Temasek Review Media Conference 2017: FAQs

Selected Questions & Answers from the Temasek Review Media Conference 2017

The following is an edited transcript of questions and answers at the Temasek Review 2017 Media Conference.

It has been edited with grammatical edits to aid readability. Questions are not necessarily listed in the order in which they were asked, but have been grouped by subject to aid readability.

Slides and charts have been added from the Temasek Review 2017 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to see all of the key financial metrics and diagrams in Temasek Review 2017.

- Performance, Returns & Year in Review

Net Divestment

Ten Year Returns

Pace of Divestments

Capital Injection

- Outlook & Issues

Valuations

Investment Horizon

China

Japan

SE Asia

Brexit & US Protectionism

US Protectionism

Cautious Outlook

- Sectors & Portfolio

Non-Bank Financial Services

Chinese Banks

Technology Investments

Energy & Resources

Travel & Tourism

IPOs

SMRT

- Unlisted or Private Transactions (Grouped Questions)

- Private Equity Deal Flows & Temasek Proposition

- Succession

Question on Net Divestment Position

QUESTION: I have a question regarding the net divestment position. Do you think this trend will continue with the rise in market valuation and what are you going to do with the extra cash? Thank you.

CHIA SONG HWEE: We didn't start off the year with the plan of having a net divestment year. As you know we are a bottom‑up investor and we look at investment opportunity just based on that lens and it so happened that, given the market environment and high valuations, we see less investment opportunity because we just find that, generally speaking, the market pricing is too high.

But on the flip side, it allowed us to exit some of our positions, or sell part of our stake, given the valuation may be trading close to our intrinsic value. So, it's quite situational, and we could not use that as a way to think about our future.

Question on Ten year Return

QUESTION: Your ten year return of 4% is the lowest in the years, is it inevitable that you are increasing unlisted assets to get higher returns?

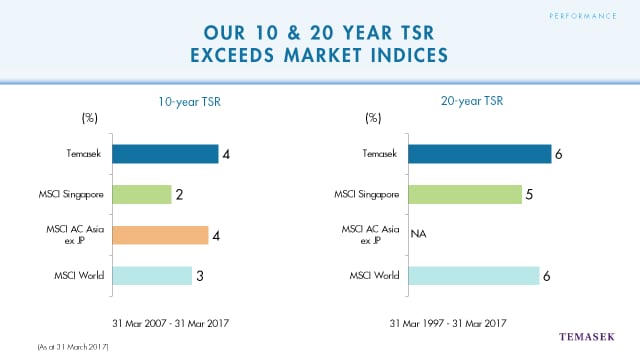

ROHIT SIPAHIMALANI: Firstly, on the 10‑ and 20‑year returns, with 60% of our portfolio being listed, our performance can never be completely divorced from the markets, and if you look at the last 10 years and the last 20 years, market returns have been quite low over this period, primarily because of the Global Financial Crisis which you could argue was a once‑in‑a‑lifetime event. Now because of those low returns, I mean that also impacted our returns, which was lower than our cost of capital over this period but you would have seen from Sulian's presentation that we outperformed almost every market index during this period which should make us feel good.

Having said that, we set for ourselves an even higher bar because for us it's not just a question about just exceeding market returns, we have to exceed our cost of capital over the longer term, which is why we started reshaping our portfolio in 2011 towards those areas which we think can give us those long‑term sustainable returns which would include both public and private investments. So that's really the strategy and I would say we've been very pleased with the results in the last six years and we think the continued execution of that strategy will allow us to meet our objectives in the longer term.

