Temasek Review Media Conference 2020: FAQs

Selected Questions & Answers from the Temasek Review Media Conference 2020

On Zoom; 8 September 2020, Singapore

The following is an edited transcript of questions and answers at the Temasek Review 2020 Media Conference.

It has been edited with grammatical edits to aid readability. Questions are not necessarily listed in the order in which they were asked, but have been grouped by subject to aid readability.

Slides and charts have been added from the Temasek Review 2020 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to see all of the key financial metrics and diagrams in Temasek Review 2020.

Question on Net Portfolio Value

QUESTION: Temasek’s portfolio value dropped by S$7 billion since last year. Could you explain on the reasons why it dropped and, also forecasting whether the extended effects of the pandemic might affect next year.

PNG CHIN YEE: The portfolio value drop was as a result of the mark‑to‑market value of our public portfolio. If you look at where global markets have been as at 31 March 2020 compared to 2019, MSCI Singapore is down 18%, MSCI Asia is down 9% and so in the context of where our portfolio is located, I think there is very meaningful mark‑to‑market adjustments that the portfolio has had to make.

The portfolio impact has been mitigated partly because Temasek has a very resilient private book and even though we do impair the private book, if we see signs of impairment in them, they've held up well in this current environment and so that's been mitigated by that.

The other mitigating factor is that, as I mentioned before, we came into this crisis with quite a large cash balance, and that's also been helpful in cushioning the impact of the negative mark‑to‑market drawdowns that we saw on the public book.

We don't want to forecast because, you know, it is a very difficult environment for everybody. But I would just say that we've seen recovery in global markets since the end of March and so that should give you an indication as to where market valuations might be and where our portfolio valuations might be today.

Question on Net Cash Position

QUESTION: It was mentioned that Temasek exited 2019 and entered 2020 with a bit more cash. Does Temasek take this opportunity to increase its stake in some of its positions especially during the pandemic when a lot of valuations were beaten down, especially your public portfolio?

PNG CHIN YEE: I think the short answer is that we did. We did back some of the companies that we like and we were actively adding on our exposure so, for example, in the payment space, we did pick up some more public exposure into the likes of Visa, Mastercard as well as PayPal. Also, in India and in China we've also been quite active. So, yes.

Question on Net Debt

QUESTION: And just aside from that one, which hopefully Dilhan can answer, your net debt is higher, it's about 83.3 billion up from 51.9 billion this year, exactly how much of that increase is due to IFRS16? Is that level of debt likely to continue to be so high next year given that you're still supporting portfolio companies? Thank you.

PNG CHIN YEE: So, the increase in net debt actually due to two key factors. One of them is actually that we've consolidated CapitaLand into our balance sheet and therefore our debt has increased by the amount of debt which CapitaLand has and that's about S$20 billion. IFRS16 has also increased the debt that we record on the balance sheet and that's about S$10 billion.

Question on Investments and Divestments

QUESTION: There has been a net divestment this year as well. Will we see a change going forward because I remember in past years the high valuation as well as uncertainties were the main reasons for net divestments. So, the COVID crash in that March period probably brought some opportunities but obviously uncertainties remain.

DILHAN PILLAY: There was a net divestment in the previous financial year at 31 March 2019 and last year was actually a net investment year. This year our pace of investment has kept in line with what we think is the right approach. As we said, we are being cautious and therefore being selective in how we deploy our capital. Of course, a significant part of capital has also now been allocated towards our stalwart companies like Singapore Airlines. So, you know, the pace of investment last year in the financial year ended 31 March 2020 also reflects the fact that we had a slower pace in the previous year, but it wasn't a net divestment year, it was actually a net investment period.

PNG CHIN YEE: I think we are quite disciplined, and we do have an active policy of reviewing all of our portfolio and make sure that the themes are still relevant. I know if the themes have been met then we will think about divesting those counters. But a lot of our investment activity is actually very much driven by the opportunities that we see at any point in time. So, while we have a broad target we're not sort of fixed by those targets and we actually do look at opportunities on a case by case basis.

Question on Investment – Unlisted Assets

QUESTION: Unlisted assets position is now 48%, a very big increase from 42%. Intuitively, one would imagine that's a function of the fact that at March 31, listed markets were still heavily down and perhaps that is a distortion but I did want to ask you is that the case and has that turned back towards the previous equilibrium or has there been a conscious effort to put more into unlisted assets?

PNG CHIN YEE: I don't think there's been a significant change in the portfolio mix since the end of the year. Clearly markets have rebounded since March 31 which pretty much marked evaluations as a result of COVID. So that's, I guess, an indication to the positive.

From the liquidity perspective, we're still very liquid. As you know, when we were here last year, we talked about the fact that we wanted to de-risk in light of slowing economic conditions. Clearly, we didn't foresee COVID coming through, but we had actually de-risked significantly coming into this year.

In terms of our private assets, they have delivered stronger returns than our listed portfolio and they've outperformed and given as a liquidity premium that we expect to derive from being invested in the private space. So, you're right to say that this is all a function of the relative evaluations of our listed versus our private portfolios and I think with the recovery in the market you may say see some retracement of that 48% at this point in time.

Having said that, we do have at least half of our portfolio in the private space, mark to market because of the underlying exposures that they're in. The other half, which is not mark to market, we recognise at book value and recognise impairments on a year‑to‑year basis where we ‑ if and when we see deterioration in the portfolio. So, the marks on that book is actually quite fresh.

Out of the half which is not mark to market, two thirds of those are companies which you will be very familiar with, Mapletree, SingPower, PSA and Watson, some very high‑quality names. Only a small portion of that is in what we call earlier stage companies. They will comprise about sort of 5% of our overall portfolio. And within those, we've a pretty good track record of our private investments. So, some of the names that you're familiar with today, for example, Alibaba, Adyen or Celltrion, Meituan, these started out as private investments in our portfolio and we've seen very good realisation from these investments over time. So, I hope that addresses most of your questions.

