Transcript: Temasek Review 2020 Media Conference

The following is a transcript of the Presentation of the 2020 Temasek Review. The text should be read in conjunction with the slides shown in this transcript. It has been edited from delivery only for readability.

To refer to a selected transcript of the Question & Answer session which followed, click here.

To see all of the key financial metrics and diagrams in the 2020 Temasek Review, please click here.

STEPHEN FORSHAW:

Good afternoon, ladies and gentlemen. Welcome to the presentation of Temasek Review 2020 - Committed, Resilient, Together. My name is Stephen Forshaw. I'll be looking after you this afternoon. This is the first time we've done this on Zoom. So, I hope you will bear with us. We are going to try to get it all right for you and get to as many questions as we can during the Q&A segment.

A few housekeeping things if I can start with. This annual report covers our review from April 2019 to 31 March 2020. As you would have seen, we're a little later than usual this year, the reasons for that I think we made very clear when we announced the preliminary set of numbers on 21st July this year.

In the annual report, all of our figures are in Singapore dollars unless otherwise.

A reminder, please, that we're under embargo until 3:00pm this afternoon Singapore time. Given that we're dealing with Zoom this year, let me just take you through how this is going to work. We're going to start with a presentation and a video. The video overview of our year in review followed by a presentation by KC Yeoh, our Senior Managing Director, Enterprise Development Group and Deputy Head, Singapore Projects. That presentation will also include some videos. So, this should come through on your Zoom screen pretty seamlessly. After this, we will move to a panel Q&A. Dilhan Pillay, the Chief Executive Officer of Temasek International, Png Chin Yee, the Deputy Chief Financial Officer of Temasek International and Head of Financial Services, and Wu Yibing, our head of China and Joint Head of the Enterprise Development Group joining us from Beijing on the line, will be joining KC on the panel.

We'll deal with your questions. We have plenty of time for questions, but the format will be a little bit different. Please use the raised hand function on the participant channel in Zoom to indicate to me that you have an interest in asking a question. When I come to you, I'll call you by name and if you can bear with us before you start your question, just wait until we get you on the screen here so the panellists have the benefit of being able to see and hear you before you ask your question. So, in other words, I will call you a second time at which time you can then commence with the question you have. It will take us a second or two to spotlight you and that's also for the benefit of other participants on the Zoom function who will then be able to see and hear your question.

Can I ask you to keep your videos on but mute your sound until and unless you're asking a question and once your question was asked, if you can then go back onto mute so that we don't get any background noise.

We do, as you know, have a WhatsApp channel for all of you if there's any technical issues that arise, if there's anything that you need from our back end team to support you during the Zoom conference you can contact us through the WhatsApp channel and, likewise, we'll be able to broadcast any messages to you if there's any technical issues we have during the presentation.

The recording of this afternoon's session will be made available online after the session. We will be able to get that to you. As usual, we will also post a transcript of this on our website later on this afternoon. The presentation slide will be available as well so all of the materials that you need should be available to you either now or very quickly after, in the case of the transcripts and so on.

If you need anything, please feel free to reach out to the team, we're here to help and we'll be as quick as we can in getting back to you.

So, look, these are housekeeping matters. Do bear with us. As I say, a reminder, please, wait until you're called for the question and then wait a second time so that we can all see and hear you for the benefit of the people who are also participating in this Zoom conference.

So, without further ado I would like to introduce the video and KC will take you through the presentation.

Welcome to Temasek Review 2020.

YEOH KEAT CHUAN:

Good afternoon, everyone. My name is KC. Welcome to our special launch of the Temasek Review. I'll start with an overview of our institutional performance, followed by our performance and the global outlook. I will conclude with a few words about our people and communities.

COVID-19 has devastated lives and livelihoods globally. We are still in the middle of the pandemic. However, I am confident we will survive this test, because we are committed, resilient and will work together to come through it. This pandemic reminds us to stay prepared for the unknown, to stay focused, and to remember our core purpose.

