Energising a net zero future

Energising a net zero future

It is critical for everyone to lean in and radically collaborate to decarbonise in an inclusive way.

Photo by William DeHoogh on Unsplash

Energy is the primary driver of climate change, contributing more than two-thirds of greenhouse gas emissions. It is impossible to meet the goals of the Paris Agreement without a complete transformation of the sector from one dominated by fossil fuels to one dominated by low- and zero-carbon sources.

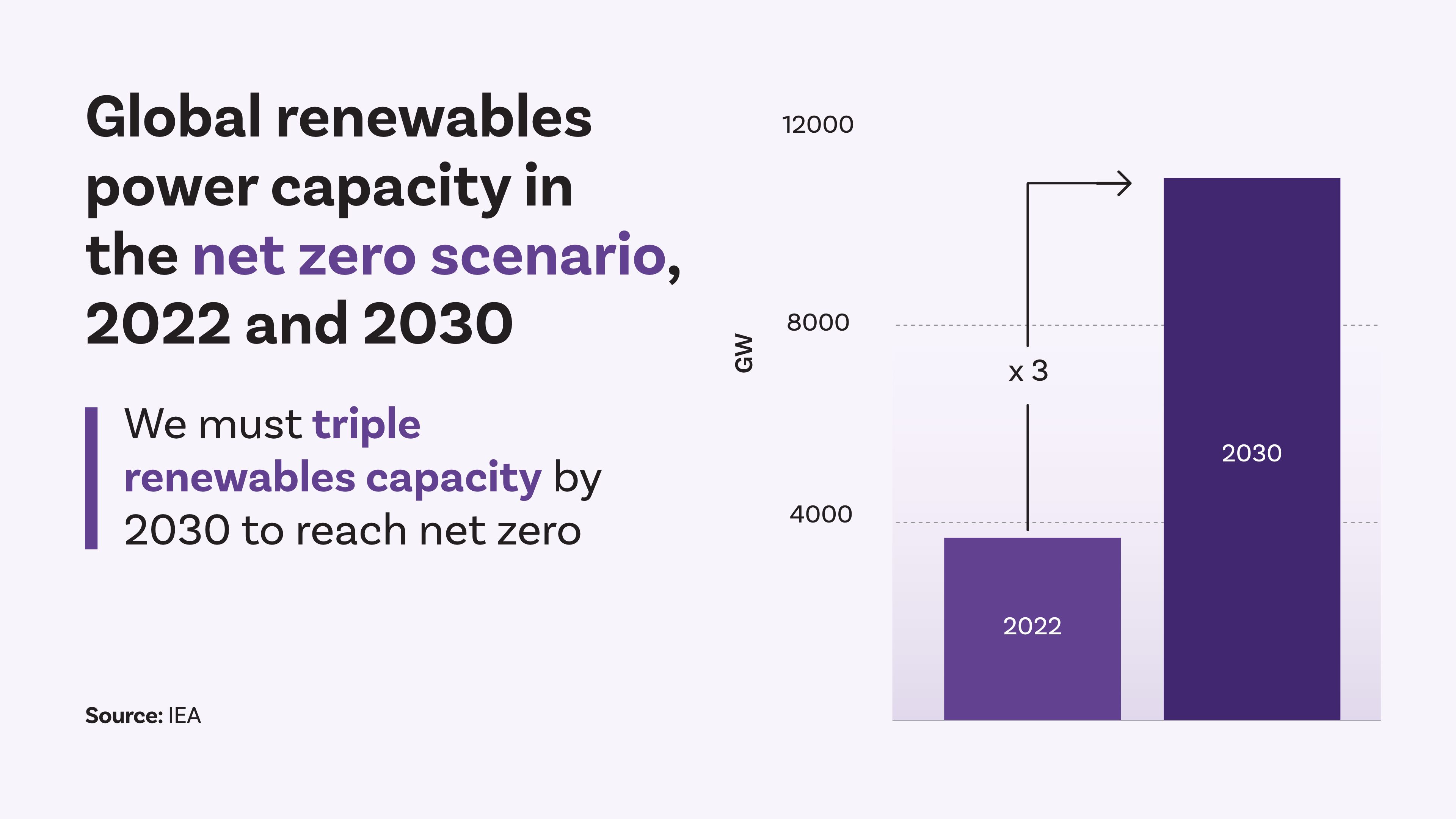

The pathway to reaching net-zero by 2050 is ambitious. According to the IEA, this will require a tripling of total global renewables capacity to 11,000 GW by 2030 while doubling the annual rate of energy intensity improvements to drive down demand for fossil fuels. Advanced economies must lead the way to allow emerging and developing economies more time for their transitions.

The challenge for emerging economies

Emerging markets are already amid transitions of their own, moving rapidly towards modern, industrial economies with higher energy demands. It is in the long-term interests of everyone – and most especially those markets – for that demand to be met with low- and zero-carbon energy. These countries tend to be more vulnerable to the impacts of climate change because they are clustered in regions of the world with warmer climates and are more reliant on manufacturing than services (which are more adaptable to extreme weather events).

Not unlike developed economies, emerging economies are taking a variety of approaches to the energy transition. Many are taking strides towards expanding their renewable capacities.

India, for instance, aims to expand its renewable capacity from 180GWH to 450-500GWH by 2030. Temasek is playing its part in this effort, jointly establishing an energy platform with EQT Infrastructure in 2020 which focuses on developing utility-scale renewable projects across solar, wind, and hybrid in India. Despite many encouraging developments, most emerging markets remain dependent on fossil fuels to meet their growing energy needs.

The main barrier to shifting from fossil fuels to renewables is their relative expense. Achieving emissions reduction targets in Southeast Asia alone will require over US$1.5tn in cumulative investments by 2030 – but deployment of green capital has declined seven per cent since 2021. Investors face many challenges, from constraints on market access to uncertainty about policy direction. Only by coming together as a community spanning all sectors and continents can these challenges be resolved.

