Feeding the Next Billion: Agriculture’s Big Opportunity

Feeding the Next Billion: Agriculture’s Big Opportunity

Produced in partnership with Bloomberg Media Group

In Brief

- Current production methods will not produce enough food to meet future demand amidst climate change, population growth and changing consumption patterns.

- The solution lies in driving greater efficiencies by applying advanced new technologies across the entire food supply chain.

- The world’s agri-food companies have a tremendous opportunity to innovate and change how food is produced for current and future generations.

Every morning, employees at oil-palm plantations across Malaysia and Indonesia survey their crops and check the land for leaky irrigation systems. For generations they traversed the snake-inhabited terrain on foot, covering five hectares per day in the tropical heat. Today, they survey their plantations with drones.

Each drone covers up to 2,500 hectares per day, capturing images that are later fed to computers and analysed using artificial intelligence. The computers review 10,000 hectares worth of data in just a few hours – a job that would have taken a group of 20 people two weeks to complete1.

These and other emerging technologies are revolutionising the future of agriculture. As agricultural solutions become cheaper and more widely available, farmers and businesses around the world are using them to increase output, produce more nutritional food and shorten supply chains. This comes at a time when humanity faces one of its biggest challenges: feeding a growing global population, projected to reach 9.8 billion by 20502, amidst declining agricultural yields.

Rapid urbanisation and climate change lie at the heart of the problem. Growing cities threaten to stress existing supply chains, while changing weather conditions have already reduced average yields for the world’s top ten crops by 1%3. These trends will hit Asia the hardest – by 2030, the region is projected to be home to more than half of the global population but only one quarter of the world’s agricultural land, according to the Asia Food Challenge (AFC) Report, jointly published by PwC, Rabobank and Temasek.

Asia already can’t feed itself. Now, consumers want more, the population is growing, and you have climate change. That's going to impact how you grow. A perfect storm is forming.

Ping Chew, Asia Head of RaboResearch Food & Agribusiness, Rabobank

Unlocking Opportunities Around the World

Farmers and businesses alike are increasingly embracing smart agriculture technologies, such as precision farming and gene editing, to boost crop yields. This translates to a global smart farming market that is forecast to reach US$23.1 billion globally by 2022, more than double 2017 levels4.

However, challenges are on the horizon. Data privacy, for instance, is a major concern as farmers around the world are protective of information on yields, land prices and herd health. Putting the right polices and regulations in place is crucial for further progress.

is forecasted for the global smart farming market by 2022

Drones developed for precision agriculture embody another challenge of some smart agriculture technologies. There is concern that foreign governments could collect sensitive agricultural information in the markets in which these drones are deployed in5.

Meanwhile, Asia Pacific lags other regions in smart agriculture. Varied levels of economic development and the lack of access to financial services make securing the means to innovate challenging. Where financing is available, fragmented farming networks and informal land tenure agreements lower the incentives. According to the AFC report, agri-food tech investment per capita in 2018 stood at US$2.50 and US$1.80 for China and India respectively, significantly lower than the US$24.10 for the U.S.

Over the next ten years Asia will require some US$800 billion of investment in the sector to satisfy consumer demands and build a more secure, safe and sustainable supply chain, the report says. The scale of this transformation presents a significant commercial opportunity for investors as industry players develop and adopt new technologies to meet the requirements of the future.

An Industry Ripe for Disruption

Companies around the world are using disruptive new technologies to boost yields, reduce the environmental impact of farming, produce more nutritional food and shorten supply chains. A start-up in Norway, for instance, is using computer vision and machine learning to predict sea lice in fish farms6. In Holland, an Internet of Things start-up is using nano-satellites to monitor soil moisture, beehives and crops7. In Singapore, an urban farming company is growing 11 tonnes of vegetables in less than 50 square metres of space8. The potential is vast.

“Investors, corporates and governments across Asia can turn this into an opportunity,” said Richard Skinner, Asia Pacific Deals Strategy and Operations Leader at PwC Singapore. “Corporates can deploy these technologies and make a greater profit. Governments can transform their industry and move people from old-fashioned farming techniques to value-added ones, creating jobs and value for the region. Investors in agrifood and agritech have shown they can make strong returns.”

