FinTech Festival 2017: Keynote Address by Chia Song Hwee

Good morning, ladies and gentlemen. A privilege for me to be here.

I have broken down my presentation into three parts.

First, I will give you the background of how Temasek has evolved over time since inception, our journey so far, and next I will talk about how we look at the future, how we're dealing with it and lastly, since this is a Fintech event, I would like to share our perspective of Fintech and how we look at the space.

Over the past, I would say, 13, 14 years, we have been guided by these four investment themes when we look at investment opportunities. First is Transforming Economies; second, the Growing Middle Income Populations, followed by Deepening Comparative Advantages - that's why we look at companies with unique business model, IPs or capabilities; and lastly, Emerging Champions - whether or not they are regional or global champions.

As you can see from here, the first two themes are macro big-picture investment approaches, whereas the latter two are very much micro, and I would say that finding opportunities there a lot more challenging than the first two themes that we have.

Before I go to the next chart, I would just like to mention a couple of things so that you can have the context of what I'm going to say in the next few pages.

Temasek - we are not a fund manager. We manage our own balance sheet. We only have one shareholder, which is the Minister for Finance. Our portfolio grow by the profits or returns that we get. And secondly, our portfolio is mark to market. As of the end of our last financial year, 60% of our portfolio are listed.

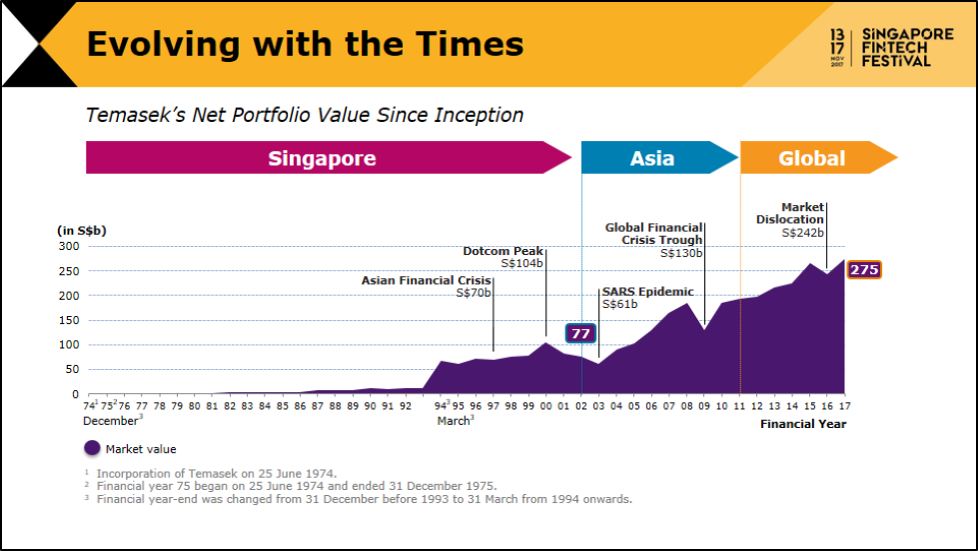

So Temasek started back in 1974 as an investment holding company when the Government decided to focus on regulation and not be involved in the commercial aspect of the country. So Temasek has taken over the entities that was created and owned by Government at that time.

For the most part, we were pretty much a holding company. We didn't do much with our assets until much later in year 2000 onwards. But you can see that in year 1994, we have a little bump in our portfolio value and that was the listing of Singapore Telecom, Singtel in short, back then, which created a lot of value for us. If I recall correctly, the earnings multiple at the time of listing was 43 times1. Of course, today, it doesn't trade at that level anymore.

Okay, up to 2002, we were very much focusing only on our assets in Singapore, and also during that time, our portfolio companies in Singapore started growing their businesses outside Singapore, especially in Asia, and our portfolio grew during that time. In 2002, the company decided that we needed to invest more aggressively overseas and if you recall our investment themes being Transforming Economies as well as Growing Middle Income Populations being the focus, we obviously picked Asia as the place where we are going to spend more time and resources on. So we grew our portfolio during that period in Asia.

And then in around about 2010, 2011, we decided that we needed to reshape our portfolio, given the headwinds that we saw in certain sectors, as well as the growth opportunity in certain sectors that we needed to get exposure to. Because of the sectoral focus that we wanted to have, we had to be closer to the ground and as a result we have opened up offices in London as well as in the US, growing our presence, and we believe that we are more global now as an investor. So if you look at during that period from year 2002 to 2017, March, which was our last financial year end, we have grown our portfolio value by two and a half times.

