Temasek portfolio crosses US$100 billion mark

Healthy total shareholder return of 27% Group wealth added a robust S$23 billion Wealth added of S$7 billion from investment activities

Singapore

Temasek Holdings (Private) Limited (Temasek) released its latest annual financial review today. The Temasek Review 2007 outlines the group financial summaries for the year ended 31 March 2007 (FY2006), and provides an overview of the financial and investment highlights of the firm. The review also lays out the investment firm's framework for governance and risk management, and touches on Temasek's community contributions in various ways.

As an investment house, Temasek's net portfolio value grew to S$164 billion (US$108 billion), up from S$129 billion (US$80 billion) a year earlier. This is the first time that Temasek's portfolio has crossed the US$100 billion mark. Shareholder funds grew to S$114 billion, up 26% from S$91 billion the previous year. Wealth added, or economic profit, was a healthy S$23 billion for the year, including S$7 billion from its activities as an investor.

Key highlights

- Temasek's net portfolio value grew to S$164 billion, crossing the US$100 billion mark.

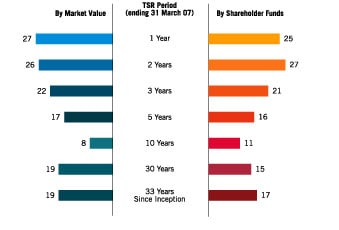

- Total shareholder return (TSR) by market value for the year was a healthy 27%.

- TSR by shareholder funds was a solid 25%, reflecting the sound underlying performance of its portfolio companies and its investments.

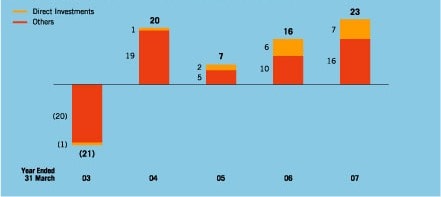

- Wealth added was a robust S$23 billion. This includes S$7 billion of wealth added from Temasek's direct investment activities. Also known as economic profit, wealth added is the excess shareholder return by market value above a risk-adjusted aggregate cost of capital.

- The reshaping of Temasek's portfolio continued, with an increase in its exposure to Asia (ex-Singapore and Japan) to 40%, up from 34% previously.

- Temasek increased its exposure to Singapore from S$57 billion last year to S$62 billion as at end March 2007. As a percentage of the total portfolio, the share of Singapore was 38%.

- Temasek holds a more diversified portfolio, with 38% underlying exposure to Singapore, 40% to rest of and the balance to the OECD and other economies. No investment is larger than 20% of its net portfolio value compared to 30% a year ago.

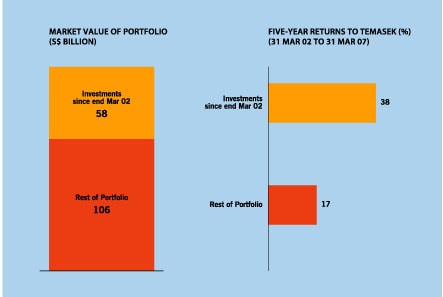

- Investments post-2002, when the focus on Asia began, are now valued at S$58 billion, delivering a five-year compounded return of 38% per year compared to a five-year compounded return of 17% per year for the rest of the portfolio.

