Transcript: Temasek Review 2019 Media Conference

The following is a transcript of the Presentation of the 2019 Temasek Review. The text should be read in conjunction with the slides shown in this transcript. It has been edited from delivery only for readability.

To refer to a selected transcript of the Question & Answer session which followed, click here.

To see all of the key financial metrics and diagrams in the 2019 Temasek Review, please click here.

STEPHEN FORSHAW:

Good afternoon, ladies and gentlemen, my name's Stephen Forshaw. Welcome to Temasek Review 2019.

Today's presentation format—we will have a video to summarise the year in review, just to come. I know you've just seen some videos, you're going to see a few more during the afternoon. Then we'll have a presentation. We have two presenters today. First up, John Vaske, our Head of Americas, is joining us, and he'll be followed by Png Chin Yee, who is our Head of Financial Services and Senior Managing Director of the Portfolio Strategy and Risk Group. Each of them will present this afternoon. Then we'll move to your questions and answers. For the Q&A, the two presenters will also be joined by Dilhan Pillay, the CEO of Temasek International and Chia Song Hwee, the Chief Operating Officer of Temasek International for your Q&A.

Also, a reminder today that we report in Singapore dollars, so all figures that you see today will be in Singapore dollars unless otherwise indicated. Our reporting year is for the period from April 1, 2018, to March 31, 2019.

Also, I just want to highlight to you one important pointer on a change to the accounting standards that comes into effect for this year. So, for your benefit, you will see an attachment to the media release that explains to you the changes to the reporting of our group net profit as a result of the implementation of International Financial Reporting Standard Number 9, IFRS 9. Just let me take a moment to explain the consequence of that.

As an investment company, we report our performance in two ways—that is the portfolio performance and group financials. The portfolio performance is the primary way we use to measure our performance and consists of Net Portfolio Value and Total Shareholder Return. Group Financials is a consolidation of the financials of Temasek and its operating subsidiaries. As I think you know, from time to time, accounting standards change and we have to implement those. This year, we have adopted, or as Singapore has adopted and converged to the International Financial Reporting Standards (IFRS)--we've adopted those reporting standards for our annual report.

The consequence of IFRS 9 means that changes in the market value of our sub-20% investments—that is companies in which we hold less than a 20% share—of which there's about 40% of the portfolio, are moved and consolidated into the group net profit result even though they are not realised. This is important because, as you will see from the attachment on the press release, it will lead, over time, to material fluctuations in the group net profits. I wanted to highlight in particular upfront why that will be occurring in future and we've given you a look back comparison of what that would have done on the last ten years of data.

So just want to make sure you understand that, keep it in perspective, but the key point for us is that it doesn't affect the way we report our portfolio performance through Net Portfolio Value (NPV) and Total Shareholder Return (TSR) because, as we mark the portfolio to market, NPV already includes the mark to market gains or losses on sub-20% investments. We can deal with any questions you have on that, but the attachment is in the press release and also, it's explained on page 50 of the Temasek overview.

So, with that, let me now introduce the video and then welcome John to the stage for the start of Temasek Review 2019.

JOHN:

Good afternoon, and as Stephen mentioned earlier, I’m John Vaske and I would like to extend my welcome to the launch of Temasek Review 2019. Today we'll be giving you an overview of our performance, as well as some key updates and highlights for the financial year.

At Temasek, we are committed to do well, do right, and do good, as an investor, institution, and steward.

As an active investor and shareholder, Temasek is committed to doing well by delivering sustainable value over the long term.

Let me now take you through our performance.

As context, we use Net Portfolio Value, Total Shareholder Return, and our Risk-adjusted cost of capital as key indicators to track, measure and report our portfolio performance.

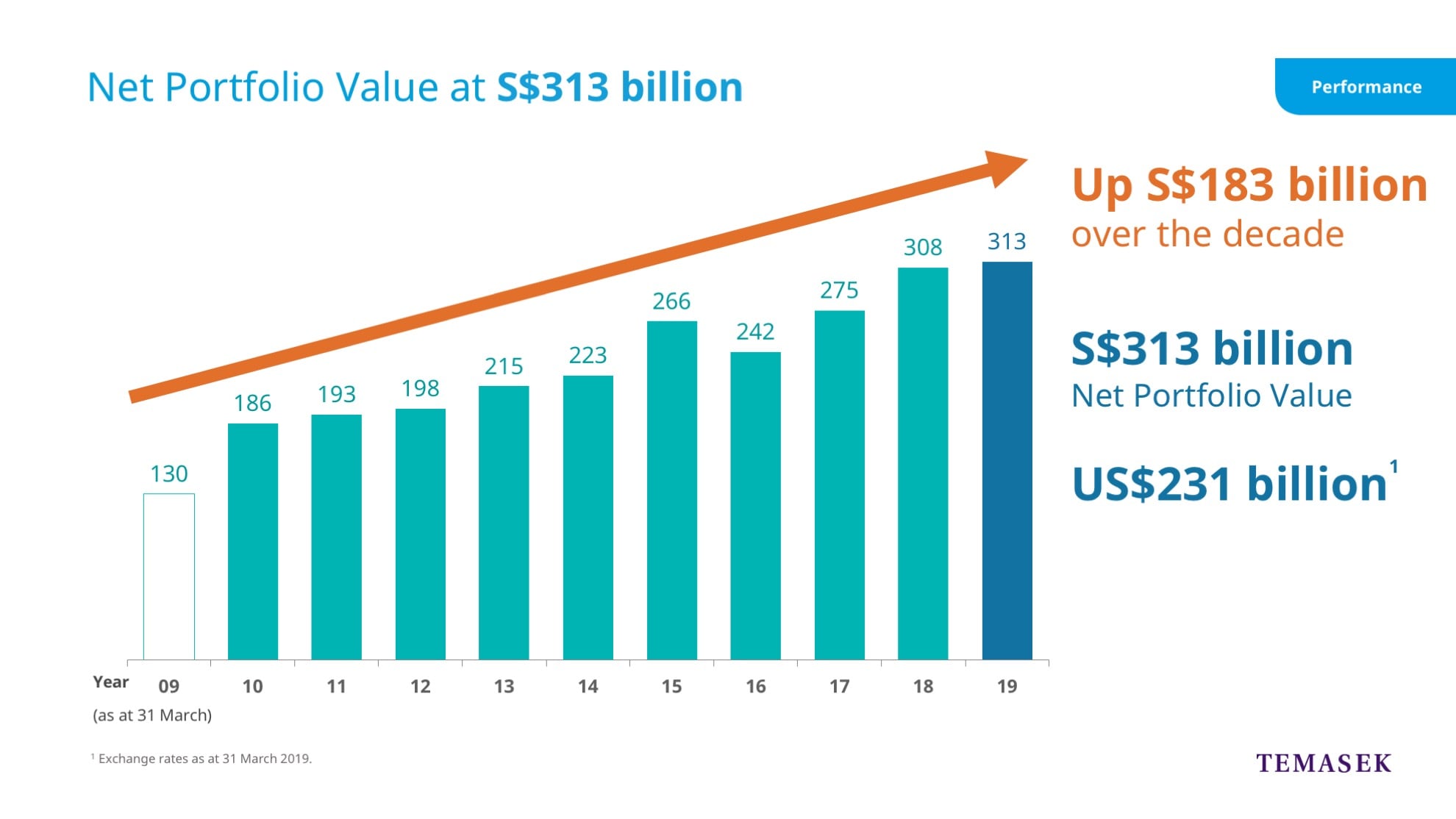

Let me start with our Net Portfolio Value, or NPV.

As you saw in the video a moment ago, we ended our last financial year with a record NPV of 313 billion Sing dollars.

Our US dollar equivalent was 231 billion US dollars, as of March 31st, 2019.

Over the decade, our NPV was up 183 billion Sing dollars.

