Temasek Review 2019: Record Net Portfolio Value of S$313 Billion

Look, Think, Act – Now Together

For a Sustainable World and a Better Future

- Net portfolio value of S$313 billion1 as at 31 March 2019

- One-year Total Shareholder Return (TSR) of about 1.5%

- Ten-year TSR of 9%; 20-year TSR of 7%

- Invested S$24 billion; divested S$28 billion

- Dividend income of S$9 billion

Singapore, Tuesday 9 July 2019 – Temasek reports a net portfolio value of S$313 billion1, up S$183 billion over the decade, as at 31 March 2019.

One-year Total Shareholder Return was 1.49%, with annualised returns of 15% compounded over 45 years since inception in 1974.

The company anticipated an increasingly challenging environment since last July, and moderated its investment pace, investing some S$24 billion and divesting S$28 billion for the year.

Temasek received dividend income of S$9 billion from its portfolio.

Look, Think, Act – Now Together

Mr Lim Boon Heng, Chairman, Temasek Holdings, said:

“We are committed to do well, do right and do good, as an investor, institution and steward. Sustainability is, and should be, at the core of everything we do. Ultimately, we can thrive over the long term only if our communities do well, and we do right for our people, institution and planet.

“Climate change is the most urgent challenge confronting humanity today. Let’s look at what’s happening around us, and think what it means for people, lives and livelihoods – we are already one degree warmer today thanduring our pre-industrial past, with only half a degree2 more to go to the tipping point of 1.5 degrees Celsius. We need to act now, urgently and boldly together, for a better and more liveable world, for our future generations.”

Building a Better, Smarter, More Sustainable World

Mr Dilhan Pillay, CEO, Temasek International, commented:

“We have been investing in structural trends driven by transformational technologies, sustainable living, longer lifespans, and changing consumption patterns as people’s income grow and lives get uplifted. Going forward, we will increasingly reshape our portfolio in line with these trends.

We continue to build our portfolio for the future by increasing our exposure in unlisted companies. Investments in this space have generally performed well and provided us with better returns than listed ones since 2002.”

Six structural trends help shape our investment direction in Temasek: longer lifespans, rising affluence and sustainable living drive social progress, enabled by technological solutions for sharing economies, smarter systems and a more connected world.

As a generational investor and a steward, we recognise there is an urgent need for solutions that support sustainable, longer and more fulfilling lives, while protecting the natural environment. Investments into such solutions include Neoen, an international solar, wind and energy storage company; Pivot Bio, a synthetic biology company producing nitrogen-fixing microbes that reduce the need for chemical fertilisers; and indoor farm operators like Sustenir Agriculture and Bowery Farming, operating in Singapore and US respectively, that grow and deliver high quality fresh clean produce in urban spaces using less resources.

Increasing longevity globally presents both challenges and opportunities. We invested in companies that seek to develop new therapies for ageing-related diseases such as cancer and neurodegenerative diseases, as well as those that provide high quality healthcare services. These include: BeiGene, a company based in China specialising in developing novel therapies for cancer; Denali, a company based in the US which focuses on developing therapies for neurodegenerative diseases; Iora Health, which provides value-based healthcare solutions to seniors; and Sheares Healthcare, a pan-Asian healthcare services platform headquartered in Singapore.

An Active Investor

We remain anchored in Asia with 66% exposure by underlying assets. We have been growing our exposure in Europe (10%) and North America (15%), in line with the emerging trends and opportunities. These two regions now form a quarter of our underlying portfolio exposure, behind Singapore (26%) and China (26%).

Geographically, the US again accounted for the largest share of our new investments during the year, followed by Europe and China. Our underlying exposure is 60:40 in mature3 economies and growth4 regions.

We remain disciplined in focusing on intrinsic value and our risk-return framework. As an owner and investor, we have full flexibility to reshape and rebalance our portfolio, whenever opportunities or challenges arise. We continue to manage our liquidity and balance sheet for resilience.

