Khazanah and Temasek announce strategic joint investments in real estate

Khazanah and Temasek commit to joint developments in Iskandar Malaysia and Singapore

MEDIA RELEASE

.jpg) | .jpg) |

Singapore - Khazanah Nasional Berhad (“Khazanah”) and Temasek Holdings (Private) Limited (“Temasek”) are pleased to announce the establishment of M+S Pte Ltd (“M+S”) and Pulau Indah Ventures Sdn Bhd (“Pulau Indah”).

Owned 60:40 by Khazanah and Temasek respectively, M+S will develop land parcels in Marina South and Ophir-Rochor in Singapore. Pulau Indah, a 50:50 joint venture between Khazanah and Temasek, will develop projects in Iskandar Malaysia in Johor.

These joint developments were supported by the Prime Ministers of Malaysia and Singapore in their Joint Statements of 24 May 2010, 22 June 2010, 20 September 2010 and 27 June 2011.

M+S develops two key sites in Singapore

M+S Pte Ltd will develop four land parcels in Marina South and two land parcels in Ophir Rochor, each as an integrated development.

An indirect wholly-owned subsidiary of UEM Land Holdings Berhad (“UEM Land”), a real estate company within Khazanah’s portfolio, and an indirect wholly-owned subsidiary of Mapletree Investments Pte Ltd (“Mapletree”), a Temasek portfolio company, have been appointed to oversee the marketing and development of the project at Marina South. For the Ophir-Rochor site, UEM Land and an indirect wholly-owned subsidiary of CapitaLand Limited (“CapitaLand”), another Temasek portfolio company, have been appointed to oversee the marketing and development.

Khazanah and Temasek are both committed to the successful commercialisation of these land parcels, which will include office, residential, hotel and retail components.

The gross development value of the project with a permitted gross floor area (“Permitted GFA”) of up to 501,020 sqm is estimated at approximately SGD11 billion (RM27 billion), subject to design and development plans.

Pulau Indah develops two new sites in Iskandar Malaysia

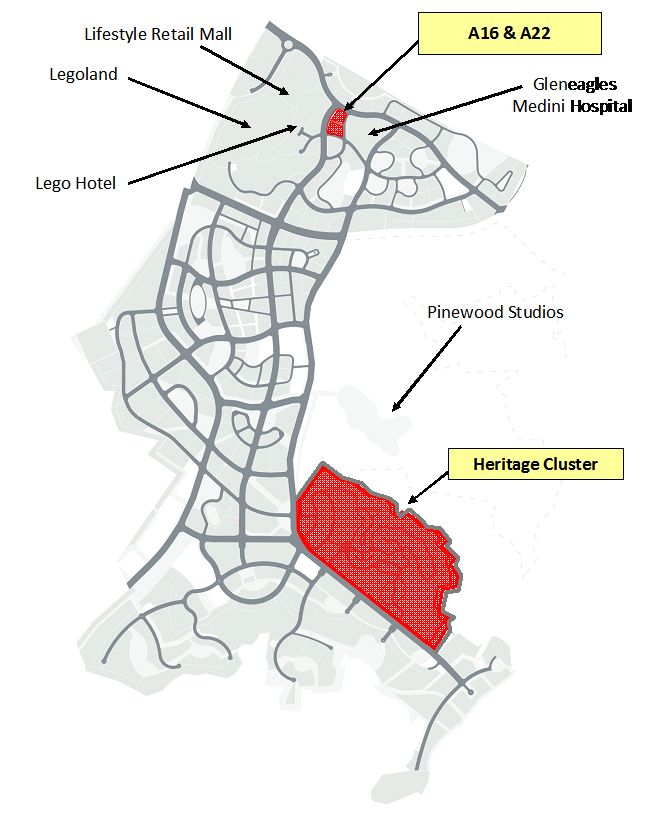

Khazanah and Temasek have worked together since last May to identify suitable sites in Iskandar Malaysia for joint commercial development. Two sites, one in Medini North and the other at the Heritage Cluster in Medini Central, have been confirmed.

Pulau Indah intends to develop serviced apartments, a corporate training centre, and commercial, retail, residential and wellness-related offerings on these sites. Khazanah and Temasek are currently in discussions and negotiations with potential partners and operators for the various components to maximize the commercial potential of the location.

The gross development value of the Iskandar project with a Permitted GFA of up to 1,365,675 sqm is estimated at approximately RM3 billion, subject to design and development plans.

Planning and design works for the projects had commenced in 1Q/2011. With the signing of these agreements today, the projects will move towards design and further implementation and delivery of the initial phases over the next five years.

Khazanah’s Managing Director, Tan Sri Dato’ Azman Hj Mokhtar, said: “We are honoured to be undertaking these exciting developments at these key sites in Singapore and Iskandar Malaysia with our counterparts from Singapore, Temasek Holdings. The development in Iskandar with Temasek will be highly complementary and builds on the momentum of existing and planned projects in Iskandar Malaysia, in which Khazanah has been involved since 2006. Both these projects mark our first joint development investment with Temasek, and we look forward to a strong and fruitful partnership in both Singapore and Iskandar Malaysia.”

Ms Ho Ching, Executive Director & CEO of Temasek, added: “Both the Khazanah and Temasek teams put in tremendous effort, working very closely together to develop the best ideas possible for our joint projects. We were also very fortunate to have the expert and highly professional support of leading real estate companies like UEM Land from Malaysia as well as Mapletree and CapitaLand from Singapore. I am also especially grateful for the guidance, advice and support of very experienced industry leaders who will guide the Singapore developments as key Board members of M+S. I look forward to the successful development of the projects both in Johor as well as Singapore."