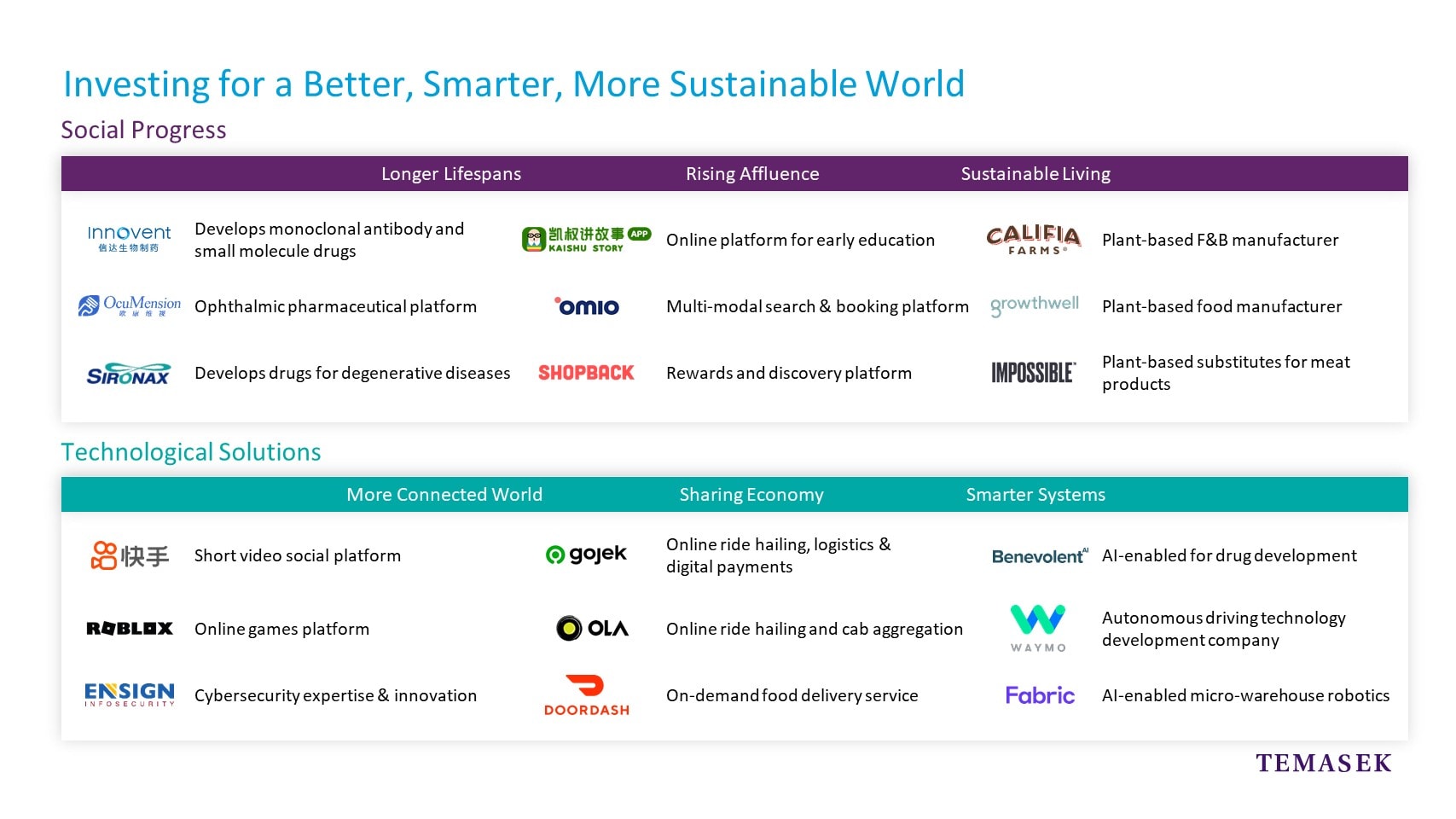

YEOH KEAT CHUAN: I just wanted to add, Chin Yee, that if you look at 2010, 23% of our portfolio was unlisted assets, so that has grown very steadily over the years and the other reason is also it's very much in line with the structural trends we're seeing. Spaces like longer lifespans, more connected worlds, smarter systems – that's where the opportunities lie.

PNG CHIN YEE: Our ability to invest in both the private and public space gives us a competitive advantage, relative to those whose mandates are actually more constrained because, for example, one of the things we've liked is around payments and we've invested in the public space with Visa, Mastercard, PayPal, etc, but we've also invested in the private space with Adyen and being able to do that across the capital structure actually gives us a lot of flexibility in terms of how we pursue a theme.

