Expanding Temasek’s US Footprint

Expanding Temasek’s US Footprint

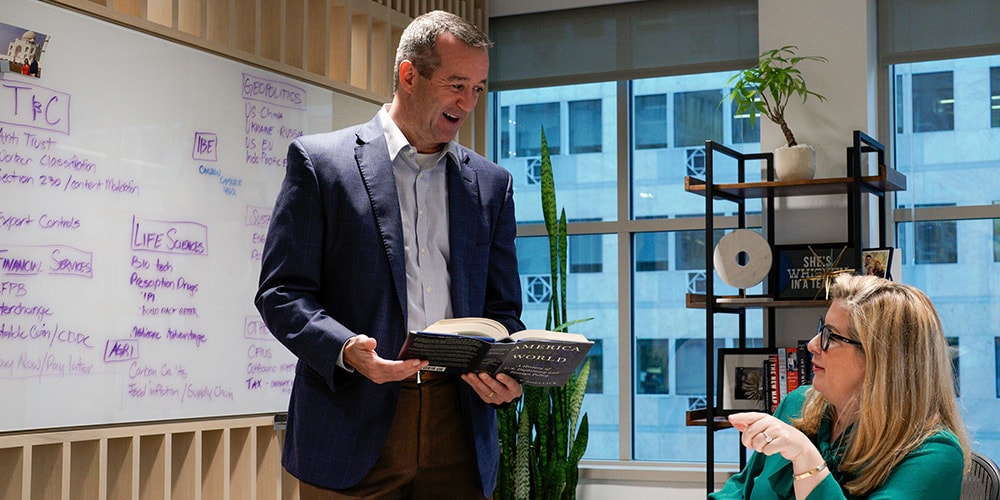

“Ten years ago, we were just a handful of people in New York,” Pierce Scranton reflects. “Today, we have some 100 people in the Americas, and assets north of 20 per cent of Temasek's overall portfolio.”

From his office on the 8th-floor of Washington’s Homer Building, Temasek’s Deputy Head of North America and Managing Director of International Relations has had a front-row seat to the company’s remarkable growth in the US, the largest recipient of Temasek’s capital over the last seven years.

Plans to invest a further US$30 billion over the next five years will see the US remain the leading destination for Temasek’s investment dollars, and position the company as a dynamic player in the world’s deepest and most competitive capital market.

“As long as we continue to approach the market with the same level of commitment and understanding, the future looks very bright,” says Pierce.

Navigating complex terrain

Pierce is no stranger to high-stakes environments.

Before joining Temasek, he held several notable positions in US politics and government relations, including as Executive Director for Global Government Relations & Public Policy with JPMorgan Chase. By 2017, he was ready for a new challenge. “I had heard of Temasek, knew its reputation, and was interested in the opportunity to do something entrepreneurial,” he says.

At the time, Temasek was expanding its US footprint. Its New York office had been up and running for three years, and the company was in the process of opening a second office in San Francisco.

Meanwhile, the global trade and investment landscape was shifting, with tightening restrictions and heightened regulatory scrutiny. Temasek recognised the need for an on-the-ground presence to anticipate and understand the impact of local policies on its portfolio. Having already established a dedicated institutional relations team in China, it now looked to set up similar teams in key capitals in Europe and the US.

Pierce’s deep political and policy expertise made him a natural fit to lead the Washington DC office as Managing Director for Institutional Relations.

The early days were intense, he recalls, coinciding with debates over reforms to the Committee on Foreign Investment in the United States (CFIUS), which screens potentially sensitive foreign investments. “Shortly after coming on board, it became clear we needed to develop a strategy on how we would manage the risks that CFIUS reforms might represent,” he says.

Understanding how CFIUS works and using that understanding to structure deals is essential for foreign investors, says Pierce. “It’s critical to engage with the government transparently, and ensure they understand who you are and what your intentions are.” By clearly outlining its boundaries and maintaining transparency, Temasek has earned a reputation as a trusted investor, he says.

“Temasek’s reputation is obviously something that has been 50 years in the making, but it precedes me everywhere I go, and is an enormous asset when talking to policymakers who are concerned about geopolitical risks from international investors.”

Initially, Pierce focused on understanding issues that potentially impacted Temasek or the industries relevant to it. As he became more familiar with Temasek’s portfolio companies and investments, his role expanded to include identifying policy or political issues that may affect the larger Temasek ecosystem.

“Over time, I started working more globally,” he says. “Investments from our teams in India, China, Singapore, or Europe can trigger CFIUS reviews if there’s a US nexus. When this happens, our team quickly assesses the transaction risks and potential sensitivities, then determines how to help structure the deal.”

The Washington office quickly proved itself an indispensable resource within the Temasek ecosystem. “People began calling us for assistance, rather than us reaching out to see if there were any concerns,” he says.

As Temasek’s US footprint grows, with investments in high-growth industries from AI and healthcare to financial services, so has the challenge to ramp up policy expertise across diverse sectors. “As long-term investors, we often have the luxury of taking deep dives into each issue, which I truly appreciate.”

Growing for generations

In 2023, Pierce took on the additional role of Deputy Head, North America. Looking back, he says that Temasek’s growth in the country has not just been about numbers. “I’ve watched the company grow into a truly global, sophisticated investor across all aspects of the capital spectrum, whether public or private, early or late stage, growth equity, credit, or funds.”

Temasek’s success, he believes, lies equally in its long-term vision and commitment to sustainable growth.

“We have one of the most unique mandates, which is to grow for generations,” he says. “Everywhere I go, I have a good story to tell – how we’re trying to help companies grow, create jobs, add wealth, help societies, as well as solve big problems like climate change and curing diseases. That’s what makes Temasek stand out – and it’s something I’ve been very proud to be part of.”

As Temasek continues to deepen its presence in the US, Pierce remains optimistic about the road ahead.

“We’ve reached another inflection point. The US will be a growth engine for years to come.”

Everywhere I go, I have a good story to tell – how we’re trying to help companies grow, create jobs, add wealth, help societies, as well as solve big problems like climate change and curing diseases. That’s what makes Temasek stand out – and it’s something I’ve been very proud to be part of.”

Pierce Scranton

As we mark our 50th anniversary, we present 50 stories from our staff, alumni, and beneficiaries who have been a part of Temasek's journey through the years.

Hear for the first time their anecdotes of what went on behind the scenes as they grew alongside the firm. Together, they capture pivotal milestones of Temasek, and tell the story of an institution built By Generations, For Generations.