Temasek Review Media Conference 2019: FAQs

Selected Questions & Answers from the Temasek Review Media Conference 2019

The following is an edited transcript of questions and answers at the Temasek Review 2019 Media Conference.

It has been edited with grammatical edits to aid readability. Questions are not necessarily listed in the order in which they were asked, but have been grouped by subject to aid readability.

Slides and charts have been added from the Temasek Review 2019 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to see all of the key financial metrics and diagrams in Temasek Review 2019.

Question on Global Outlook

QUESTION: In your outlook on global growth, you specified that recession remains a risk in the medium term even though it's not a risk for the very short term. The same time last year we were talking about the looming risk of a recession come 2019 and early 2020. So, can you define the timeline that you're looking at out here, in terms of things deteriorating in a meaningful manner economically?

PNG CHIN YEE: I think it's hard to be too specific about these things, but the expectation is that, I guess, we're seeing data that suggests that growth is slowing and then the question becomes what do policymakers do in response to that. And our expectation is that there will be some cuts in rates which will help to cushion the impact and then we'll just have to watch and see how that unfolds. So, I guess when we say near term, sort of in the next 6 to 12 months we don't expect to see a recession, but beyond that I think we need to actually see what comes.

CHIA SONG HWEE: And the fact that the Fed decide to cut rates reflects their concern about growth slowing and they're trying to be pre‑emptive. So, while the mechanism of slowing down on recession may defer now because of the Fed action, but it's clear that directionally we are all concerned about growth slowing down.

Question on Global Trade Issues

QUESTION: I notice that the United States made up the largest share of the new investments in the past financial year and while China is ‑ also forms about 26% of the portfolio exposure which is one of the highest, alongside Singapore. So, could you share with us your plans to mitigate risks from the US‑China trade tensions and especially if it could hurt growth in the future for these two countries?

JOHN VASKE: I'm happy to start. So, I think, you know, we're very aware of the set of circumstances that you just described. I think the US still represents an interesting area of investment for us, given the themes and the trends that we're trying to pursue and so I think that remains the case today. But I think when we operate in this sort of, you know, kind of trade environment or geopolitical environment, it behoves us to be disciplined in the way that we approach some of those things, maybe with a little greater scrutiny. I'd also say that we're spending a lot more time, or additional time with our portfolio [companies] trying to understand the impact of the existing investments we have. So, it's not just new capital that we're deploying in this environment. It's also, frankly, you know, looking at the existing portfolio and trying to figure out what impacts that may occur to changing supply chains or things of that nature. So, I think it's a pretty intensive effort across all fronts. But we still see the respective geographies as important to us, relevant to us and interesting investment opportunities.

PNG CHIN YEE: I think just to add to that, a lot of our investments in both of these markets are geared towards domestic consumption. And so they're relatively insulated from the issues that you're raising. So, for example, we are invested in the financial space, in technology, consumer technology in terms of business models, right, so people like Tencent, Alibaba, e‑commerce. So those remain relatively insulated and geared towards the domestic theme rather than the export theme.

CHIA SONG HWEE: Let me just add to that. So, one thing that we are mindful of is the second order effect. I think we are quite comfortable with the near‑ term immediate impact where we see it as minimum based on our portfolio construct, but we are also concerned about the headwinds that will lead to slower growth for the entire world. That will obviously impact everything. So, we're more mindful of the second order effects, third order effects, than [just] the first order effect.

Question on Global Trade Issues (2)

QUESTION: I have one question regarding the domestic investments that are more towards the domestic space. Are we likely to see more of that in the future given the risks that were outlined earlier?

PNG CHIN YEE: Yes, so I think in particular we referenced China. We've seen China actually begun its structural transformation in this economy many years, right? It's moved away from investment‑led to a more consumption‑led economy and, actually, if you look at where manufacturing has been, it's actually been moving up the value chain and China is the longer sort of the low‑cost producer that it was in the past. It's actually moved up from there. And you see increasingly consumption and services contributing more to China's growth. If you look at our portfolio, that has also mirrored that transformation. When we first went into China a lot of that was in the banks and in the recent years, we've moved away from just being involved in the banks to insurance, like I said, consumer, technology, life sciences. So, I think you can expect us to continue to evolve the portfolio in line with where we see greater growth opportunities within China.

Question on Global Trade Issues (3)

QUESTION: I've got a macro question. So, your views on how the US‑China trade war will ultimately play out and how you factor that outcome into your overall investment strategy?

PNG CHIN YEE: So, I guess it's hard to speculate as to how that will turn out. So, our focus really is on, as you rightly pointed out, what is the impact on our portfolio and what are we going to do next. So, as I've mentioned, our investment strategy in each of those markets have been very much focused on domestic themes and that will continue to be so. And so, I guess, as we look at new investment opportunities in that space, we're looking for companies which will have strong secular structural forces that underpins them, despite whatever goes on around the world.

So, one example I'll give you is that in the US, we've been increasing our exposure in the payments space. Obviously if growth slows down everyone is going to get impacted. But there are structural forces within the payment space which will drive away from cash to using digital payments such as ecommerce and, you know, even the Government's push to promote digital payments. So, we're looking for companies which actually have got other factors which drives growth that will help support them, even when growth as a whole slows down.

CHIA SONG HWEE: I also want to add that as supply chains will shift because of the dynamics, we also believe that out of changes there's investment opportunities, and we just need to stand ready and keeping track of those developments.

DILHAN PILLAY: So just to add one more point. We still see tremendous opportunity in the US and China, and also in Europe. But we also see increased opportunity in India and South‑East Asia. And so there are always opportunities when you see some degree of volatility or disruption in the market and so I think we have to be mindful that when you see a negative event, there's also positive outcomes that will come about but in a different area.

Question on Global Trade Issues (4)

QUESTION: A follow‑up on the US‑China point. I mean, one of the big obvious risks is that these trade tensions start spilling over into other kinds of disputes like, for instance, a potential tech war. We've all seen what's happening with Huawei. Obviously tech is an area focus for you, you've been talking about it. Can you tell us a little bit about how you are bracing yourselves for potentially stronger disputes on the tech front and how that could impact your portfolio and how you're prepared to maybe change ways in which you look at tech‑related companies?