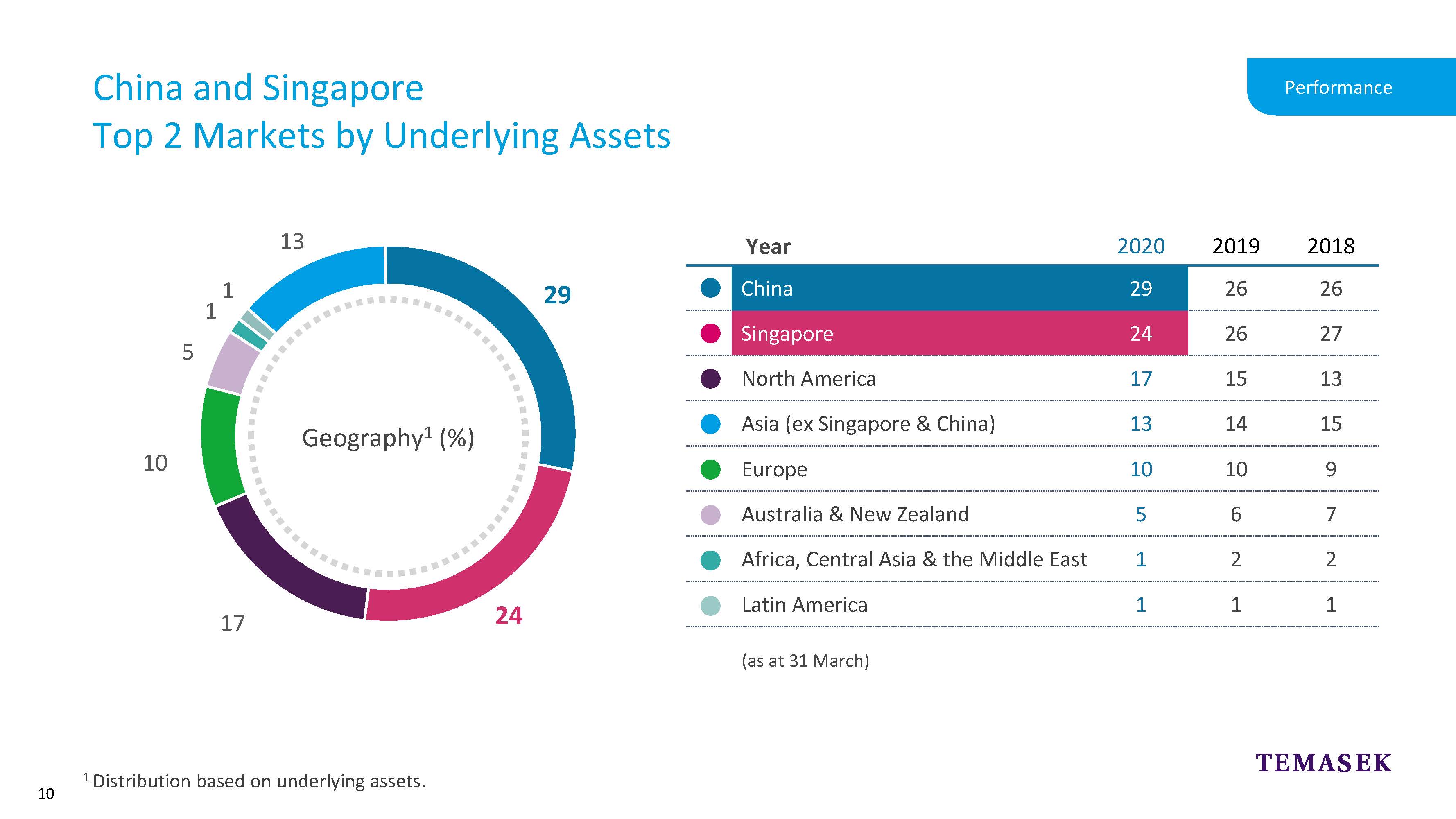

Question on Investment – Portfolio by Geography

QUESTION: This is the first time China investment surpassed the percentage of Singapore and is this going to be the case going forward?

PNG CHIN YEE: On our geographical exposure, if we can just pull out the slide that was in the presentation earlier on today. So, this shows our exposure by underlying assets.

So, it reflects the fact that a lot of our portfolio companies who are based in Singapore have also expanded outside of Singapore as part of their own plans to capture market opportunities outside of Singapore. Most importantly, if you look at this exposure based on where companies are domiciled, about half of that is still Singapore‑based companies.

Secondly, the reason why China has overtaken Singapore in this instance is really because of the relative valuations that we see in the two markets. If you look at the market as a whole, MSCI China has outperformed Singapore by 15 percentage points and actually our own China portfolio has outperformed MSCI China. So that just shows the relative magnitude of change in relative valuation.

I think the last point I'll note is that I don't think we should be surprised to see our exposure increasingly being sort of non‑Singapore because if you compare the economies of Singapore versus China or versus the US, for example, we are a smaller economy, right, so I think it's quite natural as we evolve that we will see much more exposure outside of Singapore.

Having said that, we do continue to invest in Singapore. We've got several initiatives in this space that KC can talk about and, you know, we do support the local ecosystem here as well. KC, maybe you want to touch on that.

YEOH KEAT CHUAN: Certainly. I'll just highlight a couple of structural trends examples in the space of longer lifespans, in life sciences, for instance, we've invested in a company ‑ we were the founding investor in a company called Tychan which is looking at infectious diseases. They've coupled analytics with biologicals manufacturing with regulatory sciences to accelerate the pace of getting a product from the lab to the clinic. If you consider that typically it takes about two years for a product to get into the clinic, Tychan has done so for the first in class monoclonal antibody against Zika. They did it in ten months and we're very pleased that they're now addressing the fight against COVID as well.

The second example I'd like to highlight is about the more connected world and that relates to how today we are increasingly much more digitalised. In fact, the two most common phrases that we hear during this period of lockdowns is one, "You are on mute", and second, "Can you hear me now?" And this really reflects that many more people are working from home and they're using machines that may not necessarily be secured and that's really a need and a demand for cyber security to be able to harden the attacks that face us, and prevention and we are seeing an increase in cyber-attacks.

We created a cyber security company two years ago called for Ensign Info Security and they are actively looking at providing managed security services. One of our portfolio companies called Sygnia is the leader in incident response and they're partnered together with Ensign Info Security to provide their services in Singapore.

Question on Investment – Structural Trends

QUESTION: What do you see the trend going forward especially due to the changes that could be brought forward by COVID? Will you be looking at sale of the properties or less investment ‑ less new investment into property and what kind of sectors and why?

WU YIBING: As a long‑term investor in China, we also benefitted from the reform in China and also the long‑term trends that has been highlighted in the previous slide. China has been embarking on the journey of the reform and, for example, the trends of digitalisation, longer lifespans, has driven a whole set of innovation and the leading Chinese companies.

As Chin Yee has pointed out, we started to invest in these companies when they were private and even at their early stage and the examples would be Innovent and Ocumension, we invested prior to their IPO and since IPO steadily added to our position and that benefitted to our outperformance to the market.

DILHAN PILLAY: You mentioned about the trends, yes, you know, we have six trends that we have adopted as a way of going forward in the context of portfolio construction. We are doing a review of those in the context of what we are experiencing through the COVID situation today and what could possibly be scenarios arising out of this COVID situation into the post‑COVID world. So those are ongoing things that will be natural in the context of our portfolio evolution and construction and I would say that we will learn a lot from this current COVID pandemic.

Question on Investment – Structural Trends (2)

QUESTION: Noticed that Temasek hasn’t made any sharing economy investments recently. Can you give some colour around why you haven't done that?

PNG CHIN YEE: On sharing economy, I think we've invested in DoorDash last year as well and that's in addition to investment in Ola as well as Gojek. So, while we want to invest behind these themes, we want to also be very disciplined and we don't feel compelled to invest just because it's part of the themes. So, we just need to make sure we find the right opportunity at the valuation and then we invest. So, I wouldn't be very fussed about, you know, whether we invest in one subsector or not in any given year.

Question on Investments – Structural Trends (3)

QUESTION: There was a report earlier this year, before COVID hit, that Temasek might have been in talks, actually, to take a majority stake in WeWork China. I just wanted to know if you care to comment on these reports and whether or not your view of the coworking space has changed given how drastically COVID‑19 has impacted this particular sector?

WU YIBING: Coworking is as a part of the sharing economy, we think the fundamental model still would work, obviously impacted by the COVID in terms of the overall commercial real estate I think is going through a difficult time right now but we believe the sharing economy theme and its theme of increasing the efficiency of the existing ‑ the commercial property should prevail in the long run. So, we've been very cautious in this, you know, investment. And then with the existing investment, we already are looking through some restructuring so that we can actually take advantage of the current relatively high vacancy rate in terms of the commercial real estate and then capture the efficiency gain that coworking has provided.

Question on Investment - Investment Opportunities

QUESTION: You mentioned in your statement that you have considerable cash on your balance sheet. Can you quantify that for us and give us a sense of how you plan to deploy it? What are the best opportunities right now that you see out there both by sector and by geography, if you will?