The COP28 agenda

COP28 will be this year’s greatest opportunity for world leaders, investors, and community representatives to unite and translate their climate ambitions into climate action. With pledges already in place, discussions are likely to concern the practicalities of decarbonising food, energy, and other sectors.

Such transitions will be impossible for much of the world without sufficient climate finance in place. This is a top issue on the agenda at COP28.

As with other aspects of climate action, it is not merely a question of commitment, but also of how that commitment should be enacted. To encourage continued economic growth fueled by renewables, it is vital to deploy a range of climate finance tools in emerging markets. These range from carbon markets to debt instruments targeting specific sectors.

Temasek at COP28 and beyond

At Temasek, we believe that an accelerated energy transition relies on collaboration between public and private actors – that is why we are joining the dialogue at COP28 in Dubai.

We are working to hasten the energy transition in many markets. This includes deploying capital towards clean energy solutions to help bring them to market as quickly as possible, from grid-scale battery storage (Form Energy) to green hydrogen (Topsoe); helping carbon-intensive businesses reduce their emissions responsibly; and forming partnerships with a variety of funds similarly committed to making decarbonisation possible. Since 2021, for example, we have partnered with global impact investment group LeapFrog Investments, supporting the expansion of its investment capabilities across emerging markets in Asia and Africa.

At COP28, we look forward to participating in conversations, convening stakeholders, and learning from each other to progress the agenda across these areas.

The energy transition is an unprecedented challenge. It places extreme pressure on emerging markets, which must balance meeting rapidly growing energy needs while phasing out fossil fuels, all while wrestling with the worst impacts of climate change. Public and private sectors must come together at COP28 to deliver the finance that makes this transition possible.

Join us to hear from global business leaders and Temasek executives on how we are deploying catalytic capital to finance sustainable solutions and close the financing gap. Find out more here.