Temasek delivers record profit of S$18 billion for Financial Year ended March 2008

中文版 | Bản tiếng Việt | India Release

- Record profit of S$18 billion for the year

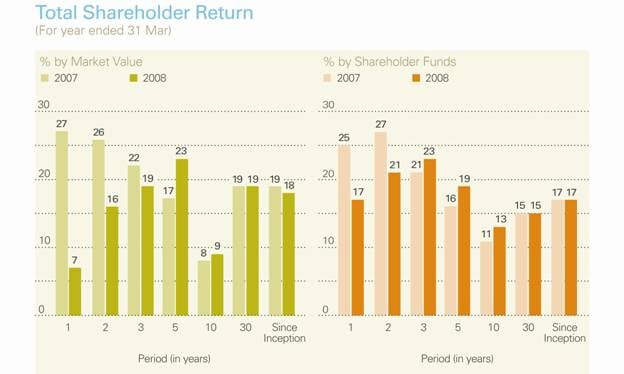

- One-year Total Shareholder Return of 7% by market value, 17% by shareholder funds

- Five-year cumulative wealth added of S$60 billion; wealth added fell S$6 billion below cost of capital hurdle for the first time in five years

- Net investments outside Asia (S$10 billion) exceeded net investments in Asia (S$5 billion)

Singapore

Temasek Holdings (Private) Limited (Temasek) today released its latest annual financial review for the year ended 31 March 2008. In its fifth year of publication, the Temasek Review 2008 provides the firm's financial, investment and operating highlights of the year.

During financial year ended 31 March 2008, Temasek achieved a record profit of S$18 billion on the back of strong operating performance of its portfolio companies and healthy realised gains from its direct investment activities.

Temasek's portfolio grew to S$185 billion, an increase of 13% from S$164 billion the previous year. On the back of a weaker US dollar, the value of Temasek's portfolio grew 24% from US$108 billion to US$134 billion. Shareholder equity increased 26% to S$144 billion over the same period. The increase in portfolio size was partly due to a new capital injection of S$10 billion by the Minister for Finance (Incorporated), Temasek's shareholder, as part of its asset reallocation. On a cumulative basis, Temasek remains a net contributor in dividends to its shareholder.

Despite a severe credit squeeze and nervous volatility in the global financial markets, Temasek delivered a one-year total shareholder return (TSR) of 7% by market value, including dividends. TSR by shareholder funds was a solid 17% for the year.

Wealth added (or economic profit) for the year was S$6 billion below its cost of capital hurdle, as global markets saw sharp marked-to-market corrections in 1Q08. However, the five-year cumulative wealth added was a healthy S$60 billion.

Temasek's Senior Managing Director, International, Mr Michael Dee said: "It was an eventful year for Temasek. While we were prepared to stay on the sidelines, it turned out to be a busy year."

Mr Dee added: "We continued to build the foundation for long term returns even as we actively rebalanced our portfolio. At the same time, the massive structural adjustments also presented some interesting medium to long-term opportunities. Internally, we continued to build systems and capabilities while we expanded our engagement externally with communities in and outside Asia."

An active year

It was an active year for Temasek on the investment front. The firm made S$32 billion of new investments while monetising S$17 billion of its portfolio, compared to S$16 billion of investments and S$5 billion of divestments in the previous year.

For the first time in Temasek's history, net investments outside Asia (S$10 billion) exceeded net investments in Asia (S$5 billion). In the preceding five years, Temasek had invested a net S$26 billion in Asia and just under S$1 billion of net investments in non-Asian economies.