PNG CHIN YEE: We came in with considerable cash on our balance sheet partly because of where we saw the outlook in 2019. I would say that our focus really is along the structural themes that we've talked about. And we are quite selective in this environment, given that there is also quite a lot of uncertainty in the macro. So, we will be very bottoms up in terms of our thematic and trying to pick stocks that we think fit the themes that we've identify as being long-term winners in this environment.

So, several investments that we've done in the recent sort of three months as examples for you to consider. So, in May this year we were able to participate in the sell down by PNC of their stake in BlackRock and we think that's something that fits within our thematic. We believe that BlackRock is a very high-quality company that will come out of the situation very well. It's a market leader in ESG, it's a market leader in technology, it sells its Aladdin platform to other asset managers and is the market leader in the asset management space. So, these would be the type of companies that we would look for and want to invest in.

Even just last week, we closed a S$1 billion investment in India, Schneider India, which does low‑voltage electrical switch gear. So, we continue to look for opportunities which fits the themes that we like, and we are very selective in this environment.

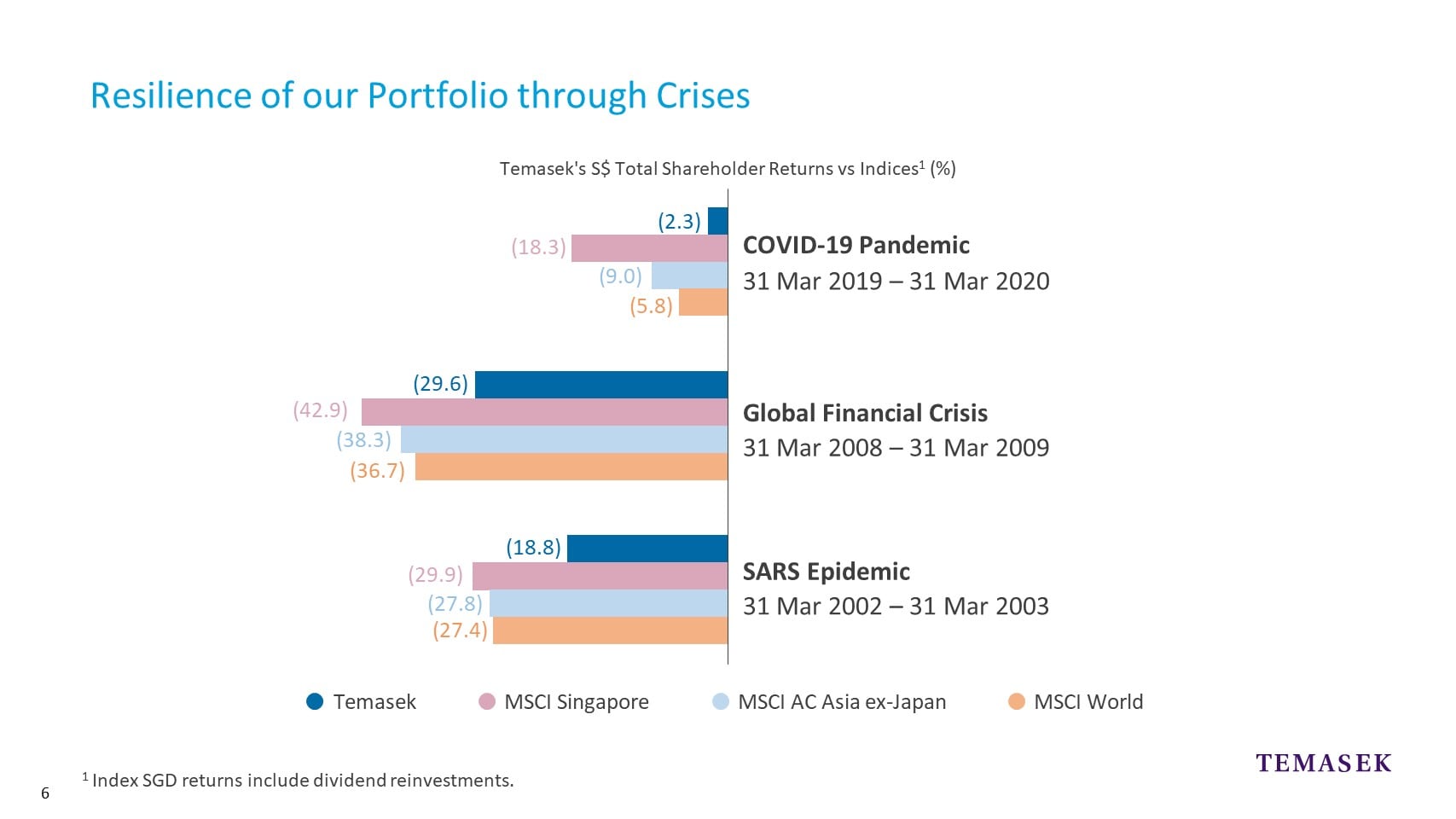

Question on Investments – Total Shareholder Returns

QUESTION: Is this year is the first time that Temasek’s one-year TSR is in negative territory? Do you think this is here to stay for the next financial year given how you mentioned the global market outlook remains volatile and there are challenges ahead?

PNG CHIN YEE: This is not the first time we've had a negative TSR. If you could just pull out the chart on the TSR you see that in previous crises we've also registered a negative TSR1.

But I think you need to look at that in the context of the general market performance. Obviously, the results are based off March 31 which marked the trough of the global markets, If you look at MSCI Singapore, it was down about 18%, Asia is down about 9%. So, you need to look at that result in the context of where the market was generally.

I would say that since March 31, markets have recovered from those lows so that should give you an indication as to where we stand. It's going to be very hard for us to speculate what the rest of the year is going to look like but from March, the markets have recovered.

________________

1 Click here for the reference to the Rolling S$ Total Shareholder Return (%) Chart.

Question on Investment – Key Sectors (1)

QUESTION: You talked about resilience and being selective in your investment for the medium to long term. Are there any particular winners you think in this COVID era that you would be possibly placing more bets on or being weightier on in terms of your investment portfolio and your proportion – especially in the Life Sciences, Fintech and Financial Services. But anything that stands out for you, perhaps even out of the ordinary that you think would possibly make good bets for your portfolio going forward?

PNG CHIN YEE: So, I think you're absolutely right to say that we've seen an acceleration in some of the trends, particularly in the digital space, right. So, an example would be, as you mentioned, you know, e‑commerce. We're all now ordering groceries from the leisure of our homes instead of going, you know, to the supermarkets. And on the back of that, we also see an acceleration in payments trend and that's really tied to both e‑commerce but also penetration of digital payments rather than using cash because we don't want to have cash changing hands. We see these trends here to stay but they're not going to go away just because COVID has passed. I think these are very sustainable trends that we have seen accelerated.