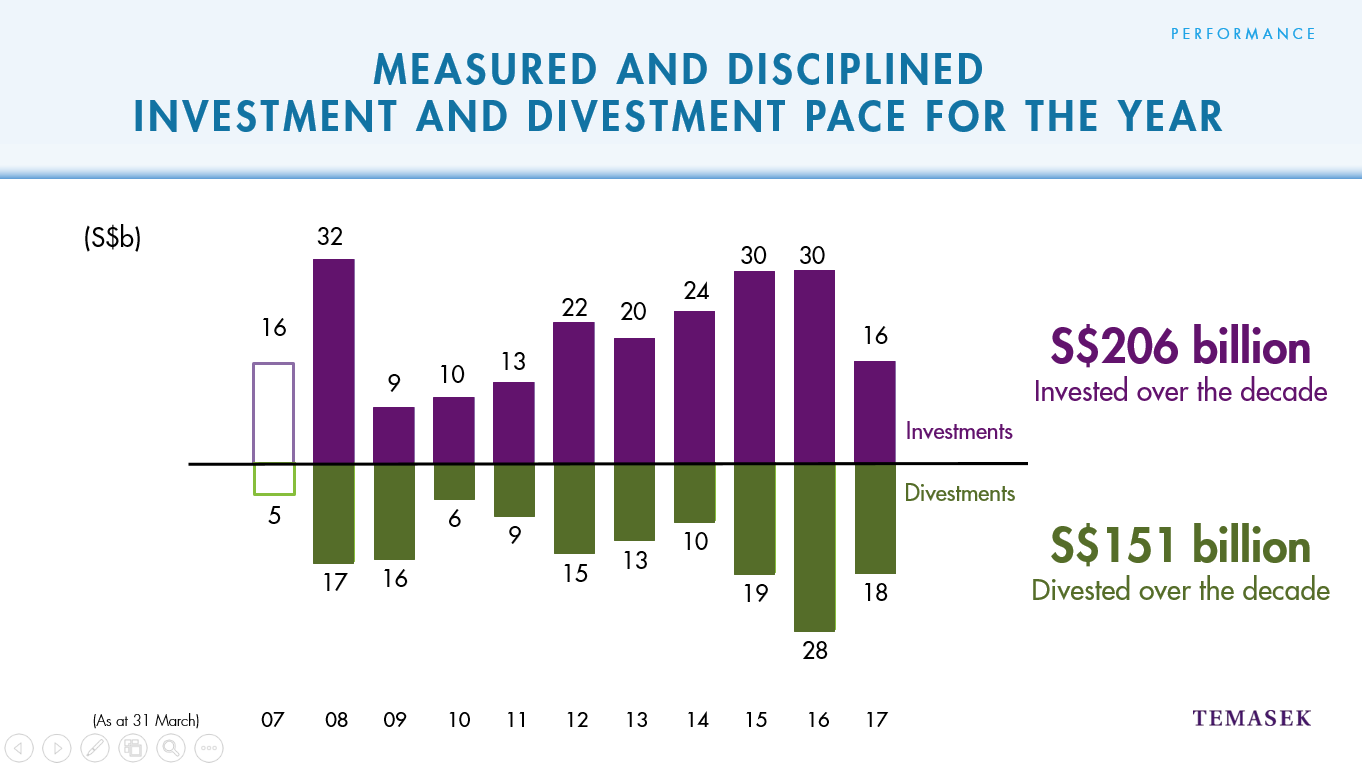

Question on Pace of Investments

QUESTION: It's a follow‑up question to Song Hwee's earlier comment on the slowing down, relative slow down to the new investment on the back of high valuation. The situation seems to be continuing, so will this slow down, relatively lower new investment and divestment continue this year as well, do you think, and further on next year?

CHIA SONG HWEE: I will say something and maybe Dilhan can add to that. We can only say that if the backdrop doesn't change, then we will remain cautious and our pace of investment will be quite disciplined, as you have seen [from] what we have done last year. But some of this could be influenced by the size of the transaction. For example, we may come across a very attractive private situation that requires us to deploy a lot more capital. So that might change the number. So, it's really hard for us to kind of predict what will the number be for the coming year. But the disciplined approach will continue.

DILHAN PILLAY: So just to add to that, as we look at the pipeline, the pipeline is a robust pipeline of opportunities, which are being evaluated in all the markets that we are in and all the sectors that we are focussed on. The issue is converting that pipeline into actionable opportunities for which we can invest at the return requirements that we have. And of course we have to bear in mind, as we've spoken before, that there is a lot of competition out there, so we just have to try to be much more competitive if it makes sense for us. Frankly, we've been proactive sourcing transactions for many years, that will continue. So, I don't think the pace of investment is linked to opportunities which are available. It's really linked to getting the returns that we want.

Question on Capital Injections

QUESTION: Am I right in assuming, looking at your numbers, that there have been no capital injections from the Government?

ROHIT SIPAHIMALANI: Well, there have been no net capital injections during the last year.

Question on Valuations

QUESTION: Talking about valuations going forward, I mean how do you see valuations going and, you know, over the short term and over the long term as well?

