So Every Generation Prospers: Temasek’s Three Pathways to Sustainability

So Every Generation Prospers: Temasek’s Three Pathways to Sustainability

A snowless Davos; habitats reduced to dead zones; crops battered by extreme weather. The vast effects of climate change are unfolding in real time, and on a scale that’s impossible to ignore.

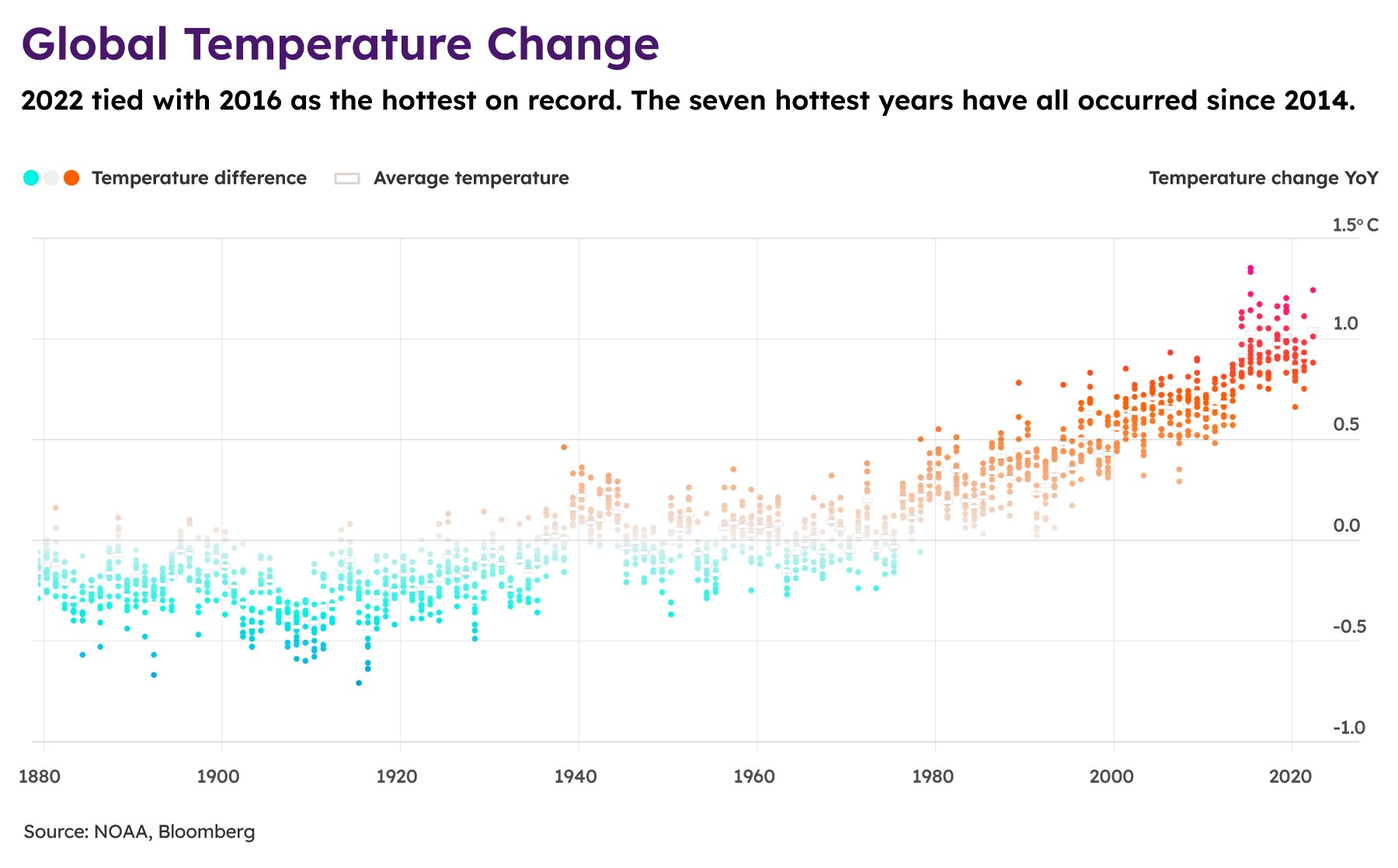

When it comes to Earth’s vital statistics, the outlook remains precarious.

2023 opened with a rapidly depleting carbon budget, with only nine years of emissions left at 2022 levels for a 50% chance at keeping to the 1.5C Paris Agreement limit. To put this into perspective, Clean Tech 1.0 began to bloom between 2006 and 2011, but it wasn’t until around 2018 that Clean Tech 2.0 began to take shape. The climate emergency cannot afford another 17 years for transformative changes to take place; we need to act now. And in 30 years, or just a single generation, our chances of keeping global warming below the higher 2C limit will slip fully out of reach.

