Letter to the Financial Times regarding the article, "Singapore’s Temasek sours on European companies amid US tariff threats"

This article grossly misrepresents Temasek’s investment stance on Europe by neglecting material facts that were shared during our Temasek Review media briefing, with FT and other international media.

Our Chief Investment Officer, Rohit Sipahimalani explicitly stated during the briefing that we have a strong presence in Europe and it is amongst the key markets that will be the “biggest recipients of our capital.” This is contrary to the assertion that “rising trade tensions from US President Donald Trump’s tariffs have made Temasek fearful that the European companies it has previously targeted for investment will be among the worst affected.”

Rohit added that Temasek’s plans to invest S$20 to S$25 billion in Europe over five years remain on track, and we continue to see opportunities in Europe. He noted that “we will invest in high-quality businesses that are going to be more resistant to the geopolitical shocks we are seeing today.” These include family-run businesses with strong franchises and deep engineering or technical leadership in sectors such as industrial and new energy, financial services, and consumer goods.

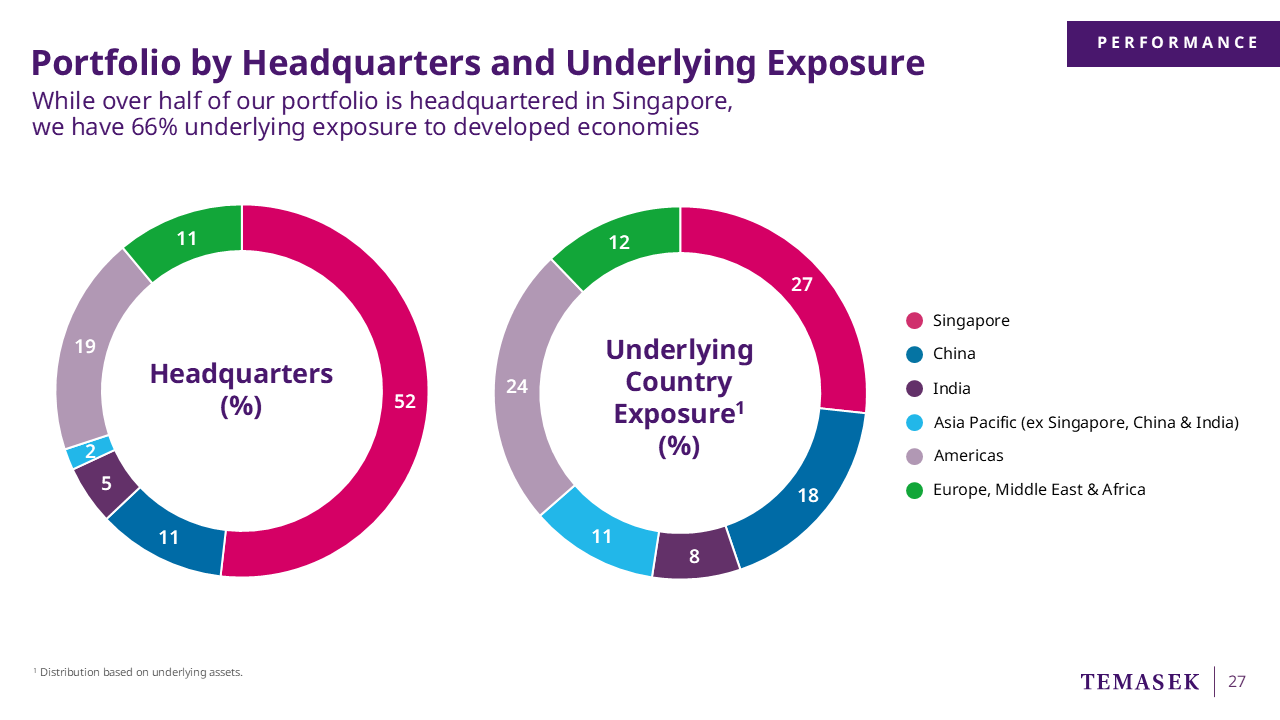

Over the past year, the absolute value of our underlying exposure to EMEA has increased and our portfolio exposure in EMEA by headquarters was up by 1% (over S$4 billion). However, the article ignored these facts and only highlighted in isolation our underlying exposure is down a percentage point from a year ago.

