Temasek portfolio at record S$193 billion

中文版 | Bản tiếng Việt | India Release | Versão em Português | Versión en Español

-

Overall portfolio delivered 10-year total shareholder returns of 9%

-

Investments made after March 2002 delivered nine-year annualised returns of 21%

-

Temasek ended the year with a net cash position

-

Group net profit more than doubled to S$13 billion for last financial year

-

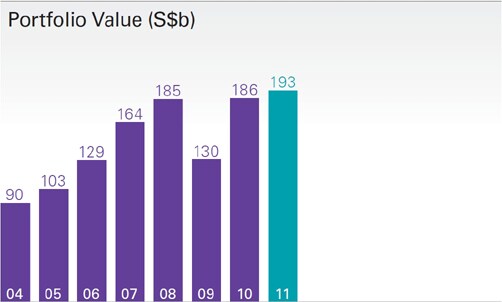

Net portfolio value:

- 31 March 2011: S$193 billion

- 31 March 2010: S$186 billion

- 31 March 2009: S$130 billion

- 31 March 2008: S$185 billion

- 31 March 2007: S$164 billion

-

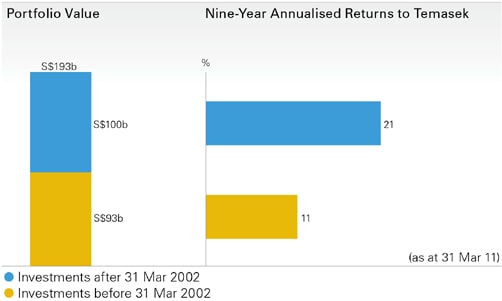

Nine-Year returns to Temasek by investment vintage

- Investments made before 31 March 2002: 11% annualised returns between March 2002 and March 2011

- Investments made after 31 March 2002 : 21% annualised between March 2002 and March 2011

-

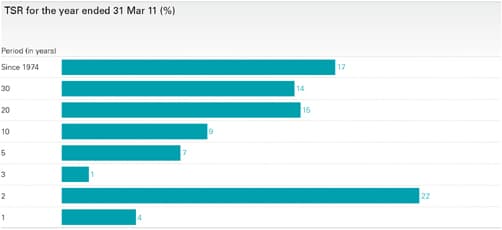

Total shareholder return as at 31 March 2011

- One-year : 4.60%

- Five-year : 7%

- 10-year : 9%

- 20-year : 15%

- since 1974 : 17%

-

Investment activities

- Investments: S$13 billion

- Divestments: S$9 billion

-

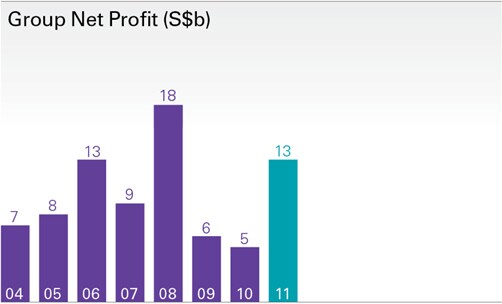

Group net profit

- 31 March 2011: S$13 billion

- 31 March 2010: S$5 billion

- 31 March 2009: S$6 billion

- 31 March 2008: S$18 billion

- 31 March 2007: S$9 billion

Singapore, Thursday, 7 July 2011 - Temasek Holdings (Private) Limited (Temasek) today released its annual performance review, Temasek Review 2011 – Building for Tomorrow.

Covering the financial year ended 31 March 2011, Temasek Review 2011 reports a record year end portfolio value of S$193 billion, up from S$186 billion in the previous year.

Temasek continued its 2002 strategy of steady and active international investment, particularly in Asia, to reshape its portfolio for sustainable long term returns.

Mr S Dhanabalan, Chairman of Temasek Holdings, said, “While Asia rebounded swiftly in 2010, the USA and European economies continued to face uncertainties. Rising debt burdens, inflation risks, and political upheaval in the Middle East, tested the resilience of the global economic recovery. Against this backdrop, Temasek continued its steady investment and divestment pace, ending the year with a net cash position, in anticipation of opportunities ahead.”

For Temasek, investments made after 31 March 2002, when it began shifting its portfolio weight towards Asia, delivered annualised returns of 21% over the last nine years, or over 5.5 times returns for the period. The portfolio of earlier vintage investments made before 31 March 2002 , comprising mostly Singapore-based investments, delivered creditable annualised returns of 11% over the last nine years, or under 2.7 times.

From the shareholder perspective, Total Return to Temasek's Shareholder (TSR) for the year was a modest 4.60%. This is based on the value of the overall portfolio, including cash and cash equivalents in the overall Temasek portfolio, as well as dividends to the shareholder and net of any capital injection from the shareholder.

Five-year and 10-year TSRs were steady at 7% and 9% respectively, while the 20-year and 30-year TSRs were 15% and 14% respectively. Since its inception in 1974, Temasek has delivered a healthy 17% compounded annual return.

Group net profit was S$13 billion, more than doubled from S$5 billion a year ago, due to higher contributions from Temasek investment activities and improved profits from its portfolio companies.

Investing for Sustainable Returns

Temasek remains anchored in Asia as part of its strategy to build its portfolio for resilience and sustainable long term risk adjusted returns.

During the year, Temasek maintained its steady pace of investments and divestments, with S$13 billion of investments and S$9 billion of divestments. It supported the recapitalisations of its portfolio companies, and stepped up its investments in the energy and resources sector, as well as in non-Asia growth economies such as Latin America. Temasek closed the year with net cash.

China remained Temasek’s largest investment destination. Additional investments included over S$3 billion in the rights issues of China Construction Bank and Bank of China.