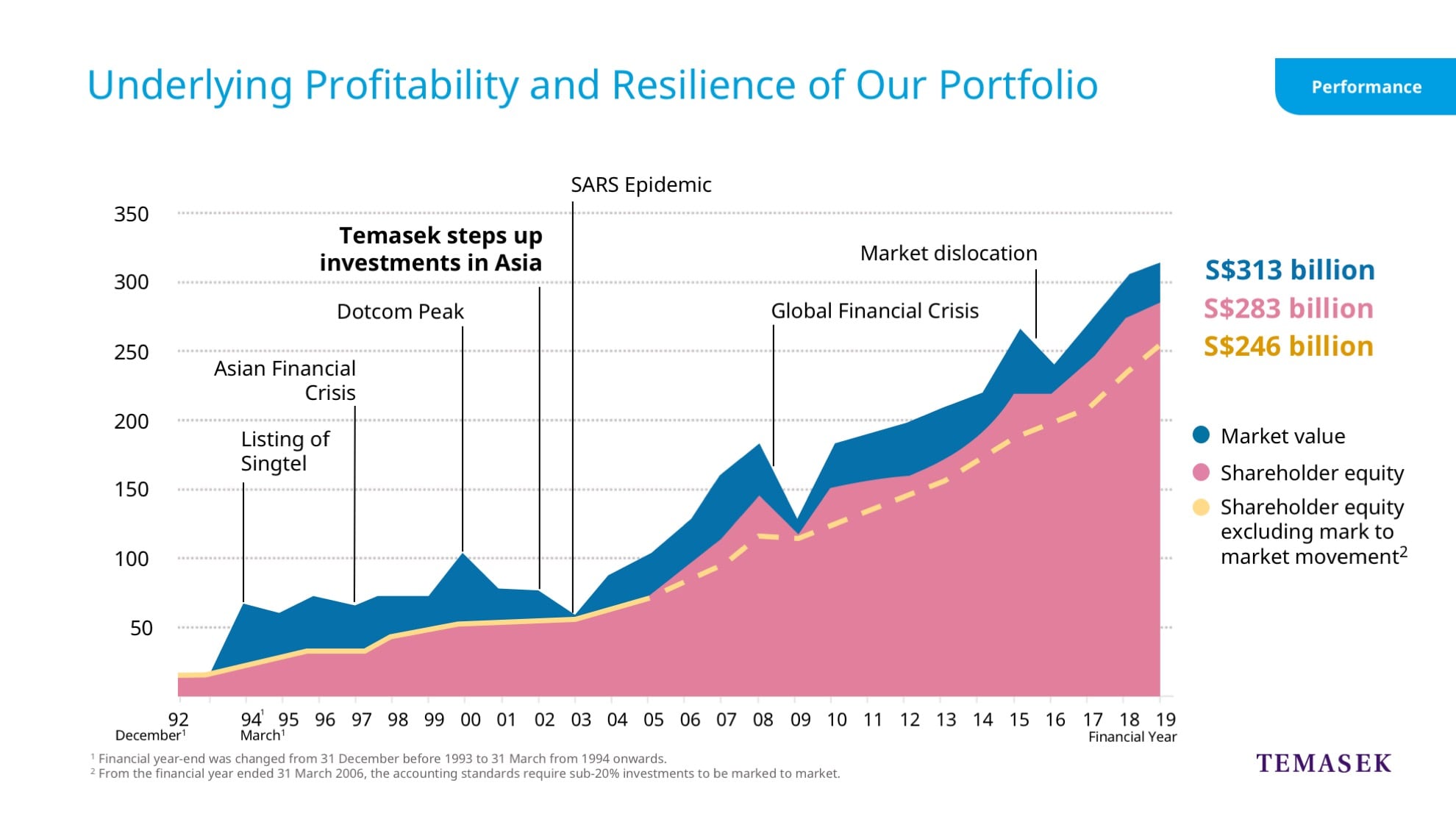

In the next chart, the blue area shows our portfolio, by market value.

As you can see, it rises and falls, and is volatile on a year to year basis.

The pink area reflects our shareholder equity.

Next, the yellow line shows our shareholder equity excluding mark to market movement for our sub-20% investments.

There was a change in accounting standard after March 2005, and hence the dotted yellow line from Mar 2006 shows what our shareholder equity would have been, without the mark to market movement of our sub-20% investments.

The yellow line reflects the underlying performance of our portfolio companies.

As you can see, it is more stable compared to the blue and pink areas.

This is an indication of the resilience of the companies in our portfolio.

For the financial year ending 31st March, our market value was 313 billion dollars.

Our shareholder equity was 283 billion.

Excluding the mark to market effects of our sub-20% investments, our shareholder equity would have been 246 billion.

