Temasek portfolio market value rebounds S$56 billion to year-end high of S$186 billion

中文版 | Bản tiếng Việt | India Release | Bahasa Indonesia | Versão em Português | Versión en Español

Steady long-term returns of 17% compounded annually since inception

-

Net portfolio value:

- 31 Mar 10 : S$ 186 billion

- 31 Mar 09 : S$ 130 billion

- 31 Mar 08 : S$ 185 billion

| Total Shareholder Return* as at 31 Mar 10: | ||||||||||||||||||||||||

*TSR is the annually compounded rate of shareholder return over the specified period | ||||||||||||||||||||||||

- Investment activities:

- New/Recapitalisation investments : S$10 billion

- Divestments : S$6 billion

- Recapitalisation investments : S$3 billion

- Group net profit : S$5 billion

Singapore

Temasek Holdings (Private) Limited (Temasek) today released its annual performance report and institutional review, Temasek Report 2010 – Making a Difference, for financial year ended 31 March 2010.

Temasek Report 2010 sets out highlights of the firm’s portfolio returns and investments, its consolidated group financial summary and institutional framework as well as its engagement with stakeholders, including the wider community.

Delivering Long Term Returns

The market value of Temasek’s portfolio as at 31 March 2010 rebounded to a new financial year-end high of S$186 billion. This is an increase of S$56 billion from a year earlier, with a Total Shareholder Return of over 42% for the year.

The book value of the Temasek portfolio increased to S$150 billion, up from S$50 billion 10 years ago, underpinned by the secular growth of its portfolio companies and Temasek’s own investment activities.

Total Shareholder Return (TSR), measuring returns on an annually compounded basis since inception, was 17% by market value, and 16% by shareholder funds. Both 20-year and 30-year TSRs held steady at a creditable 16% by market value and 14% by shareholder funds.

Medium-term five-year TSR was relatively robust at 11% by market value and 14% by shareholder funds, while 10-year TSR compounded annually from the peak of the dotcom bubble, was 6% by market value and 12% by shareholder funds.

Also known as Wealth Added or Economic Profit, total portfolio returns to the shareholder, net of a risk-adjusted hurdle, was S$42 billion for the year, while group net profit was S$5 billion, with lower profit contributions from some of the portfolio companies which were impacted by the global financial crisis.

Temasek closed the financial year on 31 March 2010 with a comfortable net cash position.

Mr S Dhanabalan, Chairman of Temasek Holdings said, “Since inception, Temasek has been committed to create and deliver sustainable value as an active investor and shareholder of successful enterprises.”

“Our portfolio has delivered consistently through market cycles. Long-term TSR by market value held steady at 17% since inception, while both 20- and 30-year TSRs were 16%.”

Investing in Asia

Since 2002, Temasek has been an active investor in Asia. This year, nearly 80% of the underlying portfolio exposure is in Asia, including Singapore.

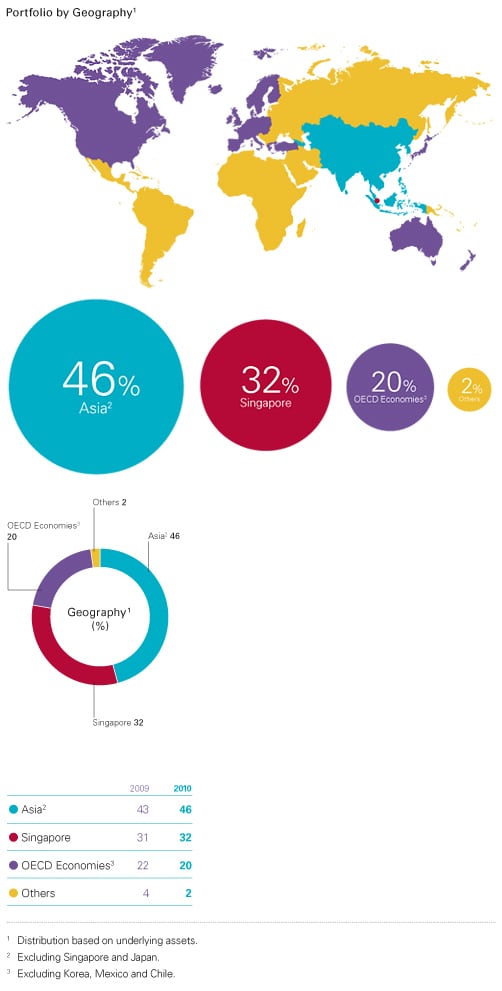

As of 31 March 2010, Temasek’s underlying exposure to Singapore was 32%, while the rest of Asia, excluding Japan, stood at 46%; and OECD and other economies at 22%.