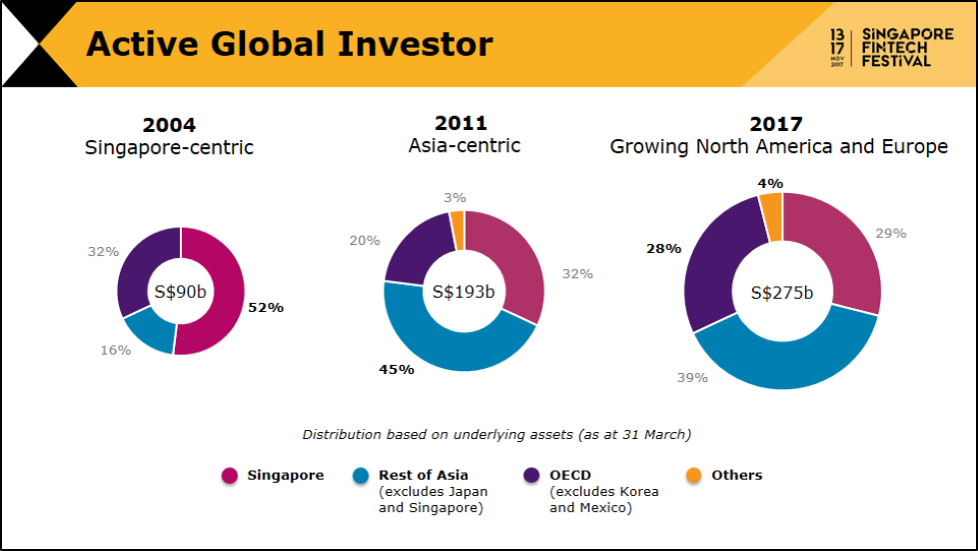

This is how our portfolio has evolved, if you look at it from a geographical exposure standpoint, and this is based on the underlying assets.

So, for example, if our portfolio company has got investments or assets in Indonesia, Australia, we break the value down into that and we account for it that way. Back in 2004, when we were still very much Singapore-focussed, you can see that 52% of our portfolio value was in Singapore, obviously, and the blue part, which is the rest of Asia, and then OECD countries in the purple portion.

Since 2002, 2004, we started investing more aggressively in Asia. You have seen that grown, the blue portion to 45%, and Singapore shrunk from 52% to 32%. As I mentioned earlier, we, back in 2001, we decided that we needed to reshape our portfolio, given our mix has been quite heavily in the financial services sector and in the telecom space. And we need more diversity, which brought us to opening up offices in both Europe and London, as well as in US focussing in other subsectors.

So, you can see our portfolio continued to reshape. Singapore went from 32% to 29% and Asia, excluding Singapore, went from 45% to 39%, but OECD exposure went up from 20% to 28%. Now, I just want to mention here that if you compute the numbers, while the Singapore portfolio has shrunk in percentage terms, but in dollar terms they continue to grow. Our portfolio in Singapore is actually much bigger now compared to 2004 when it was 52% of our portfolio. And in the blue portion, out of the 39%, China accounts for 29% of the 39%. So China is our second largest country of investment.

So what causes us to shift our emphasis and have offices in Europe for coverage in Europe and the US?

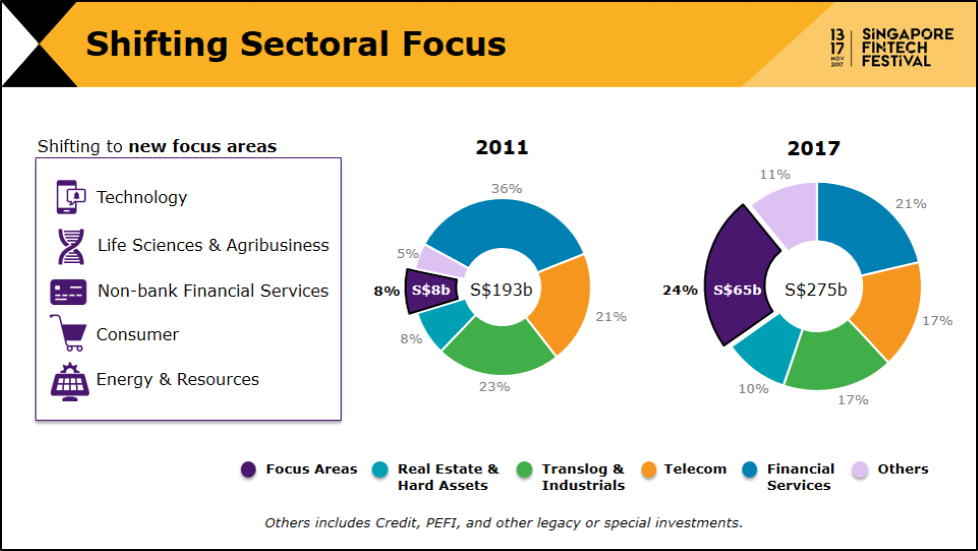

Our portfolio, as I say, was very heavily focussed on the banks, financial services as well as the telecom space as we participated in the growth of the emerging economies. Obviously the growth prospect in those two sectors was not going to be as robust as before so we've chosen five sectors to deploy more capital in six years ago, namely technology, life sciences, non‑bank financial services which will include insurance as well as payments. For example, consumer space continue to ride on the middle income population growth theme, and energy and resources.