Our portfolio comprises both listed and unlisted assets, with the latter consisting of companies and funds. Our blue chip companies, such as Singtel, DBS, PSA and China Construction Bank, as well as our international portfolio of high quality funds, pay steady dividends and cash distributions. Our investments in funds have been instrumental in helping us gain deeper insights into new markets and have provided co-investment opportunities.

Investment Highlights

Financial services remain as the largest share (25%) of our portfolio by sector. For our new investments, we continue to focus on non-bank fintech and payments platforms such as Ant Financial in China that operates the flagship Alipay payments platform; and Global Payments, a global payment solutions provider.

Technology, Media and Telecommunications, particularly technology, remains a key investment focus. Some of our new investments include North American companies such as UST Global, a digital solutions provider and DoorDash, an online food delivery marketplace; OlaCabs, an online ride-hailing company in India; and Bionexo, a Brazilian healthcare e-commerce company.

In life sciences, we invested in Aerogen, a global medical device and therapeutics company based in Ireland; Hangzhou Tigermed, a clinical contract research organisation supporting the development of innovative drugs in China; and Orchard Therapeutics, a UK-based commercial-stage biopharma global leader in gene therapy for rare diseases.

In the US, we invested in Farmer’s Business Network, an agriculture analytics platform for farmers; and Rent the Runway, an online e-commerce website for renting designer apparel and accessories.

Over in Europe, we invested in Safran, an aircraft engine equipment manufacturer based in France.

China investments included WeWork China, a co-working space provider; and Gracell Biotechnologies, a next-generation cell therapy company.

We stepped up our divestment pace, in cognisance of macroeconomic headwinds. Divestments included Gilead Sciences, Cargill Tropical Palm and Klabin. We continue to maintain significant holdings in Alibaba, CenturyLink and IHS Markit, even as we shed some stakes to rebalance our portfolio. Post March 2019, we completed our divestment of Bank Danamon.

Catalysing Innovation

The Fourth Industrial Revolution is being powered by rapid technology developments. Technology breakthroughs in fields such as Artificial Intelligence (AI) have the potential to transform a wide range of industries.

During the year, we invested in several innovative early stage AI companies across the world. These included Eigen, an AI company targeting finance, law and professional services sectors; ThinCI, a semiconductor company that produces specialised chips to support AI applications; and AirMap, an unmanned traffic management platform for drones.

These early stage investments, including indirect investments through venture capital funds constitute 3% of our portfolio. They provide us with early and deeper insights into innovation, enabling us to better track future opportunities and understand potential implications for our broader portfolio, in addition to delivering returns.

Enabling Communities

As we do well and do right, we also aspire to do good as a steward, both through our non-profit philanthropic organisations, such as Temasek Foundation, and directly as an intergenerational investor at Temasek.

Temasek Foundation delivers community programmes focused on building people, building communities, building capabilities and rebuilding lives.

Programmes last year include Project Silver Screen which provides silver age Singaporeans with functional health checks; Temasek Foundation’s partnership with the Singapore SingHealth Group to train maternal and children healthcare professionals in India; and the Global Liveability Challenge which aims to fund innovative solutions to sustainability challenges. These outcome-focused programmes enable individuals, families and communities to achieve sustainable improvements and progress in their lives.

To date, Temasek Foundation programmes have touched over 900,000 lives across Singapore and Asia.

In June this year, we launched the Temasek Shophouse as our gift to Temasek Trust for social impact in Singapore and beyond. Temasek Shophouse aims to be a convenor for community collaboration and a catalyst for advancing sustainability.

Looking Ahead

Equity markets have been volatile for the past year and a half. Concerns remain around escalating tensions, especially between China and the US. These tensions may further moderate global growth. We also remain watchful around the risks of a late cycle recession in the US, while Brexit and political fragmentation continue to weigh on Europe.