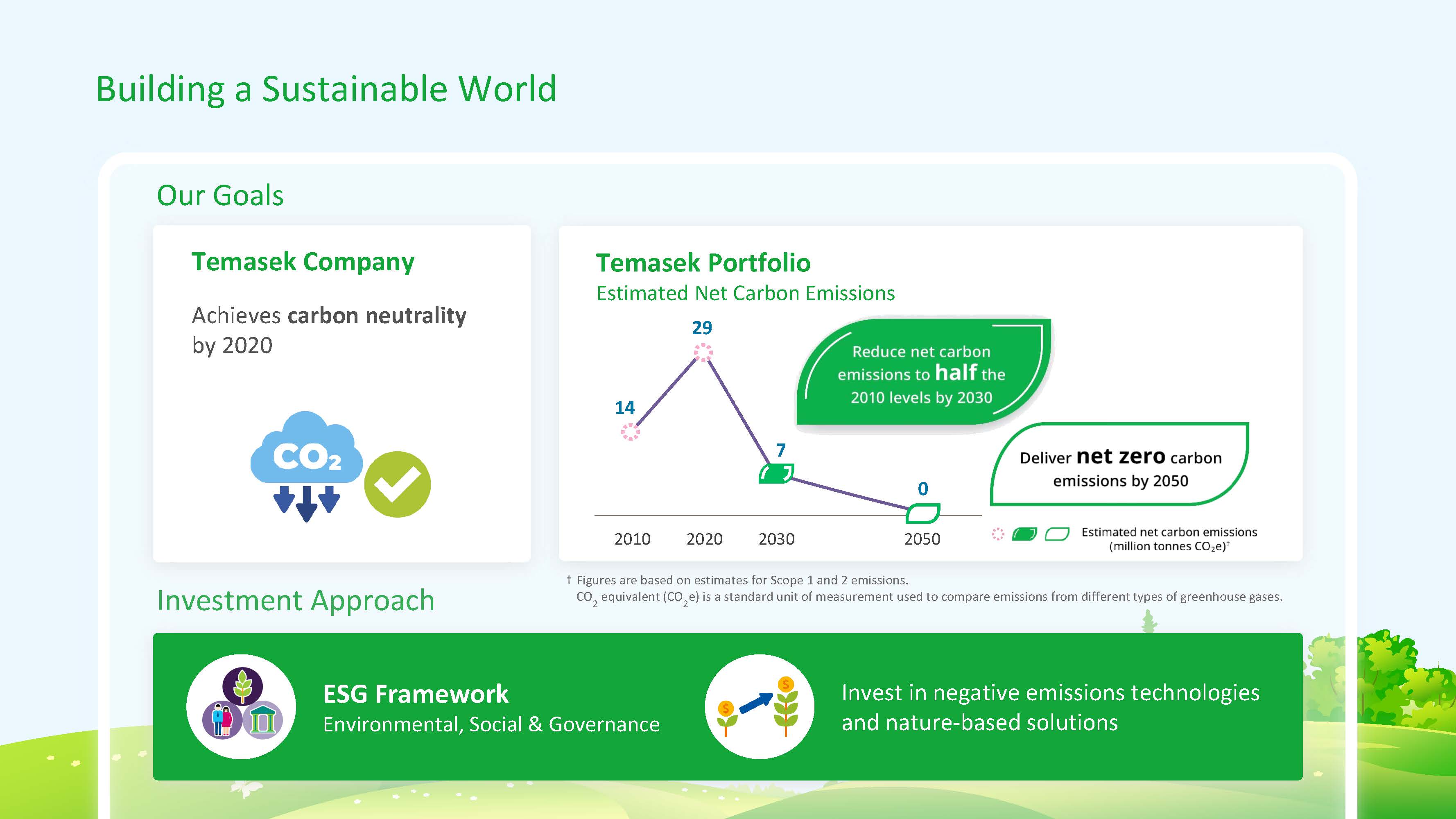

Sustainability is at the core of everything we do. We remain focused on our ambitious 2030 goals.

As you saw in the video, we delivered a carbon neutral Temasek last year. We also aim to halve the net carbon emissions of our growing portfolio by 2030.

To do so, we will work closely with our portfolio companies on their carbon reduction plans. Our aspiration is to deliver a net zero emission portfolio by 2050.

We’re firming up our plans for the next few years and we’ll share more details soon.

As you know, Temasek is an active investor. We are constantly reshaping our portfolio. Let me now take you through our performance.

