The Coming EV Revolution in Emerging Asia

The Coming EV Revolution in Emerging Asia

A new report, released by Leapfrog Investment and Temasek, lays out the US$1.3 trillion opportunity for investors in backing the EV revolution in emerging markets. Its findings demonstrate that there are many advantages to investing in decarbonisation.

The importance of mobility in emerging markets

Decarbonisation shapes the way Temasek invests – and mobility in emerging markets is a key piece of addressing the decarbonisation puzzle.

The Powering an affordable EV revolution in emerging Asia report, released by LeapFrog Investments and Temasek in September 2024, makes the case for private capital to electrify the mobility sector: Southeast Asia and South Asia need US$1.3 trillion (SG$1.7 trillion) in cumulative capital to power the EV revolution.

Over the next 30 years, the emerging markets of Asia and Africa could account for up to 80% of population growth and 50% of GDP growth globally, with up to four billion people projected to join the middle classes during this time. How these billions of people live their everyday lives – including how they travel from place to place – will help shape the trajectory of climate change.

Market trends show that appetite for personal mobility is rising rapidly with incomes in these markets. In the 12 months between April 2023 and March 2024, over 28 million vehicles were bought in India (a 12.5% increase on the previous year) while in Indonesia, motorbike sales grew 19.4%. Increasing vehicle ownership is to be celebrated – it will expand access to healthcare, education, and employment – but it could also come at an irrecoverable cost to the planet if these millions or even billions of new vehicles are powered by fossil fuels.

However, Temasek is optimistic about the future of the sector. Unlike in sectors such as agriculture and the built environment, the technology to decarbonise personal mobility at scale already exists – and is being adopted. In India, new giga-factories are being built across the country to manufacture over 1.5 million EVs annually, with numbers growing steadily year-on-year.

The EV revolution: a growth opportunity

For investors like Temasek, the EV revolution is a growth opportunity. Deploying capital to scale up the EV ecosystem in the world’s fastest growing markets is an important intervention to mitigate emissions of planet warming greenhouse gases, but also makes increasingly sound commercial sense.

Across Asia’s emerging markets, improvements to technology and infrastructure, growing manufacturing capacity, and new financial and subscription models for vehicle ownership are driving down total and upfront costs of EVs. There is compelling evidence of the lifetime cost advantage of these vehicles over internal combustion engine equivalents – as much as 40% cheaper. At the same time, other key constraints to adoption – such as range anxiety – are also being addressed.

The report suggests that decades of rapid growth for EV sales in South Asia are ahead, with volume of EV sales in India potentially expanding to represent nearly half of all new two- and three-wheeler sales by 2030 with investment in infrastructure and government support. This could continue to accelerate in the decade to follow, driving sales of internal combustion engine vehicles down to almost 0% by 2040.

Temasek has seen promising signs of growing consumer interest in EVs within its own portfolio. Last year, it announced a US$145m investment in the passenger EV unit of Mumbai-based automaker Mahindra, which aims for electric models to make up 20-30% of its total SUV sales by March 2027.

“The clean transportation sector is likely to gain further momentum globally, but price tipping points must be reached for capital to be deployed at scale,” explains Siddartha Bhattacharjee, Head, Mobility & Logistics Investments at Temasek.

The clean transportation sector is likely to gain further momentum globally, but price tipping points must be reached for capital to be deployed at scale

Siddartha Bhattacharjee, Head, Mobility & Logistics Investments, Temasek

Temasek’s commitment to decarbonisation

Reconfiguring the mobility sector around a new power source has much in common with the much wider challenge of decarbonisation. It requires political will, well-targeted policies, behaviour-shifting incentives and mobilising trillions of dollars – where investors have a critical role to play.

Playing this role is in investors’ interests as much as it is in the interests of the people on the front line of the impacts of climate change. This is not just because of the immense growth opportunities in decarbonisation solutions, but because there is simply no return on investment to be made on a dead planet.

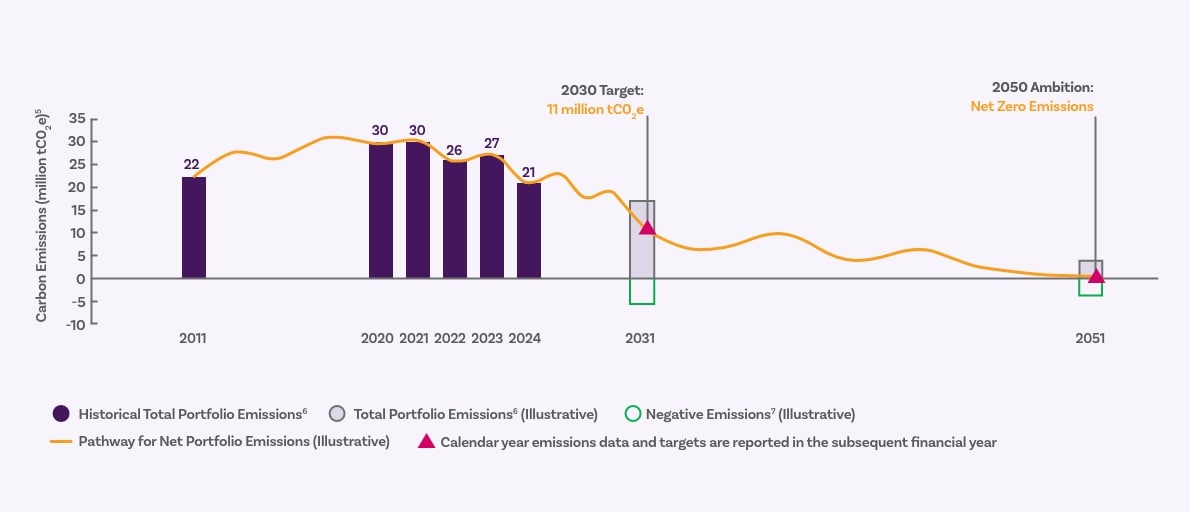

Temasek targets to reduce the net carbon emissions attributed to its portfolio to half its 2010 levels by 2030, with the ambition of net zero by 2050. Source: Temasek’s Sustainability Report 2024

“As a generational investor, we invest for sustainable returns over the long term, and to generate a positive impact on people and planet. Accelerating our collective progress to net zero will require a systems-based, all-hands-on-deck approach. The technology improvements and business innovation we’re seeing in emerging Asia’s EV sector, when coupled with enabling policies and substantial investments, hold tremendous promise for transformative impact at pace and at scale,” said Dr Steve Howard, Vice Chairman, Sustainability at Temasek.

That is why Temasek considers its commitment to decarbonisation to be critical in building a resilient and forward-looking portfolio.

It has set targets to reduce the net carbon emissions attributed to its portfolio to half of its 2010 levels by 2030, with the ambition to achieve net zero by 2050. The firm’s efforts to catalyse climate action are underpinned by three key pathways: investing for a low-carbon economy, encouraging decarbonisation efforts in its portfolio companies, and enabling solutions for carbon markets.

Investing in the electric mobility sector in emerging markets can help build a more sustainable and prosperous future – and it is but one of many opportunities to do so.