A Resilient Portfolio Amidst The Covid-19 Pandemic

Temasek reports a preliminary portfolio value of S$306 billion

ahead of its final Temasek Review release in September

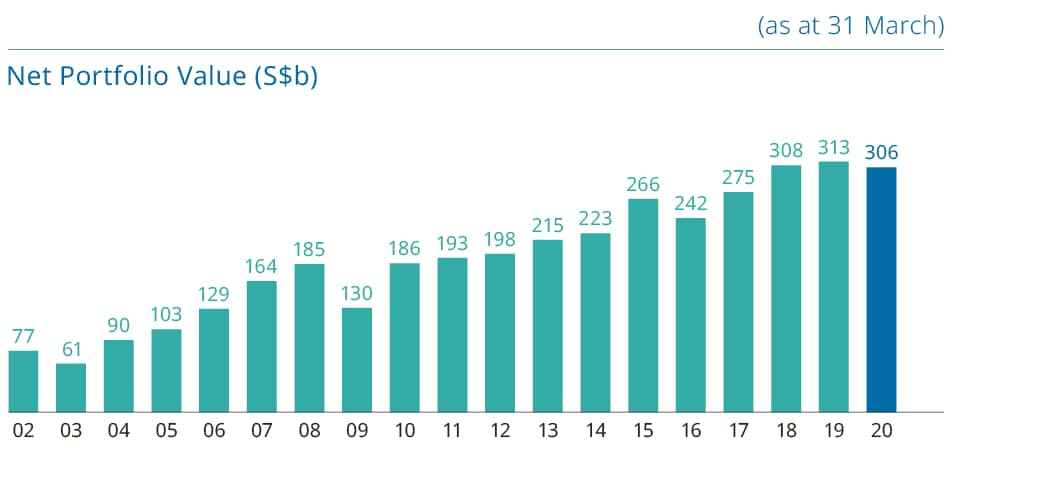

- Preliminary net portfolio value (NPV) of S$306 billion as at 31 March 2020

- One-Year Total Shareholder Return (TSR) of -2.3%

- NPV tripled over last 16 years with TSR of 7.5%

- Ended the year in a net cash position, with a strong balance sheet

Singapore, Tuesday, 21 July 2020 – Temasek is providing its preliminary portfolio performance1 for its last financial year ended 31 March 2020, ahead of the September release of its final audited annual consolidated group financials and portfolio performance.

Temasek’s preliminary portfolio performance

Based on current unaudited management information, Temasek’s NPV was S$306 billion2 as at 31 March 2020.

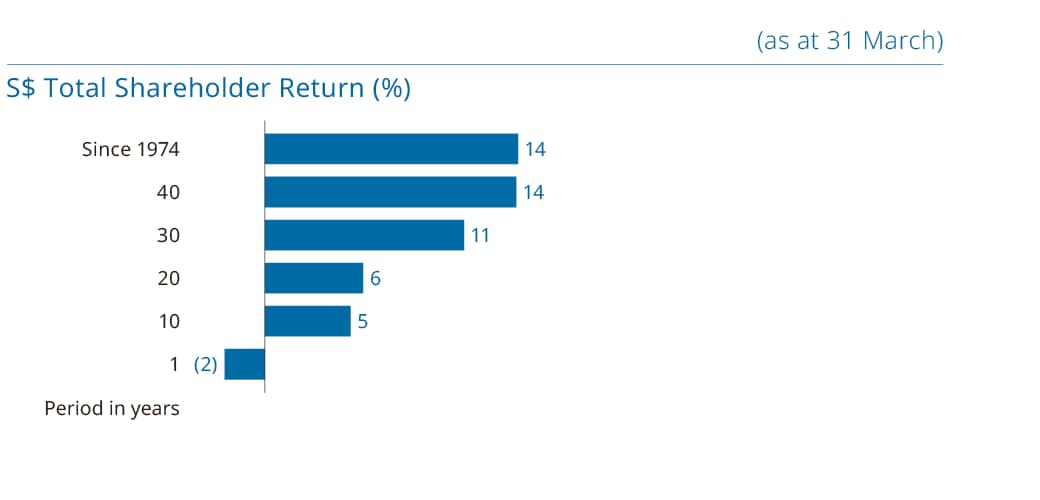

One-year TSR was -2.3%. TSR since inception in 1974 remains a robust 14% compounded annually. TSR takes into account all dividends distributed to the shareholder, less any capital injections.

Temasek’s NPV has tripled over 16 years, up from S$90 billion as at 31 March 2004, reported in its inaugural Temasek Review. Its 16-year TSR was a compounded 7.5% from 31 March 2004 to 31 March 2020.