So back in 2011, those sector accounts were only 8% of portfolio value and as we finished last year it grew to 24%. That's a combination of us putting more capital to work and the return that we have been able to generate. I cannot share the exact numbers, but this focus area have generated a return that is far more superior than the company average. So we seem to have picked the right trend and invested accordingly.

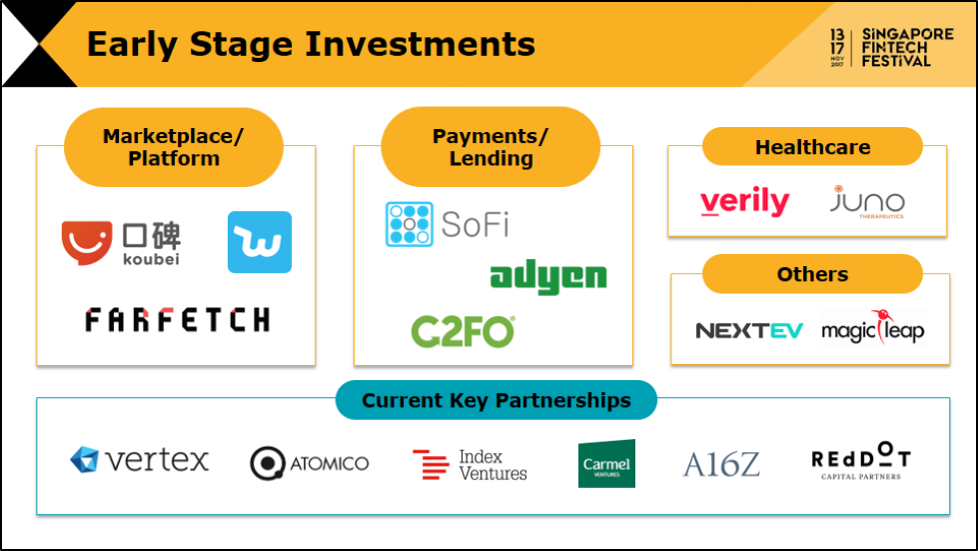

Now, given our size of $275 billion, we need to be quite disciplined in how we approach investment and size matters. We tend to invest in larger size ticket with one exception, and the exception is investing in early stage companies.

We can't cover the space entirely; it's physically impossible. You just heard how many start-ups just on Fintech alone. So we work with partners. Some of them we seeded; we created them like Vertex in Singapore but they pretty much cover the Asia and US, and Red Dot is an Israeli VC company trying to bridge the start-ups there and this part of the world, and some of the names there that you may already be familiar with.

We can't cover everything. The area that we like up to now is where we can deploy capital to work, serving large markets. So marketplace platform is an area that we like. Payment lending, which is not a surprise - you have heard what Gary said. Healthcare, healthcare services and new drugs are also areas of focus for us and the others which tend to be more opportunistic; and recently we invested in NextEV - it's an electric vehicle company start-up in China, and MagicLeap in AR and VR.

So that's what we have been doing in the past, especially in the past 14, 15 years as we reshape our portfolio with the view that we had six years back. So let me now talk about the future - the future trend.

We can't predict the future like anybody else, but we try to do our best in anticipating them and getting ourselves ready for it. So there are four things that I would like to talk about.

The first is we push ourselves to cover the trends that is cutting across sector and I will elaborate a little bit more on what I'm saying here.

The other part is increasingly we try to integrate the element of sustainability into our investment approach, not just because we think environment and governance are important, but we truly believe that by integrating sustainability in the way we invest, we can make better returns.

With how fast things change in today's world, we also believe that we need to leverage the local team better as they are closer to the ground.

And lastly, something closer, I think there's a lot of opportunity in South East Asia and I would like to also share a little bit of our perspective there.