The eight-year compounded annual returns for Temasek from its new investments made since March 2002 were over 23%, giving us a healthy growth in our exposure to Asia, including Singapore.

Shaping Our Portfolio

Temasek takes a long view of its investment posture, regularly reviewing and rebalancing its forward stance.

Explained Ms Ho Ching, Executive Director & CEO of Temasek Holdings, “Since mid-2007, we have maintained the flexibility of remaining in cash and kept a steady investment pace. This followed from our early 2007 assessment of increasing medium-term geo-economic risks and signs of bubbly market conditions. By mid-2007, we stepped up our monetisation, and prepared to stay on the sidelines going into 2008.”

Mr Simon Israel, Executive Director of Temasek Holdings, added, “Through the roller coaster of a massive correction, from the market peak of 2007, to a near meltdown in 2008 and early 2009, and a mixed recovery in the second half of 2009, we kept our cool, and focused on what we needed to do as a long-term investor. We maintained a liquid posture, kept our powder dry, made sure the home base was secure, and invested and divested steadily, taking advantage of opportunities which came along.”

During the last financial year, Temasek made a total of S$10 billion in new investments and $6 billion of divestments. These included over S$3 billion of rights issues in and recapitalisations of its portfolio companies to enhance their financial flexibility. This included the rights issue of Bank Danamon and Chartered Semiconductor Manufacturing in April, Neptune Orient Lines in July and CitySpring in September 2009. Further, Temasek injected S$1.5 billion into Singapore Power in October 2009, and S$210 million into Surbana in February 2010 to support their growth plans.

New Investments range from a platinum producer in South Africa, to a Canadian-listed oil and gas company, an LED manufacturer in Korea and an innovative biotechnologies company in Brazil.

Temasek also established SeaTown Holdings in August 2009, a wholly-owned global investment company with committed capital of over S$4 billion, bilateral co-investment rights between Temasek and SeaTown, and the potential for third-party co-investment in the medium term. Sustainable urban solutions provider, SingBridge International, was formed in June 2009 to focus on the investment and development of integrated townships and large-scale projects in Asia.

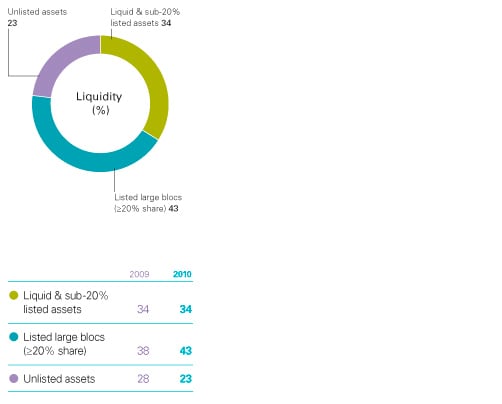

Staying Flexible & Liquid

Since mid-2007, Temasek has been maintaining a relatively liquid stand in anticipation of the risks and market opportunities, and has had the full financial flexibility of a net cash position.

Temasek also took advantage of renewed confidence in the credit markets in the fourth quarter of 2009 to issue new Temasek Bonds, particularly at the long end. These serve as public markers of Temasek’s credit quality, enhancing capital efficiency, increase funding flexibility, and expanding Temasek’s stakeholder base in Singapore and internationally.

To date, Temasek has eight outstanding Temasek Bonds, totalling just under S$8 billion (under US$6 billion), as part of its US$10 billion Global Guaranteed Medium Term Note (MTN) Programme. Three are USD-denominated and five SGD-denominated, with varying maturities of up to 2039, and a weighted average maturity of about 13 years.

Shaping Our Institution

Temasek is defined by its people, from the pioneer leaders who established Temasek on commercial principles, to the current team who strive to deliver consistently for the long term.

The Temasek ethos of ownership and stewardship rests on the foundation of good governance, and the values of meritocracy, excellence and integrity.

Apart from the continuing programmes to upgrade and improve its systems and processes, Temasek continues to place critical emphasis on the development of its people as one team, and as its future generation of leaders.

Building a Shared Future

The twin pillars of Temasek’s contributions to the community are sustainability and good governance.