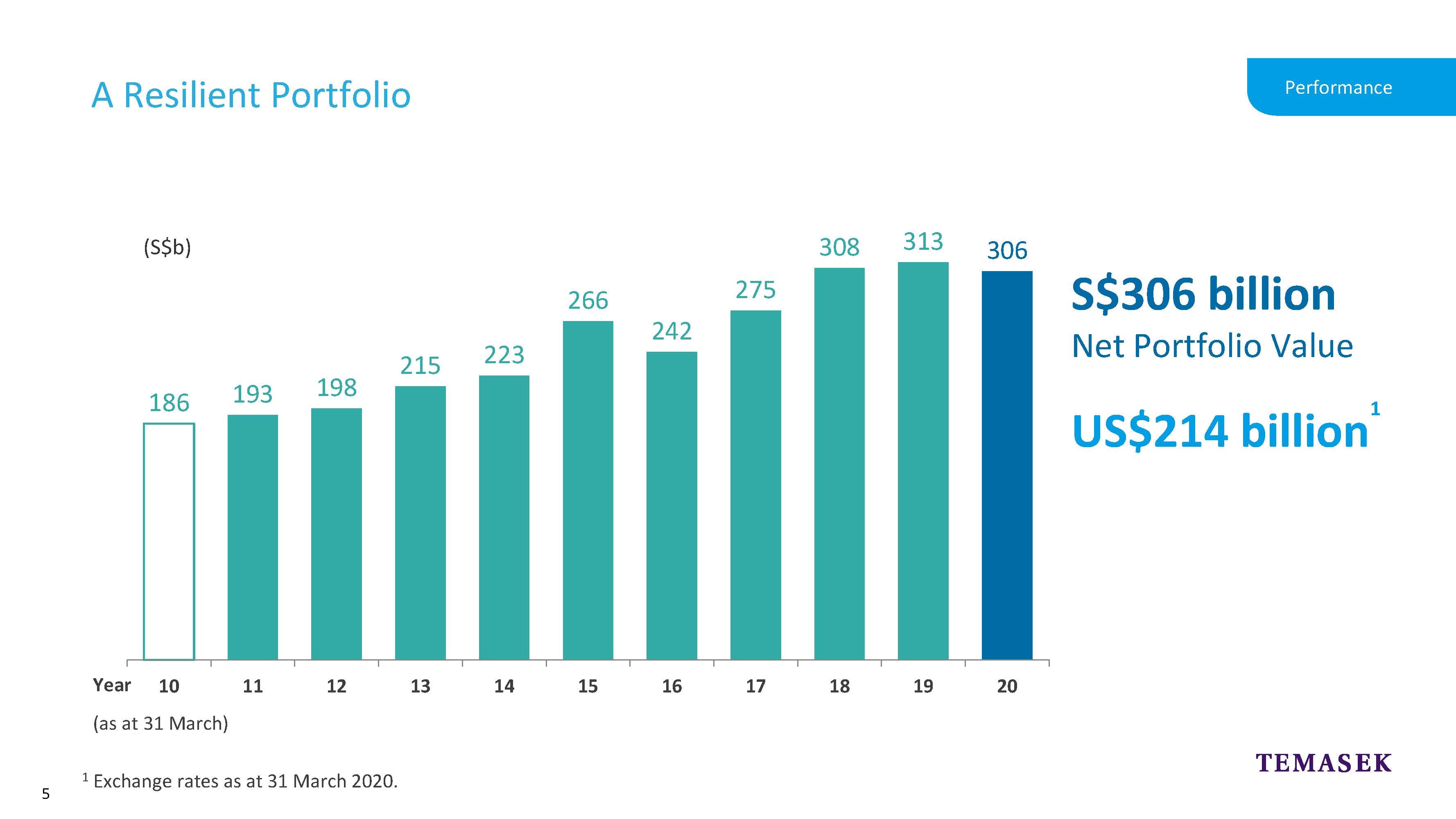

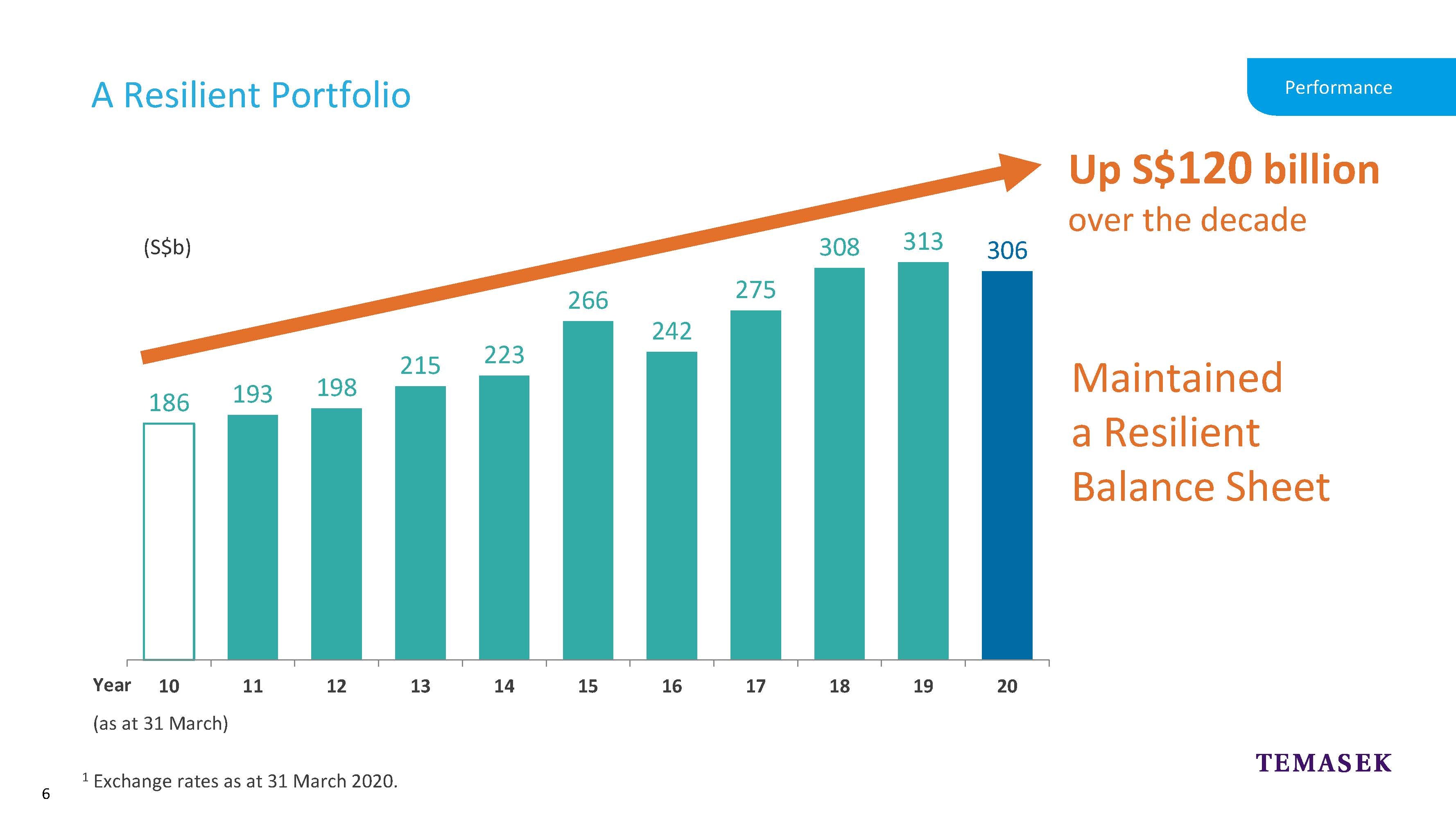

The blue bars in this chart show our Net Portfolio Value, or NPV.

The pandemic cut short a promising end to our performance this year, but the resilience of our portfolio came through for us. We ended our last financial year, with an NPV of 306 billion Sing dollars.

Over the decade, our NPV grew by 120 billion dollars.

We ended the year with a strong and resilient balance sheet.

This gives us the flexibility to invest for the longer term, ride through the market dislocations, and reposition our portfolio for the post-COVID-19 recovery.