CHIA SONG HWEE: Maybe I'll start. Yes, we are very focused on technology but where we have been focusing on in the past eight to ten years has been businesses that do not rely much on import and export, but more on creating new business model enabled by technology to drive skill and customer adoption. The examples that you have heard from Chin Yee and John actually speak to that.

Question on Global Trade Issues – Interest Rate Cuts

QUESTION: About seven months ago the Fed famously did an about face from tightening to a more dovish approach of the economy. I'm wondering what kind of effect that had on Temasek's approach to its portfolio? Can it be described as incremental or something more dramatic? And I guess, you know, up until that time there could still be the expectation that this extraordinary period of monetary policy would be reversed eventually following the GFC. Has this change by the Fed led you to expect a more permanent change in the way the global economy is managed?

PNG CHIN YEE: So, I think that that change obviously was an important one, and actually that came because they saw a slowdown and so they acted quite pre‑emptively to cut rates. I think what that means to us is as we look forward, if the low inflation environment and the low interest rate environment continues, then I think our expectations is that returns are going to be much more challenged going forward. And so for us, what does that mean? How do we then position our portfolio in light of that? And one of the themes we talked about was actually going a little bit earlier in terms of investment, being more focussed on the private markets because we think that gives us good value in certain areas today and we've actually been able to get better returns from our private investments in the past.

So, we have to look at our portfolio as a whole and try to get it to a more resilient place and try to build towards a more resilient portfolio for us to ride through the next few years.

DILHAN PILLAY: But we will also see, and we've also seen more competition in the areas that we focus on. So, there's a lot more capital now looking for yield, as you know. So that finds its way into the sectors that we like and so valuations remain elevated and so as we look for the returns that will commensurate with our allocation of capital, we have to be mindful of the fact that, you know, it's going to be an expensive world out there and for the good quality assets, we have to find ways in which we can ensure that we get a long term value from those investments.

So there's more allocation towards alternatives, to private equity, to growth equity, even venture capital, very significantly the last couple of years and that will continue in the next few years and so we're quite prepared for that enhanced competition and we just have to make sure that we are very focused on returns.

CHIA SONG HWEE: I would like to add also it's not all about making new investment. We really have a very sizable position. We have ‑ we believe we have many, many good companies in our portfolio. We need to work with our portfolio company to create more value, to build on our ecosystem which we believe that we can get a little bit more from it.

Question on Investments - Developing Markets

QUESTION: So, with that framework in mind (structural trends), would you be looking increasingly into frontier markets, for example, to the point on supply chains?

Well, we believe that the potential for ASEAN, for example, is very promising, not only because of these trade tension, but also because of the demographic. We have been always optimistic about the development and I think with that, there may be more opportunity for us to explore.

JOHN VASKE: I’d also just add that on this front, it's also hard to answer specifically in the general, for obvious reasons, but it's also impacted differently sector by sector, right, and then also whether we do public or private investments, depending on kind of where the capital need is and so each one of those is a very granular analysis that we do.

Question on Investments – Unlisted Assets

QUESTION: Unlisted assets account for 40% of the Temasek portfolio right now. This percentage was 28% ten years ago. So, what is the main reason Temasek has invested more in unlisted assets than listed assets for recent years? And how do you assess the risk of investing in unlisted assets, and do you expect this percentage ‑ will you continue to increase in the near future?

DILHAN PILLAY: So, you're right. About 10 years ago, in 2011, listed assets were 80%, unlisted assets were 20%. Today it's 42:58. In the last financial year, [69%1] of our [new] investments were in unlisted assets and that's a trend that's been increasing over the last ten years, and we think that pattern will continue. It's in line with two things. First of all, our focus areas, whether it's technology, life sciences, fintech, consumer or agriculture, in particular ag-tech, but also in line with the six trends that we see. Because the six trends really try to address the convergence of different sectors in new things that are rising where you see more convergence within science and technology. And so that tends to be much earlier and so as we try to sort of engage with these trends to see where they can go, the impact they will have on the world, on investment opportunities, on our portfolio companies, we will see an increased allocation of capital to that strategy. So, it will increase in time.

And if you think about volatility in the markets going forward in the next few years, private investments will, based on our past performance and based on what we've seen, they will give us a better return to the future as we shape the portfolio going forward, say, next ten years.

1Corrected from the 48% that was mentioned originally

Question on Investments – Unlisted Assets

QUESTION: Could you just comment briefly about whether or not Temasek is keen to list some of your unlisted companies, particularly the Singapore companies like PSA

PNG CHIN YEE: I guess it's not for us to list the companies. That's a decision for the board and management of those companies to decide whether it furthers their business to do so.

CHIA SONG HWEE: And if they are delivering good returns, we actually are agnostic whether or not they are listed or unlisted.

Question on Investments – Bayer

QUESTION: I just wanted to get a sense, you obviously made an investment into Bayer in April. That's fallen about 36, 37%. How long do you think you will need to stay there before you start seeing an actual return on that investment? And do you still have confidence in the board and its activities?

JOHN VASKE: I'll start. I mean, as you correctly point out, Bayer was underwritten with a long‑term thesis. The individual companies played to many of the trends we've articulated this morning, particularly longer lifespans, sustainable living. The combination of the two has the potential to be more impactful against some of these trends. The opportunity to invest along a best‑in‑class set of franchises in that regard was the original thesis and that holds true to this day. As it relates to our assumptions around the operating metrics of the company, they have held in line, for the most part, in terms of that period in time, so we're quite encouraged by that. We're also, you know, watching pretty closely, floods in the midwest and there will be pressure that comes on that but those are things that are beyond our control.

But from a fundamental point of view, the company's performing as expected. I think the current share price decline is obviously a reality, it's a function of the uncertainties around some product litigation, which is for a key product in the legacy Monsanto portfolio. We're watching that closely.

I think to the other part of your question, we're quite encouraged by the engagement of the supervisory board and the executive management team in terms of taking that seriously and doing the things that they need to do to be mindful of it. So, the long‑term thesis that we underwrote initially remains true today and our confidence level is high.