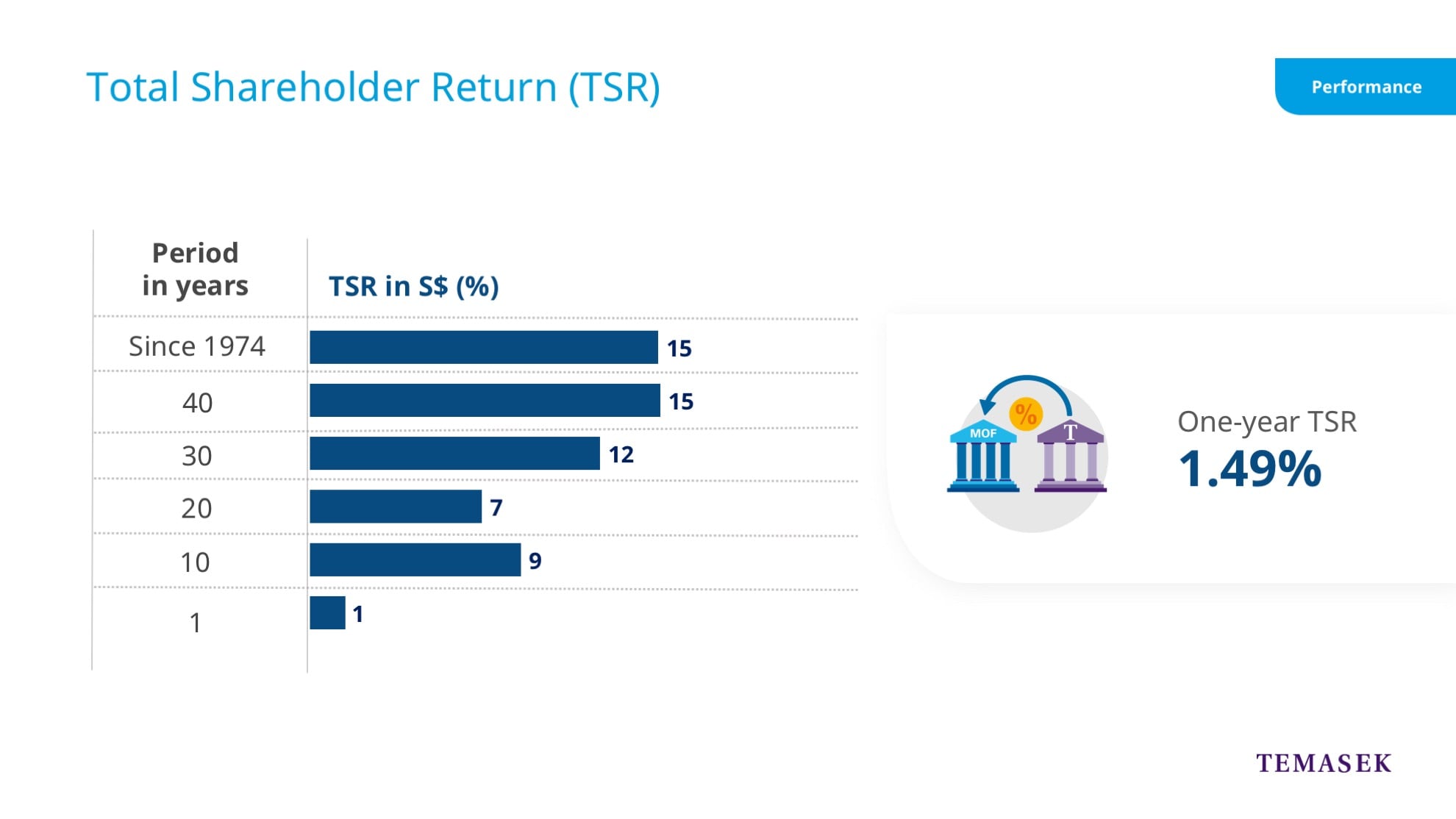

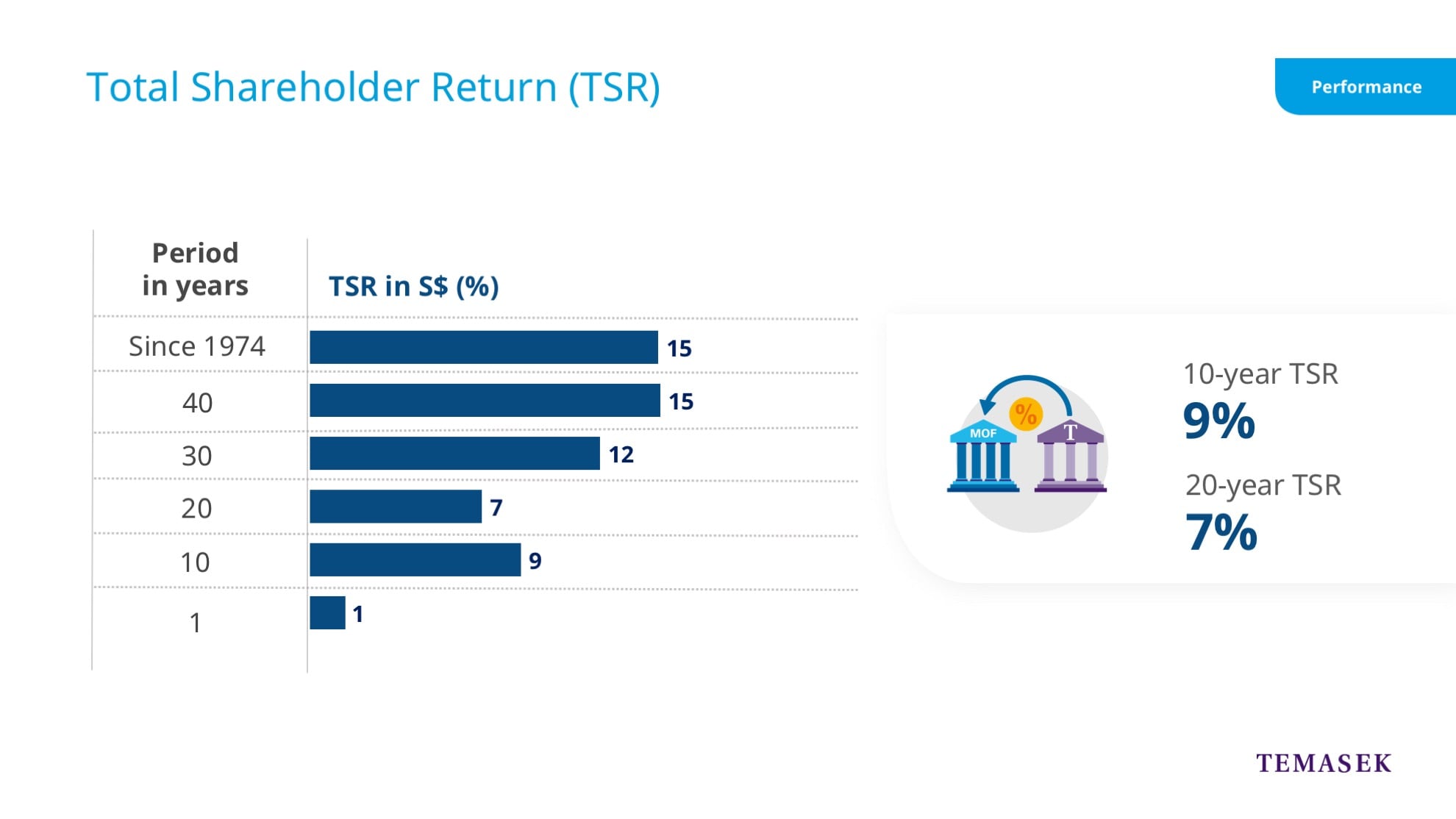

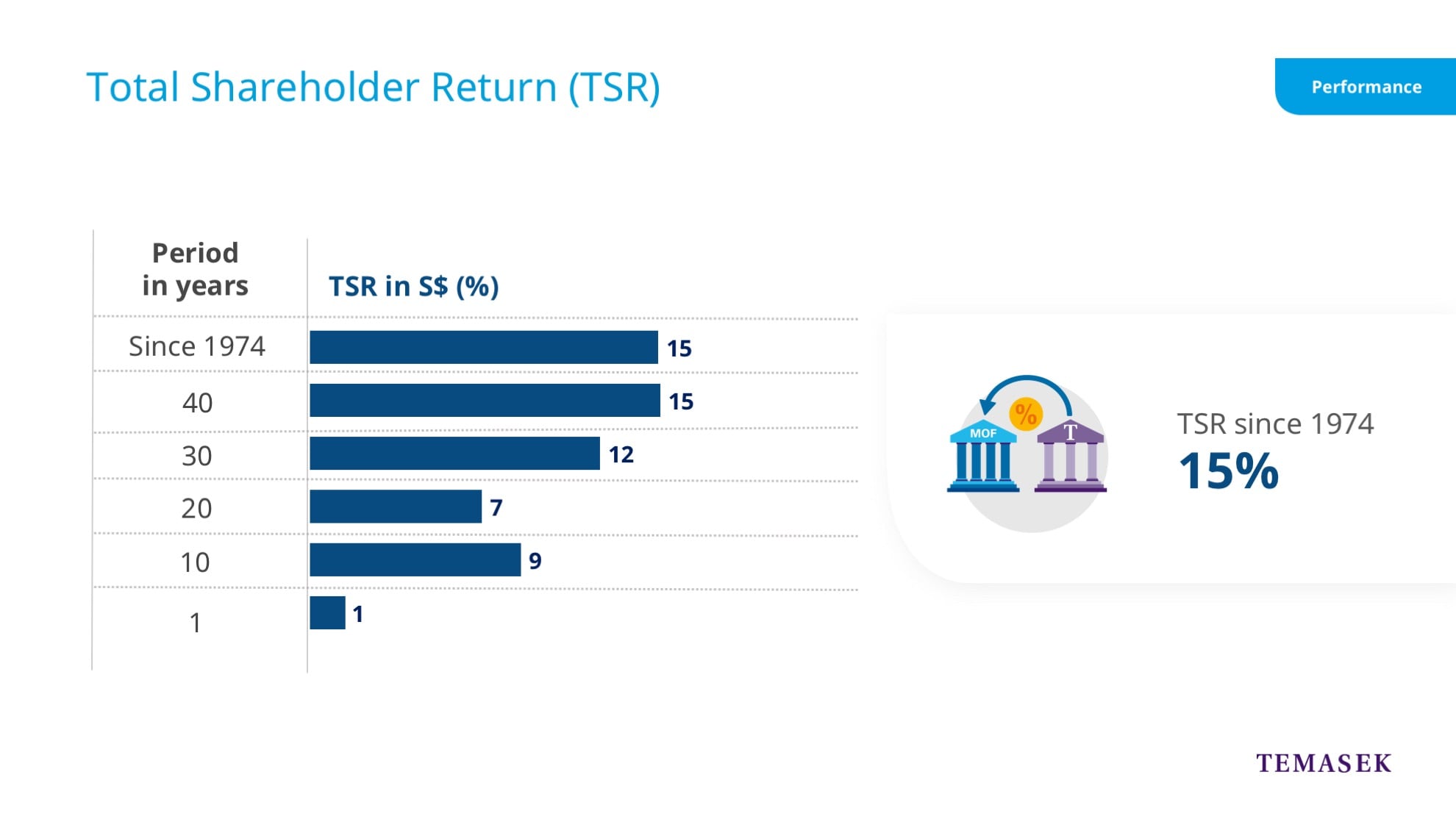

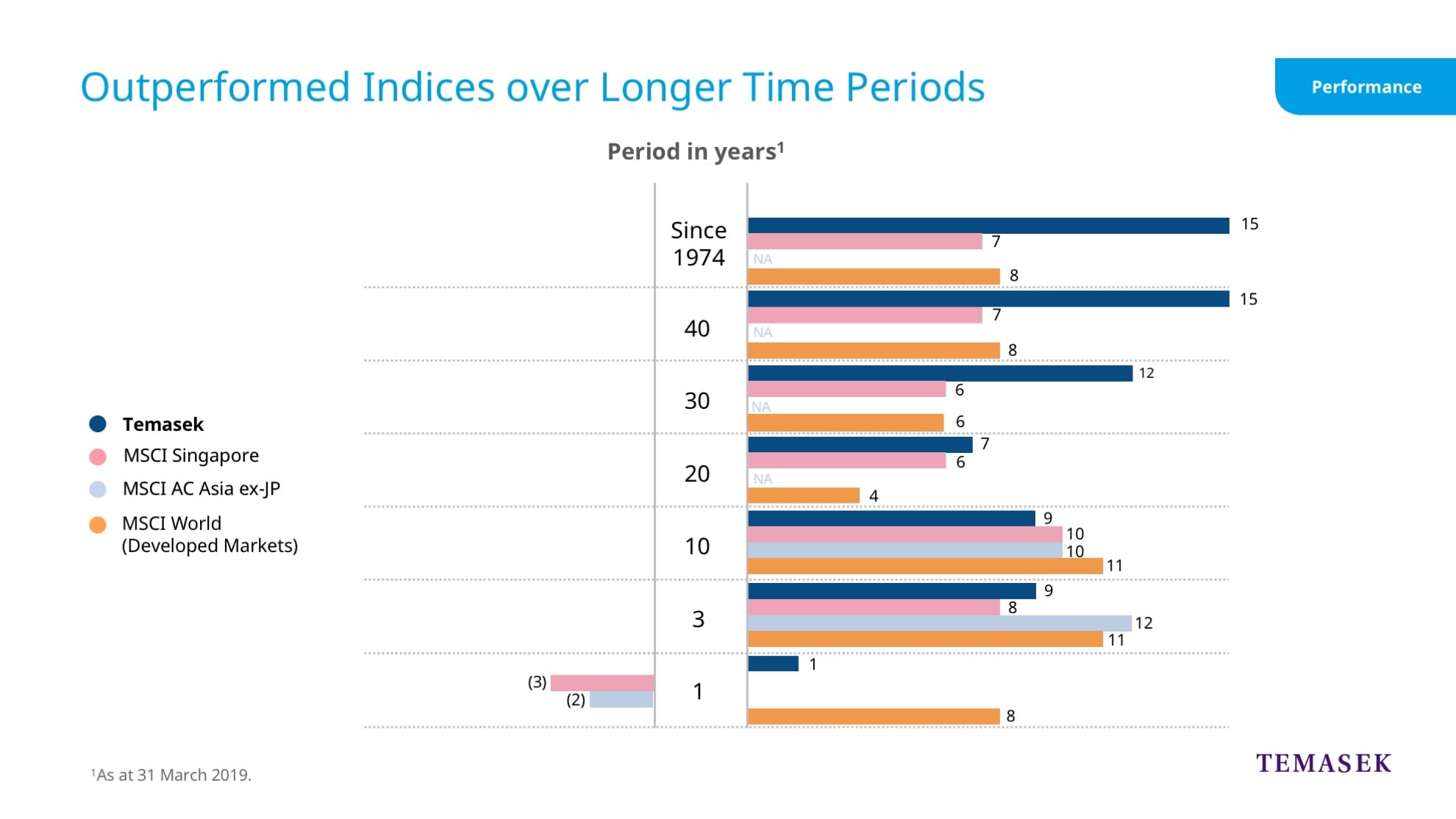

This chart shows our Total Shareholder Return, or TSR, over different time periods.