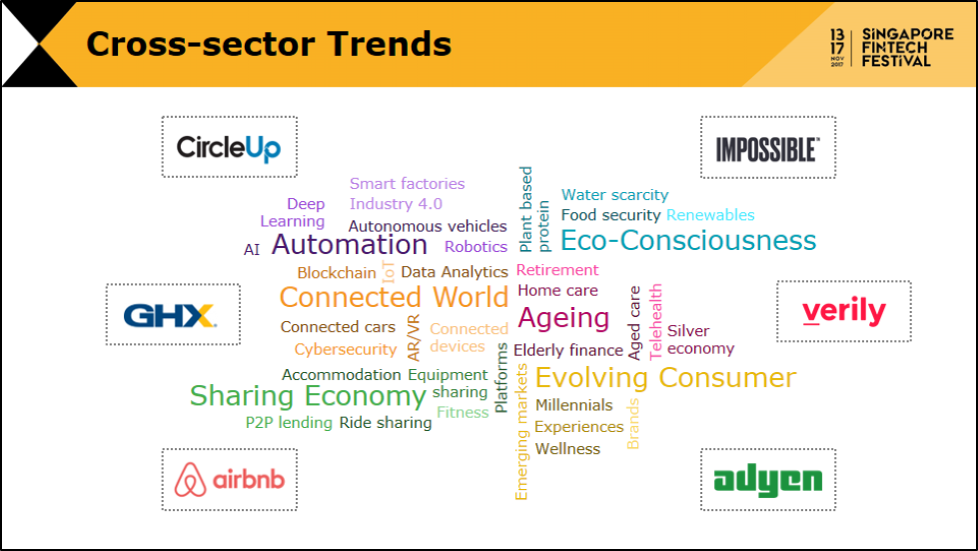

So first is the cross‑sector trends. In the past two years, we have invested quite heavily in researching what the world is going to look like 10, 15 years from now.

We don't have a crystal ball but we try. We work with our cross‑sector teams, country teams as well as external resources and experts. There are a few things that you cannot pick up from there from eco consciousness to connected world and shared economy and so on. I'm not go into a lot of those details. Many of these trends are still in early days. While they are still early, we decided that we need to take the first step and start making investment and, as we get involved in this development, we are better placed for it.

So maybe I would just like to pick one example just to illustrate the point about the impact of these new trends.

We believe that the trends that we are seeing going forward have got impact across sectors, and it's got the elements of disruption - even more so going forward. So as we think through this, we actually have to challenge ourselves in how we should organise ourselves going forward. We are organised today by markets, as well as by sector, and as this trend cuts across sectors; how we are organised today will not be able to allow us to address the trend going forward. So we are actually going through quite a bit of rethinking of how we should organise ourselves.

So one example I would like to pick is Impossible Foods. What they do - they basically produce beef burger but they are not real meat. It's made out of plants. But we don't see this as a food company. We see this as a company having great capabilities in big data analytics and marrying that with scientific focus on solving big problems. So what they do is through data analytics and quick iterative learning to come up with ingredients that produce a burger that just tastes like ‑ not only tastes like, but the texture is like meat and I've tasted a few of them; they're really good.

But what excites us about this is - it is not just producing food. They can make burgers; in future they can make prawns, fish and so on. But the capabilities around it is actually sector agnostic. They can solve a lot of problems with the capabilities that they have. And there are other examples on this page here that also speak to the same type of capabilities.

Sustainability. The UN have published 17 Sustainable Development Goals. If you look at them, they are quite comprehensive but if you think about taking on those 17 Goals, it is rather challenging. So we have our own interpretation of sustainable development and we simplify it and call it ABC by bucketing them into this category. A stands for Active Economies, B - Beautiful Society, C - Clean World.

We have been running forums we call Ecosperity, for four years and the last one was held in June of this year, where working together with the Business and Sustainable Development Commission, we have jointly published BSDC Asia Pacific Sustainability report and in that report it highlights the business opportunities in Asia, with sustainability themes including sectors like food, agriculture, water, urbanisation and so on.

In that report you will see investment opportunities or business opportunities amounting to US$5 trillion ‑ the US$12 trillion that you look here is a global number ‑ and the opportunity to also create over 200 million jobs in the region. So we believe that these opportunities are there, and are real, and we should incorporate them into the way we look at our investments.

While we look for investment opportunities with a sustainability theme, our portfolio company on their own have also been pushing the limits and boundaries of their sustainability efforts.

For example, SP Group - they are a utility company doing distribution of power in Singapore. They built the world’s largest underground water cooling district, supporting the power requirements of Marina Bay area, if you know where that is, where the casino is. The energy consumption through that effort, 40% of energy consumption reduction has been achieved. The thing about the carbon dioxide reduction of emissions that these efforts could bring, and there are more efforts that the company are taking on, both in Singapore, as well as in the region, pushing this concept.

Singapore Airlines, I hope most of you have flown in on the airline - they have their green initiative called the Green Package; by using biofuel, upgrading the plane to more fuel‑efficient aircraft, as well as optimising their operating flight operations so that they have less impact on carbon emissions.

And lastly on Impossible Foods. I just want to stress here that it is not a proposition for being healthy. In fact, they give you the same calories. It mimics the same texture and taste and therefore it gives you the exact calories, but it has got huge impact on the environment. It does not need a lot of land; it does not need a lot of water compared to raising cattle and consuming beef.