In 2003, Temasek committed to set aside a share of its returns, whenever it delivers returns above its risk-adjusted hurdle. These provisions fund donations, endowments and other contributions to the wider community.

Temasek Trust was established with its independent Board of Trustees to oversee the management and disbursement of philanthropic endowments and community gifts for non-profit philanthropic organisations and beneficiaries.

In June 2009, S$100 million was endowed to Temasek Trust to support a new philanthropic organisation, Temasek Cares, to provide support and succour to the needy in Singapore. In December 2009, a further S$70 million was endowed to the Temasek Trust to support programmes to build capabilities in healthcare and special needs sectors in Singapore.

These contributions complemented earlier initiatives such as Temasek Foundation and other non-profit philanthropic institutions. During the year, three-year old Temasek Foundation committed about S$20 million to 35 programmes in Asia, supporting the building of expertise in technical and vocational education, as well strengthening regulatory frameworks and enhancing public management capabilities. In its first year, Temasek Cares committed almost S$2 million to five programmes for 1,200 beneficiaries in Singapore.

Since inception, Temasek has committed over S$1 billion for community and other public good causes.

Looking Ahead

The European sovereign debt crisis points to the underlying structural imbalances and the bumpy re-adjustments ahead as past excesses are still being worked through. Downside risks include inflation in the medium term, as well as political, policy and regulatory risks in the near term, and the potential cracks in the global credit system.

Mr Dhanabalan elaborated, “Protectionism may rear its head as developed markets struggle to cope with high unemployment, weak fiscal positions and mounting debt burdens. On the other hand, developing markets risk asset bubbles, and loose lending may haunt their banking system down the road.”

Ms Ho Ching added, “We expect global growth to be slower in the medium term with Asia maintaining its secular long-term growth. Our focus on Asia will continue.”

Simon Israel emphasised, “Directionally, we are likely to increase our exposure to Asia over the next decade, but will continue to maintain the full flexibility to shift our portfolio stance in response to major development, trends or market opportunities.”

- End -

1. Portfolio Value since Inception

.jpg)

2. Total Shareholder Return

3. Portfolio by Geography (%)

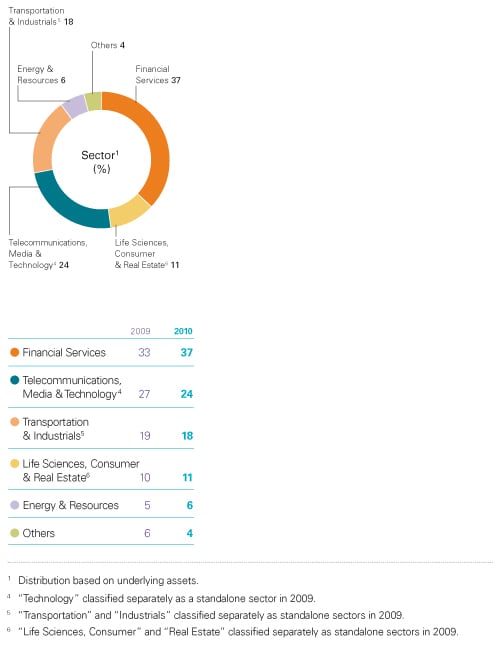

4. Portfolio by Sector (%)

5. Portfolio by Liquidity (%)

For further information on Temasek, please visit http://www.temasek.com.sg/

To view and download all content from the Temasek Report 2010, please visit http://www.temasekreport.com/2010

Additional Information

- Opening Remarks by Simon Israel, Executive Director and Head, Singapore (Checked against delivery)

- Media Conference Key Questions & Answers

- Temasek Report 2010 Key Highlights

- Temasek Report 2010 website

- Temasek Report 2010 Technical Briefing Presentation

- Photo of Panellists (L-R) Leong Wai Leng, Simon Israel, Jimmy Phoon

- Biography of Panellists

For media queries, please contact:

Tan Yong Meng

Director, Corporate Affairs

Tel: (65) 6828 6651

E-mail: yongmeng@temasek.com.sg

Paul Ewing-Chow

Senior Associate, Corporate Affairs

Tel: (65) 6828 6979

E-mail: paulewingchow@temasek.com.sg

Kelvin Lee

Senior Vice President, Weber Shandwick

Tel: (65) 6825 8027

E-mail: klee@webershandwick.com