Impact of COVID-19 pandemic

Prior to the onset of the COVID-19 pandemic in the last quarter of the financial year ended 31 March 2020, Temasek’s NPV had been growing steadily and trending well.

As an investor with a long term horizon, Temasek does not manage its portfolio to short term mark to market changes, by benchmarking against public market indices, or comparing against the returns of other companies.

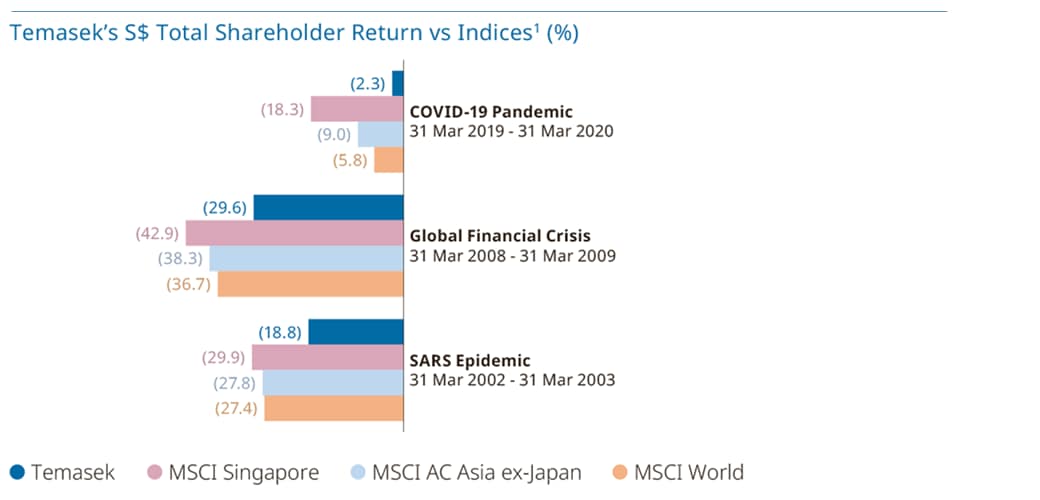

However, as a reference to how it has performed over the last financial year relative to market indices in Asia, the Temasek portfolio stayed resilient with a 2.3% decline, compared to the MSCI Singapore Index and the MSCI AC Asia ex-Japan Index, which declined 18.3% and 9.0% respectively. Globally, the MSCI World Index declined by 5.8%. Most of these declines were the result of the sharp market correction in the last quarter up to 31 March 2020, in response to the onset of COVID-19.

As was evidenced during the SARS epidemic and the Global Financial Crisis, Temasek typically outperforms market indices during market downturns.

Temasek ended the year in a net cash position with a strong balance sheet.

This means Temasek has the capacity to work with its portfolio companies to position them for the future. It also stands ready to invest in opportunities arising from volatile market conditions during and post COVID-19 recovery.

Temasek’s investment approach

As an active investor and shareholder, a forward looking institution and a trusted steward, Temasek maintains a strong focus on delivering sustainable value over the long term.

Mr Dilhan Pillay, Chief Executive Officer of Temasek International, commented, “Rising geopolitical and trade tensions, as a result of increasing nationalism and protectionism, will create more uncertainties for long term investors and asset owners. These uncertainties are now exacerbated by the immediate, as well as longer term, impact of COVID-19. However, we may see investors sharpen their focus in some areas, like digitalisation and healthcare.

“We aim to build a resilient portfolio as a long term investor. On the whole, we are pleased with our performance, despite the sharp correction due to COVID-19. We have a good mix of listed and unlisted investments, a good balance between our portfolio stalwarts, and our new investments into emerging and longer term trends. These help to add to our resilience”, added Mr Pillay.

He further elaborated, “Our unlisted investments are recorded at book value adjusted for impairment – companies like PSA continue to provide steady returns, even as they prepare actively for future challenges like the hydrogen economy and other longer term changes. In addition, our other investments, guided by our themes and trends, have also performed well. We continue to work with our portfolio companies to ride out this crisis, building up their resilience and positioning them to emerge stronger in the post COVID-19 world.”

COVID-19 response as a forward looking institution and a trusted steward

Beyond being an investor, Temasek is a forward looking institution and trusted steward.

Since 2003, the company had already instituted a policy to set aside a portion of its positive returns above its risk-adjusted cost of capital to benefit the community. This reflects our ethos of doing things today with tomorrow clearly in our minds.

Ms Leong Wai Leng, Chief Financial Officer of Temasek, explained, “With the onset of COVID-19, we have redirected a significant proportion of these community funds to support various COVID-19 initiatives, including those being initiated by Temasek Foundation. We believe that we, together with our portfolio companies, the government and the community, must all do our part to collectively fight and defeat the COVID-19 pandemic.”