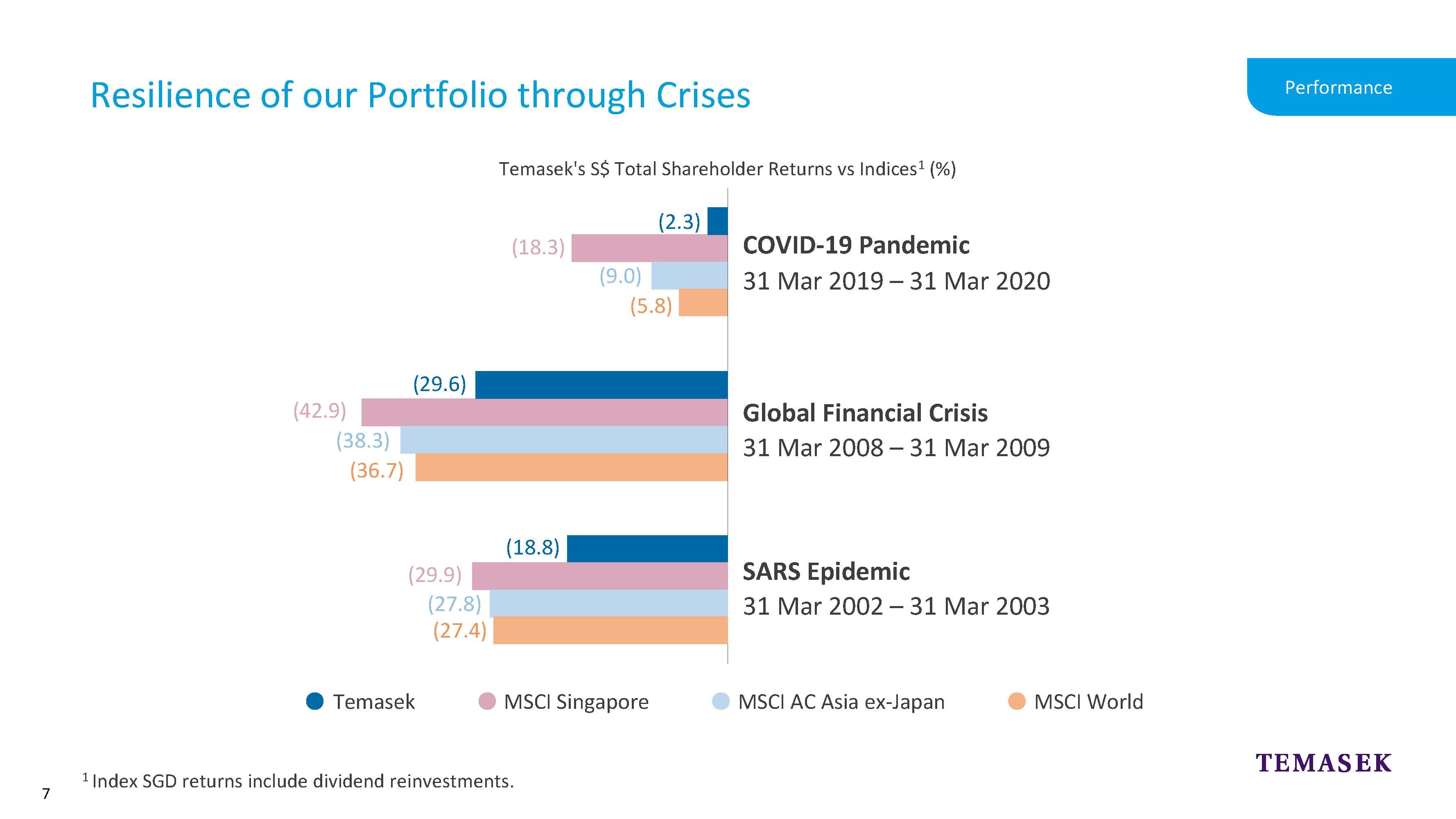

The blue bars in this chart represent our Total Shareholder Returns.

The top segment shows our performance during the COVID-19 Pandemic in March this year. You can also see our relative performance during the Global Financial Crisis in 2009. This is followed by the SARS Epidemic in 2003, at the bottom of this chart.

They show the resilience of our portfolio through global crises.

In particular, our portfolio has been resilient during this Pandemic. This is mostly due to our limited exposure to the travel, hospitality and entertainment sectors.