These returns include the dividends paid to our shareholder and exclude capital injections from our shareholder. Our one-year TSR was 1.49%.

Our longer term 10- and 20-year TSRs were 9% and 7% respectively.

Our TSR since inception in 1974 was 15%.

Let me now explain our risk-adjusted cost of capital approach.

It is built bottom-up, investment by investment.

It takes into account the country, sector and company risks.

We then aggregate the results from all our investments to give us an overall number.

In other words, we don’t have a target for our risk-adjusted cost of capital.

Instead, the number we report is an aggregated bottom up figure.

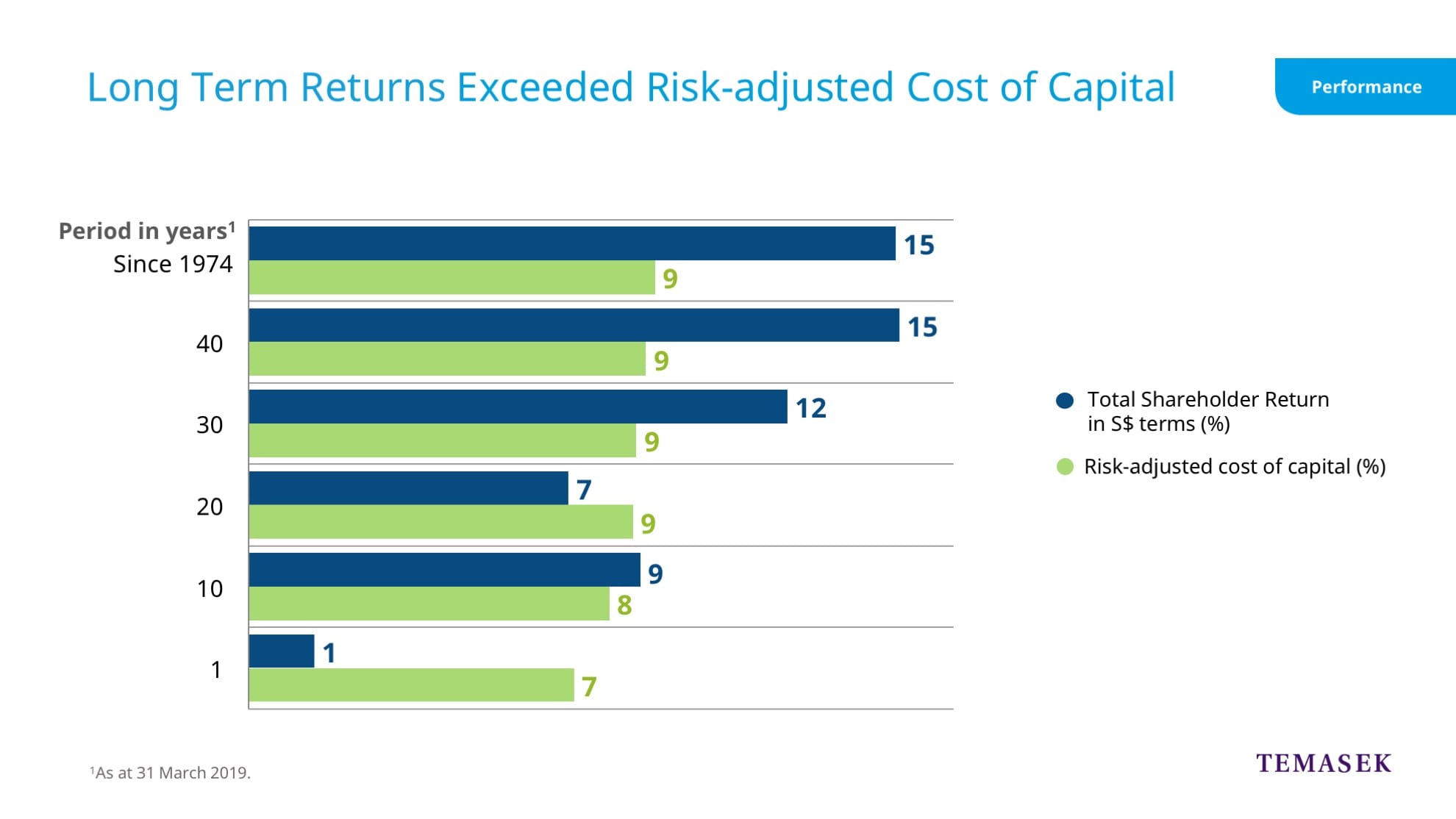

Our long term returns have exceeded our risk-adjusted cost of capital.

Here, we see the blue bars of our total shareholder returns again.

The green bars represent our cost of capital, aggregated bottom-up over the different periods.

Although we have a small positive one-year TSR, we did not meet the risk-adjusted cost of capital.

However, as you can see, our long term returns have generally exceeded our risk-adjusted cost of capital.

We don’t manage our portfolio by public benchmarks, but some of you may be interested to know how we have done relative to various indices.

Here we have our returns over different time periods.

Let’s take a look, first, at the MSCI Singapore Index – this was negative over the last one year.

Similarly, the MSCI Asia index excluding Japan was also negative for the last one year.

Then, we have the MSCI World index over various time horizons.

Overall, Temasek has generally outperformed these indices over longer time periods.

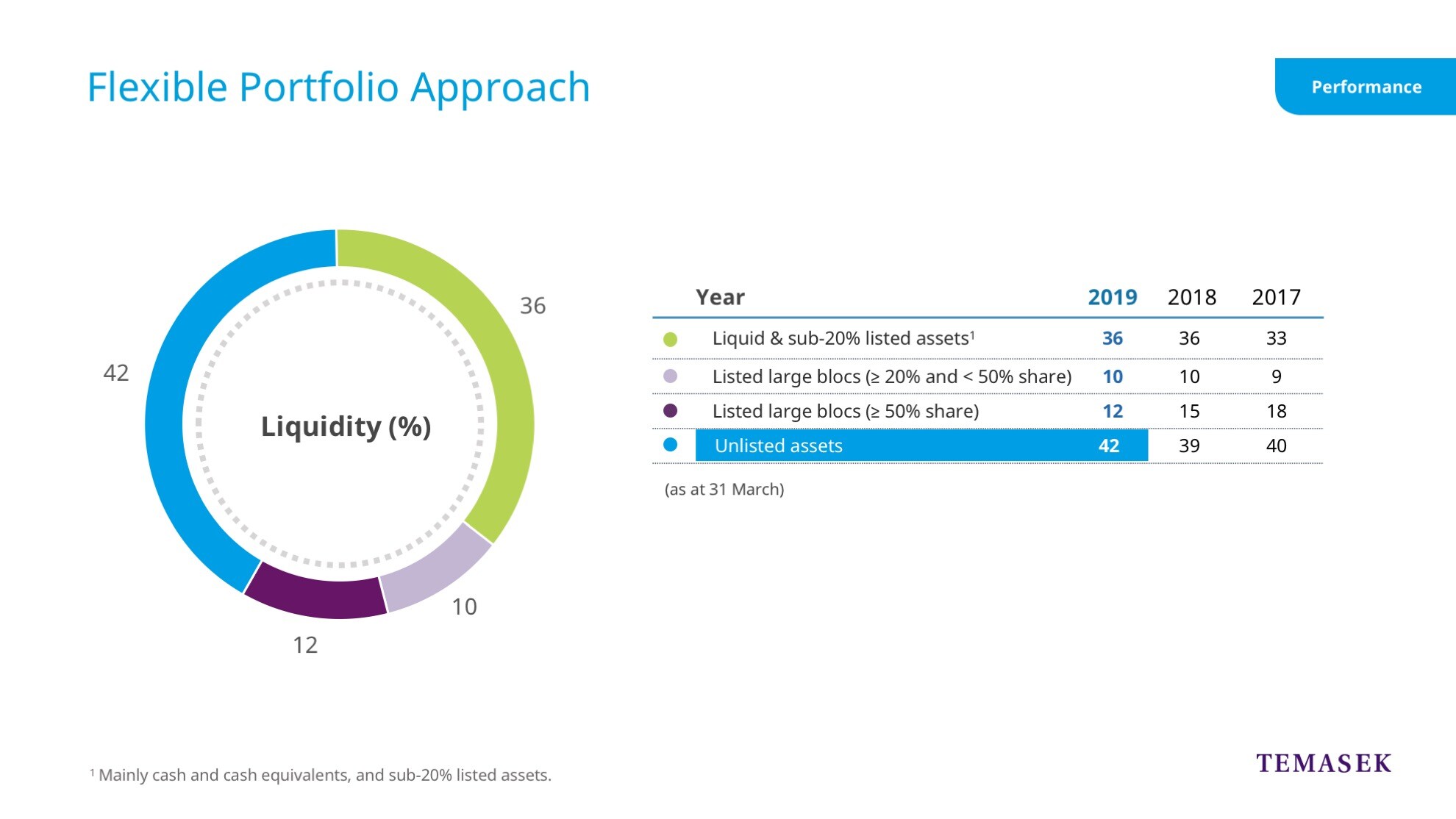

At Temasek, we have a flexible portfolio approach.