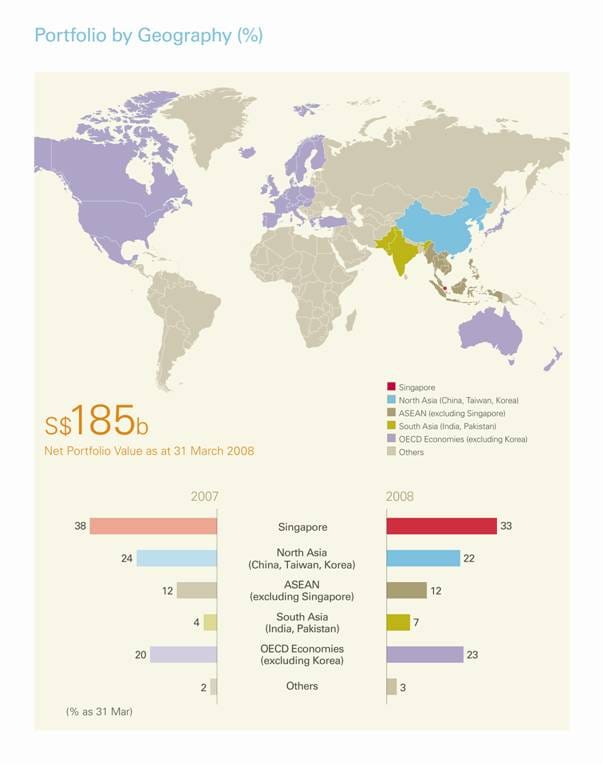

Temasek's underlying asset exposure to economies outside Asia increased from 22% of its portfolio to 26%, bolstered by investments such as Merrill Lynch in USA and investments in Latin America and Russia. Portfolio exposure to Singapore fell for the first time from S$62 billion to S$60 billion, partly due to the sale of Tuas Power, and continued to account for a smaller part of a growing portfolio - 33% in financial year ended March 2008 compared to 38% and 44% in financial year ended March 2007 and financial year ended March 2006 respectively. Exposure to Asia (excluding Singapore and Japan ) was 41% from 40% a year ago, despite S$12 billion worth of divestments.

Investments made since 2002, when Temasek reshaped its portfolio significantly to increase its exposure to emerging Asia, have delivered a six-year annualised return of 32%, compared to the 16% delivered by the rest of the portfolio.

About 79% of Temasek's portfolio comprises liquid or listed assets, down slightly from 82% last year.

In terms of industry sectors, financial services and telecommunications & media continued to account for the bulk of Temasek's portfolio, increasing their combined share from 61% to 64%. These two sectors are good proxies for exposure to the potential presented by transforming economies and a growing middle class.

Investment highlights

Temasek's total investment amount of S$32 billion during the year was split evenly between Asian (S$17 billion) and non-Asian (S$15 billion) markets. In December 2007, Temasek anchored Merrill Lynch in its capital raising exercise with an investment of about US$4.9 billion for about 9%. In July 2008, Temasek invested a further US$3.4 billion, of which US$2.5 billion came from a reset adjustment from the bank.

In line with its strategy to invest in companies with strong comparative advantages and sound leadership, Temasek also invested £975 million (US$2 billion) in Barclays PLC and raised its stake in Standard Chartered Bank to about 19%.

Other investments during the year included Bharti Infratel (telecommunications - India), Tata Sky (media - India), Interpharma Investments Limited (life sciences - Asia), China Railway Construction Corporation (infrastructure - China) and Binh Chanh Construction and Investment Corporation (real estate - Vietnam). Temasek also increased its stake in MEG Energy, a Canadian oil sands company and STATS ChipPac, a semiconductor services provider listed on the Singapore Exchange.

As part of its portfolio rebalancing, Temasek divested its interest in China COSCO Holdings, an integrated shipping company, SNP Corporation, a Singapore-based publishing firm, and Punj Lloyd, an Indian company in the energy and infrastructure space. It also conducted a trade sale of Tuas Power, one the three power generating companies (gencos) it plans to fully divest. Tuas Power was sold to China Huaneng Group for S$4.2 billion. The sale of the remaining two gencos - Senoko Power and PowerSeraya - is expected to be completed by mid-2009.

Besides equities, Temasek has also diversified and taken positions in commodities, fixed income, credit products and distressed assets.

Community engagement

As a long-term investor, Temasek has a stake in the success of Asia and the stability of the global economy, recognising that social, environmental and governance factors can impact the long-term sustainability of companies and businesses.

The firm actualises its commitment as a responsible corporate citizen by supporting efforts that develop people and build communities through various initiatives including scholarships, youth exchanges, healthcare and research, governance programmes and disaster relief. Over the last decade, Temasek has committed almost S$1 billion to fund public good beneficiaries, of which S$500 million was endowed to the Temasek Trust in May 2007.

In its first year, since its formation in May 2007, the Temasek Foundation committed S$16 million for 14 programmes across Asia, including China, India, the Philippines, Singapore and Vietnam, supported by endowment proceeds from Temasek Trust.