Moving to our portfolio highlights…

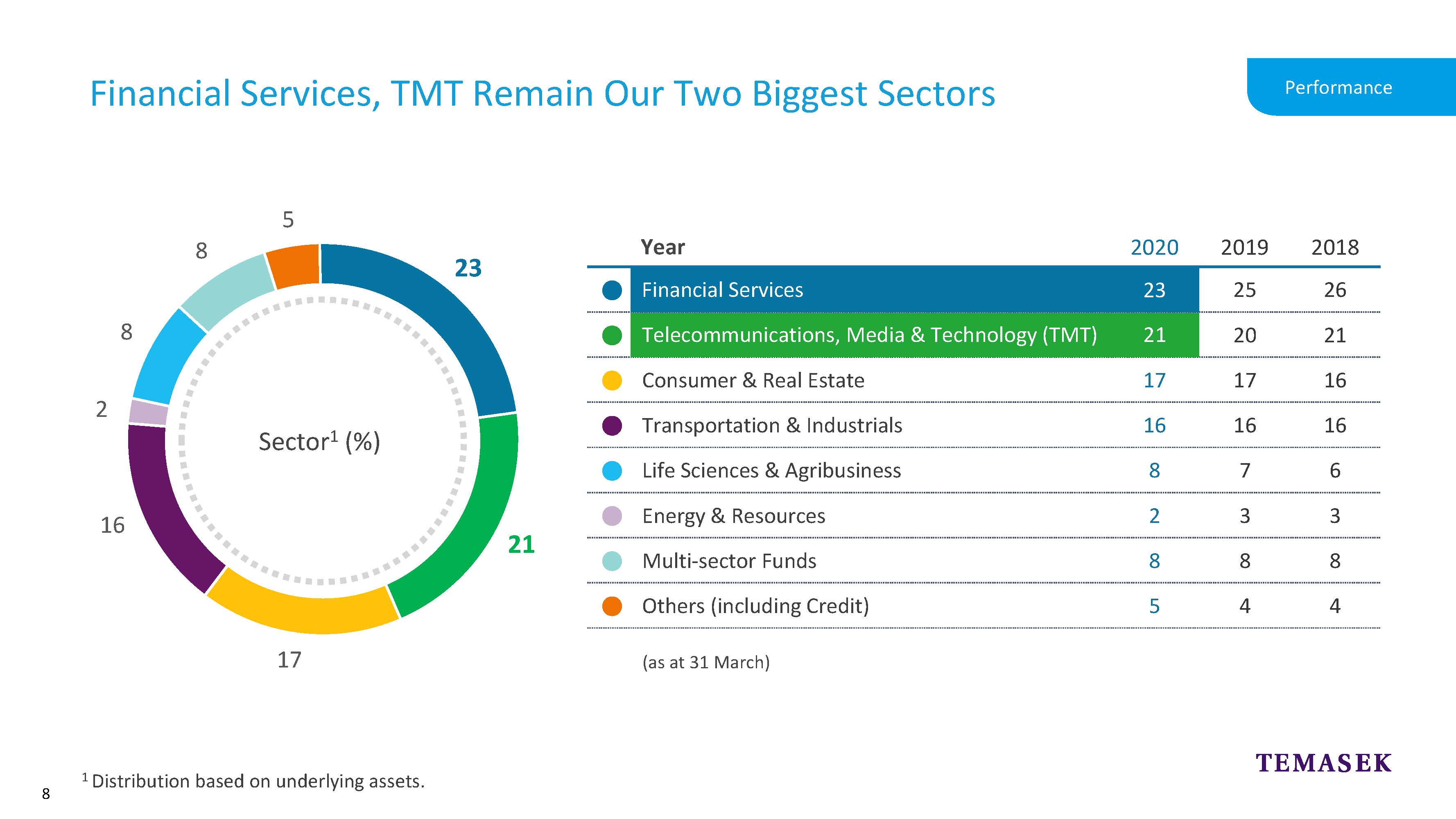

This pie chart is a snapshot of our portfolio by sector.

Our two largest sectors continue to be Financial Services at 23%, and Telecommunications, Media and Technology, at 21%.

We have been actively reshaping our portfolio towards the structural trends and focus sectors. This includes the Non-bank Financial Services, Technology, Life Sciences and Agribusiness.

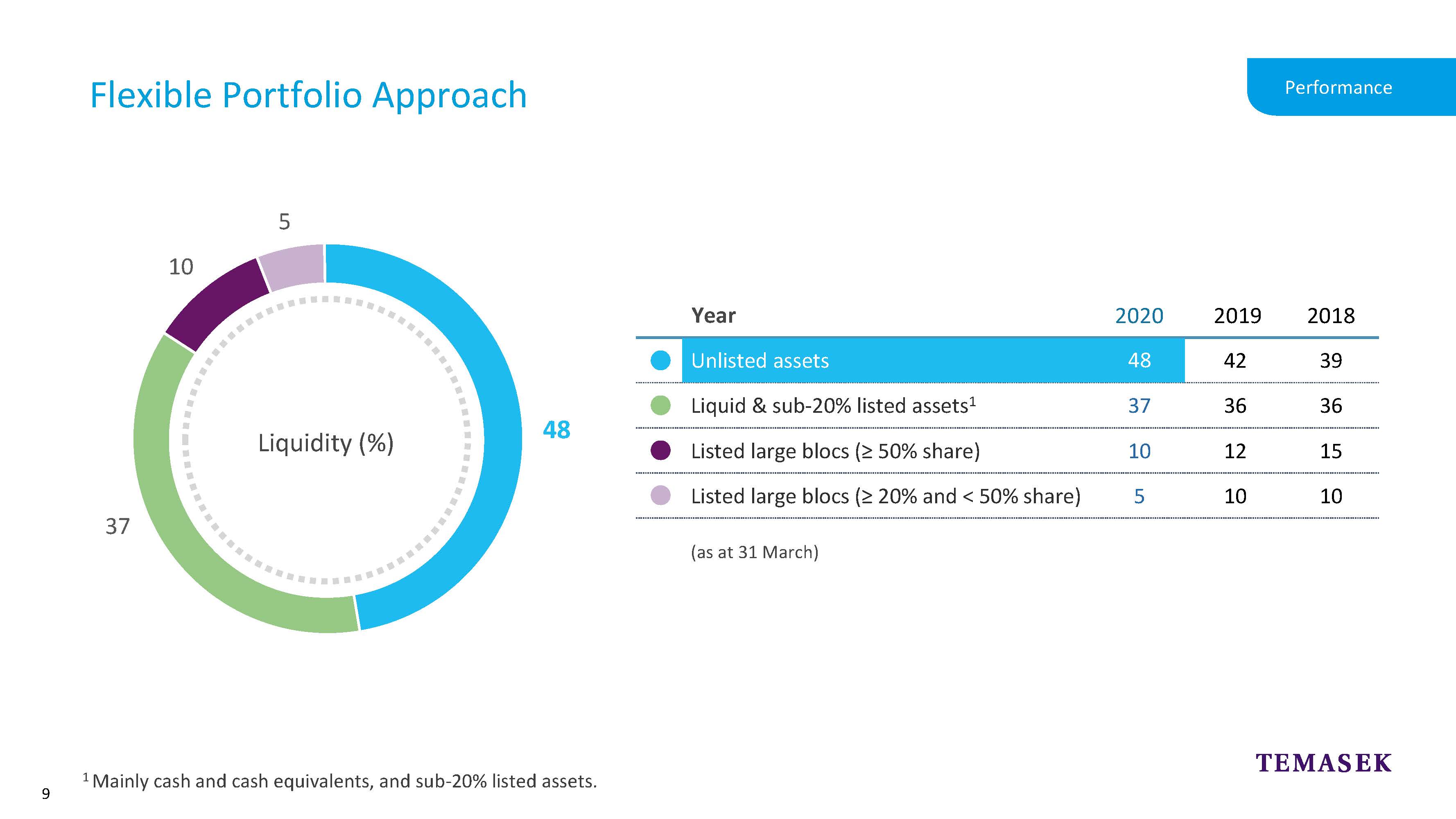

This chart shows the flexible liquidity mix of our portfolio.

It comprises both listed and unlisted assets.

Our unlisted holdings is in blue at 48%. This is our largest exposure.

Some of our unlisted companies are PSA and Mapletree.

Together with our funds, these are sources of steady dividends and distributions.

In addition, our investments in funds allow us to gain insights into new markets and provide co-investment opportunities.