Dr Fidah Alsagoff, Head of Life Sciences and Joint Head of Enterprise Development Group, noted, “We have partnered various groups across separate COVID-19 response tracks – with government agencies; Institutes of Higher Learning including universities and polytechnics; research bodies; and medical companies – to research and develop solutions that could potentially prevent virus transmission or enhance treatment, as well as to pilot medical trials.

“These range from the humble swab for sample collection, to a lightweight booth for safe swabbing at GP clinics and elsewhere, to a lightweight ICU-grade ventilator with modern features like remote monitoring and control capabilities. We are also seeding SMEs with capital or advance orders to enable them to undertake pilot programmes or build local supply lines for diagnostics, and other testing or medical supplies. We are very pleased to see many companies, both our portfolio companies as well as other partner companies, coming up with various novel solutions to safeguard our lives and livelihoods.”

Mr Pillay added, “We activated our business continuity plans early in January, and alerted our portfolio companies so we could share insights and information as it came to hand. We have also partnered Temasek Foundation, SMEs, overseas companies and other community groups to step up on our COVID-19 responses since the onset.

“We were clear from the beginning that we are dealing with an exponential challenge – every day is one day more for the virus to multiply and continue its spread in the community. Not only did we need to respond to immediate needs, we also had to anticipate future needs. This is why we continue to support work on the next-generation test kits, and other solutions, so that we add to the toolkits available to manage and prevent the spread of the virus.

“No one is safe until everyone is safe. This is why we worked with Temasek Foundation and various community and business partners to distribute more than 1 million litres of hand sanitisers, 12 million masks, half a million face shields, and 180,000 oximeters to various groups in our Singapore community. In particular, we wanted to support the vulnerable among us, as well as the essential services staff working on the frontline, such as healthcare, public transport, security and the like.”

Mr Robin Hu, Head of Sustainability & Stewardship Group, added, “We have contributed medical supplies such as diagnostic kits, testing equipment, ventilators and oxygen concentrators, PPEs, masks and sanitisers to more than 30 countries3. These include our ASEAN neighbours, as well as those much further afield, such as in Middle East, Africa, Europe and Latin America.

“For instance, over 400,000 sets of the Singapore Fortitude diagnostic test kits, developed and produced in Singapore, have been distributed or donated across the world. Our staff across China, India, Europe and the Americas have also helped to provide food and medical supplies to their local communities, especially to those whose lives have been badly disrupted by the outbreak. They have also raised money for local donations and other COVID-19 causes.”

More information about Temasek’s COVID-19 initiatives will be shared in the Temasek Review 2020 in September, along with its portfolio and financial performance, as well as investment highlights and outlook.

Reporting of portfolio performance and audited group consolidated financials

Temasek reports its performance in two ways: portfolio performance and financial performance. This is unlike most investment companies and fund managers, which typically report only their portfolio performance. It is also unlike operating companies, which typically report only their audited financials.

For portfolio performance, Temasek reports its NPV and TSR. For financial performance, Temasek publishes its Group Financial Statements that are presented on a consolidated basis, in accordance with International Financial Reporting Standards, and audited by an international accounting firm. These comprise the financial statements of Temasek, and its subsidiaries and interests in associates and joint ventures, many of which have operations globally.

Given the COVID-19 situation, global lockdowns and work-from-home arrangements, many companies, especially those with operations globally, have not been able to close and audit their financial reporting in the usual time. Various exchanges and regulators around the world, including Singapore, have extended financial reporting and filing deadlines for companies.

In Singapore, the Singapore Exchange (in consultation with the Accounting and Corporate Regulatory Authority and the Monetary Authority of Singapore) and Inland Revenue Authority of Singapore have also granted extensions of about two months for results announcements, annual general meetings and tax filings.

In view of this, Temasek is experiencing a similar delay of two months for its release of Temasek Review, as the Group consolidation process can only start when all financial statements from portfolio companies have been received. Because of these exceptional circumstances, Temasek is providing preliminary portfolio performance data now, and will share its final portfolio and financial performance upon completion of audit in September.

##END##

About Temasek

Temasek is an investment company with a net portfolio value of S$306 billion4 (US$214b, €196b, RMB1.52t)5 as at 31 March 2020.

Our three roles as an Investor, Institution and Steward, as defined in our Temasek Charter, shape our ethos to do well, do right and do good.

Our investment philosophy is anchored around four key themes: Transforming Economies; Growing Middle Income Populations; Deepening Comparative Advantages; and Emerging Champions.

Six structural trends help shape our investment direction in Temasek: longer lifespans, rising affluence and sustainable living drive social progress, enabled by technological solutions for sharing economies, smarter systems and a more connected world.