In India, Temasek invested S$280 million in GMR Energy, giving it a significant exposure to the growing Indian power sector.

In Singapore, Temasek invested over S$100 million in Hutchison Port Holdings Trust, the first container port business trust listed on the Singapore Exchange.

Investments in the energy and resources sectors during the year included an initial S$500 million in Odebrecht Oil & Gas, a leading Brazilian upstream services provider for the oil industry, and S$700 million in Chesapeake Energy Corporation, the second-largest producer of natural gas in the USA.

In Mexico, in partnership with Impulsora Mexicana de Desarrollos Inmobiliarios, Temasek committed over S$100 million to pursue land banking opportunities with its first joint investment in Supra Terra.

Divestments during the year included Temasek’s stakes in Fraser and Neave, Hana Financial Group and Fortescue Metals Group.

Temasek ended the year with an underlying portfolio exposure of 77% to Asia, including 32% in Singapore. Latin America and other growth regions were a growing 3%, while mature economies of Australia & New Zealand and North America & Europe comprised a steady 20%.

The portfolio mix is balanced 45:55 between growth regions and mature economies.

Ms Ho Ching, Executive Director and CEO of Temasek explained, “We will continue to invest in the transforming economies of Asia and Latin America. At the same time, we remain open and ready to participate in opportunities in mature markets such as our recent investments in the USA.”

Financing Framework

The annual Temasek Review, Temasek Bonds and credit ratings are public markers of Temasek’s credit quality. They are also an integral part of the Temasek commitment to anchor Temasek’s institutional framework for financial discipline over the long term, foster good governance, and expand its stakeholder base.

Starting with its maiden 10-year Temasek Bond in 2005, Temasek has issued additional Temasek Bonds over the last two years to build out its debt maturity curve, including a groundbreaking 40-year Singapore Dollar Temasek Bond in late 2010. To date, Temasek has issued S$10 billion of triple-A rated Temasek Bonds in Singapore dollars, US dollars and British pounds sterling, with an average debt maturity of 16 years.

In February 2011, Temasek established a US$5 billion Euro-commercial Paper (ECP) Programme to cover the short end of its debt maturity curve. The Temasek ECP Programme has been assigned the highest short term ratings of A-1+ by S&P and P-1 by Moody’s.

Both the Temasek Bond and ECP Programmes form the major building blocks in its financing framework.

Contributing to the Community

As a responsible corporate citizen, Temasek is committed to the wider communities through its philanthropic support and endowment gifts for building people, as well as building the capacity and capability of communities around Asia, and rebuilding lives.

Temasek launched two philanthropic foundations in August 2010, following strong returns in excess of its risk-adjusted hurdles in the previous financial year that ended 31 March 2009, The Temasek Education Foundation supports educational causes in Singapore, while the Temasek International Foundation promotes and advances international scholarship and fellowship in the broader global community.

Looking Ahead

Temasek remains optimistic on the longer term outlook in Asia and other growth economies, despite medium term inflationary and structural risks, compounded by global imbalances.

Mr S Dhanabalan explained, “According to a recent McKinsey Global Institute report, mid-sized cities in growing markets are projected to deliver almost 40% of global growth by 2025. We continue to see the rising middle income populations driving rapid urbanisation and housing demands. Innovation will spur demand for new services, which could also lead to attractive investment opportunities.”

Temasek’s four investment themes of transforming economies; growing middle income populations; deepening comparative advantages; and emerging champions; will continue to guide its investments in the decade ahead as it strives to deliver sustainable long term value to its shareholder.

Ms Ho Ching elaborated, “Our strategy is to continue to invest and divest at a steady pace; stay liquid; shape a resilient portfolio and yet maintain the full flexibility to shift our portfolio mix, if and when necessary. Institutionally, we are committed to do things today for the long term. We are here to build a better tomorrow for our future generations. Directionally, we would like to further expand our stakeholder base to include co-investors and retail investors over time.”

- End -

1. Portfolio Value

2. Total Shareholder Return

3. Group Net Profit

4. Portfolio Value & 9-year Annualised Returns

5. Global Exposure

About Temasek Holdings (Private) Limited

Incorporated in 1974, Temasek Holdings is an Asia investment company headquartered in Singapore. Supported by 12 affiliates and offices in Asia and Latin America, Temasek owns a diversified S$193 billion portfolio as at 31 March 2011, concentrated principally in Singapore, Asia and growth markets.

Temasek's investment themes centre on Transforming Economies, Growing Middle Income Populations, Deepening Comparative Advantages and Emerging Champions. Its portfolio covers a broad spectrum of industries: financial services; transportation & industrials; telecommunications, media & technology; life sciences, consumer & real estate; energy & resources.

Total shareholder return for Temasek since its inception in 1974 has been a healthy 17% compounded annually. It has a corporate credit rating of AAA/Aaa from rating agencies Standard & Poor's and Moody's respectively.

For further information on Temasek, please visit www.temasek.com.sg.

To view and download the Temasek Review 2011, please visit www.temasekreview.com.sg.

For media queries, please contact:

Tan Yong Meng

Director, Corporate Affairs

Tel: +65 6828 6651

E-mail: yongmeng@temasek.com.sg

Jeffrey Fang

Associate Director, Corporate Affairs

Tel: +65 6828 6857

E-mail: jeffreyfang@temasek.com.sg

Sharon Seetho

Director, Kreab Gavin Anderson

Tel: +65 6339 9110

E-mail: sseetho@kreabgavinanderson.com

Additional Information

• Media Conference Presentation Slides

• Media Conference Selected Questions & Answers

• Temasek Review 2011 Key Highlights

• Photo of Dilhan Pillay Sandrasegara

• View an audio/video presentation on our performance as at 31 March 2011