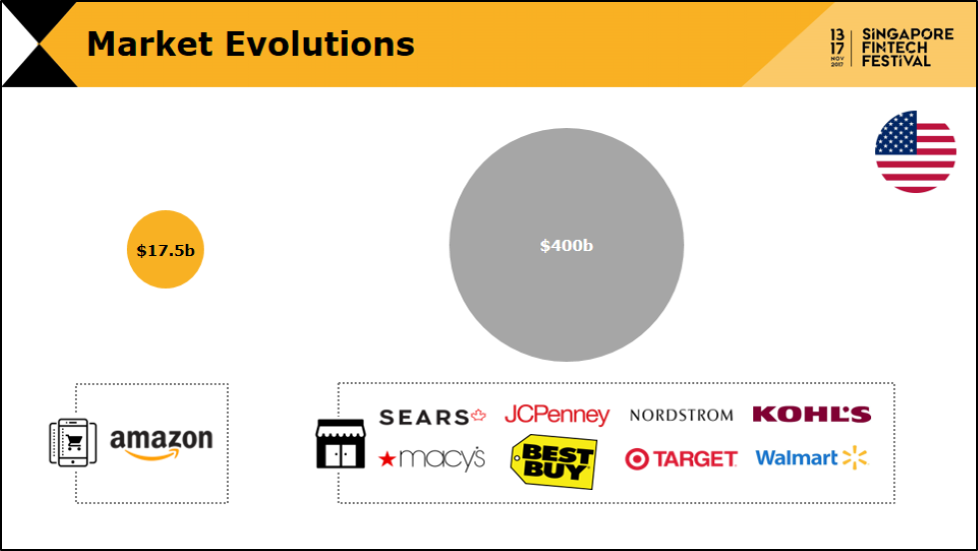

I talk about us needing to leverage our local team because markets are evolving very quickly, and we need to be close to the ground so that we can react or anticipate better; and this is just an example which I don't think will surprise anybody. Ten years ago, Amazon market cap was less than US$18 billion and you have large number of retailers with the aggregate market value of US$400 billion.

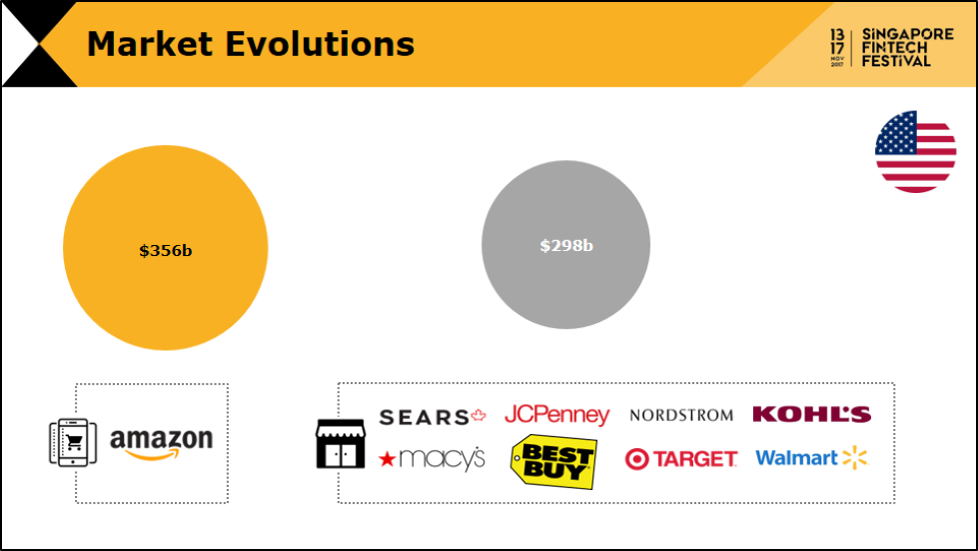

Today, this is the picture. Amazon is worth US$350 billion, and the aggregate of the retailers are below US$300 billion. It's a big shift over a 10‑year period - not a very long time. And the momentum seems to be gaining as well.