MICHAEL BUCHANAN: It's going to be driven, of course, partly by our generally constructive outlook on economic growth. So that will provide the underpinnings for earnings, so that's encouraging. But of course, if the starting point for valuations is relatively high, and we have a very gradual move from central banks to reduce the amount of accommodation, then you'd expect those valuations to edge down. So, it's interplay between the earnings which are improving, and valuations which are edging down.

Question on Investment Horizon

QUESTION: Are you able to provide some colour on what has changed in the investment horizon from last year? Were you cautious even last year, I mean the year before, when you talked about it or in the recently concluded year, what has really changed? Is it just valuations or is there a fight for deals which makes valuations more stretched? Thanks.

CHIA SONG HWEE: I will attempt to answer that and [others] please jump in. There are many variables come to play as we look at investment opportunities. The two years preceding March 2017, you see we actually have strong investment momentum. We invested S$30 billion in each of the years. But given the valuation considerations, as well as perhaps more competition for transactions, you have seen that we reduced our pace of investment quite a fair bit.

Now, we did not really change in terms of our investment stance. We always have been disciplined, but with the valuations as we saw it, we think that the upside may be limited and it may not meet our return requirements and therefore we have to slow down the pace.

ROHIT SIPAHIMALANI: As Mike pointed out, actually the economic environment is actually looking better today than it looked in the last couple of years. You know, the growth outlook is much better. So, what's really changed is, one, valuations have got more stretched, that's one, and then secondly, we are now approaching a point where in the next couple of years you will see central banks reversing their easy monetary policy and as you have rate increases that will have an impact on market multiples. So, I think that's what influences our cautious stance but, you know, as again, Mike mentioned, it's got to be an interplay between to what extent earnings growth can offset those multiples and that will really determine the future market outlook.

Question on China

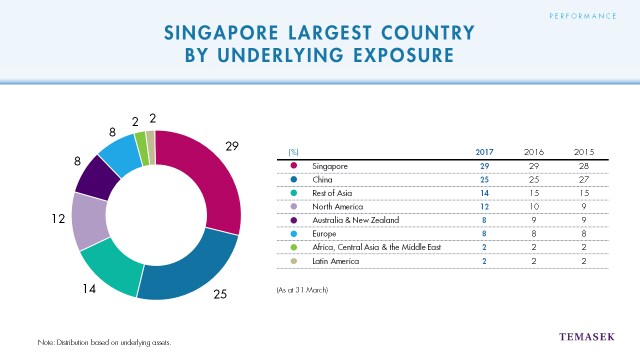

QUESTION: A question about China because I notice where US is still your largest market for investment but is China likely to surpass US in the next few years and how about other new markets in South‑East Asia region for your new investment?

CHIA SONG HWEE: China remains our key investment destination. It still accounts for 25% of our portfolio value. Even though it may look flattish at 25% year on year, but the absolute dollar amount has increased, actually.

From the allocation of investment in terms of geography, it's not so much that we have a pre-conceived idea of where we want to invest country-wise but it's still very much driven by our investment themes, direction, and the bottom‑up investment opportunities. As you can see, in the past six years we've been emphasising on certain subsectors like technology, life sciences and I will say US is actually a pretty good place for us to look for those opportunities.

Question on Japan

QUESTION: Japan was earlier mentioned as a mature economy and we think it's kind-of shrinking. Do you have any kind of strategy or plan for Japanese portfolio or market?

MICHAEL BUCHANAN: Maybe I can start on the general outlook for Japan. We think it's actually very well placed to benefit from that improvement in the global growth environment that I described earlier and so in that sense the fundamentals for Japan are very good. In addition, you have relatively accommodative monetary policy continuing by the BOJ [Bank of Japan] and that will become more of a differentiating factor going forward compared to the Fed [Federal Reserve] and eventually to the ECB (European Central Bank]. And so any currency implications from that will also help Japan so. The outlook for Japan, we think, is quite constructive and we've been looking at opportunities there. We've stepped up a little bit but it's still relatively early days for us there.

Question on South East Asia

QUESTION: Are you able to share some ‑ give some details about opportunities in closer to home South‑East Asia? How is that shaping up? Obviously, the drivers of valuation that you see, or at least the reasons, are a bit different here compared to the US and other places. So, in these emerging markets do you see opportunities? How's the pipeline and can we expect an increase in investments based on the potential opportunities? Thanks.