The outlook in China may come under more pressure from a prolonged standoff with the US. This may be mitigated by its awareness of macro risks and policy headroom. Overall, we remain optimistic on China’s trajectory in the medium term, on the back of timely and targeted reforms to transition the economy towards a more sustainable growth path.

In Singapore, activity is moderating alongside global growth, with increasing downside risks from global tensions. However, the potential of increased trade and investment into the growing ASEAN region could favour Singapore in the long term. We also expect some segments of the economy, including professional, financial and technology services, to remain resilient.

Png Chin Yee, Senior Managing Director, Portfolio Strategy & Risk Group, noted, “While the increasingly challenging global environment may dampen business confidence and investment, we expect policymakers to be primed for dovish policies that could cushion any substantive pressure on growth. If growth continues to be weak, the low interest rate environment is likely to persist into the foreseeable future. This could lower returns expectations for the longer term.”

John Vaske, Head, Americas, shared, “We are deploying capital to catalyse and support companies which can deliver innovative solutions to meet changing demands, and address global sustainability challenges. We have a framework to incorporate environmental, social and governance considerations in our investment decisions – this is very much aligned to our purpose of creating sustainable value over the long term.”

Chia Song Hwee, President and Chief Operating Officer, concluded, “In general, we manage our portfolio and liquidity for resilience, especially in anticipation of a more challenging outlook. We were concerned about the downside risks last year, and have deliberately tempered our investment pace. We continue to be disciplined in our investment approach, and remain watchful of the macro headwinds. However, as a generational investor, we will continue to seek opportunities in line with the structural trends that we have identified as the drivers for future demands and growth.”

##END##

About Temasek

Temasek is an investment company with a net portfolio value of S$313 billion as at 31 March 2019.

Our Temasek Charter roles as an investor, institution and steward, shape our investment stance, ethos and philosophy, to do well, do right and do good.

Our investment philosophy is anchored around four key themes:

- Transforming Economies

- Growing Middle Income Populations

- Deepening Comparative Advantages

- Emerging Champions

We actively seek sustainable solutions to address present and future challenges, as we capture investment and other opportunities that help to bring about a better, smarter and more sustainable world.

Temasek has had an overall corporate credit ratings of Aaa/AAA by rating agencies Moody’s Investors Service and S&P Global Ratings respectively, since our inaugural credit ratings in 2004.

Headquartered in Singapore, we have 11 offices around the world: Beijing, Hanoi, Mumbai, Shanghai and Singapore in Asia; and London, New York, San Francisco, Washington D.C., Mexico City, and Sao Paulo outside Asia.

For more information on Temasek, please visit www.temasek.com.sg

For the latest Temasek Review, please visit www.temasekreview.com.sg

Connect with us on social media: Facebook (Temasek); LinkedIn (Temasek); Twitter (@Temasek); Instagram (@temasekseen); YouTube (TemasekDigital); WhatsApp (+65 9101 0207) and WeChat (temasek_digital).

For media queries, please contact:

Stephen FORSHAW Head, Public Affairs Temasek Tel: +65 6828 6518

|

For investor queries, please contact: Derrick WAN Managing Director Investor Relations Temasek Tel: +65 6828 2328