Companies have seen what they think is two, three years of growth all pushed into the first half of this year. And so, we've also taken the opportunity during the crisis to deepen our exposure in this space. So I think we highlighted that we have actually increased our exposures to payment stocks. For example, Visa, Mastercard and PayPal and so I think what we would like to do is really take a look at our trends that we identify, see what's relevant, what's accelerated and make bigger bets against those which we think are going to benefit in this environment and coming out of this environment. So, I think some of these themes are very relevant given today's world and we'll continue to put money behind them.

Question on Investments – Key Sectors (2)

QUESTION: The share of investment in the life sciences has increased from 3% five years to 8% this year. So, what trend do you see in agribusiness sector and is this investment in line with Singapore's national strategy of increasing self‑sufficient rate?

YEOH KEAT CHUAN: I think the answer, as I mentioned earlier, there are exciting opportunities in plant‑based proteins. When you talked about Singapore's 30 x 30 goals and there are investment opportunities also in Singapore where, for instance, the likes of Sustenir which is a vertical farm company. They are growing their crops in urban environment, what they call CEA or control environment agriculture, and increasingly as the COVID has raised concerns about self‑sufficiency and food supply chains, I think we will see more of such companies.

Another company that we've invested in is Apollo and they are an aquaculture company, seawater fish but built inland on several levels of fish farming. So, all of that I think will not just be exciting investment opportunities but also help to meet the Singapore government’s sufficiency goals.

DILHAN PILLAY: Let me just add to what KC said. Our focus on agribusiness pre-dates the 30 x 30 strategy. I mean we identified this as an area where we have to think about putting capital to work, simply for the reason of urbanising economies and growing middle income populations and the demand ‑ and the changing diet demands of such a population. And, for example, when you think about it, you know, as people ‑ as you urbanise and people move into middle‑income populations, the change in diet has a significant impact on resources not just land resources but also water resources. For example, 70% of freshwater is used in the production of food in agriculture.

So, as you think about this, the opportunity is not just for Singapore but actually Singapore is just a by‑product. The opportunity is actually very global and so we saw that as something that we want to be part of and that's why we've allocated capital to this area, whether it's in the area of alternative proteins or aquaculture or crop science. It's an area that requires actually more capital and, you know, so far it's done well for us and we're still keen to invest more in it.

Question on Investment – Investment Outlook

QUESTION: Could you explain the rationale behind Temasek’s long-term investments with the current economic climate compared to the previous year?

PNG CHIN YEE: So maybe just to go back to the question around the investment pace that we've had. So obviously the numbers that we've shown you is for year ended March 2020. So that reflects the activity in the last year. So, I made a couple of points there. One is that we do have some transactions which have been recorded both as investments as well as divestments. So, for example, the CapitaLand Surbana Jurong transaction actually was recorded both as an investment and divestment.

But more broadly I think what we do is that we look for opportunities on more than flat basis and sometimes there are opportunities and sometimes there aren't, right. So what we do is we try to be quite careful in picking up space that we like, the companies that we like, and then if the valuation makes sense, then we will invest and so those really very bottom‑up decisions that we take and clearly you know that our stance has always been or has been in the last couple of years that we are very cautious and that informs all the decisions that we make.

Question on Investments – Real Estate Portfolio (1)

QUESTION: On the topic of property theme, a lot of property investments that were considered recession proof, like student housing or nursing homes, are not holding up quite well during the crisis. Is that going to affect how you invest in property ahead?

DILHAN PILLAY: On real estate, and you raise the issue as to segments of real estate that may not be performing so well. As of now, the real estate investments that we have are not held by us directly. Most of it is held through our portfolio companies, whether it's CapitaLand or Mapletree, and their management teams are on top of these issues looking at what the future could be for segments that they're invested in, not just limited to the two that you've mentioned.

Question on Investments – Real Estate Portfolio (2)

QUESTION: About property investment, how big is your property investment now and how was it compared to a year ago?

DILHAN PILLAY: You asked the question about real estate portfolio. It's roughly 10% of our portfolio value and really our real estate holdings are primarily in the securities that we have in two of our main companies, Mapletree and CapitaLand. And those companies are, of course, considering what the effect of COVID has been on their business including the future work, for example, and thinking about what their strategies should be going forward and that's something we engage with them on.

Question on Investments – ABC World Asia Fund

QUESTION: What are other investments the ABC World Asia fund has been making?

DILHAN PILLAY: ABC World is a new fund. It has made an investment in Sunseap, which installs rooftop solar in Singapore, Vietnam, and other parts of Asia. It's an investment that Temasek also made in the company as well and it appears in the documents that we have shared with you. They're also focused on areas of financial inclusion and they have a very healthy pipeline of things that they are looking at but they're obviously pacing the investments given that the fund is quite new.

Question on Investments – ANT Financial

QUESTION: On Ant Financial, you were an early stage investor in the company. Can you give us a sense of how much you invested in that C round and whether you plan to sell any or all your stake in the IPO and if not, what's your outlook for the IPO and for that company in general?

PNG CHIN YEE: On Ant, I'm not sure it's appropriate for me to comment too much about Ant at this point, given they're undergoing their IPO. I would say that we are happy to be able to participate in their journey. We do like what they're doing in the China financial services space. They're providing inclusive finance to a large swathe of the population that previously may not have access to credit or asset management or insurance in the way that Ant is able to deliver. And they've really used technology in a very meaningful way, melding that with data analytics to provide a very cost‑effective and efficient way of serving a large part of the population. So, I think there is, you know, quite a lot of potential for Ant going forward still.

Question on Investment – Keppel

QUESTION: Temasek withdrew the partial offer to Keppel last month, but at the same time, you’re now actually a major shareholder for SembMarine. So, Keppel is now trading below 4.40 and Temasek is a major shareholder for Sembcorp. Are there any other plans that involve both companies?

DILHAN PILLAY: Both SembMarine and Keppel are listed companies. Their boards have duties to all shareholders, and I think it will be up to the two boards to decide what their business models are going to be and how they like to move forward. It's not really for us to direct things at all. That's not our governance framework. So, I think that's very much up to the boards of each company as to where they see their journey going forward.

Question on Investments – Singapore Airlines

QUESTION: Singapore Airlines has gone through half its cash it raised earlier this year. Will Temasek be keen to lead another round of fund‑raising?

DILHAN PILLAY: SIA is managing its capital as best as it can. We committed to supporting $15 billion of fund raise. They have raised something like $11 billion so far. It's really an exceptional time for the aviation sector with the limitation in travel and SIA, of course, is doing the best it can with the situation that's in place today.

