A Journey of Growth:

Temasek’s Evolving Portfolio

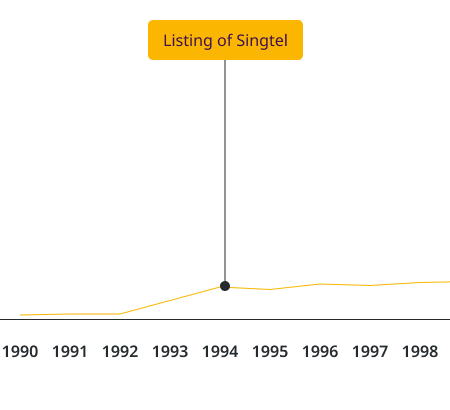

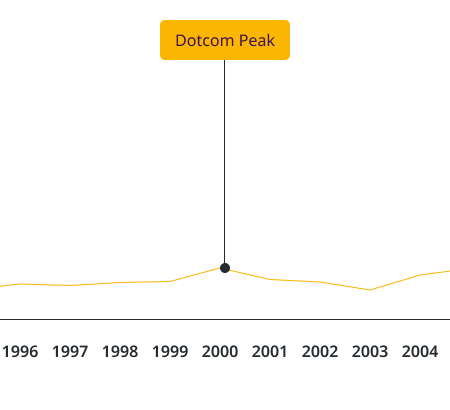

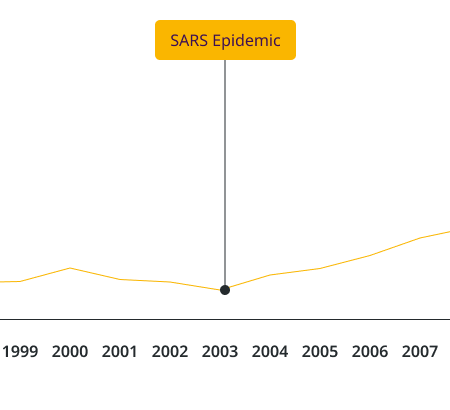

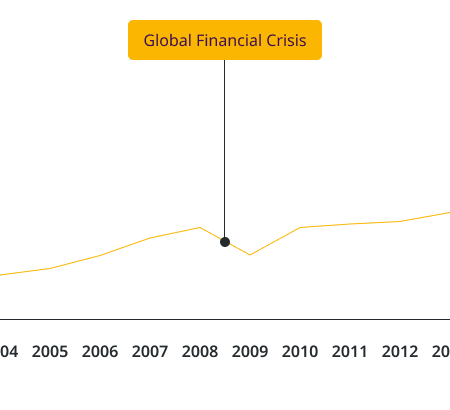

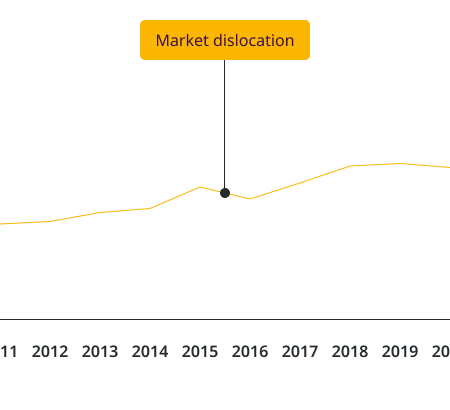

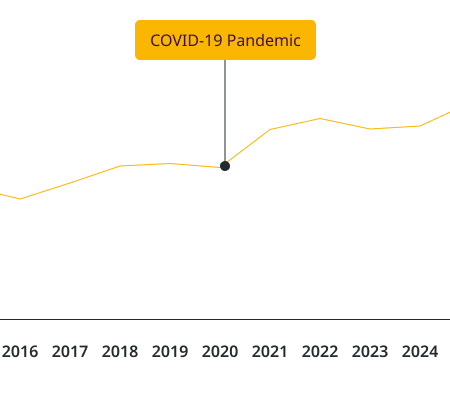

Since our inception, Temasek has transformed from a Singapore holding company into a global investment company rooted in Singapore.

Our recent journey has been guided by three successive 10-year roadmaps: T2010, T2020, and now our T2030 strategy, each building on the last to prepare us for a rapidly changing global environment as we construct a resilient and forward-looking portfolio to deliver sustainable returns over the long term.

Explore our portfolio's growth and evolution through the interactive chart below. All figures are in Singapore dollars (SGD).