CHIA SONG HWEE: Maybe I add to that from the investment process standpoint. We have identified the litigation risk as one of the key risk factors. We had consulted, I suppose we've gone through the whole due process. While we recognise that it may be a binary risk, as in all litigation cases, we make the investment with that in mind.

JOHN VASKE: It's probably a good point to make also that this plays to our form of capital. We have the benefit of looking at things on a longer term. I think part of the share price decline is driven by people who don't have the luxury of that timeline and the ability to look at the uncertainties around something like a litigation issue and be as patient as we have the opportunity to be.

Question on Investments – Public versus Private markets

QUESTION: Just wanted to be sure, given if I'm right to assume that Temasek over the years has become less risk averse in terms of its cautious stand it's taking going to more private compared to the public markets?

DILHAN PILLAY: I wouldn't say it's a question of change of risk tolerance or risk profile. I think it's where we find the opportunities. You find more opportunities in private space we'll go for that. We have, however, you know, allocated more capital recently or a little bit more capital to early stage investing but that's, as I mentioned, because we see trends which are happening. We need to understand those trends. We have to figure out what's investible. We have to figure out how it affects our portfolio, positively and negatively and, you know, if there's good investments out there like, you know, smarter systems, sustainable living and so on, I think we want to be at the forefront of what's emerging.

CHIA SONG HWEE: Actually, I would like to add to that. Public [markets] investing, you're subject to market volatility but volatility itself is not a risk. We focus on fundamental risk, risk of the business, risk of the sector, macro risk. That, it doesn't matter whether you're in public or in private situation. So, we are more concerned about the fundamental risk rather than the volatility risk.

JOHN VASKE: The other thing is some of this is frankly a trend. I can speak from the US where there are fewer and fewer public companies today than there have been historically and that's an issue that the regulators are focused on. In some ways this is a function of the opportunity set that we have today where companies are staying private longer for a whole host of reasons, including the market volatility we talked about, the burdens of being a public company, the disclosure, everything that goes into that.

Question on Investments – Total Shareholder Returns versus Market Indices

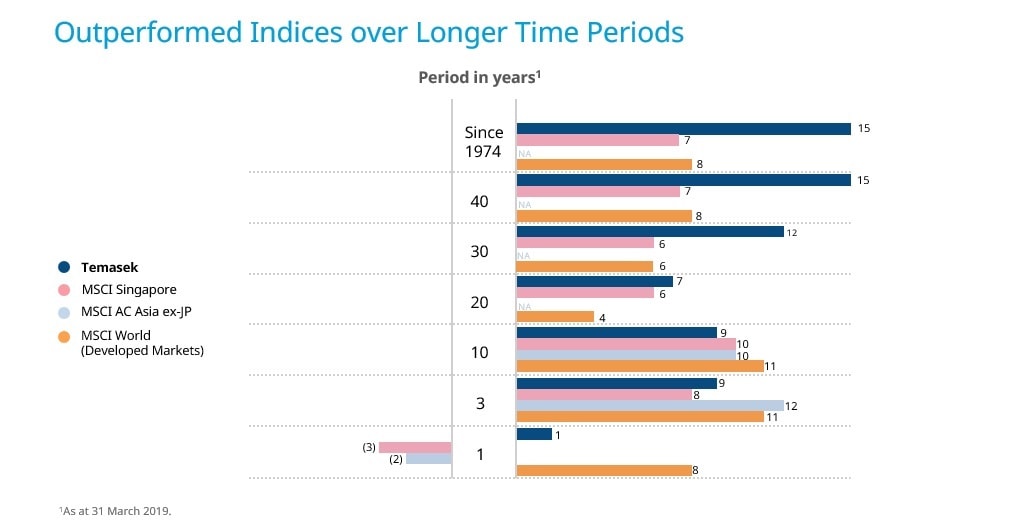

QUESTION: I wanted to ask you to give us a little bit more of an explanation as to the drop in the total shareholder return (TSR), the one year specifically. It is ‑ seems to be one of the sharpest, not the sharpest but one of the sharpest drops in the last decade. So how do you explain this? It is true that obviously public markets have also not necessarily performed in an amazing way but looking at some of the comparisons that John gave us, it is true that the MSCI in Singapore and Asia ex Japan were negative territory but the MSCI World yielded about 8% in returns. So, could you tell us why that was the case?

DILHAN PILLAY: So, if look at our portfolio mix, 26% in Singapore, 26% in China, 14% Asia ex Singapore and China, that's already 66%, in these three geographical areas. So that's two thirds of our portfolio exposure. So, when you looked at the MSCI Asia ex Japan and look at MSCI Singapore, you could see that if you correlate two thirds of our portfolio to that performance, you could pretty much figure out where we are compared to that.

So we're relatively underweight in Europe and in the US in particular, in connection with MSCI World but that's not how we see long‑term portfolio construction. Because we think about what we are doing, we are actually investing for long‑term sustainable returns and where's global growth coming from? We see global growth continuing to come from Asia. The weightage capital to Asia still remains very significant. The returns from Asia are also expected to be significant as against developed market returns.

What we've seen in the last few years, obviously in the US market is a significant upswing in the public markets and so that's not really where we have significant exposure. We have significant exposure in the US and Europe to the private markets. Now, in the future we believe that would actually give us very good value as we continue to invest in the US and Europe in the private markets. And so over time, I think you will see that our returns will reflect the reshaping of our portfolio according to the focus sectors, the six trends and geographies where we're allocating capital towards.

So, this performance of 1.49%, if you think about two thirds of our portfolio being focused on Asia, and as compared to returns that Asia's generated in the last 12 months, it is what it is.