Europe has been the second-largest recipient of our capital since 2022 and will remain so based on our capital allocation for our portfolio construction. We continue to actively source opportunities and approve sizable transactions notwithstanding the uncertainties arising from tariffs.

Our recent investments include Neoen (renewable energy), Keyword Studios (video game technology services), VFS Global (visa processing), Atlantica Sustainable Infrastructure, and SRG (financial services).

The article conflates our views on the macroeconomic outlook with our investment activities in the region.

During the media briefing, our Joint Head of Corporate Strategy, Lim Ming Pey’s presentation noted that while there is a sense of elevated trade uncertainty that could impact the growth trajectory of the region, our portfolio in Europe remains resilient.

The media presentation is available here and the exchange with FT and other international media on Europe at the media briefing is reproduced below.

Chia Song Hwee

Deputy CEO, Temasek

Europe presentation slide and transcript of the Media Briefing on 8 July, which was attended by the FT and other media outlets

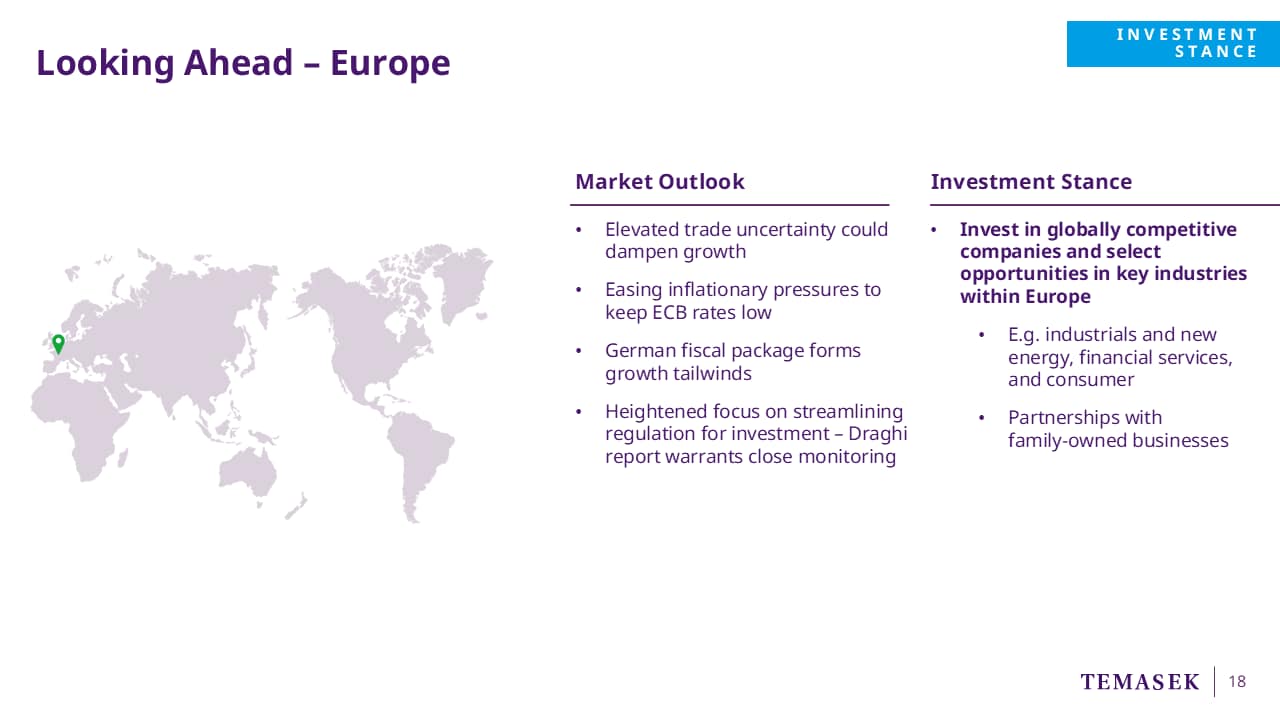

Next, on to Europe.