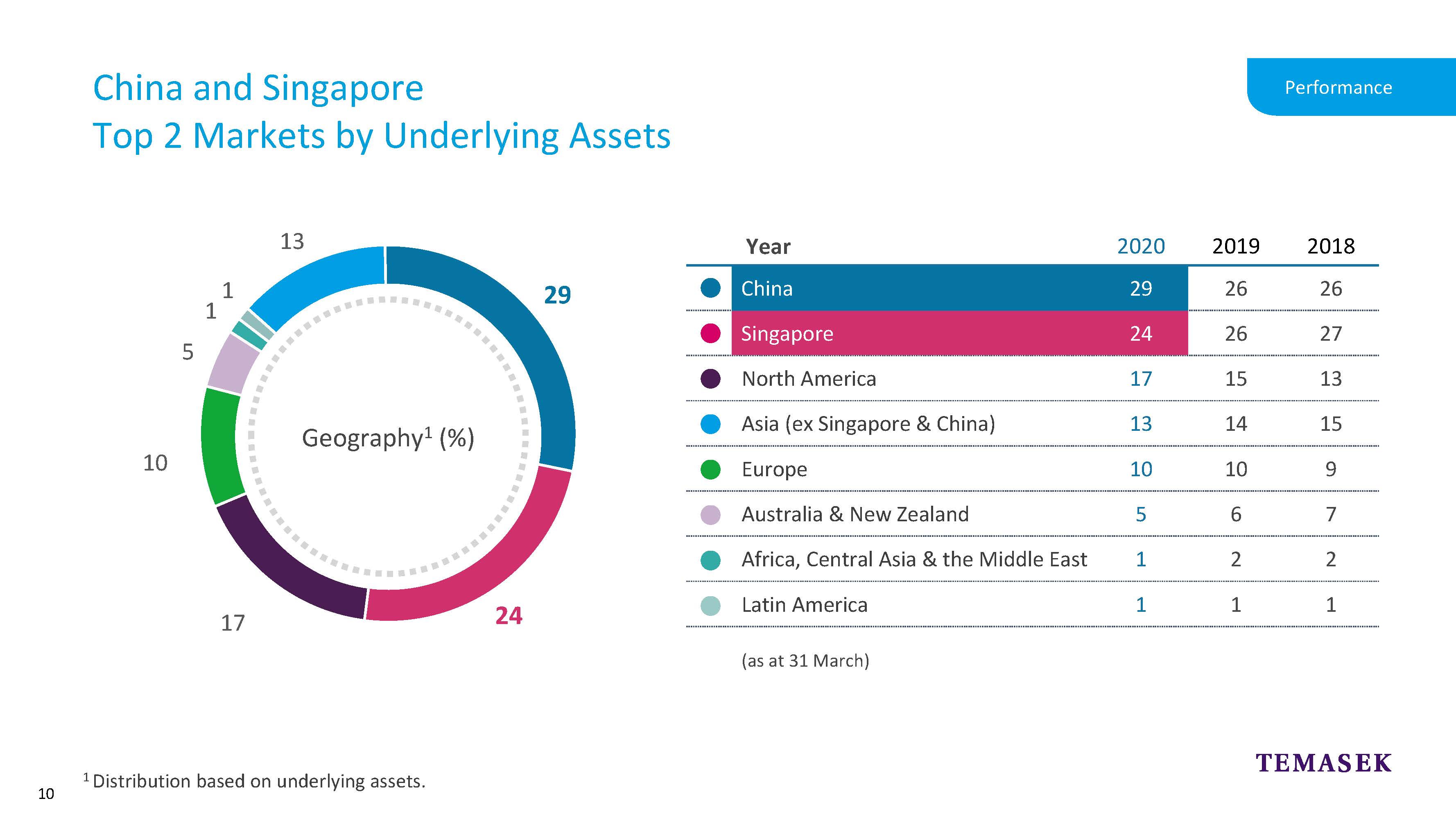

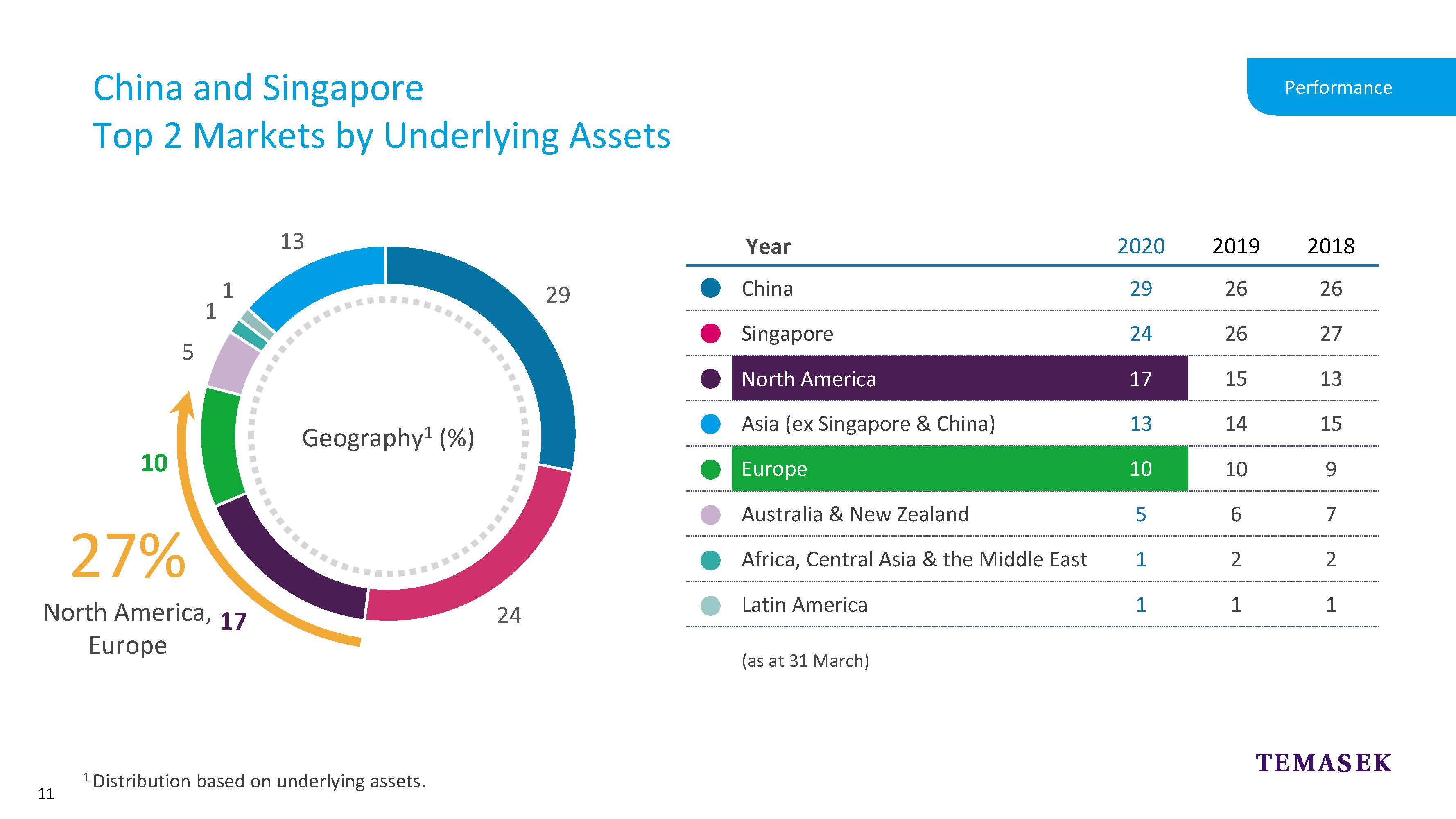

Now, let us take a look at our portfolio mix by geography.

This pie chart shows our portfolio mix based on the underlying assets of the companies and funds in which we are invested.

Our top 2 market exposures were China and Singapore, at 29% and 24%.

The relative rankings of these two markets were affected by the local market movements in March.

North America and Europe, come in next, at 17% and 10% respectively.

Together, these two regions now form over a quarter of our underlying portfolio exposure.

The US again accounted for the largest share of our new investments during the year.

This wraps up our performance section.

The global economic outlook remains uncertain.

As you know, some countries are seeing a resurgence of COVID-19 cases. These have resulted in a resumption of lockdowns.

This uncertainty could result in a prolonged economic slowdown.

Policymakers worldwide have responded with expansionary fiscal and monetary policies.

Increased geopolitical tension and technology bifurcation could result in a more uncertain environment for long term investors and asset owners.

So, we remain cautious while staying open to investment opportunities in resilient companies. Let me share more detail on a few key markets.

I’ll start with the US.

The economy has contracted sharply due to nationwide lockdowns and mass layoffs.

This is its largest contraction since World War II.

However, swift and aggressive response from policymakers had helped to reduce tail risks.

The economy is recovering, but the path remains uncertain.

More fiscal support is needed.

At the same time, there are medium term risks arising from the US-China strategic rivalry.

In China, the economy recovered strongly after the sharp downturn due to the pandemic.

Industrial activity resumed steadily, and exports remained resilient.

On the downside, some sectors continue to face headwinds.

For the first time in nearly 20 years, China did not set a GDP growth target.

We expect the government to uphold broadly accommodative policy to support the economy and boost jobs.

While implementing reforms may be challenging, Chinese authorities remain focused on rebalancing the economy.

In summary, we are optimistic on China over the medium term.

Moving on,

In Europe, the economy has bottomed.

The initial recovery pace had been sharper than expected. But that pace has now moderated.

The recent increase in infections has dampened activity.

Monetary and fiscal policies remain relatively loose. This will help offset the negative impact of the crisis.

The announcement of the EU recovery fund has a strong signaling effect in terms of EU cohesion.