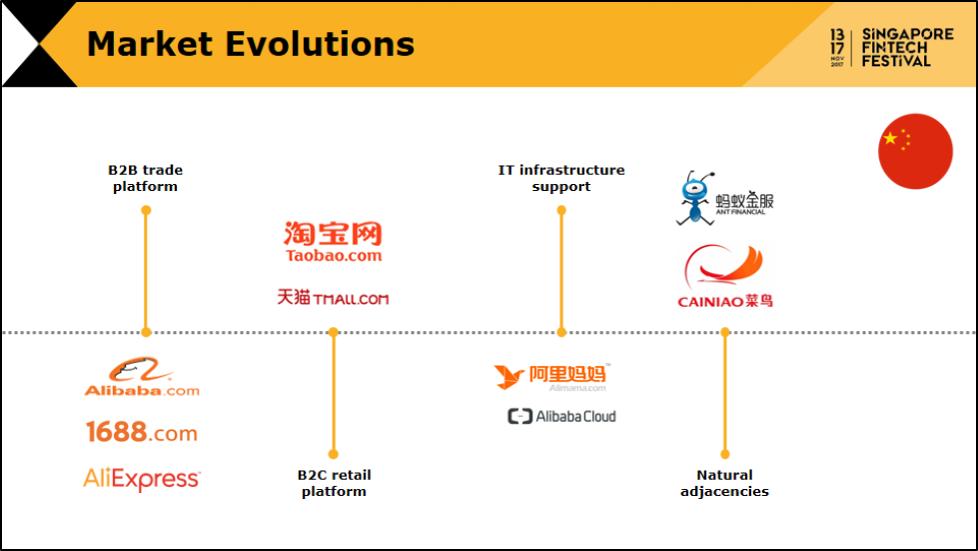

Closer to this part of the world, Alibaba started as a B2B platform, then they have added on B2C. They were then into cloud IT infrastructure; now they have banking license in financial services, and are also branching into logistics.

We are the early investor of Alibaba, so we have been tracking their progression and have invested alongside some of their initiatives. If we are not on the ground, I think it will be very difficult to follow the trend, and the development and the speed of change. So for us having people on the ground is quite critical.

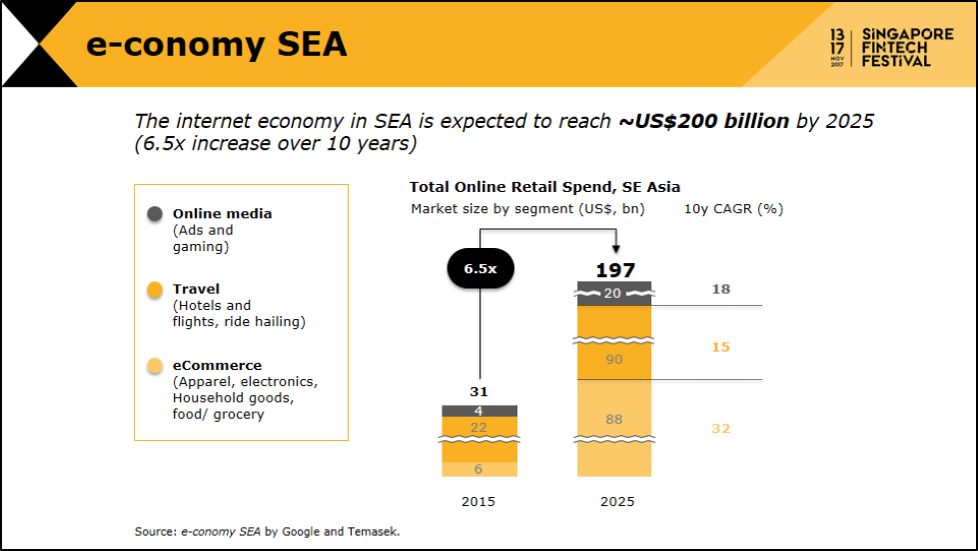

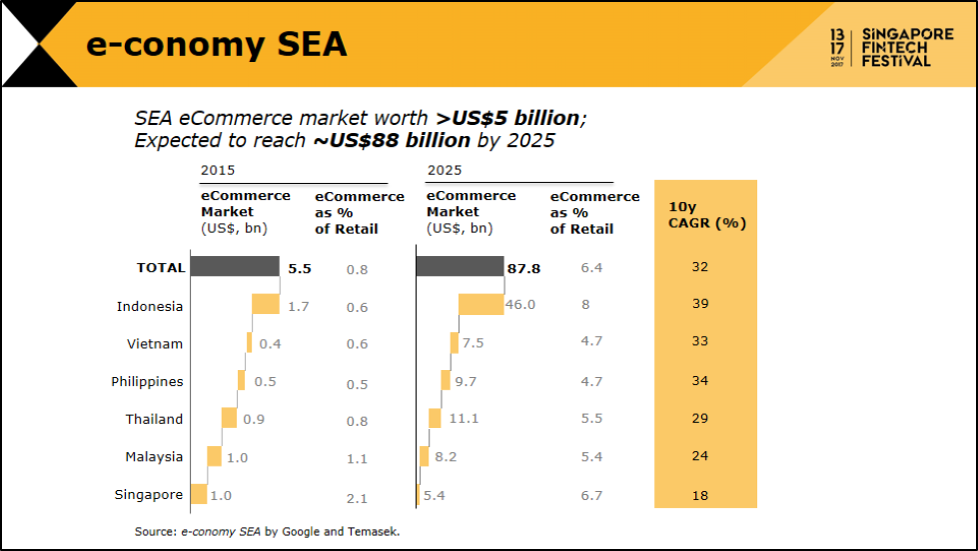

Now let me talk about the opportunity in South East Asia. A year ago2, together with Google, we did a research in South East Asia, the countries in South East Asia in terms of a growth prospect, and this is a report - a high‑level summary of the report.