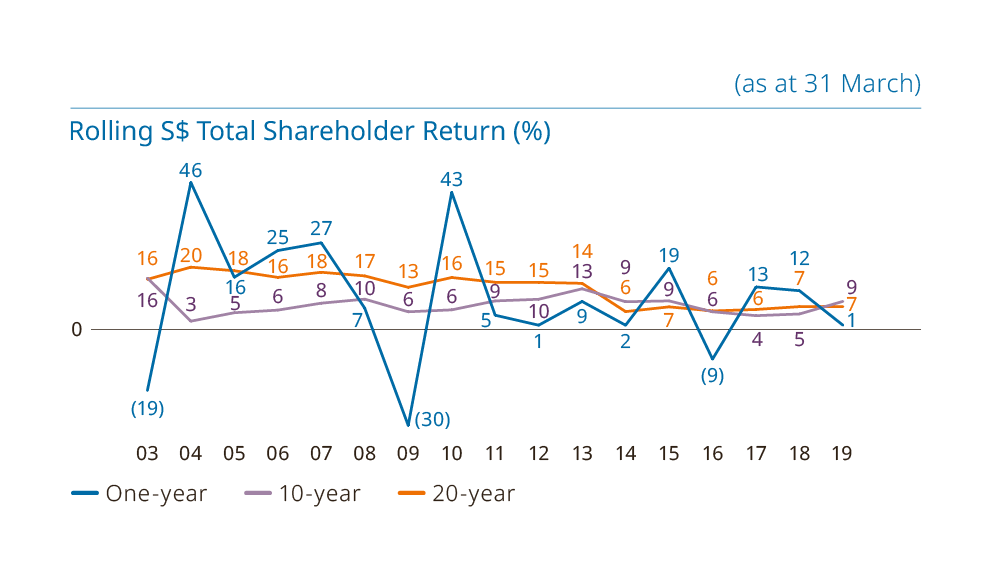

CHIA SONG HWEE: May I just add to this more on a technical point. I'd like to draw your attention to this chart here. Let's focus on the ten year which is the purple line, and this is a ten‑year rolling return and you can see that for last financial year we reported 9% return. But if you look at the year before, it was 5%. All it means is that the points have shifted, depending on where you start and where you end. It so happened the GFC impact has dropped off the ten‑year and therefore we have a big bump in the return. So, there's some technicality over there.

JOHN VASKE: I just would echo what's been said. You know, if you think about the other comment that was made that the US is the beneficiary of more capital going in as an investment over the course of the last year, that, by definition, means we're earlier in those investment periods, always with a long‑term mindset in terms of underwriting and also trying to do it in a market that is pretty fully valued from the US in terms of where we are in the economic cycle. So being able to pass out where the opportunities are, deploy the capital, I think we just need to be patient and let those things play themselves out.

Question on Investments – Total Shareholder Returns versus Risk-Adjusted Cost of Capital

QUESTION: As I understand, Temasek's also judged against your hurdle rate or your risk‑adjusted cost of capital. In the earlier slide we did see a fairly large gap. Would it be fair to say that Temasek has underperformed vis‑à‑vis the hurdle rate and given your structural look at the way you're investing, particularly going to private markets as well, how do you see this gap? Do you expect it to continue? And in your reporting to your final shareholder, which is the government, is it considered an underperformance here?

PNG CHIN YEE: So maybe I'll take the first part which talks about our cost of capital. So, the way we look at cost of capital is, we are taking certain risk when we make an investment, and so we want to weigh the returns of the investment against that risk. So, for example, if we were to invest in a very safe asset, the cost of capital should be lower for that versus a higher one. So, it is true that, you know, last year we haven't met our cost of capital but if you look over the longer term, we’ve generally exceeded that cost of capital.

Having said that, you know, if we do expect that the environment is going to be a negative one, and you're going to see sort of negative returns environment, for example, then it is possible that we also invest in opportunities which may not meet our cost of equity but which gives us positive returns, because positive is better than zero. So, I think we need to take that in context.

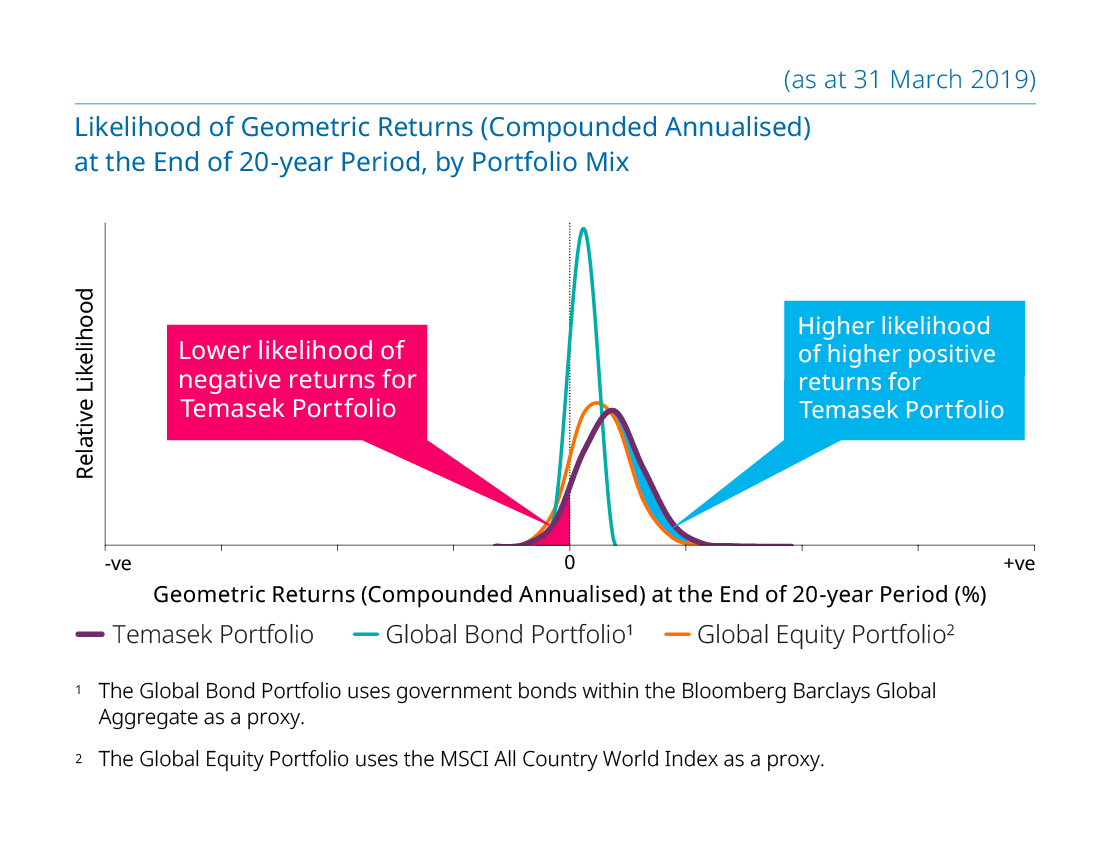

DILHAN PILLAY: So, what does our shareholder look to us for? It's to make sure that we have a portfolio that's resilient, that's able to give them long‑term sustainable returns, over a very long period of time. That's what they're relying upon under the net investment return framework. So that's what we're focusing on. So what we have been doing systemically over the last ten years or so is to shift the portfolio in a way that resilience comes across and we can get returns against a cost of capital framework that takes into account the risk that's out there in the markets that we are investing in.

