quite low.

Maybe the last point I will leave you with is that it's very important for us to manage to our liquidity position and balance sheet strength. As you think about whether we are going to issue further retail bonds, once again, we remain flexible and open to the idea. We issued our first retail bonds in 2018, and they were well received. We were certainly appreciative and thankful for the support that we received in the market for those.

NAGI HAMIYEH: In a nutshell if we have the right opportunity to spend the capital, we might consider raising a bond. It's evident that the markets are conducive because of where interest rates are, but the first and primary question we'll ask ourselves is: “what is the need, or what is the usage of these proceeds that we raise?”.