This pie chart shows the liquidity mix of our portfolio.

Our largest exposure in blue is in the unlisted space, at 42%.

Our unlisted blue chip companies include Mapletree, Singapore Power and PSA.

Our unlisted assets also include high quality funds.

Together, they pay steady dividends and distributions.

Our investments in funds have been instrumental in providing co-investment opportunities.

They also help us gain deeper insights into new markets.

As you can see, we have the flexibility to deploy capital across both private and public markets.

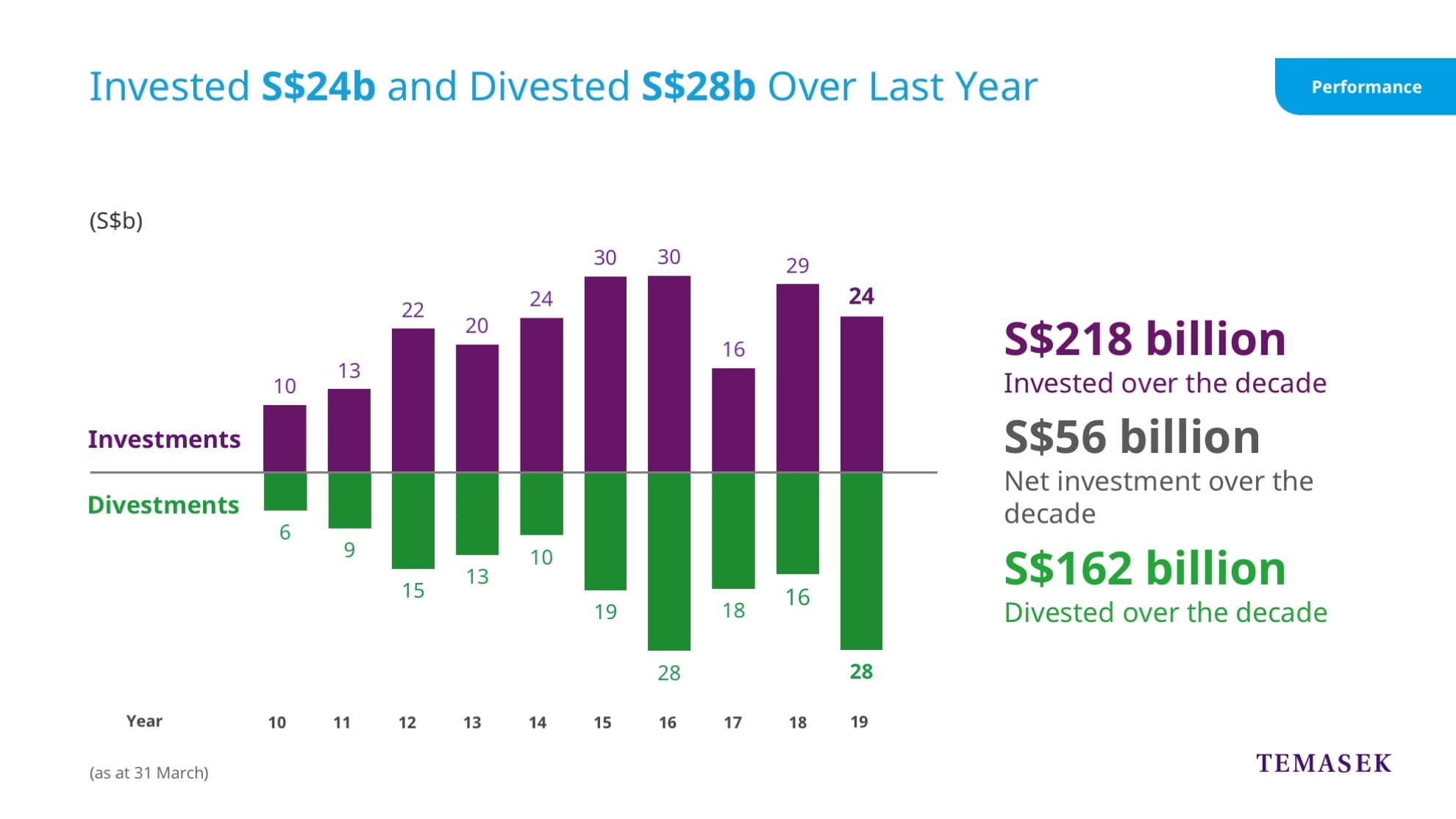

Let’s next take a look at our overall investment activities.

Last year, we invested 24 billion dollars and divested 28 billion.

As you can see, we have been active over the past ten years.

Over the decade, we have invested a total of 218 billion dollars and at the same time, we have divested a total of 162 billion.

This represents a net investment of 56 billion over the past decade.