We believe that the Internet economy in South East Asia will reach about US$200 billion by 2025, and you can see the breakdown of the sector, media, travel, but the larger piece of it is e-commerce.

But from a country perspective, Indonesia represents the biggest, or probably the fastest, growing part of the pie when we look at e-commerce, accounting for almost US$90 billion between now and 2025. So if you are looking at building your Fintech business, South East Asia should not be ignored.

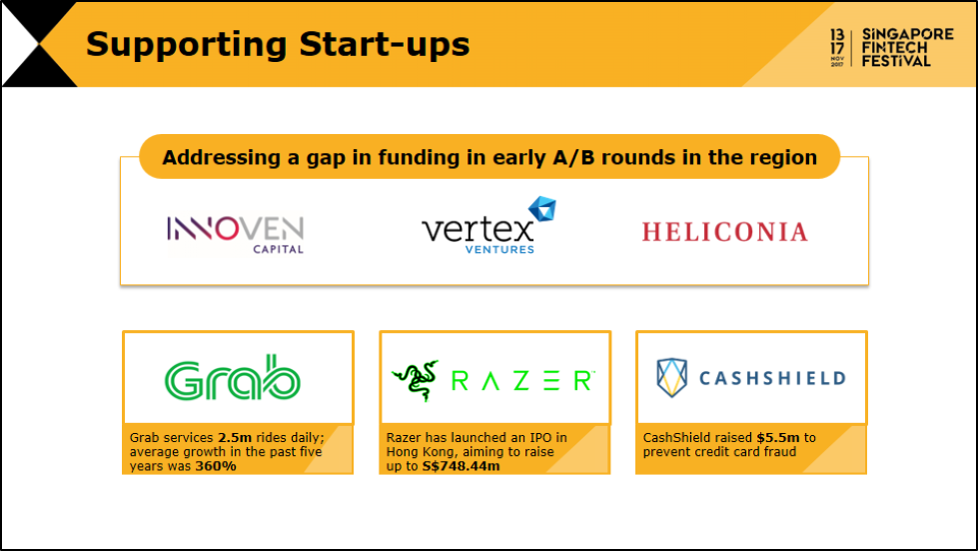

But there are barriers to this. It is still a relatively small market and there are quite a number of barriers; and one of them is around funding. Start-ups are able to find seed money, angel financing; but when it comes to A or B round, many of them run into difficulties as they are not able to find investors as they are raising their subsequent rounds.

So we decided that we should create solutions and help solve part of the problem. So we have seeded - created - Innoven Capital. We have invested more; a separate vehicle under Vertex focussing in South East Asia, and we also created a new entity called Heliconia - specifically addressing the funding gap in this part of the world, and our platform companies here have invested in companies like Grab. Today, it's a ride sharing company - they are running about 2.5 million rides a day now, and Razer has just gone public in Hong Kong last week, I believe, raising about close to S$800 million.

So I would like to also add onto this that there is close collaboration between the two governments, Indonesia and Singapore, to enable start-ups to have access to market and also access to capital. If you like, we can ‑ you can get in touch with the officials in EDB; they can point the right direction.

Recently, the Singapore and Indonesia Government have set up an Indonesia-Singapore Business Council, and I happen to be one of the council members. There are three pillars that both governments are trying to facilitate trade and business development between the two countries; and one of them is about the digital economy. So I will encourage you to think about Indonesia being the market, and using Singapore as a hub for you to grow your business, and for investors to look at opportunities using the ecosystem that has been built here.