We actively seek sustainable solutions to address present and future challenges, as we capture investment and other opportunities that help to bring about a better, smarter and more sustainable world.

Temasek has had overall corporate credit ratings of Aaa/AAA by rating agencies Moody’s Investors Service and S&P Global Ratings respectively, since our inaugural credit ratings in 2004.

Headquartered in Singapore, we have 11 offices around the world: Beijing, Hanoi, Mumbai, Shanghai and Singapore in Asia; and London, New York, San Francisco, Washington DC, Mexico City, and Sao Paulo outside Asia.

For more information on Temasek, please visit www.temasek.com.sg

For Temasek Review 2019, please visit www.temasekreview.com.sg

Connect with us on social media: Facebook (Temasek); LinkedIn (Temasek); Twitter (@Temasek); Instagram (@temasekseen); YouTube (TemasekDigital); WhatsApp (+65 9101 0207) and WeChat (temasek_digital).

For media queries, please contact: Stephen FORSHAW Lena GOH |

For media queries, please contact: Dawn TAN |

Key Figures in S$ and US$6

Total Shareholder Return as at 31 March 2020

TSR (%) |

One-year |

10-year |

15-year |

16-year |

20-year |

Since 1974 |

in S$ terms |

(2.28) |

5 |

6 |

7 |

6 |

14 |

in US$ terms |

(7.07) |

5 |

8 |

9 |

7 |

16 |

Charts

Net portfolio value tripled over last 16 years

Total shareholder return of 7.5% over 16 years

Resilience of Temasek’s portfolio across crises

Over the long term, Temasek’s portfolio has been relatively resilient across crises; this reflects the underlying quality and resilience of the companies in our portfolio.

1 Index SGD returns include dividend reinvestments.

The preliminary portfolio performance presented in this announcement is based on unaudited consolidated financial statements for the fiscal year ended 31 March 2020. The final portfolio performance information may be different upon completion of the audit of the consolidated financial statements for the fiscal year ended 31 March 2020, but is not expected to be materially different from the preliminary information presented in this announcement.

_______________________________

1 The preliminary portfolio performance presented in this announcement is based on unaudited consolidated financial statements for the fiscal year ended 31 March 2020. The final portfolio performance information may be different upon completion of the audit of the consolidated financial statements for the fiscal year ended 31 March 2020, but is not expected to be materially different from the preliminary information presented in this announcement. The audit of the group consolidated financials and portfolio data is expected to be finalised in September, due to delays in receipt of the audited results of companies and associates in the Temasek portfolio, as a result of lockdowns, circuit breaker, and other business and community restrictions arising from COVID-19 responses across the world.

2 As at 31 March 2020: Equivalent to US$214 billion, at an exchange rate of S$1 : US$0.7015; €196 billion, at an exchange rate of S$1 : €0.6407 and RMB1.52 trillion, at an exchange rate of S$1 : RMB4.9786. The corresponding NPV for other currencies are rounded to the nearest billion, after currency conversion from SGD based on the exchange rate as at 31 March 2020.

3 Some of the countries include Southeast Asia: Indonesia, Malaysia, Philippines; South Asia: India, Sri Lanka; Central Asia: Uzbekistan; Oceania: New Zealand; Africa: Gabon, Cote d'Ivoire; Europe: Italy.

4 The preliminary portfolio performance presented in this announcement is based on unaudited consolidated financial statements for the fiscal year ended 31 March 2020. The final portfolio performance information may be different upon completion of the audit of the consolidated financial statements for the fiscal year ended 31 March 2020, but is not expected to be materially different from the preliminary information presented in this announcement.

5 As at 31 March 2020: Equivalent to US$214 billion, at an exchange rate of S$1 : US$0.7015; €196 billion, at an exchange rate of S$1 : €0.6407 and RMB1.52 trillion, at an exchange rate of S$1 : RMB4.9786. The corresponding NPV for other currencies are rounded to the nearest billion, after currency conversion from SGD based on the exchange rate as at 31 March 2020.

6 Using S$-US$ Exchange Rate as at 31 March of the respective years.

7 The preliminary portfolio performance presented in this announcement is based on unaudited consolidated financial statements for the fiscal year ended 31 March 2020. The final portfolio performance information may be different upon completion of the audit of the consolidated financial statements for the fiscal year ended 31 March 2020, but is not expected to be materially different from the preliminary information presented in this announcement.

8 As at 31 March 2020: Equivalent to US$214 billion, at an exchange rate of S$1 : US$0.7015; €196 billion, at an exchange rate of S$1 : €0.6407 and RMB1.52 trillion, at an exchange rate of S$1 : RMB4.9786. The corresponding NPV for other currencies are rounded to the nearest billion, after currency conversion from SGD based on the exchange rate as at 31 March 2020.