But I must say it's really an exceptional company and, you know, it has always been considered amongst the most admired companies in the world. They have a resilient work force, you know, and I believe that they will come up with a way in which, when the post-COVID world allows travel to come back in, they will be able to continue operation.

Question on Global Trade Issues

QUESTION: What are the specific measures Temasek takes to hedge against the sanctions from China or the US? Alibaba was a good example where you shifted the shares.

WU YIBING: As we mentioned, we look at the fundamental value of the company. In terms of the capital market, obviously when companies have multiple listings and then we would basically get exposure for both markets, that's not a vote of confidence in one market versus the other, it's just getting exposure that reflects what's the underlying value of the company.

PNG CHIN YEE: I can just add to that, our exposures in China, for example, are mainly in the consumer tech space and not squarely in the space that's sort of being contentious. So, from the perspective, I think they would be relatively better positioned in this climate and so I think some of the actions that you talk about, you know, may not be so relevant for our portfolio.

Question on Global Trade Issues (2)

QUESTION: You mentioned that geopolitical tensions were cited as a key risk. Would there be a financial impact on Temasek's overall portfolio?

DILHAN PILLAY: Geopolitical issues have been there for some time but in particular, the US/China, relationship is critical because these are the two biggest economies in the world and what happens between them has a natural impact on other economies and also therefore on companies that are globalised and have business models which are very reliant on that relationship being on an even keel.

And I can't comment on where that's going to turn up because nobody quite knows but I can just say one thing which is that US and China are major significant destinations of our capital in a sense that in the last five to six years, the top two destinations for our capital has been the US and China and that will continue to be the case going forward based on where we see our trends as well as portfolio construction around the focus areas that we have identified. So that relationship within the US and China is actually quite an important one for us.

But there are also other geopolitical tensions and issues that arise, you know, and so we're watching those all very carefully. It's a very complex world, and even though more so nowadays we have to think more broadly as we look at investments. It's not just about the robustness of business models, all these things actually weigh in. But at the end of the day, all investors are in the same position and we just have to make sure that the scenarios that we're thinking about are those scenarios that can lead us into making hopefully the right decisions that we need to make.

WU YIBING: I want to add, we made the theme of the structure changes that exist in the market. We've identified five years ago those trends that we highlighted today and our investment in China had been focused on domestic consumption driven, innovation driven, and service led. We stayed away over the last five years from export driven, you know, low-tech manufacturing. So that obviously positioned us well and today what we see in the geopolitical tension and COVID, further accelerates those trends.

We deeply believe that China, as we mentioned, would, regardless of the political, the geopolitical tension, deepen its reform and opening up. And then it’s well positioned for the domestic-based consumption economy and for those sectors would continue to grow and because of its rising middle class. So, we would focus on those sectors that would be resilient and then in the mean time being cautious about the risks that are brought upon by the geopolitical tension.

Question on Global Trade Issues (3)

QUESTION: With the Trump Administration ramping up pressure as well as the potential of delistings for US-listed Chinese companies, what measures are you taking to avoid being caught in the crossfire in case there's an escalation of tensions there?

WU YIBING: Just in terms of the BlackRock JV, the reason we invested in that is we have always been, as a long term investor in China, looked at the trends that potentially will benefit Chinese reform. Clearly in the wake of COVID, China has accelerated its opening up and dependence reform, particularly in the financial sector, and then they opened the asset management sector. As Chin Yee has mentioned, BlackRock is a great company. We have shared values, and then also the asset would be a long term investor in CCB. We see the partnership with the different strong firms getting together and creating an innovative model, that's why we are focused on it.

In terms of the current geopolitical tension, we clearly looked at ‑ we believe in the strength of the company fundamentally would prevail. So, we're looking for the sectors that are long‑term resilient, despite the different scenario. Those would be sectors that benefit from domestic consumption focus on the structure trend, we emphasise again and again and then we believe, as the company's intrinsic value grow and the market value regardless of where they list, would eventually be reflected.

Question on Global Outlook – Interest Rate Environment

QUESTION: Investments and valuations, and risk profiles might be distorted by the low interest rate environment. This has been exacerbated by the stimulus and support measures in the global environment and markets. Some even raise the potential of zombie companies being brought up also or being propped up. What are Temasek's views are on whether risk profiles have been distorted and if this is influencing how Temasek is going about managing or recalibrating their risk profiles?

PNG CHIN YEE: I think you are right to say that valuations across global markets today are not cheap. But as you've also mentioned it's really underpinned by the low interest rate environments that you've had. So, if you're discounting a stream of cash flows using a low discount rate then clearly multiples are going to be higher as a result. And this is especially so for the tech companies which are benefitting from the current environment and investors are increasingly willing to pay up for growth that they see with these companies.

So I think while there is a strong underpinning for why they trade where they trade, we are a little cautious around some of the valuations which we do think is a little stretched. And so depending on which company we're looking at, you know, we do have some concerns around that and so we're quite careful with regards to where we place, our investment dollar. And, you know, it is true that if rates were to go up, that could have implications on valuations. But at the current moment I think rates are here to stay low for a longer period. We don't really see, you know, inflation in the near term. It's also indicated a greater tolerance for inflation overshoot, etc.

So, I think for where we are right now, you know, we want to invest behind the policy tailwinds but being very mindful of the risk which we see in the marketplace.

Question on Sustainability

QUESTION: Given that Temasek may not hold a majority in some of its portfolio companies, how would you be able to influence the sustainability decisions?

PNG CHIN YEE: From a portfolio engagement perspective, we have never let our percentage holding deter us from having an active dialogue with our portfolio companies. What we bring to the table is not just money for our portfolio companies but also a sharing of best practices and what we think is important to them. So, we do engage actively across our portfolio companies to help them think about what they need to measure, what they need to disclose, what they need to do to reduce carbon emission.

Question on Sustainability (2)

QUESTION: What specifically are the sustainability factors that will guide your investment decisions?

PNG CHIN YEE: We've had a big focus on carbon emissions but that's not the only thing that we're focused on. We are focused on all ESG factors and we've incorporated that into our investment decision making as well as monitoring framework. So, what would ‘E’ involve? Environmental factors could be both land use, water use, carbon emissions. Social factors could be sort of work force diversity and obviously governance is an important part of the consideration as well.

So, we've incorporated all of that into our investment decisions and when we make any investment decisions we look at what are the material factors in each of these that pertains to the company and then we make a very active decision as to whether or not we want to invest in the company and we have turned down investments because we don't feel that it actually meets our criteria for ESG sustainability.

Question on Sustainability (3)

QUESTION: Does the sustainability mandate restrict the types or number of prospective investees? How will that impact the rate of return on your portfolio?