The odds are formidable, but for forward-looking global investors like Temasek, the resolve to tackle climate change is just as strong.

A Multi-Generational Purpose

Temasek has defined its purpose through a simple statement: “So Every Generation Prospers.” This single, unifying pledge captures a forward-looking, multi-generational commitment that has guided Temasek to make a difference for today’s and future generations.

Amid a volatile economic backdrop of inflation, energy insecurity and post-pandemic recovery, one thing has remained constant: Temasek’s unwavering focus on sustainability, rooted by its purpose.

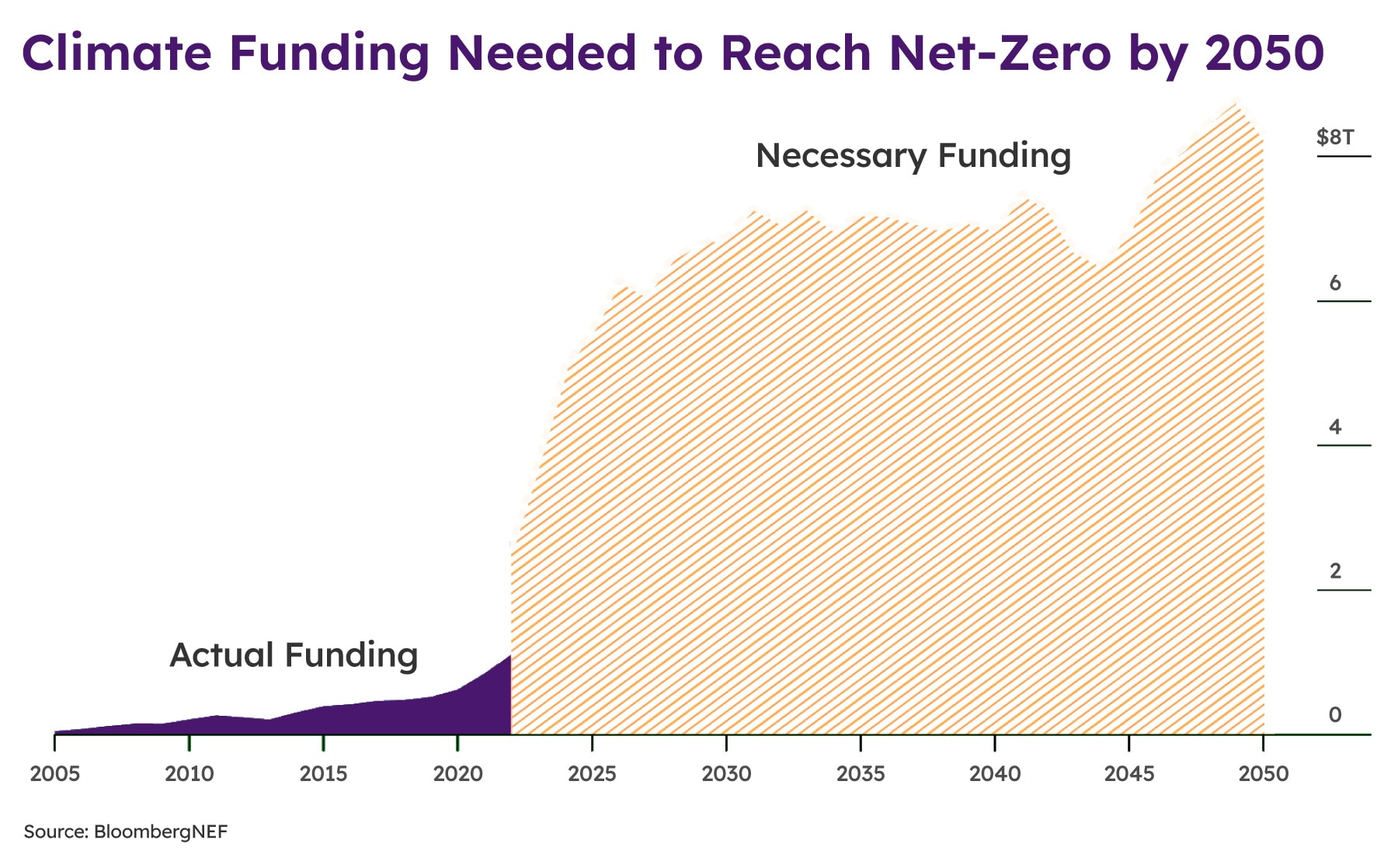

Given the urgency, scale and breadth of the necessary transition to achieve net zero, governments and corporates need to work together to mitigate carbon emissions and transition us from a grey to a green economy through innovative and scalable solutions.