And so, if you look at this slide, you will see that the global equity portfolio, which is the orange curve, gives you a particular return profile but our portfolio is expected to outperform that. So we would expect to have more years in which we were to outperform the global equity portfolio and there will be fewer years when we will underperform there. So, it's very important for us to make sure that we're focused on that sort of strategy going forward and that's really what our shareholder expects us to do. So, the things we do today is with respect to making sure that that portfolio is created over the long run. So that just adds to Chin Yee's point.

Question on Investments - Portfolio Construction

QUESTION: Typically, from data there is a six to eight‑month lag. If the outlook is pretty pessimistic now, how are you constructing the portfolio? I know that you said you're scaling back on investments. But what specific steps considering that the data might catch up later? How are you managing the valuation risk in private markets or private investments?

CHIA SONG HWEE: Maybe I'll address the first one. When we look at portfolio construction, it's not a one‑year action. When we think about portfolio construction, it's 10, 15 years down the road: what we want to see our portfolio in that timeframe and then we work backwards on what we need to do in the near term. So that's how we think about portfolio construction.

DILHAN PILLAY: Every year we have a very healthy pipeline of things that we look at but we only execute if we feel that the investment will give us the risk reward that we expect from it and is able to be part of a portfolio that's constructed for long‑term sustainable value. So that's really the way we look at it. I wouldn't say that we are scaling back investments. I think where we can find value, we'll be very happy to deploy capital for that, especially one which will give us a long‑term sustainable profile.

Question on Investments - Ascendas-Singbridge

QUESTION: I wanted to ask about the Ascendas-Singbridge divestment. Do you have any particular plans for those funds?

DILHAN PILLAY: Oh, you mean the proceeds. They're part of the total amount of cash that we keep and it's commingled and its part of our [cash] allocation. As we mentioned, we look at opportunities bottom up and so where we find those opportunities, we do want to deploy capital. Despite the fact that we have a view that we need to be cautious, given all the things which are happening out there, the low interest, low inflation, lower growth, lower return world. But also because the geopolitical events that we're seeing today, we have to figure out where they're headed and that we need to inform ourselves more and more as we see these things and look for opportunities that could possibly still ride through all the cycles or structural changes that would happen in the business world.

Question on Investments - Existing Portfolio

QUESTION: You talked about building a resilient portfolio and looking at your Singapore portfolio, actually some of the legacy companies, especially like rig-building, are not fitting into your structural themes that you identified. Also given that these companies are going slower relative to the rest of the world and it's hard to push out returns, is there any strategic rationale for holding these companies?

DILHAN PILLAY: So these companies have served us well for many, many years and in fact, if we look at our rig-building companies they have gone through many global cycles and changed themselves and changed their business models to be what have become positive businesses not just for themselves but even for returns for their shareholders. I think they will continue to look to see how they can build on what they have. Especially we look at rig builders, it's really about the engineering capability they have, and how you can translate that engineering capability to other sectors and find value in that. And I believe that the management teams of both companies are looking at this very, very seriously and they have done this before in the past and there's no reason to believe that it won't be able to do it in the future.

Question on Investment – Market Geographies versus Public / Private Market Opportunities

QUESTION: Dilhan, you made the point that you've obviously witnessed a significant upswing in US public markets and that's not really where you have significant exposure and that, longer term you're more focused on Asia, for example, where the growth will be. So I mean, would it be fair to say that irrespective of, in a way, where public markets will go and how they will perform, the longer term vision and promise of Asia sort of trumps those trends and market movements and therefore that vision also trumps where the total shareholder return may move potentially into more negative territory?

DILHAN PILLAY: I won't want to downplay the value of the portfolio we have in private investments in the US. So, if you look at the shift of our portfolio over the last, say, ten years. We started to invest in the US more significantly from 2014 when we opened up an office in New York. In 2016 we opened up in San Francisco as well and that actually underpinned our investments in core areas like technology, life sciences and so on.

That will continue to be the case, by the way. There will be significant allocation of capital every year to the US and to these areas that we see are focus areas for the future and in line with the six trends that we have identified. And so, if you look at a portfolio construction that gives you a return profile over the next 20 years, that will be a significant component.

Some of those companies will find their way into the US public markets, and we can possibly see an increase in US public market exposure as a result of that. Our private investments will not stay private for long. They might stay private for longer, as we have seen in the technology world, but you might find it's about there.

Now if you look at allocation of capital to the US versus the rest of the world, where do we invest in the rest of the world? So, a big part of our capital goes to China, to India and now we have a focus for South‑East Asia. So, in just relative terms, you will see more allocation towards Asia compared to, say, US and maybe even Europe.

So when you think about that we would only invest capital where we see risk‑adjusted return hurdles are met and so when we invest in emerging markets in a rising Asia, we have to bear in mind our cost of capital is higher and therefore the risks are higher, to some extent and so we have to be very focussed on investing in the right things, the right trends, the right opportunities and the right return framework.

So, I wouldn't do a broad brush because, like we said, we do it bottom up. There may be a year when we find the opportunities in US and Europe are so great that we want to allocate more capital there, and then over a five‑year, seven‑year period you will see that come out in portfolio value, whether private or public markets. It's based on where our companies are also exposed.