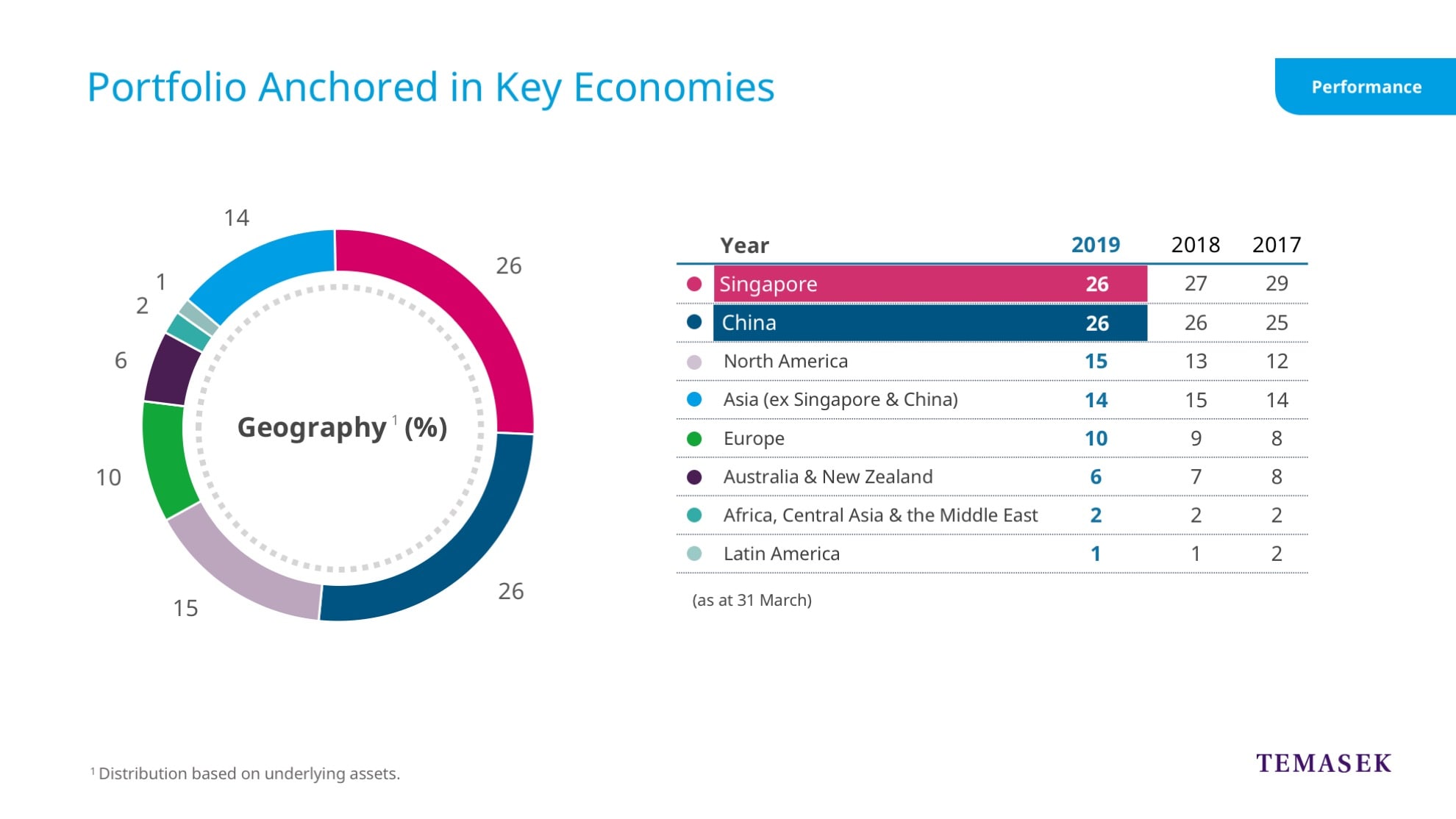

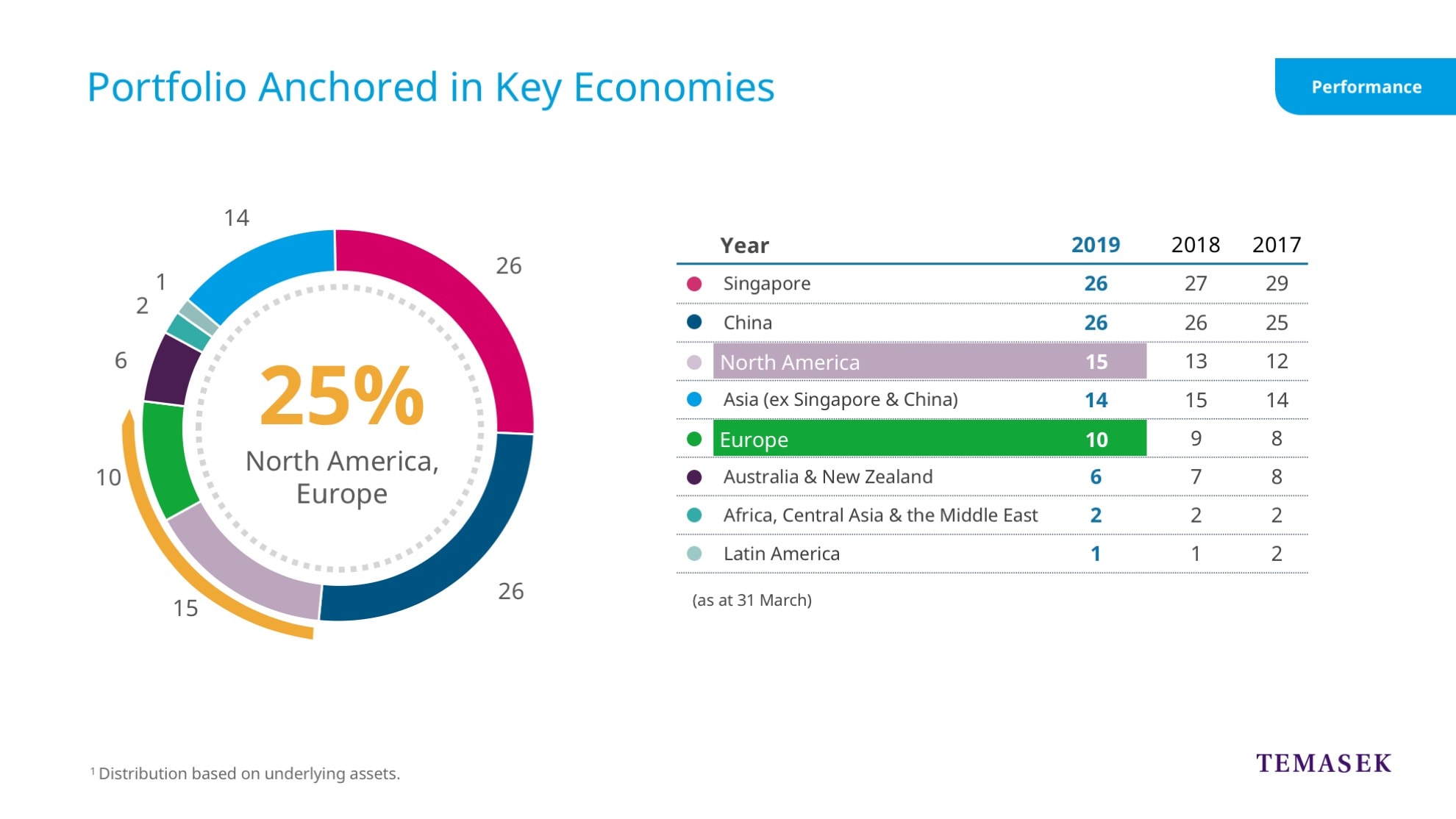

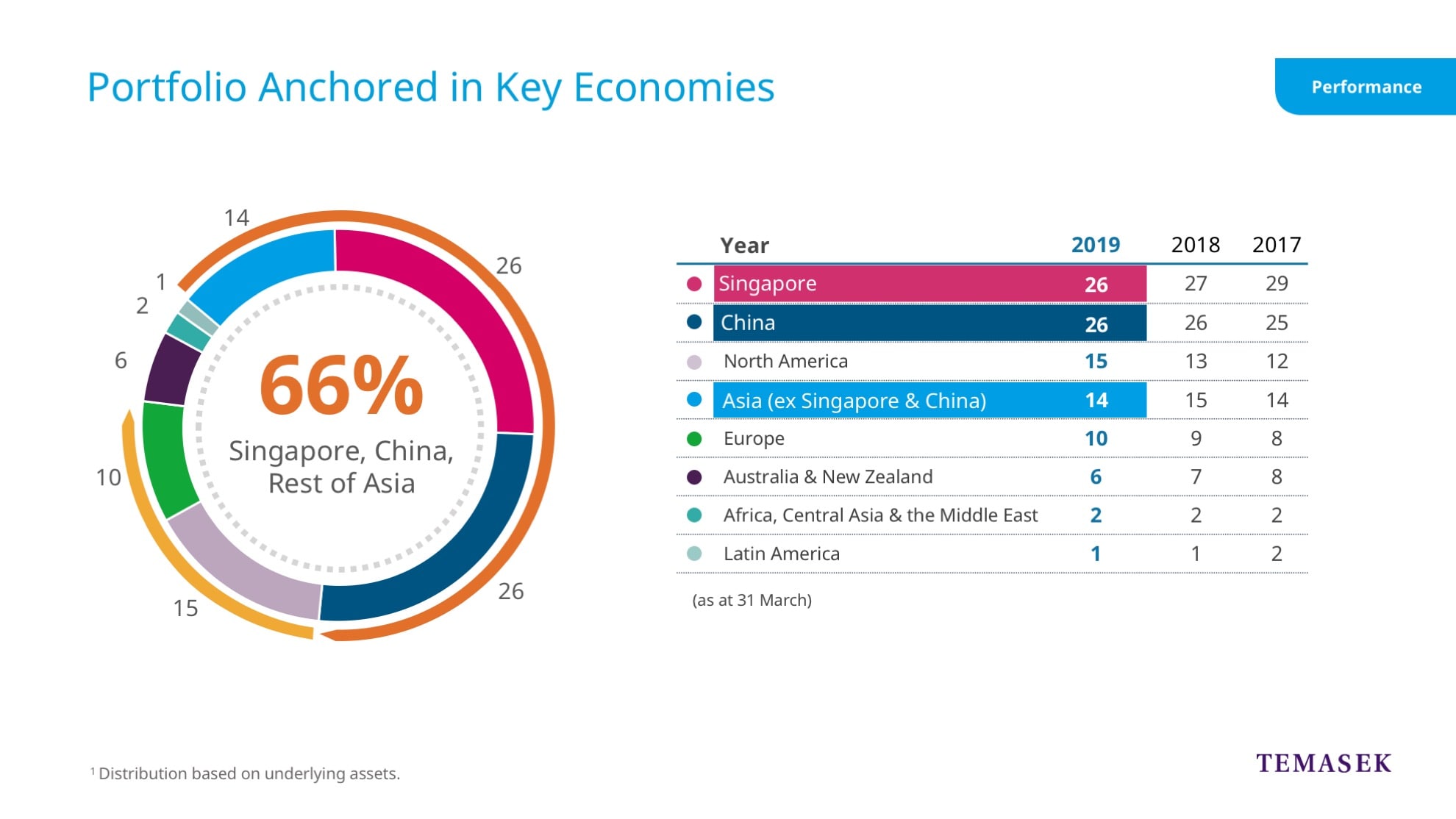

As you saw earlier, the next pie chart is our portfolio mix by geography.

Singapore and China are our top 2 country concentrations, at 26% each.

North America and Europe, together, now represent a quarter of our portfolio.

The US again accounted for the largest share of our new investments during the past year.

Overall, we remain anchored in Asia, representing about two-thirds of our portfolio.