|

Lena GOH

Director Public Affairs Temasek Tel: +65 6828 9138

|

CHONG Hui Min

Director Investor Relations Temasek Tel: +65 6828 2468

|

Temasek Review 2019 Key Figures in S$ and US$5

Net Portfolio Value

As at |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

in S$ b |

313 |

308 |

275 |

242 |

266 |

223 |

215 |

198 |

193 |

186 |

in US$ b |

231 |

235 |

197 |

180 |

194 |

177 |

173 |

157 |

153 |

133 |

Total Shareholder Return (TSR) as at 31 March 2019

TSR (%) |

One-year |

Three-year |

10-year |

20-year |

Since 1974 |

in S$ terms |

1.49 |

8.88 |

9 |

7 |

15 |

in US$ terms |

(1.93) |

8.63 |

10 |

9 |

16 |

Investments & divestments for the year ended 31 March 2019

|

Investments |

Divestments |

in S$ b |

24 |

28 |

in US$ b |

18 |

21 |

Cumulative investments & divestments for the decade ended 31 March 2019

|

Investments |

Divestments |

in S$ b |

218 |

162 |

in US$ b |

165 |

122 |

Group Shareholder Equity

As at |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

in S$ b |

283 |

272 |

239 |

218 |

219 |

187 |

169 |

158 |

155 |

150 |

in US$ b |

210 |

208 |

171 |

162 |

160 |

149 |

136 |

126 |

123 |

107 |

Group Net Profit

For year ended |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

2012 |

2011 |

2010 |

in S$ b |

12 |

22 |

14 |

8 |

14 |

11 |

11 |

11 |

13 |

5 |

in US$ b |

9 |

17 |

10 |

6 |

11 |

9 |

9 |

9 |

10 |

3 |

Changes in Accounting Standards

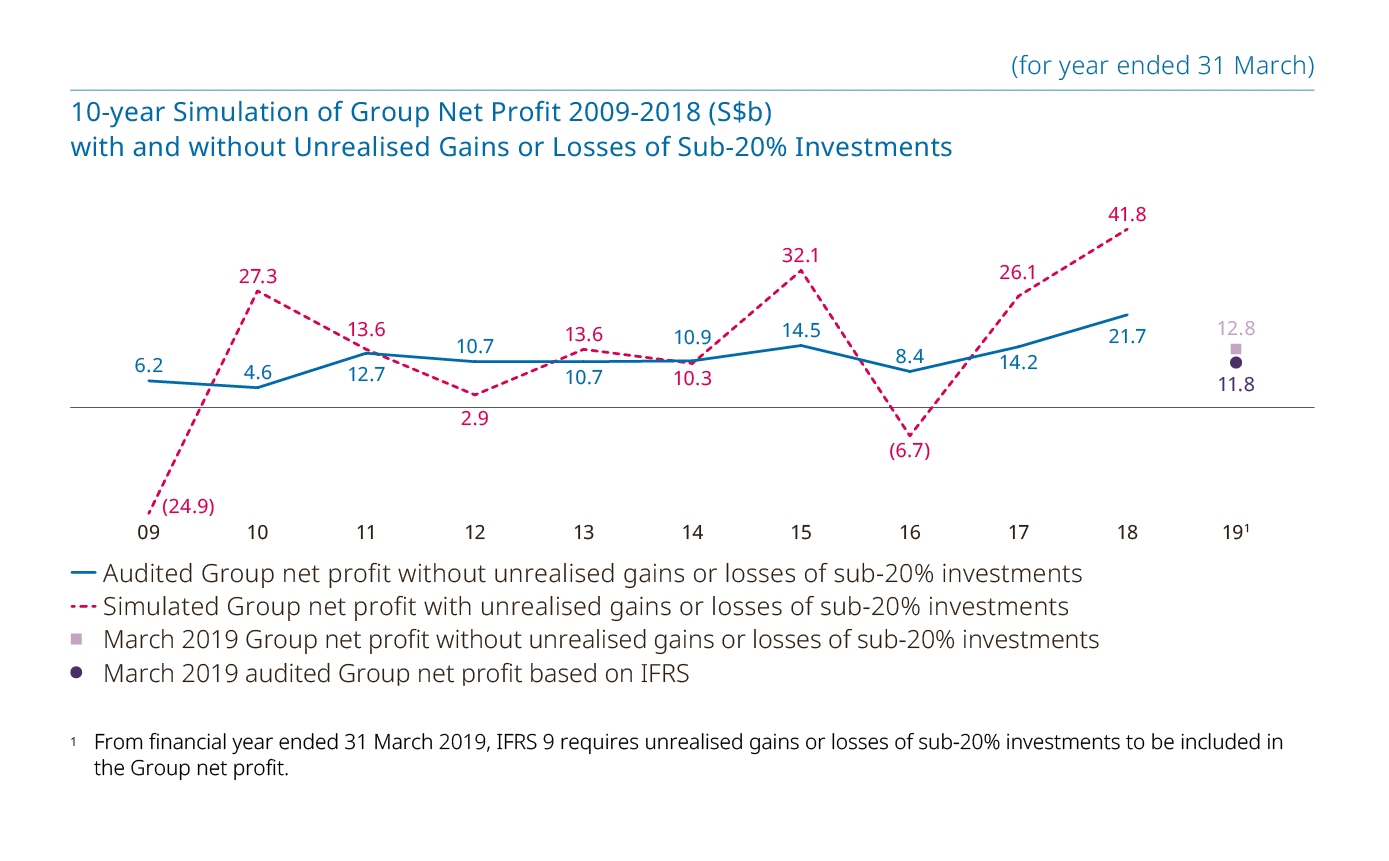

With effect from 2018, Temasek adopted the International Financial Reporting Standards (IFRS), in line with Singapore’s convergence with IFRS. This included the new IFRS 9: Financial Instruments standard, which impacts how we report the accounting profits and losses in our group financials.

Prior to IFRS 9, our income statements will account for any realised gains or losses over the life cycle of our investments, whenever we sell any of them. Year-to-year changes in market values of our sub-20% investments are captured in our balance sheet, and have no impact on the reported profits or losses in our income statements.