Temasek Life Sciences Laboratory continued research into sustainable non-food sources of biofuels and contributed to Indonesia 's post-tsunami reconstruction through training and research in rice cultivation. The Singapore Technologies Endowment Programme celebrated its 10th Anniversary in 2007 with the launch of a scholarship programme. The Singapore Millennium Foundation awarded S$12.5 million over 5 years for research in liver cancer, mental health and bio-diesel fuels.

During the year, Temasek also held dialogues on the topics of sovereign wealth funds (SWFs) and trends in foreign investments with members of the European Commission, the International Monetary Fund (IMF), the World Bank and OECD agencies. The firm supported the IMF-led International Working Group of Sovereign Wealth Funds in the drafting of the Generally Accepted Principles and Practices for SWFs.

Challenging conditions ahead

In his message in the Temasek Review 2008, Temasek Chairman, Mr S Dhanabalan noted that volatility remains high, with further contagion expected in the economies of the United States, Europe and Asia. He said: "The fallout of the credit crisis will continue to dampen the global economy over the next 24 months, with sharply escalated oil and food prices beginning to test inflation expectations."

Mr Dhanabalan added: "We are concerned with the emerging risks of stagflation. This presents huge socio-political as well as economic risks in the next three to five years. Opportunities may be limited in such a scenario."

Moving forward, Temasek will continue to centre its activities on creating and maximising long-term returns for its shareholder. It has a strong balance sheet, with low gearing, and has the flexibility of taking concentrated positions with the appropriate investment horizons, or remaining in cash.

While Temasek's primary focus remains in Asia, it is open to deepening and broadening its exposure to other markets such as Russia and Latin America through funds and direct investments.

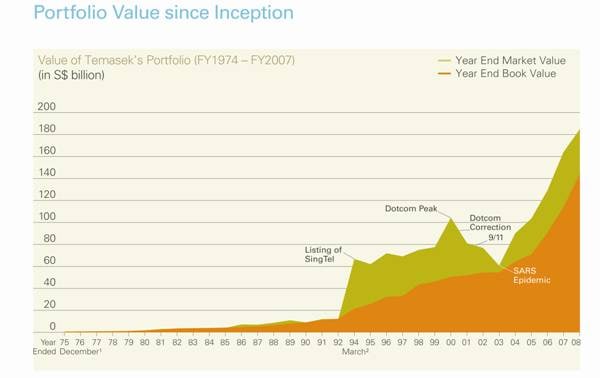

1.Portfolio Value since Inception

2.Total Shareholder Return (% by Market Value and Shareholder Funds)

3.Portfolio by Geography (%)

4.Portfolio by Sector (%)

About Temasek Review 2008

- The Temasek Review 2008 contains the Temasek group financial summary and performance highlights for the year ended 31 March 2008.

- This annual review also provides an overview of the firm's activities, an outline of its institutional framework for governance and risk management, as well as a financial snapshot of the major investments in its portfolio.

- Information from the Temasek Review 2008 can also be retrieved from an interactive micro-site which can be accessed from www.temasek.com.sg

About Temasek Holdings

Incorporated in 1974, Temasek Holdings is a global investment firm headquartered in Singapore. Supported by affiliates and offices around the world, it holds and manages a diversified S$185 billion (US$134 billion) portfolio as at 31 March 2008, concentrated principally in Singapore, Asia and the OECD economies.

Temasek's investment strategies centre on four themes - Transforming Economies, Growing Middle Class, Deepening Comparative Advantages and Emerging Champions - with its portfolio of companies coming from nine major sectors: financial services; telecommunications and media; transportation and logistics; real estate; infrastructure, industrial and engineering; energy and resources; technology; life sciences; and consumer and lifestyle.

Total shareholder return for Temasek since its inception in 1974 has been more than 18% compounded annually. It has a corporate credit rating of AAA/Aaa by rating agencies Standard & Poor's and Moody's respectively.

For further information on Temasek, please visit www.temasek.com.sg

Additional Information

- Key Highlights of Temasek Review 2008

- Temasek Holdings Corporate Backgrounder

- Frequently Asked Questions about Temasek Holdings

- Temasek Review 2008 - Key Questions and Answers

For media queries, please contact:

Mark Lee

Director, Corporate Affairs

Tel: (65) 6828 6509

E-mail: marklee@temasek.com.sg

Lim Siow Joo

Associate Director, Corporate Affairs

Tel: (65) 6828 6503

E-mail: siowjoo@temasek.com.sg

Ivan Tan

Weber Shandwick(for Temasek)

Tel: (65) 6825 8027

E-mail: itan@webershandwick.com