Your Next Wallet is You — Future Of Digital Payments

Your Next Wallet is You — Future Of Digital Payments

Forget queuing at the ATM or searching for coins. In the future, you could be paying for your purchases by simply looking at a camera

Who needs a wallet when you can just touch and go?

Cashless Anywhere and Everywhere

You’re on an overseas shopping vacation, only to realise you left your wallet back at the hotel. How does it feel to rummage through your handbag at the cashier, knowing you have no way to pay for those items temptingly sitting on the counter in front of you? Imagine a future free from all this hassle, where everything you need for a successful shopping spree, anywhere in the world, is at your fingertips… literally.

We’re already making headway into this cashless reality. Dutch fintech firm Adyen for example, has created a single infrastructure to accept payments anywhere in the world, and through any channel — be it online, on mobile or in a physical store. Think of it as an internet of payments if you like.

As Warren Hayashi, President of Adyen Asia-Pacific, says, “Payment powers trade — and innovations in this area are a driving force behind the future of commerce.”

The next big leap is to remove the need for any mobile devices at all. In this future, biometric scanning — using you to verify a transaction, whether it is your eyes, fingerprints or voice — will allow you to walk out of your neighbourhood convenience store without ever needing a wallet or having to queue to pay.

What is biometrics and how does this technology work?