Under IFRS 9, year-to-year changes in the market value of all our sub-20% investments are accounted as profits and losses in our income statements, even when no sale has occurred. As sub-20% investments comprise about 40% of our portfolio, the adoption of IFRS 9 will lead to material fluctuations in our reported profits or losses due to year-to-year paper gains or losses. Such market fluctuations do not reflect the potential gains or losses upon a sale.

A simulation of our Group net profit for the past 10 years, including the unrealised gains or losses of our sub 20% investments, is shown in the chart below.

To facilitate comparisons with past years’ Group net profits before the adoption of IFRS 9, we have provided additional disclosures, showing unrealised losses of sub-20% investments of S$1.0 billion; and Group net profit, without unrealised losses of sub-20% investments of S$12.8 billion.

IFRS 9 does not impact our Net Portfolio Value, Total Shareholder Return, or Credit Profile.

As an investor, we aim to deliver sustainable value over the long term. Hence, we focus on the performance of our portfolio over the longer time horizon, and the corresponding risk-adjusted cost of capital. We do not manage for year-to-year accounting profitability.

For more information, visit https://temasekreview.com.sg/overview/changes-in-accounting-standards.html

Six structural trends guiding our investments for a Better, Smarter, More Sustainable World:

Social Progress: Longer Lifespans

Rising Affluence

Sustainable Living |

Technology Enablers: More Connected World

Smarter Systems

Sharing Economy |

________________________

1As at 31 March 2019: Equivalent to US$231 billion, at an exchange rate of S$1 : US$0.7376; €206 billion, at an exchange rate of

S$1 : €0.6572 and RMB1.55 trillion, at an exchange rate of S$1 : RMB4.9515.

2Intergovernmental Panel on Climate Change (IPCC)

3Singapore, Japan & Korea, North America, Europe, Australia & New Zealand.

4Asia (excluding Singapore, Japan & Korea), Latin America, Africa, Central Asia & the Middle East.

5Using S$-US$ Exchange Rate as at 31 March of the respective years.

6On 1 April 2018, the Group adopted International Financial Reporting Standards (IFRS) with retrospective application for the year ended 31 March 2018. Comparative financial statements for year ended 31 March 2010 to 2017 were prepared based on Singapore Financial Reporting Standards.