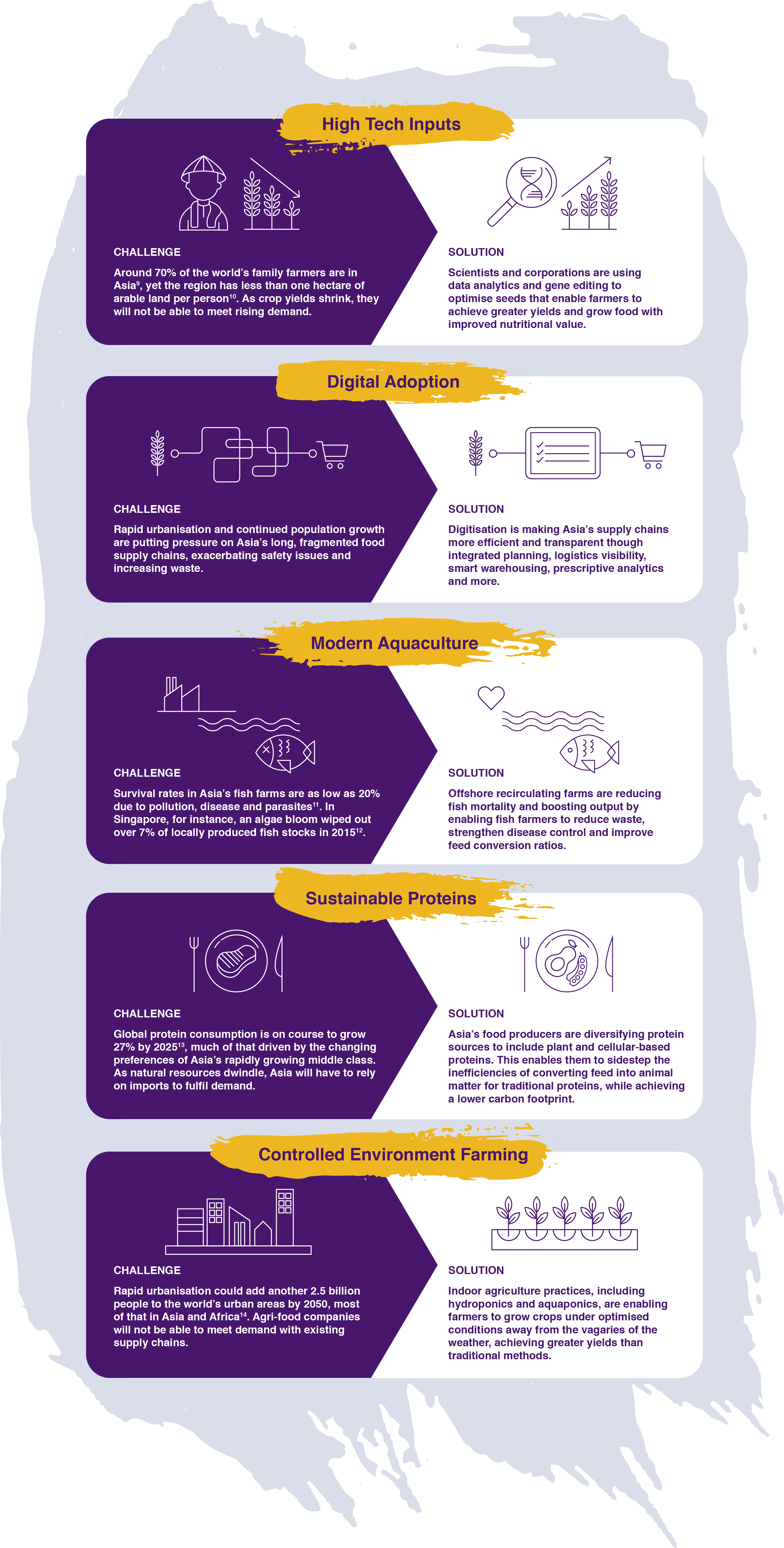

The Asia Food Challenge report lists five key areas where the application of new technologies could make a significant impact in Asia – and potentially the rest of the world – over the next decade:

The Importance of Collaboration

Collaboration is the key to making progress. By working together, the public and private sectors can develop suitable ecosystems for growth, investment and innovation15.

“New technologies and innovations are important, but for them to have meaningful and positive impact, industry players need to come together to form a cohesive ecosystem,” John Vaske, Temasek’s Head of Agribusiness, said in his welcome address at Asia Pacific Agri-Food Innovation Week held in Singapore in November 2019. “Given the scale and complexity of these challenges, stakeholders must collaborate and build on one another’s strengths,” added Vaske, who is also Head of Americas at the Singapore-headquartered investment firm.

Smart agriculture hubs will play a big role in making that happen. Major hubs in Tel Aviv and San Francisco are setting the global standard by providing a locus for collaboration and innovation16. Singapore’s Agri-Food Innovation Park, which will open in early 2021, aims to become a nexus for innovation across the entire value chain and, in the longer term, commercialise solutions in areas such as indoor farming, animal feed production as well as insect farms.

With the right ecosystems to attract capital, foster innovation and serve as testing beds for promising new technologies, the world’s agri-food companies can rise to the challenge of supporting future generations as they feed the next billion people.

As a long term investor rooted in Asia, Temasek is committed to working alongside its portfolio companies and partners across the agri-food ecosystem - to build a better, smarter and more sustainable world.

_____________________________

1 Bloomberg: Drones That Do the Work of 500 Farmers Are Transforming Palm Oil

2 UN: World Population Projected to Reach 9.8 Billion in 2050

3 PLOS ONE: Climate Change Has Likely Already Affected Global Food Production

4 Market Research: Smart Farming: The Future of Agriculture Technology and Global Smart Farming Market: Analysis and Forecast (2018-2022)

5 Department of Homeland Security: Threats to Precision Agriculture

6 PR Newswise: Aquabyte Raises $10 Million Series A Financing

7 Businesswire: Hiber Starts Commercial Trials on Global Scale

8 Ecosperity: Feeding Urban Asia: New Approached for Providing Safe, Nutritious and Affordable Food

9 FAO: Concepts and Realities of Family Farming in Asia and the Pacific

10 FAO: Concepts and Realities of Family Farming in Asia and the Pacific

11 Temasek: Asia Food Challenge: Harvesting the Future

12 Business Times: ACE Reeling in Growth Opportunities with High-tech Fish Farming and Department of Statistics Singapore: Seafood Supply and Wholesale, Annual

13 FIAL: Protein Market: Size of the Prize Analysis for Australia

14 UN: 68% of the World Population to Live in Urban Areas by 2050

15 Temasek: Asia Food Challenge: Harvesting the Future

16 Temasek: Asia Food Challenge: Harvesting the Future