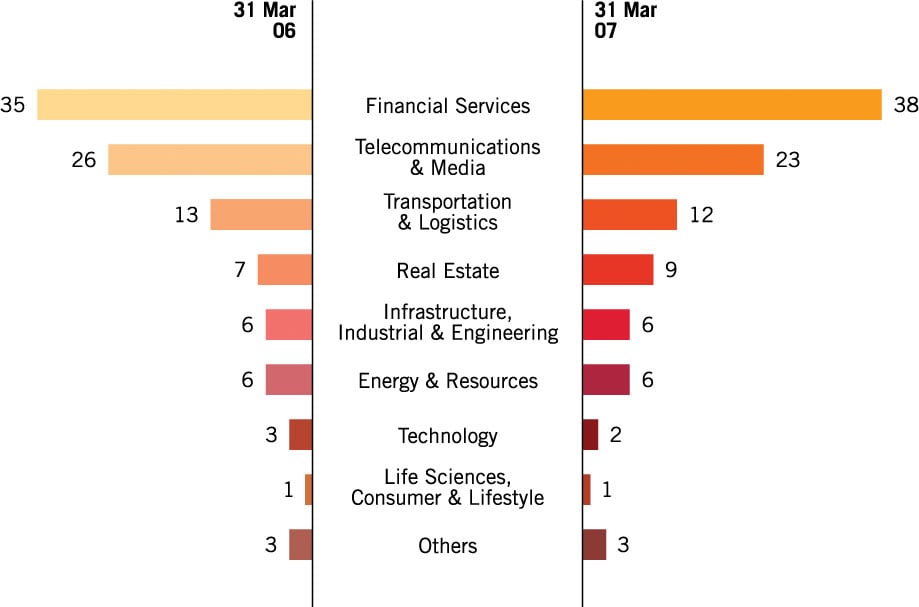

- Investments in financial services sector form the largest sector of the portfolio at 38%, with telecommunications and media being the second largest sectoral exposure at 23% of the portfolio (versus 35% and 26% respectively in FY2005).

- Temasek made almost S$16 billion of new investments and monetised over S$5 billion of its portfolio, compared with S$21 billion of new investments and S$13 billion of divestments the year before.

- Temasek formalised its community contribution through a donation of S$500 million as an endowment gift for the newly set up Temasek Trust.

Financial highlights

Mr S. Dhanabalan, Chairman of Temasek, said it was a satisfying though eventful year for the group.

"For the year, we delivered a healthy total shareholder return of 27% by market value, including dividends, or a solid 25% by shareholder funds," he reported in the Chairman's message.

Group wealth added - also known as economic profit or shareholder return in dollar terms over and above a risk-adjusted hurdle - was a robust S$23 billion. This includes almost S$7 billion from direct investment activities at the Temasek level.

The net value of its portfolio grew to S$164 billion, compared to S$129 billion a year ago. Group net profit was S$9 billion, compared to S$13 billion a year earlier. While profit contributions from the group's companies remained robust, the smaller profit was partly due to lower divestment gains at the Temasek level from a much reduced level of divestments at S$5 billion, or down nearly two-thirds compared to S$13 billion of divestments a year earlier. An impairment charge was also taken for the investment in Shin Corp.

Temasek was established in 1974 with an initial portfolio value of about S$350 million. Total shareholder return since inception remains strong at more than 18% by market value and over 17% by shareholder funds. The annual dividend yield to Temasek's shareholder has averaged more than 7%.

Portfolio reshaping

Since 2002, Temasek has been reshaping its portfolio significantly through greater focus on direct investment opportunities presented by Asia's fastest growing economies. The results of this strategy continue to be reflected in the firm's changing portfolio mix.

Temasek's underlying asset exposure to Singapore increased 8% to S$62 billion in FY2006, but it now forms a smaller percentage of the larger overall portfolio, accounting for 38% compared to 44% a year ago. Exposure to Asia (ex-Singapore and Japan) rose to 40% compared to 34% last year and just 19% in FY2004. The rest of the portfolio comprises investments mostly in OECD Economies.

Investments made since 2002 are today valued at S$58 billion, giving a five-year compounded return of 38% per year. Over the same period, pre-2002 investments earned a five-year compound return of 17% per year.

Beyond Singapore and Asia, Temasek invested in developed economies such as Japan, Europe, Canada and USA, as well as other economies such as Russia and Latin America.

In terms of industry sectors, financial services continued to be the largest in the portfolio at 38%. Including telecommunications and media, the two sectors account for more than 60% of the group's portfolio, reflecting the potential and opportunities of these industries in Asia's transforming economies.