Biometric Reality is Closer Than You Think

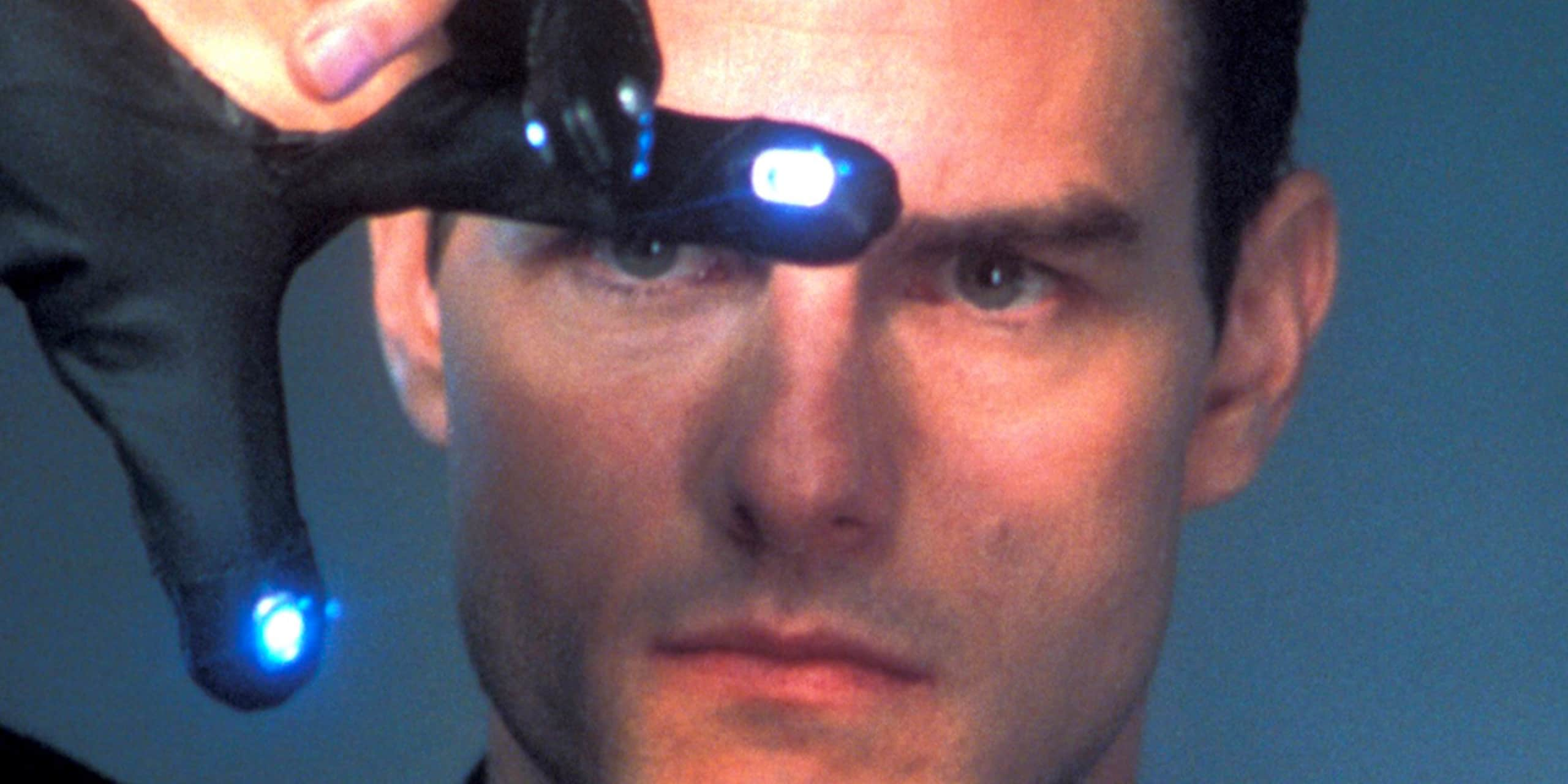

Biometrics for payment, similar to the technology seen in the movie Minority Report, isn’t too far away. Photo by Everett / Click Photos

If the mention of biometrics evokes the movie Minority Report in your head, here’s the surprise: this technology has already been around for some time. In Singapore, Apple Pay, Android Pay and peer-to-peer payment app Square Cash are already enabling transactions with the use of fingerprints, which has in turn empowered traditional banks like DBS, OCBC and Standard Chartered to get on the biometric bandwagon. The Instagram generation will rejoice to know that Mastercard (along with Alibaba and Amazon) already allows you to pay for your purchases with a selfie. With this biometric trend continuing, you can junk keying in a long-winded password or PIN for a smile instead.

What about more futuristic forms of biometric authentication like voice, heartbeat and vein recognition? Built-in sensors like the accelerometer and gyroscope will soon be a standard feature on our smartphones and wearables. To this end, cyber-security start-ups like BioCatch, AimBrain and Plurilock are already exploring smart ways to match the biometrics ‘native’ to the activity.

With AimBrain for example, users can use facial biometrics for ATM transactions, voice biometrics for call centres, and behavioural biometrics for smartphones. With multiple authentication options, all on one platform, you will receive the right security experience for the right transaction, in the right situation.

With biometric authentication, you can pay by taking a selfie!

Disturbing or Exciting?

Here’s the reality check: as long as you have a driving licence, a passport or a Facebook account, you’re already unwittingly included on facial recognition databases. If this irks you, you’re not alone. Most people are unaware that their images are being collected, stored and processed. Currently, privacy laws about how companies use such data — perhaps as basic as your facial features — remain vague and somewhat hard to enforce. These gaping holes highlight how growth in biometrics technology has outpaced the debate around its usage.

According to analysts, while most consumers are happy to swipe a finger or speak to their mobile device, fewer would be comfortable with a retinal scanner. So it is likely that some forms of biometrics will see faster adoption than their more intrusive counterparts.

Is That Really You?

Security is another key concern with biometric authentication. While it’s relatively easy to change your password in the case of theft, what happens when someone steals your fingerprint? Considering the sheer number of times we leave our prints on various items in the course of a day, fingerprint theft is a real possibility.

This is why — for the time being at least — the consensus is that we need varied methods, rather than a single method, for biometric verification. Case in point: AimBrain and other cyber-security firms are already looking into combining several different biometric methods like facial and voice recognition to enable payments.

AimBrain swaps passwords for selfies

Today, the common wallet has yet to be consigned to its inevitable place in a museum. As lawmakers and industry players address privacy and security concerns, there is no doubt consumers will gain confidence in biometrics, which will fast-track its adoption by the masses. After all, the credit card faced similar hurdles in its infancy and look how far it has come. It’s time we dab clammy palms, remove the sunglasses — and get set for our biometrics-enabled future.

Disclaimer: Adyen, Alibaba, Amazon, DBS, Mastercard and Standard Chartered are Temasek portfolio companies.