Park Kyung-Ah, Head, ESG Investment Management and Managing Director, Sustainability

At Temasek, efforts to mobilize capital – financial, human, social, and natural – to catalyse solutions for a more sustainable, resilient and inclusive world are in full gear.

On the climate and carbon front, Temasek has identified three pathways towards its climate targets:

- Investing in climate-aligned opportunities

- Enabling carbon negative solutions

- Encouraging decarbonisation efforts in businesses

Investing in Climate-Aligned Opportunities

From renewable energy companies and circular economy innovators to low-carbon solutions and alternative proteins, Temasek’s long-term investment horizon puts it in a unique position to support companies on their paths to sustainability and carbon abatement, now and over time.

It actively seeks investments with strong track records of improving carbon intensity and efficiency. Whether it’s cars fueled with no petrol, or better crops with less water, what might sound like paradoxes are just a few examples of how Temasek’s portfolio companies are seeking to rewrite the rules – all with sustainability as a common core.

“We can deploy capital in climate start-ups and growth sectors, partner across the ecosystem to pilot or scale next-gen decarbonisation solutions, and establish partnerships to accelerate energy transition,” explains Park.

Examples include Decarbonization Partners, a joint venture with BlackRock to launch a series of late venture/early-growth investment funds that focus on advancing next-gen decarbonisation solutions. Temasek also invested in the Brookfield Global Transition Fund to accelerate the transition of carbon-intensive industries.

Enabling Carbon Negative Solutions

As a member of the global Taskforce on Scaling Voluntary Carbon Markets (TSVCM), a multinational private sector initiative, Temasek seeks to contribute towards a more transparent and liquid carbon offset trading market at scale, and encourage the supply of carbon credits of high integrity and high quality.

Its hands-on approach to sustainability extends beyond focused investments in climate-aligned solutions, and into the creation of its own capabilities and platforms to enable decarbonisation.

For example, in June 2022, Temasek set up GenZero, a wholly owned investment platform company dedicated to accelerating global decarbonisation through technology-based solutions, nature-based solutions and carbon ecosystem enablers.

Temasek also spurs the development of carbon negative solutions by funding research – for instance, research led by the National University of Singapore’s Center for Nature-Based Climate Solutions to understand how blue carbon can mitigate climate change in Southeast Asia. The findings will be used to develop a knowledge database of blue carbon stocks in the region and a toolkit for better monitoring, reporting and verification. The company also took part in a new fund, dubbed Select, under Bill Gates-backed Breakthrough Energy Ventures to help late-stage clean-tech startups scale and build new facilities in key markets including Asia.

Encouraging Decarbonisation Efforts Across Businesses

As a steward for the next generation, Temasek knows that businesses are a key driver for decarbonisation.

As an asset owner, the success of our companies underpins our own success. While we don’t manage the day-to-day business decisions of our investee companies, we engage them on their climate transition plans as part of our efforts to achieve a decarbonised and carbon-efficient portfolio.

NA

“In hard-to-abate sectors such as heavy industry and transportation, where broader system and technology changes are required for a successful sector-wide transition, we play our part as a catalyst for change for our portfolio companies, bringing together relevant stakeholders and committing capital to support critical technology advancement and deployment.”

Temasek’s efforts in engaging its portfolio companies, particularly those in hard-to-abate sectors, on their own decarbonisation journeys are seeing encouraging signs: Singapore Airlines has been piloting the use of Sustainable Aviation Fuel (SAF) with the Civil Aviation Authority of Singapore since 2022.

Meanwhile, Sembcorp Industries, operating mainly in the energy and urban development space, is working towards its sustainable solutions portfolio contributing to 70% of the Group’s net profit by 2025.

Through SP Group, Temasek has further harnessed its network to support projects that improve the efficiency of resource management in Singapore's public housing estates. The utilities group also harnesses the power of digitalization and applies the concept of digital twin to optimize the maintenance and renewal of physical assets, and enhance the reliability of Singapore’s electricity network.

A Net Zero Future

With a bold ambition to reach a net zero emissions portfolio by 2050, Temasek is charting a cleaner, better and more sustainable future through these pathways. And it believes that at this critical juncture, the world can still change the trajectory of our collective future.

Challenge and opportunity are two sides of the same coin, and addressing this challenge comes with a multi-trillion dollar investment opportunity that will allow us to create a future that is cleaner, more resilient and secure. At Temasek, we are committed to playing our part so that generations, both current and future, can prosper and thrive.

NA

This content was produced in partnership with Bloomberg Media Studio and was republished with permission.