MICHAEL BUCHANAN: Starting with just the general backdrop, the way we'd look at a lot of the emerging markets. If you think global growth is going to be relatively decent but you've got tighter liquidity coming, you've always got political shocks on the horizon, what you want is economies that have the ability to respond so they need to be moving in the right direction in terms of their structural reform agenda and they need to have policy space, meaning that they could ease fiscal, monetary, exchange rate policy as appropriate. And so in the region, Indonesia, Philippines and as I mentioned earlier, you know, also India stand out for us as having that sort of room. Vietnam is also one of the countries that we would look at there.

So that's sort of the broader picture for how we would think around the region. Dilhan, do you want to jump in in terms of the individual investments?

DILHAN PILLAY: So I think we're very mindful of the fact that we are in a region that has positive signs out there and we are looking for those opportunities that can give us those risk‑adjusted returns that we need. Temasek and Google published a report last year that said that the Internet economy [in the region] could be as large as $200 billion by 2025, and the e‑commerce piece could be as large as $89 billion, $90 billion. So clearly, we see the opportunities in that space as well. And it's something that we're focussed on, it's something our venture capital group, Vertex, is focussed on, for example. They've just raised a South East Asia fund that is double the size of the previous fund. So, we're going to be looking at these opportunities, and not just standing by and letting the region go by us.

ROHIT SIPAHIMALANI: You can see the example of Lazada where Alibaba just now bought out a lot of the other early shareholders. We’re the only shareholders that continue remain in partnership with them and it's reflecting the point that the Dilhan made, the option that we see.

Question on Brexit, Protectionism

QUESTION: Thanks for that. Mike, if I can come back to you on the future risks. I believe this time last year we were quite concerned about Brexit. Is that still a concern from your perspective considering the durational aspect of the multiyear negotiation process? And if I could also ask you whether you believe perceptions of rising protectionism, especially emanating from the US Administration, are a risk for global growth and therefore for global equity markets as well that are perhaps underappreciated?

MICHAEL BUCHANAN: Well, the outcome of the Brexit talks is, of course, unclear and we wouldn't want to be investing just on the specific outcome of those Brexit talks. What we would expect, though, is that so far, the UK economy has benefitted from the currency depreciation that has come about because of the referendum on Brexit, but as we move forward, you'd expect to see domestic demand, including perhaps capex being impacted by the forthcoming actual Brexit. So that would sort of inform our broader view of investments in the UK.

QUESTION: And to the issue of the rise in protectionism, do you classify that as a risk and how big a risk is it for the future?

MICHAEL BUCHANAN: Clearly, it's a risk and it's one of the things we looked at in our [Temasek Geometric Return Model] TGEM work which is in the annual report. It's one of the downside scenarios. It's certainly not the most likely scenario but it's a risk that we've looked at. When you look at some of the elections in Europe they haven't all gone one way and France, in particular, stands out as an election that is giving rise to sort of a more reformist agenda and a pro‑European agenda. So, it's not all going in one way but clearly those risks are things that we're cognisant of.

Question on US Protectionism

QUESTION: Can I ask you again to elaborate a bit on your stance on the US Administration and possible concerns regarding protectionism? Thank you.

ROHIT SIPAHIMALANI: We see protectionism in some form will probably [happen] ‑ you're going to have some sort of tariffs, right, that is what we all expect. But I think compared to expectations at the beginning of the year, when there were strong concerns that people had about a broad‑based broad adjustment tax, etc, those risks really seem to have gone down. So as Mike said it's clearly a risk, if it happened, would have an impact on the global economy and markets but it's something we see as a tail risk and not a base case event.

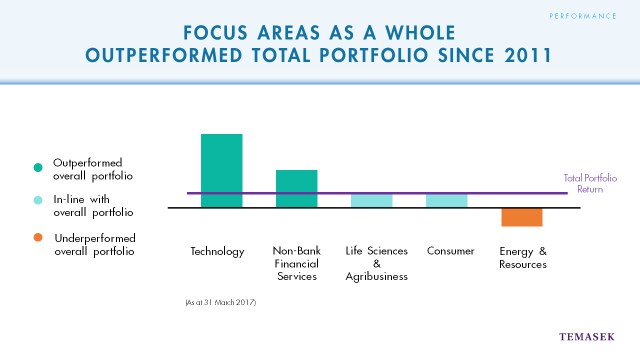

Question on Non-Bank Financial Services

QUESTION: You mentioned that for non-bank financial services, the return has been higher than average [across the portfolio]. What is the outlook for this year? Do you have a plan to increase [exposure to] this sector? Thank you.