CHIA SONG HWEE: Let me add a few comments. We could also point to you that at certain periods, the emerging market or Asia outperformed the US or European markets. It's just when you start and when you end. One thing that you would want to consider also is the equity market, capital market in Asia is still very under-represented relative to the developed market. So, there's a lot of head room and the number of institution investors that are actually investing consistently in a market is still very minimum. So, to me, that represents opportunity, not a threat, actually.

JOHN VASKE: I was going to say, the way we operate is not ‑ it's a little bit agnostic to private versus public, it's where we can have a differentiated point of view and an ability to express our capital. But I would just echo what Dilhan said. We've deployed a fair amount of capital in establishing the US base, we've participated in some early stage stuff and some later stages and it's one of the benefits of getting in early is that you can continue to be a capital provider to that company along with the journey and one element of that journey may be to become public. When that becomes a public company, and we're a public securities owner, our point of view, given the history of being alongside management when they've chased that opportunity, just gives us sort of different insight, if you will.

DILHAN PILLAY: I would like to add to what Song Hwee said, actually our returns in Asia have been actually, you know, very, very good over the years. And it gives us confidence that continuing investments in Asia is the right thing to do. If I look at the way our portfolio is being meaningfully constructed systematically going forward, you know, there's every confidence, in the absence of geopolitical events that nobody can foresee, the unknown unknowns of a very large magnitude, that the portfolio will perform in accordance with what we hope for it to be performing in 20 years, over a 20‑year period.

Question on Accounting Standards

QUESTION: I wanted to talk about the ‑ or ask about the accounting standards changes. So, it says here that moving forward you're going to have to realise the unrealised gains and losses from the mark‑to‑market value of your sub 20% investments. I just wanted to get a better idea of how much of the portfolio is actually in sub 20% investments at the moment and get an idea of what kind of impact this might have on the upside or downside on your portfolio given the change in the economic standards?

PNG CHIN YEE: So, I just want to clarify a couple of points there. So, number one, it is that we will be taking the mark‑to‑market gains and losses of our sub 20% investment into the Profit and Loss (P&L). We've always done that through the balance sheet. And it's unrealised, right. So, these are not realised loss and gains. These are actually unrealised. So, the difference is that instead of just going through the balance sheet, it's going through the P&L as well. So, what it does to the P&L is that it creates volatility from one year to the next depending on where share prices go.

If you look at one of the charts, we have for concentration, you see the sub 20% constitute about 40% of our overall portfolio. So, it's quite a meaningful part of our portfolio. But I think we would urge you to look beyond that. In any case, our net portfolio value, which is how we've always reported our results, already incorporate these effects and so they remain unchanged by the change in accounting standards.

Question on Investing alongside Temasek Portfolio Companies

Question: The second has to do with also, again, with competition and cost of capital. Given that the opportunities are arguably limited, do you see room to consolidate the number of subsidiaries that you have today? My cursory check suggests you have about 111 subsidiaries at this point and some of them there may be some overlap in this area. So, I guess a sense of are you hunting as a pack and how are you reshaping to capture all these opportunities?

DILHAN PILLAY: The second thing has to do with your question on the subsidiaries. I don't think we want to consolidate subsidiaries for the real purpose of just trying to figure out this activity there of things that we can do, put two things together. It doesn't work out really well in the long run. What's more important is that we add value to these companies in the ways we can, to help them deliver their own sustainable long‑term trajectory that we would like to see in them. Today, these companies account for about 35% of our portfolio value, so it's not small. They're a very significant part of Temasek. You know, they also represent very much part of our DNA and these companies are actually competitive in their space, but the space is changing. So we have to engage with them to figure out how we can bring our insights to them and how they can also share their insights with us where it's appropriate and we have to figure out to how we can continue to add value with them to create value for the benefit of all shareholders if they're publicly listed, or for the benefit of ourselves.

Question on Investing in Sustainable Solutions

QUESTION: You've made a very strong presentation on the environmental sustainability. But how does Temasek do this in terms of putting its money where its mouth is in terms of investments or pressuring companies to follow suit? I mean, I note that you've divested a palm oil company last year, I think a timber company as well, if I'm not wrong, and some of your companies have also ceased things like coal financing. You know, going forward what is the strategy to ensure that you meet this trend that you have identified?

DILHAN PILLAY: So sustainability is a journey, right? It's not a one‑time thing. It's something that is with you, and you're going continue with it and you're going to improve things that you do, and you have initiatives which are early and initiatives which are moving along. So, what are the four things that we are doing right now?

If I look at our book and our cover: Look, Think and Act. Look, we have an ESG framework that's been put in place now that is embedded within our investment process, for investment teams to look at ESG considerations in every investment we make, is assessed by independent team and reported to investment committee, which looks into these things very seriously. It doesn't mean that we don't invest in companies that have more of a carbon positive trajectory, but the question, is can we help them change and be better and have a better carbon outcome, for example.

The second thing which is Think. That's very important, it's very important for us to be part of the conversation to be able to be part of the thought leadership here, to be able to advocate positions where we have a point of view, whether it's in relation to UN SDGs and adoption of UN SDGs by our companies or by others. And that's manifested itself, for example, in our Ecosperity conference which has gone from a half day conference into a week‑long event, in the last event in June.

If you then Act, then there are two things we can do. Okay, first, our own carbon footprint. So, we are striving towards carbon neutrality next year. We would like our companies to also see carbon neutrality as soon as possible. Some of them have already begun their journey. SIA's made a commitment of carbon neutrality [growth] by 2020. Singtel's made their public statement [toward] carbon neutrality. We would like to see that, by 2030 the carbon emissions for the entire Temasek group is reduced by 50%. That's a journey that we have to walk with our companies, to be able to encourage them to move in that pace to be able to achieve these outcomes for ourselves. So that's an important component.

Now, the other part of Act is to invest in sustainable solutions. This comes from the direct investments we do and also through companies that we have. Now if you think about companies like Keppel, and Sembcorp and Singapore Power, they're all part of a sustainable solution journey. For example, they do water treatment and wastewater treatment, for example, and so on. These are urban solutions, they've been working on for years. Can they do more? The district cooling system that Singapore Power has, and Capital has, that's incredibly important in context of energy management to reduce the energy usage by 40%, 50%.