Moving forward, we do see downside risks due to a resurgence of COVID-19 cases.

Credit conditions may tighten.

This will affect domestic demand growth as fiscal support schemes expire.

Let me now bring the focus back closer to home.

In South East Asia, growth is likely to be muted.

The global economic downturn, coupled with a decline in trade and demand, has impacted the region’s economies.

On a positive note, South East Asia remains poised to be a fast growing region.

Policy space and structural reforms will help to boost its economic recovery.

Urban development and industrialisation, a young demographic, as well as the continued growth of the internet economy, will set the stage for ASEAN to recover.

Back home in Singapore, we are experiencing a severe contraction.

Nonetheless, parts of the economy have shown resilience.

Ongoing fiscal support is substantive, supporting employment, and cashflow needs for businesses.

Looking ahead, Singapore aims to maintain an open and competitive business environment despite the increasingly fragmented world.

It will continue to invest heavily to transform its economy and workforce.

This will help it to remain as a global investment destination.

This wraps up our outlook section.

I want to spend a few minutes talking about our people, and the bond we share as OneTemasek.

The values, the integrity and the capability of our talents help define who we are.

We strive to build a diverse workforce,

with a good mix of local knowledge and global experience.

We have a multinational team of over 800 colleagues, here in Singapore and around the world.

We are very proud of the fact that we have 32 nationalities working across offices in 8 countries.

Local nationals form the vast majority in each of our offices.

We have an almost even split of both female and male staff.

We always keep looking forward.

That means we’re continuing to build capabilities across the firm, in areas such as AI, Blockchain and Cybersecurity.

We also strive to grow our people and empower them to take charge of their own learning.

We’re exposed to a wide range of training programmes in areas such as leadership, digital technology and data science.

We also learn important life skills, such as CPR, AED, and Mental Health First Aid.

It is critical to equip our people with the opportunities to learn new things, especially in a thriving digital world.

Our people help us tackle challenges and seize opportunities ahead.

They underpin our resilience as a firm.

COVID-19 is the biggest global crisis since World War Two.

Temasek has stepped forward as part of our stewardship responsibilities, to support our communities during the pandemic.

I mentioned earlier the strong bonds we form across our global team.