PNG CHIN YEE: A lot of research has shown that companies who focus on ESG factors which are pertinent to their industry actually produce better shareholder outcomes. And part of the reasons, you know, if you don't pay attention to these factors, you might find yourself on the wrong side of regulations and you might find yourself on the wrong side of the customer, because you may not have the same market relevance if the market is not with you. And then we've actually seen that happen with the stock prices of certain companies and what is deemed to be a less sustainable industry actually derate.

It is important for us as a long term investor to focus on these issues and we don't actually see a conflict between being a good investor and paying attention to these issues.

DILHAN PILLAY: I would add that every company has to be on an ESG journey. Most companies have begun to be so. Nine out of the ten largest asset managers in the world have said they're going to put in place a sustainability framework or ESG framework and require the invested companies to perform according to that framework. So, every board, every management team has to think about this because it's no longer something in the periphery, it's actually mainstream.

The second thing is I don't believe at all that the universe of investments is going to shrink. In fact, it's going to enlarge. Why? Because new sustainable solutions are coming together in the market. Some of them will become part and parcel of existing businesses and companies are going to embrace them. Some may well be disrupted for the future. So, when you look at food, water, waste, energy, materials, clean transportation, urban development, there's going to be a huge number of opportunities that will come your way.

We are no different from every other investor in terms of looking at these trends of the future and trying to make sure that we are able to not just embrace the trends but invest in these companies, sometimes at a very early stage. This is so that we can be part of the journey and we can actually learn from it as we think about the impact those companies will have on the existing sectors in which they're focused on and the companies in those sectors which we may be invested in.

So, the knowledge that we pick up from having sustainability at the core, from embracing these new ideas and solutions can inform us and can actually improve our engagement with the companies that we've invested in, whether we are majority shareholders or we're minority shareholders. I would say it's almost a necessity for investors like us with a long term sustainable return orientation to be engaged with sustainability at the core and in our investment decisions.

YEOH KEAT CHUAN: Just to add to the last point, on the Agri-Food sector. I will give you one statistic, which is 46% of the world's arable land goes into growing crops that feed livestock and as the population grows, as affluence grows, as the demand for protein increases, there's no way you can sustainably continue that. That's why we've found an interesting and exciting investment space in plant-based proteins, to increase our investments in the likes of Perfect Day, Impossible Foods. We've also invested in companies like Memphis Meats and Califia Farms. So, these are really spaces which we see fit the sustainability goals and are also good investment objectives.

Question on Sustainability (4)

QUESTION: To achieve net zero carbon emissions goal by 2050 is quite an ambitious goal. What is Temasek's plan to achieve this and what are some of the things that are not currently being done that could help your portfolio companies be more carbon neutral?

PNG CHIN YEE: You're right to say that these are ambitious targets, but they're really informed by science because the IPCC has set out a recommendation for these kind of reduction targets if we want to keep to temperature changes to less than 1.5degrees from pre-industrialised level. That's the guidance that we have taken in setting our own goals and target.

For Temasek itself, it's not a difficult thing to do because our carbon footprint is actually very low. But for our portfolio companies, that's where the challenge lies. With that, what we want to do is really work with the portfolio companies as they go upon their own journey to have an effective carbon reduction plan.

From a new investment perspective, we've also actually trialled a carbon pricing model where we explicitly consider the cost of carbon emissions as we evaluate new opportunities. The other thing which we're looking to do is to put our capital to work behind new technologies. You're right to say that it's very hard to tackle some of these issues without carbon capture, carbon abatement and carbon negative technologies, so we need to put our money to work to try and capitalise developments in these areas. These are ambitious targets, but it's only right that we work towards them because this is what we need to do.

Question on COVID-19 Response

QUESTION: How much have you invested into the COVID support so your mask, your swabs, etc, and how much is that in proportion to this year's spending?

DILHAN PILLAY: Since 2003 our board has set aside a certain amount every year from our returns for purposes of community‑based activities and this year a significant amount of that has been put towards our COVID activities, which have been quite considerable in the five areas that was highlighted in the video. And I think it's warranted because if at all there's any time in which those efforts are needed on the scale at which we have committed ourselves towards, it is this time, especially where our communities do require companies to step forward, join with Government and join with the community in addressing the effect of COVID on populations and not just the economies or business conditions.

And I'm glad that it's not just us who have committed these amounts, there's also been portfolio companies that have stepped up as well and to make sure that communities are as safe as possible because it's only when everyone is safe that we can actually be safe ourselves. So that is where we are on the COVID activities.

Question on COVID-19 Response (2)

QUESTION: The COVID pandemic is something that has prompted every investor to relook at their investments, their strategy short term and long term. Specifically, what changes is Temasek making to its portfolio both in the near term and the long term to address this challenge?

DILHAN PILLAY: So, if you look at our portfolio, I could divide it into different components. The first, of course, is really the investment engine which comprises our direct investments as well as our traditional style portfolio companies.

In terms of direct investments, we have been on a journey to focus on certain sectors and those sectors, too, remain relevant in the context of what's been happening as a result after the pandemic. For example, Technology, Life sciences, Financial Services in the area of Payments, Fintech, Agri, Agri Food and as well as even in areas of consumer because there are changing consumer patterns as a result of what we're seeing in COVID.

That thing continues, you know, as we go along and in fact, now, we're learning so much out of COVID and the impact of technology on all the sectors that we invest in that we have to now take a different lens into business models that are relevant in these sectors.

Now then there's the traditional portfolio companies that we've had, what we call our stalwart companies. These companies have already begun to address the issue of technological advancement. So even pre‑COVID we set up a function, as you saw in the video, called portfolio development. That was really to work with our companies, to look at the business models of the future and to figure out what these companies have to do to not just remain competitive but to thrive in a new world. And COVID's actually accelerated a lot of those ideas and themes and I think that's something that we will work with our companies, in the context of strengthening them and repositioning them for that post‑COVID world.

Then, of course, the platforms we have, and we've developed those platforms over years, we have asset management platforms and so on. Those have strategies which are relevant but there is now a newer element that we are bringing to bear which is what we call perhaps a development engine for Temasek. So we set up enterprise development a few years ago to build new businesses but now we've also got something called strategic development. As you saw in the video, and that is to identify areas where we should start investing ahead right now for things that might have a longer gestation but they're worth looking at not just for current portfolio companies but perhaps for us to identify newer companies that will be part of that journey in the future. And so that's part and parcel of what we're attempting to do as we think about the portfolio, we are going to have in about 10 years' time. Maybe, you know, Chin Yee or Yibing might want to add to some of those ideas and thinking that we have.