Investments

During FY2006, Temasek invested almost S$16 billion and monetised over S$5 billion in assets. Compared to S$21 billion of new investments and S$13 billion of divestments the previous year, transactions were much fewer during the year due to the group's view of market opportunities and preference to maintain the flexibility in cash.

The group continued to execute its strategy of increasing exposure to Asia through four investment themes - transforming economies, thriving middle class, deepening comparative advantages and emerging champions.

Under these investment themes, Temasek added new holdings in companies such as ABC Learning Centres (childcare-centre operator based in Australia), Intercell AG (drug development in Austria), Country Garden (housing in China), Yingli Green Energy (solar energy equipment in China), INX Media (new broadcast venture in India), Tata Sky (DTH Pay TV in India), Mitsui Life (insurance in Japan), PIK Group (real estate in Russia), VTB Bank (banking in Russia) and Fraser & Neave (beverage and real estate conglomerate in Singapore). Temasek increased its stake in Standard Chartered Bank to 13% from market purchases, and raised its interest in STATS ChipPAC to 83% in May 2007 following a general offer.

Besides direct investments, Temasek also introduced new asset classes during the year. Through a special purpose vehicle, Astrea, it packaged a well diversified selection of funds from its portfolio of private equity and venture capital funds into a tradable structure generating significant liquidity. It also launched CitySpring, Asia's first infrastructure business trust - a new avenue for funding Asia's infrastructure.

Contribution to the community

Temasek formalised its community contribution through a donation of S$500 million (US$330 million) as an endowment for the newly set up Temasek Trust. This donation is from funds accumulated over the last four years from a share of the positive wealth added that Temasek has delivered.

One of the four non-profit beneficiaries of the Temasek Trust, the Temasek Foundation was also launched with a mandate to invest in the young in Asia, through education, healthcare, research as well as foster cross-boundary exchanges and support strong governance and business ethics.

Outlook

According to Mr Dhanabalan, Temasek's investment outlook remains one of caution "in light of medium-term geo-economic risks and signs of bubbly market conditions".

About Temasek Review 2007

- The Temasek group financial summary and performance highlights may be found in the Temasek Review 2007.

- This annual review also provides an overview of the Company's activities, an outline of its institutional framework for governance and risk management, as well as a financial snapshot of some of the major investments in its portfolio.

- The on-line copy is available at www.temasekholdings.com.sg

About Temasek Holdings

Incorporated in 1974, Temasek Holdings is an Asia investment firm headquartered in Singapore. Supported by affiliates and offices around Asia, it manages a diversified S$164 billion (US$108 billion) portfolio, concentrated principally in Singapore, Asia and the OECD economies.

The Temasek portfolio spans various industries including telecommunications & media, financial services, real estate, transportation & logistics, energy & resources, infrastructure, engineering & technology as well as bioscience & healthcare.

Temasek's total shareholder return since inception in 1974 has been more than 18% compounded annually. It has a corporate credit rating of AAA/Aaa by rating agencies Standard & Poor's and Moody's respectively.

Further information on Temasek please visit www.temasekholdings.com.sg.

Market Value of Portfolio

.jpg)

Our Total Shareholder Return

(% by Market Value and Shareholder Funds)

Returns from Portfolio Reshaping

Our 5-Year Historical Wealth Added (in S$ Billion)

Our Portfolio by Geography (%)

.jpg)

Our Portfolio by Sector (%)

Additional Information

For media queries, please contact:

Mark Lee

Director, Corporate Affairs

Tel: (65) 6828 6509

Mobile: (65) 9681 5280

E-mail: marklee@temasek.com.sg

Lim Siow Joo

Associate Director, Corporate Affairs

Tel: (65) 6828 6503

Mobile: (65) 9847 0817

E-mail: siowjoo@temasek.com.sg

Ivan Tan

Weber Shandwick

Tel: (65) 6825 8027

Mobile: (65) 9635 9765

E-mail: itan@webershandwick.com