There is a sense of elevated trade uncertainty, which could impact the growth trajectory of the region.

Tighter credit conditions for domestic market may also form headwinds, but the moderated inflationary pressures can enable the European Central Bank to keep rates low.

The Draghi report, which addresses the competitiveness and future of the European Union, gives focus to streamlining regulations, which could have a significant impact on investment opportunities in the region.

More recently, Europe has also responded with ReArm Europe and Germany’s new fiscal package, and these would be things to look out for.

For Temasek, our portfolio in Europe remains resilient.

There are many Europe-based or family-run businesses which have strong franchises, deep engineering or technical leadership, which are or have the potential to be global market leaders in their industries.

We are focused on these companies as well as in sectors such as industrials and new energy, financial services, and consumer.

Q&A Transcript (Europe section) of the Media Briefing on 8 July, which was attended by the FT and other media outlets

QUESTION: Just looking at your performance, I see that your allocation to the US went up and to Europe went down. Is that just the market? Is that just general market performance? And the second thing I'd asked before about private equity as well, can you talk us through a little bit about your thinking towards current private equity market in which exits are proving quite difficult and we're seeing a lot of investors, for example: GP is going to continuation funds etc. Is that a concern for you?

ROHIT SIPAHIMALANI: Firstly, on your first point, as you said, the minor movements year by year, I won't read too much into it. Actually Europe was a pretty active market for us last year. We made some fairly significant investments that I can talk about that later if you want. But as you would expect, a lot of these European investments actually are global companies and this is the underlying exposure. So to give you an example, we partnered Brookfield to acquire Neoen, which is a renewables company, headquartered in France. It's got some European assets. There's also a large portfolio in Australia for example, so it wouldn't show up in the underlying exposure in Europe, only a small portion you know. Similarly, we invest in a utilities company headquartered in the UK, that has some assets in Spain, but a lot of assets in the US. So not all of it will show up under Europe as such. So like I said, I wouldn't read too much into the movements, they're not material.

LENA GOH: So Arjun, actually on the Europe point, if you show the Europe slide — actually the absolute amount is up, even though it’s a slight 1 percent dip.

ROHIT SIPAHIMALANI: We don't have the previous year's numbers, but by headquarters, if I remember correctly, Europe has gone up from 10% last year to 11% this year. The underlying exposure can shift depending on the types of assets we sort of buy.

In fact, in Europe also like in other locations, we've been again focused on businesses that are gonna be less impacted by what's going on geopolitically. So as you can see, the investments we made last year, they've been either on core plus infrastructure, or they have been more service oriented. So we have been invested in Keyword Studios for example, which basically does technology services for mobile gaming companies globally, but they're based in Europe.

Similarly, we did SRG, which was an insurance broker in Europe. So again, businesses that are going to be more resilient to the geopolitical shocks that are the sort we are seeing today.

---

QUESTION: On the US, you said that ''unless something happens”, the US is going to “remain the recipient of our investments", what is that "something" you are thinking about? Who are the other recipients?

ROHIT SIPAHIMALANI: There is nothing we can foresee. Things happen that none of us can predict. We see it to be an attractive market and there are segments that we have identified that we think are going to be attractive. AI is a clear example. Nothing we can foresee will cause us to change that. We had mentioned last year about our plans to invest US$30 billion over five years in the US and we are well ahead of that pace. So at this point, we feel pretty comfortable investing in the US. In the other key three markets that we have a strong presence in Europe, India, China, I think those four markets are going to be the biggest recipients of our capital. And like I said, we are looking to incrementally doing a little more in Japan. In Southeast Asia, we always want to do more, but the scale of opportunities is not as big as elsewhere.