CHIA SONG HWEE: We're actually not in a position to predict how each sector will perform. We invest based on the secular trend, what we believe a particular company can generate into returns in a sustainable way and [over] the longer term. But this is a high-growth area and it is also having this backdrop of digitisation and the digital economy.

So we believe that the growth potential is actually quite high and we will continue to look for investment opportunities in that space. Maybe Rohit can talk a little bit about even the emerging markets, like India, the opportunities over there.

ROHIT SIPAHIMALANI: Yes, apart from banks, take India, for example, I mean you have digitisation proceeding at a pace where you have a lot of companies … we ourselves are invested in a payment infrastructure company called BillDesk out there … and then outside that, as savings are increasing, you have areas like asset management, insurance, which are again nonbank areas which are looking very attractive. We invested in ICICI Prudential the previous year, in the most recent year we invested in SBI Life. So we see attractive opportunities in the space and we will continue to look for them.

Question on Chinese Banks

QUESTION: A related question on China. As one of the biggest investors in Chinese commercial banks, what's your outlook for the Chinese banks?

CHIA SONG HWEE: We remain comfortable with our investment in the Chinese banks. There are many concerns about issues relating to credit but the banks that we have invested in, we believe that they are well positioned to manage their credit risk. The banks are also adjusting the way that they have been doing business and earning their income, with the transition of the Chinese economy from one of investment-led to consumption- and service‑led, and you can clearly see the change in their loan portfolio moving in that direction. So, we remain comfortable with our bank exposure in China.

Question on Technology Investments

QUESTION: Talking about your investments in tech, I mean how does this affect the overall portfolio in terms of risk and the traditional categories that we see? Are they still relevant, because I mean tech is kind of in everything now?

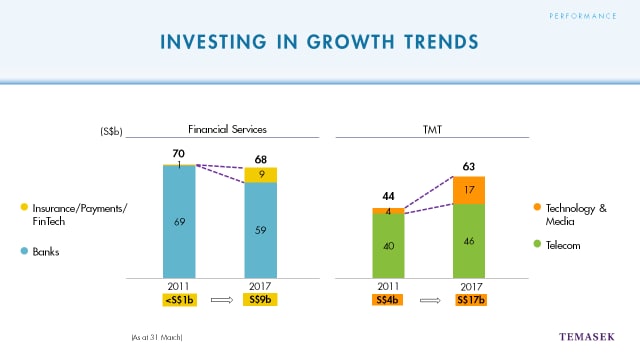

CHIA SONG HWEE: As you can see from the presentation, the tech portion is still quite a small part of our TMT overall portfolio, and with the technology evolution, the fast‑changing adoption of technology, we believe that there's a lot more head room to grow.

Having said that, our traditional investments in telcos remain relevant. If you look at how we communicate with each other today, how business communicates with each other, the backbone infrastructure is still very relevant. In fact, the next generation change to 5G will have to be supported by the telcos. So it will remain as a key part of our portfolio going forward.

Question on Energy & Resources

QUESTION: You list energy and resources as a longer-term investment opportunity still. Would you be a buyer of Saudi Aramco shares when they do come to market or is fossil fuels looking increasingly old hat in this era of decarbonisation and you do put an emphasis on renewable energy? I'm just curious.

SULIAN TAY: We don't comment on individual investment plans prospectively. But we do see energy and resources as critical to the global economy and to societies as they raise hundreds of millions of people out of poverty into the middle class. And so, we also expect demand overall for energy and electricity to continue to grow. Expectations are anywhere between 40 and 60% over the next 25 years, growth in electricity demand. And to meet that demand you need both fossil fuels as well as new energy sources. So we look across the entire spectrum. We have investments in oil and gas companies, but we also have investments in renewable companies as well.

Question on Investments in Travel & Tourism

QUESTION: A lot of your investments are travel and tourism related, like Singapore Airlines and Ctrip. Are you concerned that things like the travel ban and, of course, protectionism is going to impact those investments?