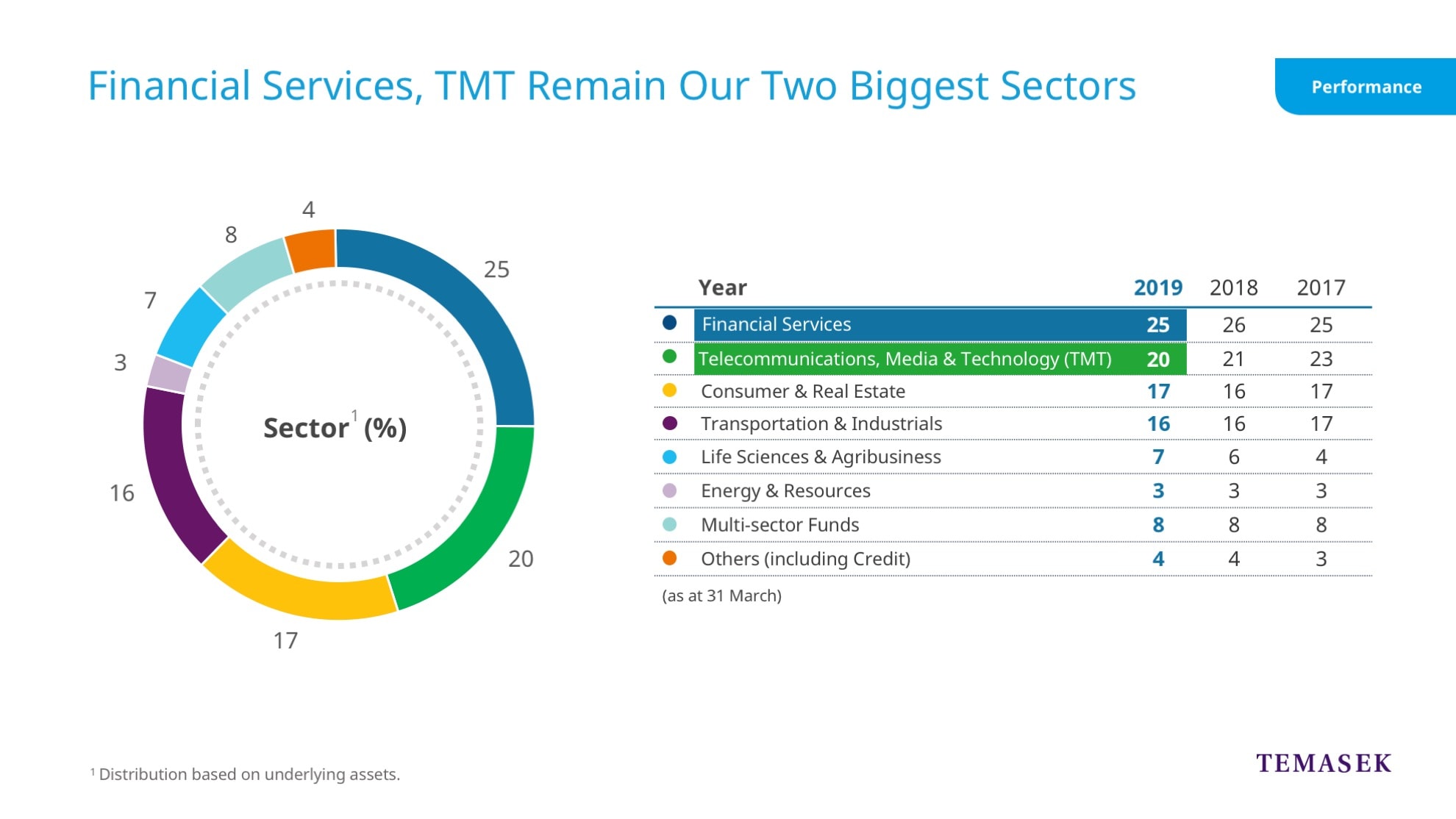

Here is a snapshot of our portfolio by sector.

Our two largest sectors continue to be Financial Services at 25% and Telecommunications, Media and Technology, at 20%.

We are committed to invest for a better, smarter and more sustainable world.

In the video earlier, you saw some of the six structural trends, which shape our investment direction.

Longer lifespans, rising affluence and sustainable living – these trends drive social progress.

Technology has also enabled a more connected world and a sharing economy, with smarter systems.

Take longer life expectancies for example – this presents a number of global challenges and opportunities.

This is why we are investing in companies such as BeiGene, which focuses on developing novel therapies for cancer.

In addition, we have also set up Sheares Healthcare Group – this focuses on healthcare delivery services in Asia and around the world.

Likewise, the combination of rising affluence and advancing technology have led to investments in companies like Omio, a travel search engine in Europe, and VNG Corporation, an entertainment, social networking and e-commerce platform in Vietnam.

Companies like Pivot Bio in the US and Sustenir Agriculture in Singapore provide sustainable solutions for food sources – they help ensure that our natural environment is protected and preserved.

In terms of technology enablers, breakthroughs in fields such as Artificial Intelligence and robotics have the potential to transform a wide range of industries.

We have invested in companies which help connect the world more conveniently.

These include DoorDash, a North American online marketplace for food delivery and Zilingo, an e-commerce fashion marketplace based in Singapore.

Companies which help share resources more efficiently and conveniently include Ola Cabs, an online ride-hailing company in India and Rent the Runway, a subscription fashion service in the US.

We also invested in several innovative early stage AI companies across the world.

These include Eigen, an AI company targeting finance, law and professional services sectors and AirMap, an unmanned traffic management platform for drones.

Going forward, investments in these areas are expected to form a larger part of our portfolio.

Let me now share a video on how we’re investing for a more sustainable world, with a particular focus on agriculture, food supply and food safety.

CHIN YEE:

Good afternoon. My name is Chin Yee.

Today, I’ll be sharing with you our views on the global outlook, and I’ll also take you through some of our community engagements.

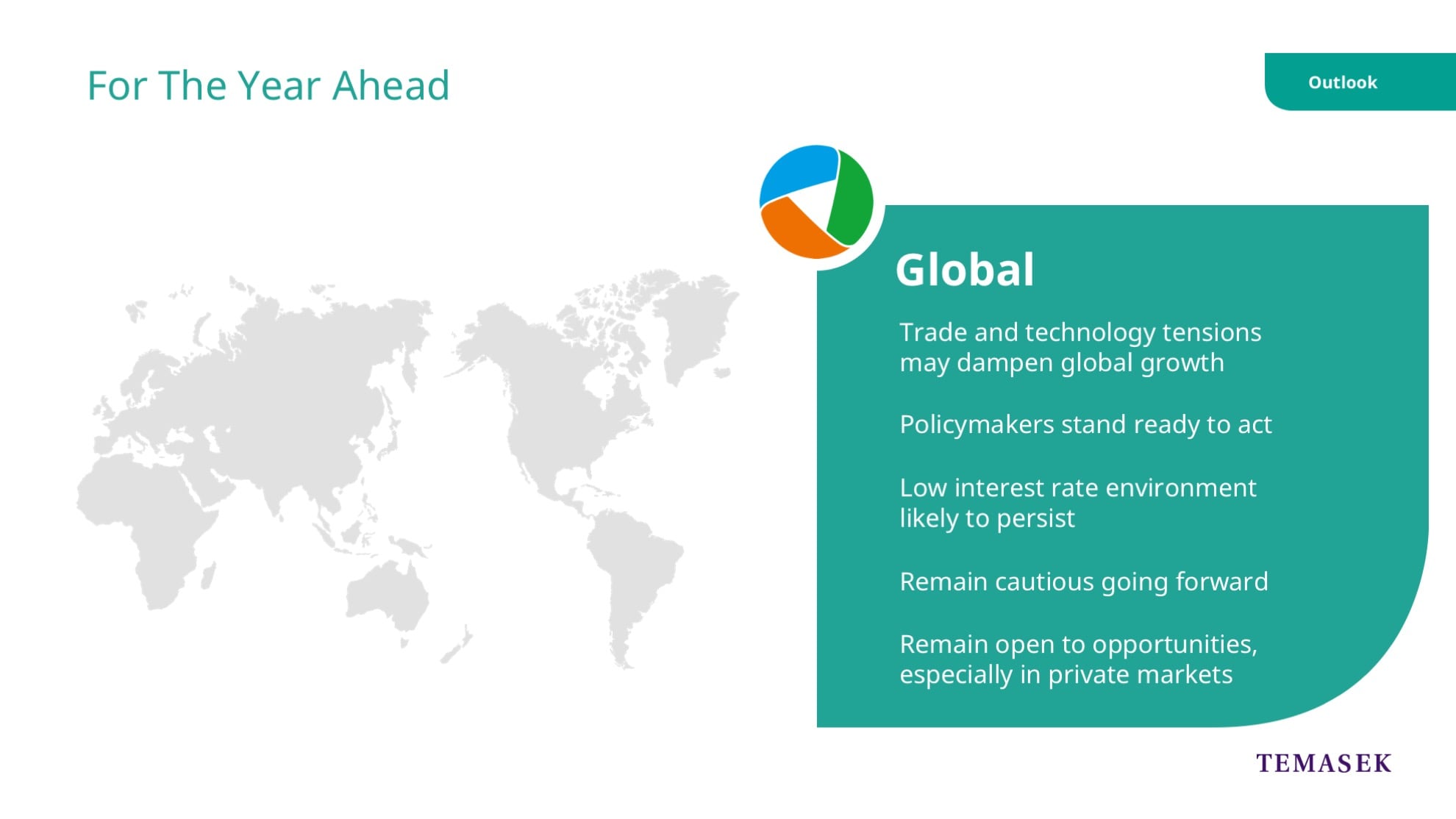

Overall, global growth has weakened since the middle of 2018.

We expect this to continue.

Trade and technology tensions are already disrupting supply chains.

Business confidence is being tested.

Capital investments have slowed.

Restrictions on the technology front could lead to a bifurcation of technology systems globally.

This could have meaningful impact for medium term growth and productivity.

Policymakers have signaled their willingness to undertake accommodative actions, but such policy space is limited particularly in markets where rates are already low.

If growth remains weak, the low interest rate environment is likely to persist. This could lower returns expectations into the foreseeable future.

Following from our investment stance last year, we remain cautious going forward.

But, as always, we remain open and alert to investment opportunities in strong, resilient companies, with an added focus on private markets.

Let me turn to a few key markets in a bit more detail.

I’ll start with the US.

Growth has already started to moderate.

Business sentiment is weakening as tailwinds from fiscal stimulus start to fade.

The imposition of tariffs has started to weigh on the US economy.

This comes against a backdrop of polarised domestic politics.

Growing risks to the economy and low inflation expectations will likely prompt the Fed to cut rates in 2019.

This could help extend the current late-cycle expansion and reduce the risk of a recession in the near term.

However, recession risks remain in the medium term.

With slower growth, the economy is likely to become more vulnerable to negative confidence shocks.