Now these are the sort of things that we want to encourage our companies to do and that's embedded within our portfolio value but at the same time we will look to invest in sustainable solutions as well.

Question on Early Stage Investments

QUESTION: I have three questions on early stage investments. How early are we talking about? The second question is how do you pick winners because obviously these companies are not profitable yet, so what do you look at? And the third question is this currently comprises 3% of your portfolio. Can we expect this to increase going forward? Thank you

DILHAN PILLAY: So, we have a multitude of strategies in the early stage. We have our own VC arm, Vertex, which has something like $3 billion of AUM and just about a billion dollars is our committed capital to it. They've done very, very well in the last few years. We have a venture debt programme that's meant to complement venture capital. We have a team in Temasek that looks at Series B. So, the earlier parts will be done by Vertex and the funds that we invest in to be able to see what's happening. At Series B level, we have a team that's engaged in investing through Series B and Series C. They're the ones who first came across Impossible Foods, for example, as an investment opportunity. And then our own main direct investment, you know, engine, which is where the investment group focuses on, they began to invest in earlier growth, not early but earlier growth and that is represented by, you know, investments, Ola, Didi, in the earlier stages and so on.

Right now, it's 3.3%. That includes the funds, direct investments that we have in earlier growth, early stage that we have with the team that looks at Series B and also our VC arm. Will that increase significantly? I don't think it will ever be a very, very significant part of our portfolio. But you see, as they mature and as these companies grow and we're able to put more capital to them, they will actually graduate into the more mid stage growth, later stage growth as part of our portfolio and no longer be classified as early.

So, we really want to invest in these companies and see what the breakouts are as well. But like I said, it's also about the insights that we get that will help us think through all the issues relating to our existing portfolio as well as our investment strategies going forward.

Question on Net Divestment Strategy

QUESTION: I see that this year-round it's the second time in recent years where the divestment exceeds the investment. Could you tell us more on the reason? And also, what would you do with the proceeds from divestments?

PNG CHIN YEE: So, we went into the beginning of last year with the view that the US was late cycle, and that there was a risk of a recession. At that point in time our fears were that given the fiscal stimulus that was in place, the economy could overheat and that could prompt the Fed to act pre‑emptively to raise rates and that could cause the economy to tip into a recession. So, it was that in mind that we actually step up our divestment pace and also moderated our investment.

Today, I think we are faced with slightly different risk, and today I think the risk are more towards the Fed cutting rates in light of the slow down in global growth. And so I think even though the factors are slightly different, the fact still is that the global expansion has been late cycle and it's now slowing, so we remain cautious in this environment going forward. When we have proceeds, we will obviously look to redeploy some of that into what we think investment opportunities which are more resilient in this environment and so you would hear us talk about our themes and our structural trends. We think if we invest alongside those cautiously, we can actually better position our portfolio for the environment that we see ahead.

Question on China - Investments

QUESTION: So, we have observed that a share of the Singapore market shrank over the past three years while the share of China market keeps increasing. So, do you foresee that the China market will overtake Singapore market in the near future?

CHIA SONG HWEE: Maybe I'll take the first one. We actually do not have a target set for any particular sector or market. Our approach is bottom up. Of course, we have the top‑down view on where we want to locate resources and capital, but it all depends on opportunities. Having said that, China is a big market and [has] also represented more opportunities. So, to attract more capital from us in the US, Europe, and so on, is quite natural. Having said that, while the Singapore portfolio has reduced in weightage, in absolute dollar term, they are very sizable and continue to grow.

DILHAN PILLAY: And by the way, investment in China includes our portfolio companies that have an increased exposure in China over the years.

Question on China – Investments (2)

QUESTION: I've got a more specific question. So Temasek has invested in Chinese cell therapy companies, so my question is why cell therapy in China in particular, and also if there are any concerns that Chinese laws could compromise the development of these therapies?

CHIA SONG HWEE: Actually, the advancement in life sciences in China has been quite remarkable. We have also seen companies succeeding in getting non‑Chinese local clients. In fact, they are international, US, European‑based customers. And all these are also subject to very stringent FDA approval. The Chinese FDA standard is no less stringent than the rest of the world. So, we also rely and take comfort on that. The level of innovation and forward‑looking, both at a company level and the government agencies, have allowed this progress to be made and is actually very encouraging.

Question on Hong Kong – Investment Outlook

QUESTION: I just want to know how Temasek is viewing the recent developments in Hong Kong, whether you're concerned and if yes, how is that going to affect your investment approach moving forward?

PNG CHIN YEE: So the way we look at these events is really with an eye on what it does for our portfolio and how we should position ourselves for it and today we don't really have direct exposure to the Hong Kong market. We do have investments in a number of stocks which are listed on the Hong Kong exchange, but they represent exposure mainly from China. So, from that perspective, you know, it's not significant impact for our portfolio and that's how we would regard them.

Question on India – Investment Outlook

QUESTION: I want to slip in a question on India. What are your plans with scaling up in India, you know, given that we've just had Prime Minister Modi be re‑elected and we've just had a new budget being laid out, as also the fact that, you know, it's one of the high‑growth economies in this part of the world?

PNG CHIN YEE: Maybe I can take that. So, we've actually been increasing our exposure to India over the years and we're committed to do so. It's a very attractive market for us from a demographic perspective of rising affluence. You know, the Modi Government has made quite a few reforms in his first term and we expect that to continue in the second term and we've seen the bankruptcy code being very meaningful in terms of helping banks resolve the corporate NPL issues that's been plaguing the market for a very long time. We've seen GST reforms as well. So, we want to see more of those reforms coming through in the market.

I guess the budget that was just announced, we see that as being a fiscally prudent and as good for the long term. I think the market may have been a little bit disappointed that it was not more growth focused, but I think for us, you know, we look at long term, so we think that's actually quite positive. Almost half our investments in India are in the financial services space, banks, insurance, we continue to build that. Beyond that we also we're very active in technology, consumer, you saw our investments in Ola Cabs last year as well. So, I think that's an area that we actually do want to spend more time and build our portfolio.