CHIA SONG HWEE: My colleagues have talked about protectionism, trade barriers, huge risks when it comes to the global economy, it's not just our investments but we still see it as kind of a tail risk event. But if you look at the positive side, tourism is growing at 4 to 5% every year and if you were to go down to the next level of details, outbound travel from China is just beginning so there's a huge potential for this sector to grow much more significantly, and innovation is also taking place in that sub-segment. Today the younger generation, the way they travel is very different from maybe how I would travel. So you actually open up quite a bit of innovation, new business models and perhaps even high growth that we have not experienced so far.

Question on IPOs

QUESTION: You see Netlink did an IPO recently, can we see anything from Mapletree or PSA, or your unlisted holdings?

CHIA SONG HWEE: That is really up to the deliberations of the board and the management. We actually have no control or oversight over that.

Question on SMRT

QUESTION: The question I had was on is SMRT now that it's gone private, what are the plans for that company? Are you looking to sell it, or what are the plans of that company?

CHIA SONG HWEE: With regard to SMRT we were pretty explicit as to why we wanted to take SMRT private at the time. With the change in [rail financing] regime, we believe that it is better for SMRT to operate as a private company, focussing on improving service quality and rail reliability and not be distracted by the short‑term capital market requirements, and the requirements of being a publicly-listed company. So, they have been privatised just a few months back. I think there's still a long way for them to go through the transition and work on the service and reliability challenges.

Question on Cautious Outlook

QUESTION: Throughout the presentation today you have used the word cautious quite many times. If pressed, what do you ‑ what is the biggest caution that you have, particularly when it comes to Asia? Thank you.

MICHAEL BUCHANAN: I guess I just come back to the point that I made earlier, which is the underlying economies are relatively resilient and it's more the things that would go to impact valuations. So your starting point for valuations is relatively high, global liquidity is going to edge towards tightening: I mean, we're not talking about a very dramatic tightening from central banks but that's the direction it's going and of course you have politics as well. And so it's the interplay of those things that would make us cautious.

QUESTION: But for Asia, is that the same?

MICHAEL BUCHANAN: I think for Asia, some of those issues around the tightening of global liquidity are certainly relevant to how we would look at valuations going forward.

Question on Unlisted Equities

QUESTION: Just wanted to make sure I understand something Sulian said. She said that the non‑listed portion of the portfolio is carried at book, not mark to market, yes? Does that mean the 13% return you report is simply the return powered by the 60% publicly listed investment?

CHIA SONG HWEE: That also includes the profitability of the non‑listed assets which, you basically book the profits to the accounts, right, so that increase will be reflected as the increase in our portfolio value as well.

QUESTION: But not the capital gains on ‑

CHIA SONG HWEE: No, we do not mark it to any kind of valuation. It's just the profit that it generates.

Question on Private Equity Investments

QUESTION: I just have a question about your private equity investments. Are you seeing more competition in the private equity space and how you're making sure that Temasek gets the best deals?

DILHAN PILLAY: So are you talking about direct investments? If it's direct investments and mostly growth investments we see a lot of competition now. Whether it's in US, China, India, Europe, there's a lot more competition and it comes from even new sources of capital. It's not just, you know, growth equity firms or PE firms or sovereign wealth funds or pension funds but now we're seeing family officers coming into the space we've traditionally played in. So, it's a competitive environment. There's lots of liquidity there and we just have to make sure that we add to the tools that we have and try to think creatively about how to approach some of these opportunities to get the returns that we want to have from them.

Question on Private & Negotiated Transactions

QUESTION: Can you explain private and negotiated opportunities, is it the same thing as private equity?

ROHIT SIPAHIMALANI: Well, it's really private negotiated deals meaning investing in private companies. By definition they're negotiated transactions. They could be minority stakes, they could be majority stakes but they are sort-of like private deals, more like what you would call private equity, yes.

Question on Unlisted Assets

QUESTION: Song Hwee, I was a bit surprised when you said you might do investments in non‑listed assets on an opportunistic basis. Over the past years you have constantly increased those investments. Did I get that right or are you saying you want to increase the share of non‑listed investments in the portfolio further?