This could come in the form of a much more hardline stance on China, or evolving geopolitical tensions, such as those we’re seeing between the US and Iran.

In China, the growth outlook could come under additional downward pressure in the event of a prolonged standoff with the US over trade and technology.

Policymakers continue to have room for easing measures to cushion a slowdown in growth.

They are likely to respond with fiscal support.

Timely and targeted structural reform can help drive domestic consumption, and that is why we remain optimistic on China over the medium term.

Moving on to Europe, growth remains weak.

The European Central Bank has limited policy space despite its readiness to act.

Risks are tilted to the downside.

We are concerned that a disorderly Brexit could inflict further harm.

This is because the UK is the Eurozone’s second largest trading partner.

Populism remains a key feature of the European political landscape.

This could impact policies, and the pace of required reforms.

Back home in Singapore, the economy is moderating alongside the global slowdown.

Geopolitical and trade tensions continue to pose downside risks.

However, we remain confident that Singapore will stay competitive.

Asia continues to be a fast growing region.

Singapore can benefit from this, so long as she maintains an open and competitive business environment, and continue to upskill and reskill her workforce.

So that wraps up our views on the outlook for global markets.

But, of course, investing is not the only thing that we do.

At Temasek, you would know that we have three roles—an investor, institution and steward.

Doing right as an institution, and doing good as a steward, underpins our ability to do well as an investor.

Let me share with you some of our efforts in this area.

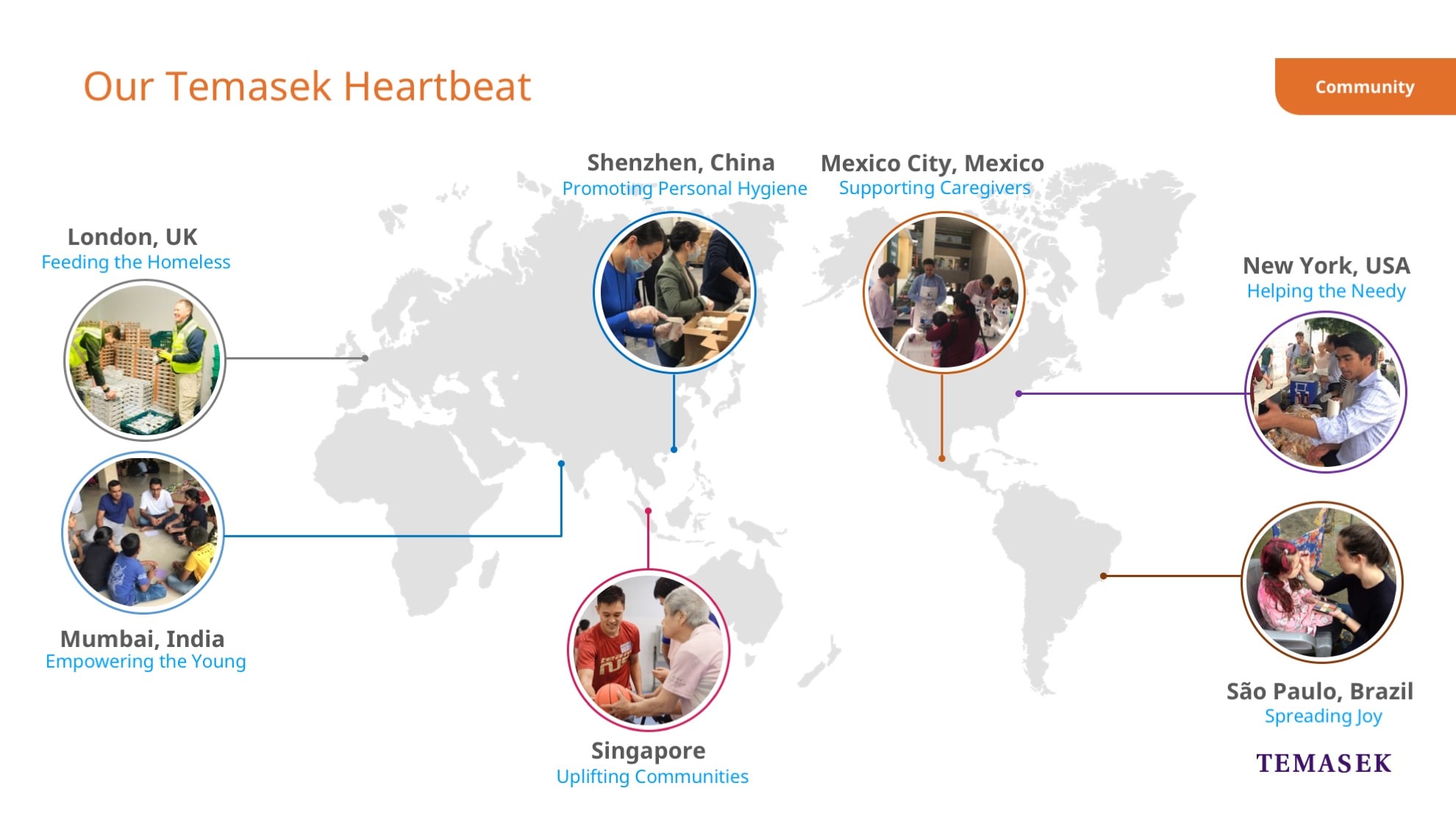

T-Touch. Our staff formed T-Touch in 2001.

This is a volunteer initiative for our folks to give our time, ideas and effort to help and support those in need.

This includes supporting the needy, elderly, as well as empowering the young.

Our teams come together to do this wherever we have offices around the world.

In addition, every year, on the anniversary of our incorporation, we bring all our people together for Community Day, where we give back to our communities.

This year, for our Singapore based staff, we partnered Central Singapore Community Development Council, to clean and refresh the rental units of the disadvantaged and the elderly.

We also held a carnival at Kallang Community Centre for disadvantaged seniors and others.

Our staff also volunteer actively throughout the year, including working in soup kitchens or helping in various homes, and are given paid leave for their volunteer work.

Beyond investing, we are committed to making a difference in our local communities.

We seed various non-profit endowments.

These help fund and support programmes delivered to our communities by the Temasek Foundation.

The Temasek Foundation works with partners, to enable individuals, families and communities to achieve sustainable improvements and progress in their lives.

To do so, we focus on four key areas.

First, building people, by instilling skills and knowledge to improve their lives and circumstances.

One example would be the i-Tile Learning Tool, developed by NTU researchers, to make learning more engaging for children with special needs.

Secondly, building capabilities, by enabling research and innovation in fields such as science, technology and engineering.

In partnership with NUS High School of Math and Science, the Marie Curie and Da Vinci Junior Programmes were designed to nurture young scientific minds in Singapore.

We also build communities by promoting dialogue, understanding and building bonds.

In 2018, the Faithfully ASEAN Interfaith Exchange was organised to build a more cohesive society.

This was done by deepening religious and cultural understanding amongst the major faiths in a highly diverse ASEAN environment.

Last but not least, we aim to help communities, families and individuals rebuild their lives when they are affected by natural disasters or events beyond their control.

An example is the iMove programme – you saw a snippet of this earlier.

iMove is a pilot programme that examines the effectiveness of using robotic exoskeletons to help patients walk again.

Temasek also seeks to support innovative solutions that can help build a more sustainable planet for our people.

For example, we partnered with ST Engineering to design the “Airbitat Oasis Smart Bus Stop” at Dhoby Ghaut.

This is a bus stop equipped with an energy-efficient air cooling and filtration system – it is a pilot to explore how we can help commuters in Singapore beat heat and pollution.

The pilot programme also measures air pollution levels at the bus stop, and allows commuters to provide their feedback on the system.

I’ll share another example of a pilot for a better world.

This is in partnership with SP Group and Gardens by the Bay.

Together, we piloted a zero-waste solution at Marina Bay Gardens.

This smart waste management system uses compact gasification technology.

It converts waste into thermal energy and carbonised biomass - that’s like charcoal powder.

This creates a self-sustaining system which can reduce carbon emissions by up to 20%.

If successful, this could provide a district-level solution for waste disposal, and bring us closer towards a circular economy.

As you can see, sustainability is part of our DNA.

You would have seen in the video earlier, that we launched Temasek Shophouse.

This restored conservation shophouse is a gift from Temasek for social impact in Singapore and beyond.

It aims to bring people together, to advance sustainability and community engagement.

We are pleased to house Miniwiz, a startup that focuses on converting consumer and industrial waste into reusable products such as sunglasses, coasters and furniture.

We are also delighted to share this space with budding social enterprises, such as Foreword Coffee.

The company is founded by two young NUS graduates to train, skill and empower workers with special needs.

We are truly inspired by these and other social entrepreneurs.

They are determined to help create a more inclusive society with better employment opportunities for all.

So do pop by for a coffee and a tour sometime soon!

In a moment, we’ll be showing you a video of CareLine.

CareLine is a programme supported by Temasek Foundation.

It provides a listening ear to the growing number of seniors who lack family support in Singapore.

Now, in conclusion, let me reiterate how we operate as a generational investor.

We do our best to look at opportunities and challenges facing the world;

We try to think systematically and critically about the issues we see;

This drives us to act boldly and methodically for a better and more liveable world.

We would like to invite you and others to join us to work now and together, for a better and more sustainable tomorrow.

Thank you.