- End -

Media Contacts:

Khazanah Nasional Berhad

Mohd Asuki Bin Abas

Senior Vice President, Communications and External Relations Unit

Tel: +603 2034 0294

Email: asuki.abas@khazanah.com.my

Temasek Holdings (Private) Limited

Serena Khoo

Director, Corporate Affairs

Tel: +65 6828 6509

Email: serenakhoo@temasek.com.sg

Attachments

| Marina South | Ophir-Rochor |

| .jpg) |

| Iskandar Malaysia |

|

| Medini Iskandar Malaysia | A16/A22 & Heritage Cluster |

|  |

Background for Media

Development of Marina South and Ophir-Rochor

The governments of Malaysia and Singapore announced on 24 May and 20 September 2010 that the Singapore government shall vest six land parcels in Marina South and Ophir-Rochor in lieu of the three parcels of Points of Agreement (POA) land in Tanjong Pagar, Kranji and Woodlands and three pieces of land in Bukit Timah (Lot 76-2 Mk 16, Lot 249pt Mk 4 and Lot 32-10 Mk 16). The Marina South and Ophir-Rochor land parcels shall be vested in M+S Pte Ltd for joint development when Keretapi Tanah Melayu Berhad vacates the Tanjong Pagar Railway Station.

The Marina South site is located at the heart of the financial and business cluster in Singapore's Marina Bay area. It is positioned between the proposed central linear park and a major public open space above the Marina Bay MRT Station, and will be well served by the Marina Bay and Downtown MRT Stations.

The Ophir-Rochor site is located between the Kampong Glam Historic District and the Beach Road Conservation Area, and in a new growth area envisioned to become an exciting 24/7 mixed-use cluster. It also enjoys excellent connectivity with the existing Bugis station and the upcoming Downtown line.

| Marina South | Ophir-Rochor | |

| Total Permissible GFA | 341,000 sq m | 160,020 sq m |

| Zoning | “White” site with minimum 60% office and activity generating usage such as retail | “White” site with minimum 40% office and 15% hotel and hotel-related uses |

| Nearby Amenities and Attractions | • Heart of the business and financial district at Marina Bay • Between the central linear park and major public open space • Served by the Marina Bay MRT Station and Downtown MRT Station | • Next to the Kampong Glam Historic District and Beach Road Conservation Area • Served by the Bugis MRT Station and future Downtown Line interchange at Bugis |

Development of Iskandar Malaysia parcels

The governments of Malaysia and Singapore announced on 24 May and 20 September 2010 that Khazanah and Temasek will undertake a joint venture to develop an iconic project in Iskandar Malaysia.

The developments in Medini are targeted to revolve around the concept of a complete lifestyle with a balanced mixture of eastern culture, heritage and style of architecture, coupled with the latest technology, world class logistics and security systems. To achieve the target, the underlying strategy is to capture various local, regional and international market segments in view of the strategic positioning of the development in key target sectors.

Khazanah and Temasek have worked together since last May and have identified two sites in Iskandar Malaysia: A16/A22 and Heritage Cluster at Medini Central.

| A16/A22 | Heritage Cluster | |

| Total Permissible GFA | 65,032 sq m | 1,300,643 sq m |

| Zoning | Commercial | Commercial and Residential |

| Nearby Amenities and Attractions | • Medini North’s catalytic projects including the Legoland theme park, Lego Hotel, Lifestyle retail mall and Gleneagles Medini (a leading private tertiary healthcare complex) • Puteri Harbour’s Family Entertainment Centre, which features world-renowned and popular children’s attractions including Hello Kitty and friends by Sanrio; the Little Big Club featuring HIT Entertainment's Thomas and Friends, Barney, Bob the Builder, Pingu and Angelina Ballerina; and a themed family restaurant by popular local cartoonist, Lat • Educational facilities through Marlborough College and Educity, a fully integrated knowledge-based hub comprising world class universities such as Newcastle University Medicine Malaysia, Netherlands Maritime Institute of Technology and University of Southampton amongst others • Pinewood Iskandar Malaysia Studios, an integrated media production studio facility • 5 minutes drive to the Second Link between Tanjung Kupang, Johor and Tuas, Singapore | |

About Khazanah

Khazanah is the investment holding fund of the Government of Malaysia entrusted to hold and manage the commercial assets of the Government and to undertake strategic investments. Khazanah is involved in various sectors such as power, telecommunications, banking, automotive manufacture, airport management, infrastructure, property development, broadcasting, semiconductor, steel production, electronics, investment holding, technology and venture capital. Some of the key listed companies in Khazanah’s investment portfolio include Telekom Malaysia Berhad, Tenaga Nasional Berhad, CIMB Group, Proton Holdings Berhad, PLUS Expressway Berhad, Malaysia Airlines System Berhad, Malaysia Airport Berhad, UEM Land Holdings Berhad, Axiata Group Berhad and Time dotcom Berhad.

For further information on Khazanah, please visit www.khazanah.com.my.

About Temasek Holdings (Private) Limited

Incorporated in 1974, Temasek Holdings is an Asia investment company headquartered in Singapore. Supported by 12 affiliates and offices in Asia and Latin America, Temasek owns a diversified S$186 billion portfolio as at 31 March 2010, concentrated principally in Singapore, Asia and the emerging economies.

Temasek's investment themes centre on Transforming Economies, Growing Middle Income Populations, Deepening Comparative Advantages and Emerging Champions. Its portfolio covers a broad spectrum of industries: financial services; telecommunications, media & technology; transportation & industrials; life sciences, consumer & real estate; energy & resources.

Total shareholder return for Temasek since its inception in 1974 has been a healthy 17% compounded annually. It has a corporate credit rating of AAA/Aaa by rating agencies Standard & Poor's and Moody's respectively.

For further information on Temasek, please visit www.temasek.com.sg.