When our colleagues and friends in China were heavily affected by the pandemic, our staff in Singapore and elsewhere, rallied to provide supplies and supported them.

Later, when there was a spike in cases here, and in other places like London and New York, our China colleagues helped us.

They procured supplies and shared what they had learnt about the virus, so that we could all stay better prepared.

When we stand together as a team, we use our complementary strengths to overcome new challenges.

We initiated a series of programmes together with Temasek Foundation.

We did this as early as January, when we saw the possibility of a global pandemic.

Hundreds of our staff have been involved to fight the virus, and I really can’t do justice to the work they did just by explaining it in words.

So, let me share a video showcasing our COVID-19 efforts.

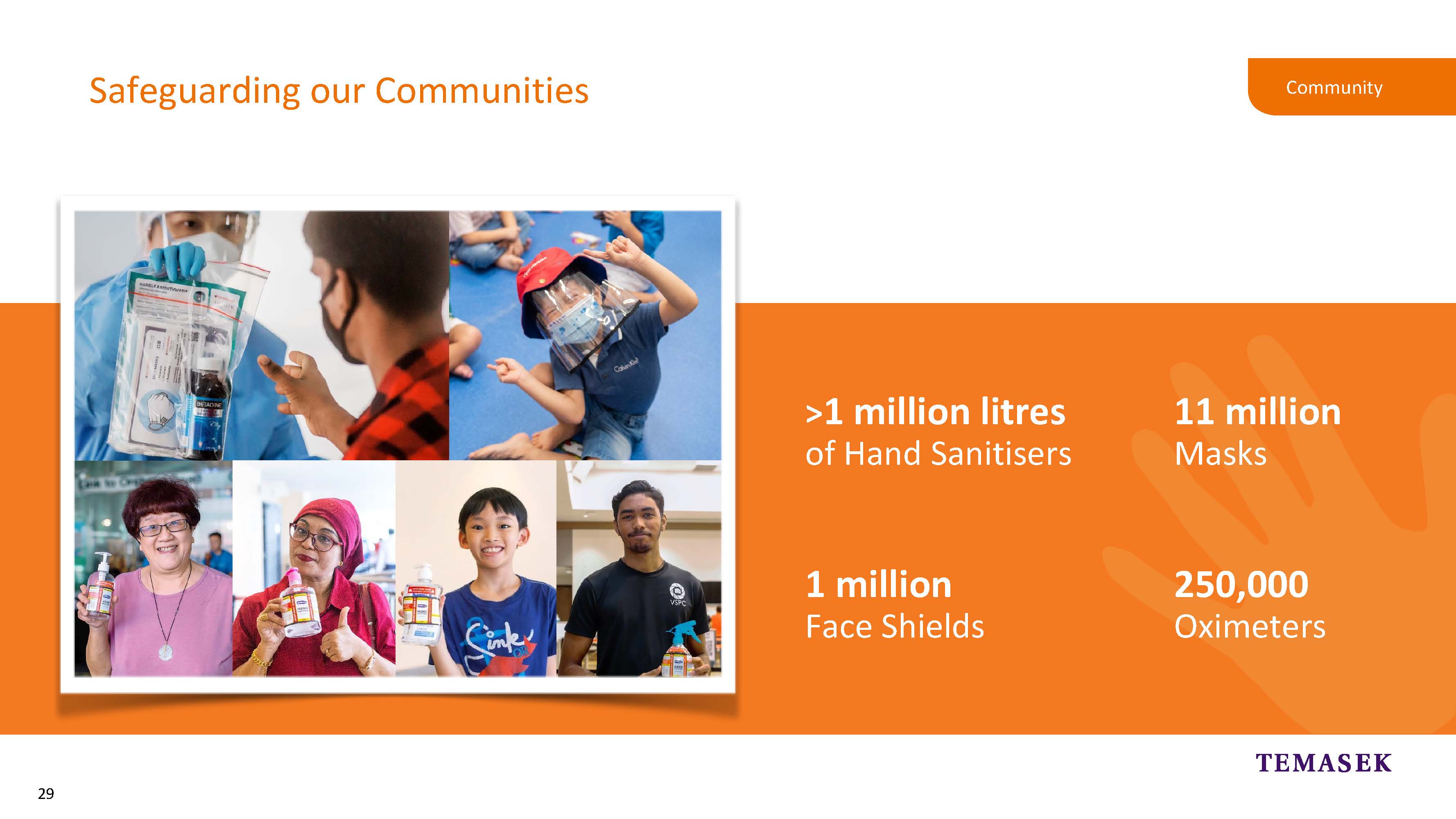

As shown in the video, essential items were made accessible to safeguard our local community and some 35 countries.

Even as we stay the course towards our 2030 goals, we will continue to do our part to fight the current pandemic, and help our communities through the challenges it brings.

At the core is a focus on people; those affected, and those who are at risk.

We will work with partners to do things, big and small, to make a difference.

Beyond our efforts on COVID-19, we have not forgotten our responsibility to exercise good stewardship.

We recognise that this pandemic has a significant impact on Singaporeans beyond the immediate health concerns.

On top of its ongoing programmes, Temasek Foundation has also set up MyMentalHealth, a web portal to make mental support more accessible.

Temasek Foundation is releasing its own annual report this Thursday.

They will showcase their wide-ranging efforts to support the community, so you will hear more from them.

T-Touch is our staff volunteer initiative.

It’s where we give back to communities in which we operate.

One of Us is the name of a programme initiated by our staff.

It aims to build awareness and understanding of mental health conditions.

It includes a meaningful series of art exhibitions featuring the work of 3 artists.

They have battled their own mental health challenges.

But they overcame their struggles through their passion for art.

Importantly, they were able to share their art with all of us.

This helps us to understand them better.

Because after all, each of them is One of Us.

At the heart of everything we do is our desire to make the world better for those around us.

Let me end with a video taken through the lens of 3 people.

They represent some of the folks we have been working with

It reminds us why we stay committed, resilient and work together.

Thank you.