CHIA SONG HWEE: We don't set targets as to what is our mix of unlisted versus listed. If we do our job right, eventually some of our unlisted companies will be listed, right? Otherwise we will not have liquidity events. So, it is really hard for us to put a number to it. The basic fundamental of unlisted investment is still whether or not we can generate returns. Of course, if a company that we invest in is unlisted, we will expect a so‑called illiquidity premium, right? In other words, we do expect to earn somewhat higher returns compared to listed assets. But the underlying basis of us looking at an investment is the same. No difference.

ROHIT SIPAHIMALANI: If I can just add, it's a question of market cycles. So today, because we see public market valuations are expensive, we have done more private investments and part of it is basically we manage to get them at acceptable values because of an edge we may have because the value that the investor sees or the company sees in us.

But take 2013 during the taper tantrum. That was a time when a lot of emerging market stocks had sort of fallen precipitously and you had blue chip companies available very cheap in the public markets. So at that time we invested heavily in the public markets, because it was attractive to do so and today, when the public markets are very expensive, we've veered more towards the private side. So ultimately, we will look to see where we get value and, you know, look to invest accordingly.

QUESTION: One very simple question that partly touches on what you just said, Rohit. So we're seeing more opportunities at the moment, given the valuations in the public market, you're seeing more opportunity in private markets?

ROHIT SIPAHIMALANI: That meet our criteria, yes, that's right.

.png)

Question on Private Equity Deal Flows

QUESTION: I just wanted to check, in terms of the dry powder that's available with private equity firms it's at record highs. With such amounts of dry powder how difficult or how competitive is it in terms of deal flows because private equity firms need to spend too?

DILHAN PILLAY: So it's the same thing you raised last year as well, it's there. It's not just a dry powder that PE funds have. It's a dry powder that sovereign wealth funds have, pension funds have, family offices have, there's a lot of dry powder out there and everyone is chasing yield as well and so the amount that's been allocated to private equity has significantly gone up and not just in the funds but directly as well. It's definitely a challenge to get returns with that sort of competition.

So, we just have to make sure that we source the deals that we feel can give us long‑term sustainable returns. And so far, I think we have been quite happy with the deals we've managed to source to date. And the record that we've shown since 2011 in areas of technology bears that out. So as long as we continue to be firmly focussed on the areas that we want to invest in and we have feet on the ground and good sourcing capabilities, we think they will do alright.

CHIA SONG HWEE: Maybe I just add that although the level of liquidity is something that we never seen in history, but asset cycles of this nature happened before, it's nothing new but of course now there are a lot more players and liquidity drivers a lot higher, but it's the same thing. What we learn from previous lesson is to stay disciplined. We really need to know and understand why we're investing and how we can make our returns, and be disciplined about it.

ROHIT SIPAHIMALANI: The most importantly for us in this environment is to be able to demonstrate to the companies we're looking to invest in, the value that we can add to them and we find that particularly if you look at companies in the US and Europe, our networks in Asia and our strong presence on the ground in key markets and our history of investing here for, you know, well over a decade, I think is value where they see.

So, I think if you look at it, a lot of the investments that we've done in the last year in the US and Europe, we almost never win at an auction, we're very bad at auctions! A lot of these have been really, you know, privately one‑on‑one negotiated deals and why would someone do that? In all these cases, the big value add they've seen from us is, one as a patient longer term investor that doesn't have a fund life so that we sometimes time horizon we can offer is different from traditional private equity firm, but we found that a big value-add they see is really the value, the benefits we can bring them through our networks in Asia, how we can help them in that area.

DILHAN PILLAY: The other thing we do have is we built up the main capability in the ten sectors that we're in, over a decade, and now we've also built up good market experience as well with the teams we have on the ground. We also have the domain expertise of our portfolio companies that we have significant interest in. So that hopefully will help us as we navigate the investment world that's out there.

Question on Succession

QUESTION: Can you talk a little bit about the succession planning, the CEO, Ms Ho, if there has been anything, has there been any change since last year, acceleration, new consideration or is it just still the same?

DILHAN PILLAY: So as I said last year, I get to answer that question every time it's asked when I'm here! As I said before, the board has a succession planning exercise, it's put in place for a number of years and continues to do so. In 2015, Lee Theng Kiat took over all the investment activities of Temasek, while Ho Ching focussed on the institutional elements of our company or our group and as well as the stewardship aspects of it. That continues and so, you know, that's where we are today.