WU YIBING: Yeah, if I might add, one example of COVID‑accelerated existing trend is in digitalisation. We invested in Meituan Dianping before its merger with Meituan. So, we saw the trend of how the younger generation, of how the younger consumers would use more digital to order food and evaluate the restaurant choices.

Of course, during COVID, because of the shutdown, food delivery becomes the main venue of getting that and post‑COVID, and those habits get strengthened and accelerated. This one example of COVID accelerating an existing trend and you can see the performance in Meituan Dianping further accelerated after COVID. We can give numerous other examples, for example, in the longer lifespan and healthcare, that's another sector that coming out of COVID that is becoming even stronger. Both are examples of how COVID accelerates an existing trend we've touched upon before.

Question on Covid Response (3)

QUESTION: Temasek has pledged about $800 million this year to fight COVID-19. How much of this 800 million has been spent so far and what is the main part of this spending? Is it on R&D or donations, or voluntary work? Moving forward, how much would be set aside for COVID-19 and what are the key areas of investment?

DILHAN PILLAY: So, I think first of all I would like to say that a significant amount of money has been expended by us on COVID-19, both our foundations as well as Temasek itself. And in the five areas that we highlighted, diagnostics, containment and contact tracing, treatment, what we call enablement which includes donations as well as protection and prevention. These activities continue because we have seen, for example, a resurgence of infections in some other countries and as countries open up, allow more activities within or travel opens up, we have to be prepared.

The most important thing for COVID is for all of us to be prepared for what could happen, not just what's happening right now and I think Temasek has to do its part as well and continue to do its part because this might be a journey that will take us some time. And so, we will set aside the appropriate amount of money to be engaged in this effort. It has to be one, as I mentioned before, between the governments, companies and individuals because all of us are in it together and as a responsible investor we see our role as being one in which we are prepared to be involved as much as possible and to do what we can do to address the issues that come out of COVID, not just in terms of the pandemic but even the effects of it.

YEOH KEAT CHUAN: I'd like to add onto what Dilhan said by prefacing that by saying we are heartened by the various parts of the community, whether it's the public sector, the private sector have come together in this fight against COVID. Just give you a couple of examples.

One is the humble swabs. That was actually limiting the number of tests we could do because the main commercial manufacturer of the swabs is an Italian company and during the height of the pandemic crisis, they were unable to supply. So, the community came together in Singapore. The research institutes, the hospitals, the SMEs, to design, validate and subsequently manufacture the swabs. We started with 3D printing because that was fastest way to get the swabs made. Subsequently now we're moving to injection moulding because you can get the scale and by the end of this year, we will have manufactured 20 million swabs.

The second example relates to transporters. At the height of the pandemic, it was a challenge to move COVID exposed passengers around and there were three transport operators: SMRT, SBST and Leisure Frontier. Together with an engineering firm called HOPE Technik and Sheares Healthcare, we redesigned and refurbished transport buses and vans to be able to safely transport the passengers around. We did this by separating the driver's section from the passenger's section. So separate air treatment facilities and introducing a negative pressure section in the passenger space. We have more than 50 of these vehicles and have provided an active means to transport passengers around.

The third and last example I'll share with you is about ventilators. There was obviously a point where it was challenging and a concern about getting enough ventilators. One of our portfolio companies, Advance MedTech, designed a ventilator that has a unique feature - tele remote monitoring and management. It's the first of its kind in the world and obviously for infectious disease you would want to minimise contact with the patients and that's now being produced in Singapore.

DILHAN PILLAY: But we've also in the investment space set aside capital for vaccine development as well as manufacturing in the context of the fight against COVID. And so that's also part and parcel of our overall approach to dealing with the COVID pandemic.

Question on Mr Liew Mun Leong

QUESTION: My question is on the court case involving Mr Liew Mun Leong. So I understand he’s a Senior International Business Adviser at Temasek. Just wondering, for Temasek, what’s its position on this? Does it go against the values of the company, and would it be taking any further actions?

DILHAN PILLAY: I think the first thing I should say is that there are many individuals who have contributed to both public service and to the private sector in Singapore, for the benefit of Singapore and our population as a whole. Liew Mun Leong is one of those persons and his track record at CapitaLand, at Changi Airport Group and at Surbana Jurong attest to that.

The court case has just had one phase of it done. There are ongoing proceedings and I don't think it's appropriate for me to comment on that. What I can say is that I think we should hear from Mr Liew on his side of the issue, and not come quick to judgment until we've heard all sides of things.

Question on Temasek’s Staff Remuneration

QUESTION: Temasek implemented a company-wide salary freeze earlier this year. Would another similar move be on the cards? Do you think Temasek needs to implement another such move given the uncertainties ahead?

DILHAN PILLAY: So, on the second question there are three things we did as early as March. The first thing we did was to reduce the bonuses of senior members of management. The second is that we imposed a wage freeze. The third is that we put forward a scheme for voluntary pay cut for senior management and the senior management took the voluntary pay cut. The savings from all that went towards our COVID‑19 initiatives for the community and that showed our need to be in line with what our companies are doing and to support them in what they were doing and to support the community‑based initiatives which are already under way.

Now going forward, of course, we have to monitor the situation to see what we need to do with our remuneration for our staff and that is something, of course, that we're paying very close attention to but it's a bit early to say whether we need to take any further action one way or the other.

Question on Temasek’s contribution to the Government’s budget

QUESTION: Singapore has had to dip into its past reserves of around S$52 billion. Was there any impact on these draws on Temasek's capital notwithstanding that your financial year ended in March 31 and the four Budgets1 happened after that. Given the fact that there's a lot of uncertainty here, are further draws also seen as a risk going forward?

PNG CHIN YEE: Temasek has been part of the NIR framework, the net investment return framework since 2016. What that framework says is that the Government can include in its budget up to 50% of the long term expected returns that you expect Temasek to generate, net of inflation. So, that's the amount that they can put into their budget and it does not rely on cash flows that they receive from Temasek. They can access cash flows in a variety of different ways.

From that perspective, we need to sort of distinguish between cash flow versus the budgetary guidelines that they can spend. So that's one. You also know that we do declare dividends every year and that the decision is actually one that's made by our board based on our own needs as well as considerations. When we look at what the Government has included in its budget for 2020, you will see that the NIR framework accounts for about 20% of the overall budget and there will be contribution under the NIR framework for ourselves, the MAS, as well as GIC.

________________

1 The Singapore Government rolled out two fiscal packages before the financial year ended 31 March 2020 and two more after the financial year. Source: https://www.singaporebudget.gov.sg/budget_2020