Question on Japan - Investments

QUESTION: I understand that Asia accounts for two thirds of your portfolio. Could I ask how much does Japan account for, and would it be increased or reduced in the near future and possibly why?

PNG CHIN YEE: So, we continually look at Japan as a market of interest. I think there are companies there who are very strong in technology and so that's where we're spending a lot of time. But I guess for today, the exposure to Japan is immaterial.

CHIA SONG HWEE: And the senior management continue to visit Japan. I was in Japan just a couple of months ago and get ourselves frequently updated on what is the development over there, and we are keen to explore opportunities and if we do come across, we will do so.

Question on Digital Banking

QUESTION: So MAS recently announced that they're going to issue up to five digital bank license. How do you see that this will disrupt your investment in the banking sector? Thank you.

PNG CHIN YEE: So I guess on the digital banking licences that the MAS is issuing, I think MAS is actually widely regarded to be a very innovative regulator and I think this is just another step as it tries to encourage innovation in the domestic banking system. And if you look, actually the Singapore banking system is very open. There's so many QFB licences which have been issued in the past. Again, it's just a journey. So, we think it's going to be good to encourage further innovation. Hopefully the new players can help to serve the underserved and meet the unmet needs of the marketplace.

The domestic banks themselves are also actually allowed to have digital banks, so they can also build their own digital banks in the context of that. So, I think it's ‑ I think that it will be good for everyone. I don't think there's going to be a significant disruption for the domestic banks. They've also been on their own digitisation journey. They've all been working very hard to improve the services that they are offering to all Singaporeans. So, I see it from that context.

Question on Retail Bond

QUESTION: One more question about the retail bond. We know the retail bond issue by Temasek last year received an overwhelming response. So, would you continue to push for the retail bond market to grow, maybe, for example, to push for Temasek companies to issue more retail bonds in the future?

DILHAN PILLAY: Whenever we've looked at raising bonds it's with respect to whether ‑ we look at market factors, right? We look at the opportunity to market, interest rates, currencies, we look at demand and so on and then we decide is it the right thing to do? Yield curves and the periods. So these things are things we look at, you know, continuously and from time to time so I can't give you a precise answer because it really depends whether we think it's the right time to do something or not with the right outcomes. So, I would say I can't comment more than that because right now, that's where we are today in evaluating the opportunities as we always do.

CHIA SONG HWEE: With regard to the portfolio companies, it's up to the board of management to decide on their own. We won't influence them on that.

Question on Institution – Engaging Portfolio Companies on Restructuring and Reskilling of Jobs

Question: The final question I have is on Singapore. Of course you're very much engaged in Singapore. Singapore is, of course, going through a restructuring phase. How are you engaging your portfolio companies to ensure that jobs are reskilled and also to ensure that the buffering against a tech disruption that is clearly ahead? Thank you.

DILHAN PILLAY: When it comes to the next thing, and by the way, there's some things which Song Hwee is working on which I ask him to go through after this. But then comes to the next thing which is what you mentioned is the restructuring phase of the economy. I wouldn't call it a restructuring phase, I would call it a repositioning phase. Every globally competitive economy has to think about this. The world is changing, or the world has changed, right? And industry 4.0 is there and there's a need for us to embrace industry 4.0, embrace technology as being part of every facet of our life, including corporate Singapore.

Many of our companies are on that journey and so it's very important for them, as they think about what robotics, automation, processing, digitisation, AI, blockchain, means to them, they have to ensure that their employees are also up there as well. We've always succeeded based on a very close relationship between our companies, the unions, the employees, that is a strength. We have to play to that strength and that includes reskilling, upskilling, training, retraining, job design, job redesign, business model design, of all our companies. That's a journey that we have started with them as well. You know, we've fostered tripartite discussions on what the future looks like in connection with the industry transformation maps that are relevant to them. But we're moving further than that. There is a thing called the Company Training Committee framework which the NTUC has come about where companies, unions, workers and then those who provide programmes as Skills Singapore come together in the context of worker training and upskilling. That should lead to improved productivity. That should lead to benefits that can be shared more widely. So that's something we ourselves are paying attention to in this new world.

CHIA SONG HWEE: I will just add that all across for the last four to five years, many – in fact I would say all – of our portfolio companies in Singapore have embarked on some form or the other of innovation, especially on the digital side, in two forms. We understand that half of the investment that has been made is to improve productivity and efficiency, automation and so on. But the other half is to invest in enabling new revenues and new growth opportunities. So, we are actually quite encouraged. Of course, some are further down the road like DBS, like SATS – the ground handling company. Others are catching up. We take comfort that none of them are staying static. They are reacting to the headwinds that they're seeing in the business and reacting, and some of them actually being at the forefront of it.

PNG CHIN YEE: I just want to add one point to say that obviously we're working with the unions and the companies and the tripartite discussion as to how to reskill and upskill the workforce. But actually, a lot of the portfolio companies are doing that themselves. So, for example, DBS, you know, we know that we had a lot of bank tellers in the past and today maybe we don't need quite as many bank tellers so we're reskilling those to be customer service representatives, to look at cross‑value investment products on top of deposit products, etc. So, I think our companies are doing that to help their work force transition as well.

Question on Institution - Succession Planning

QUESTION: Can we just get a sense of what Madam Ho is doing in the company and how is the leadership transition going?

DILHAN PILLAY: Right now, she's watching all of us. [Laughter] Ho Ching, look, I joined Temasek nine years ago and the one thing about Ho Ching is that she's empowered all of us to take leadership in this company and she was very focused on making sure that we owned the future, for ourselves and for those who work with us and for the stakeholders who depend on us. And so, she's very much now involved in the stewardship aspects of Temasek, as CEO of Temasek Holdings. She still keeps a watchful eye over all of us to make sure we continue to do the right thing. But that's really her main focus, the stewardship part and the doing right part. The sustainability journey that we've undertaken was started by her and, you know, all of us are now onto it. And so that's her role and that's her role as CEO of Temasek Holdings.

The investment arm is actually Temasek International. That's been evolving over the years and today the oversight of our investment activities lies within Temasek International and the team of people who lead it. I hope I answered your question.