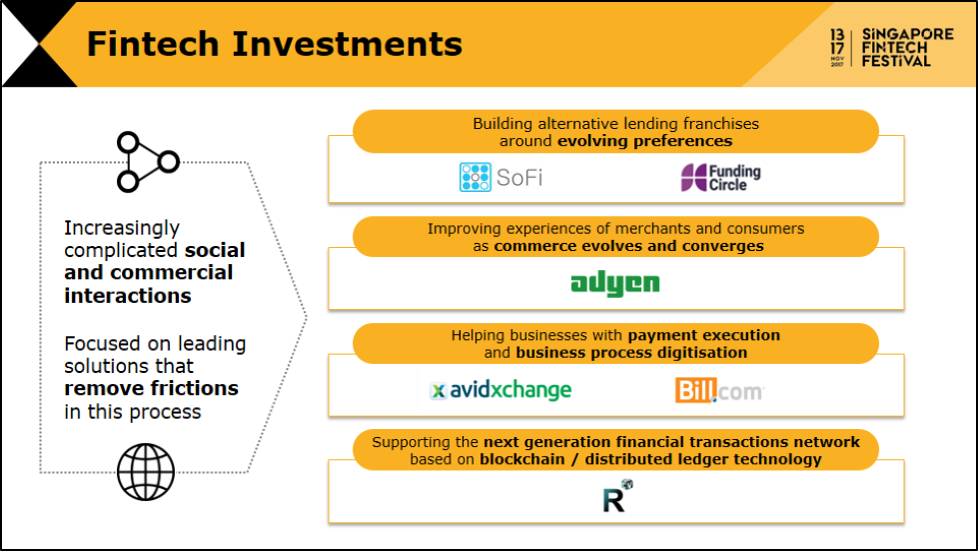

So let me move on to talk about our perspective of Fintech, which you may agree or may disagree. So what we tried to do there is we look at it from the perspective of there being increased complexity and complication between various parties interacting in the social and commercial world; and what we want to focus on are the businesses or innovation or technology that will remove the frictions in this complicated process.

So in the past three to four years we have been focussing on these three or four areas.

First is building alternate lending franchises around evolving preferences. The companies there are just some examples of investments that we make in those spaces; one of them focusses on young professionals - professionals that just started their career and their financing needs. Another one is focussing on small businesses as they interact with financial institutions addressing their funding requirements, especially working capital.

Next is Adyen; we believe that improving the merchants and consumer experience is a very important element in the payments space, and that we continue to work on looking for opportunities in this space.

And the next block is more on the B2B side; payments for B2B is still very much old‑fashioned. The friction cost there is extremely high, so we invested in companies that try to lower the friction cost there but going beyond that is to work on business processes improvement through digitisation.

And lastly, we also support the efforts in building the next generation financial transaction network surrounding blockchain or distributed ledger technology, by participating in all three consortia.

So that's what we have been doing in the last three to four years, putting our capital to work and tracking the space.

Looking forward, in the next five years, our emphasis will perhaps be in these areas.

B2B payments, especially cross‑border. As I said, B2B - there's a lot of frictions already, but if you think beyond boundaries, the friction cost is even higher.

Next is fraud detection. I did not call it cyber security here because cyber security is a separate focus effort of ours, beyond Fintech. So fraud detection is quite obvious, as Gary had mentioned. The amount of transactions, financial transactions going through the digital platform today have grown tremendously, especially in China. So being able to prevent fraud, to detect them is going to be a very important part of the development; and we believe that there are a lot of opportunities there, and that's a space that we would like to put more money to work.

And lastly, more generally - artificial intelligence, which you also saw. Many investors are also interested in this space. In general, Temasek is very focussed on the development of artificial intelligence, not only in the Fintech space but cutting across all sectors. It's got tremendous implications, not only for investment opportunity but impact that you will have in our existing portfolio.

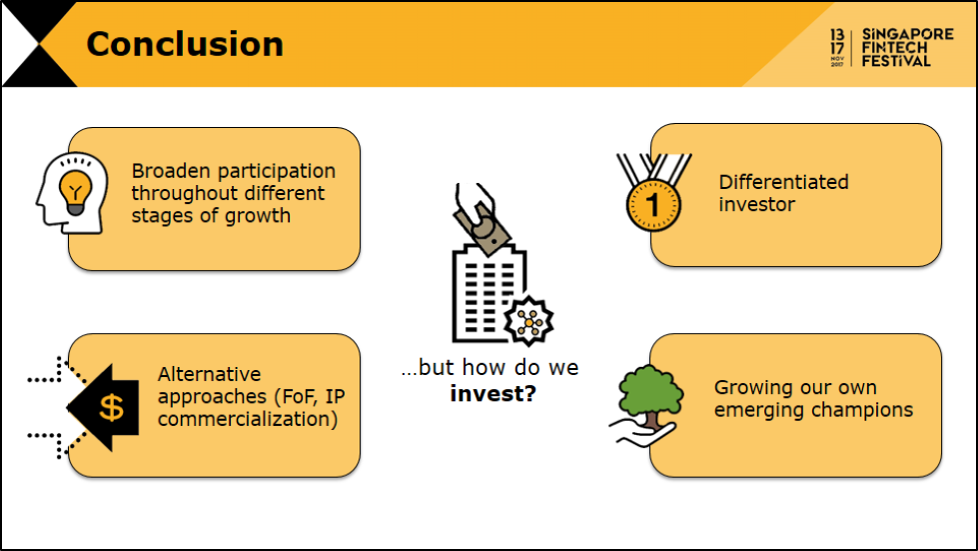

So with that, I conclude my presentation by mentioning a few things about how we do investments.

First, we need to broaden our participation through exposing ourselves to various stages of the company life cycle - from start-ups all the way to mature businesses. We need to be differentiated as money is all the same. We need to be able to create and add value. We need to find new approaches. If we can't find companies or solutions that have got high friction costs, we may consider building it ourselves and growing our own champions.

With that, I would like to thank you for attention and wish you a fruitful day ahead. Thank you.

Footnote:

1, 2 Data points have been edited for accuracy.